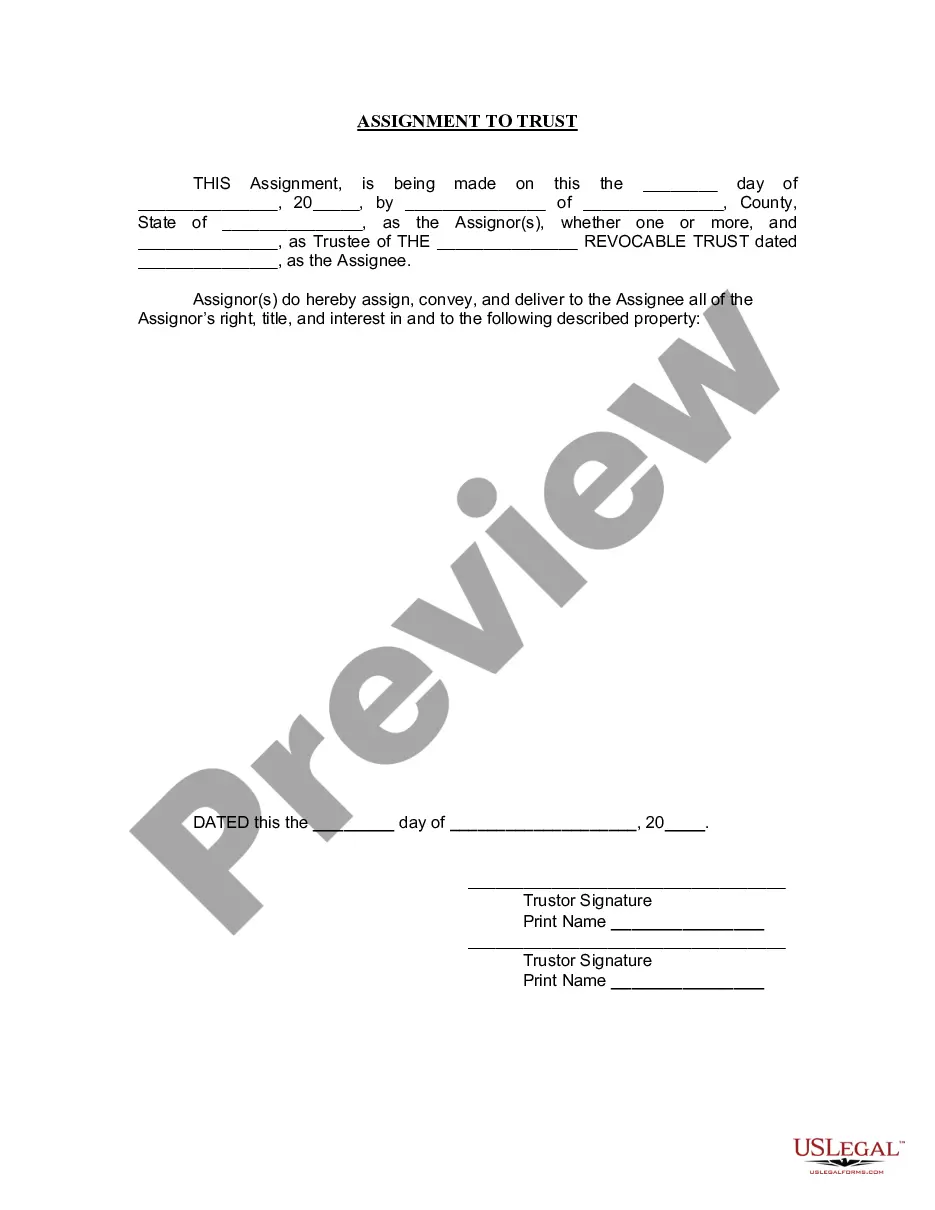

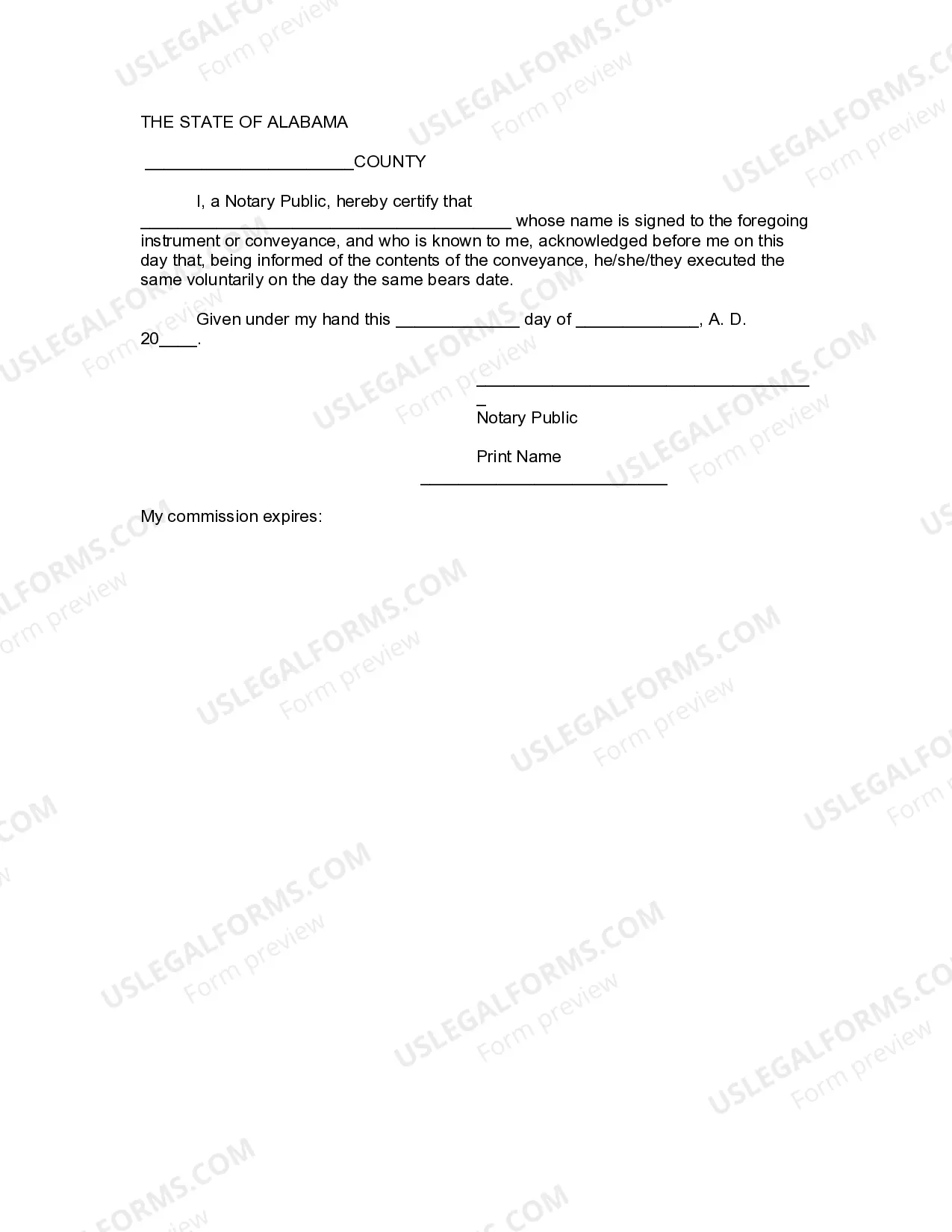

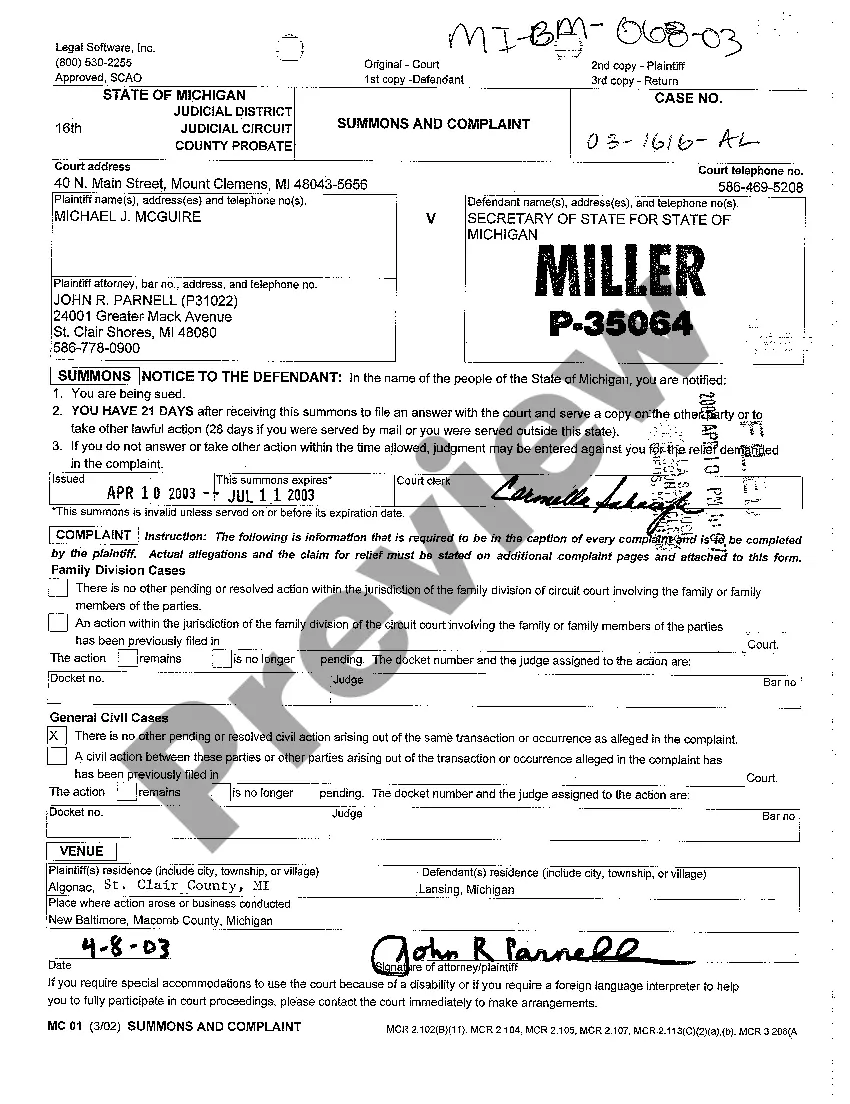

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established uring a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Alabama Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Assignment To Living Trust?

Utilizing Alabama Assignment to Living Trust instances crafted by expert attorneys helps you avoid complications when filing documents.

Simply acquire the form from our site, complete it, and seek legal advice to assess it.

Doing so will save you significantly more time and expenses than having legal experts draft a document tailored to your requirements from the ground up.

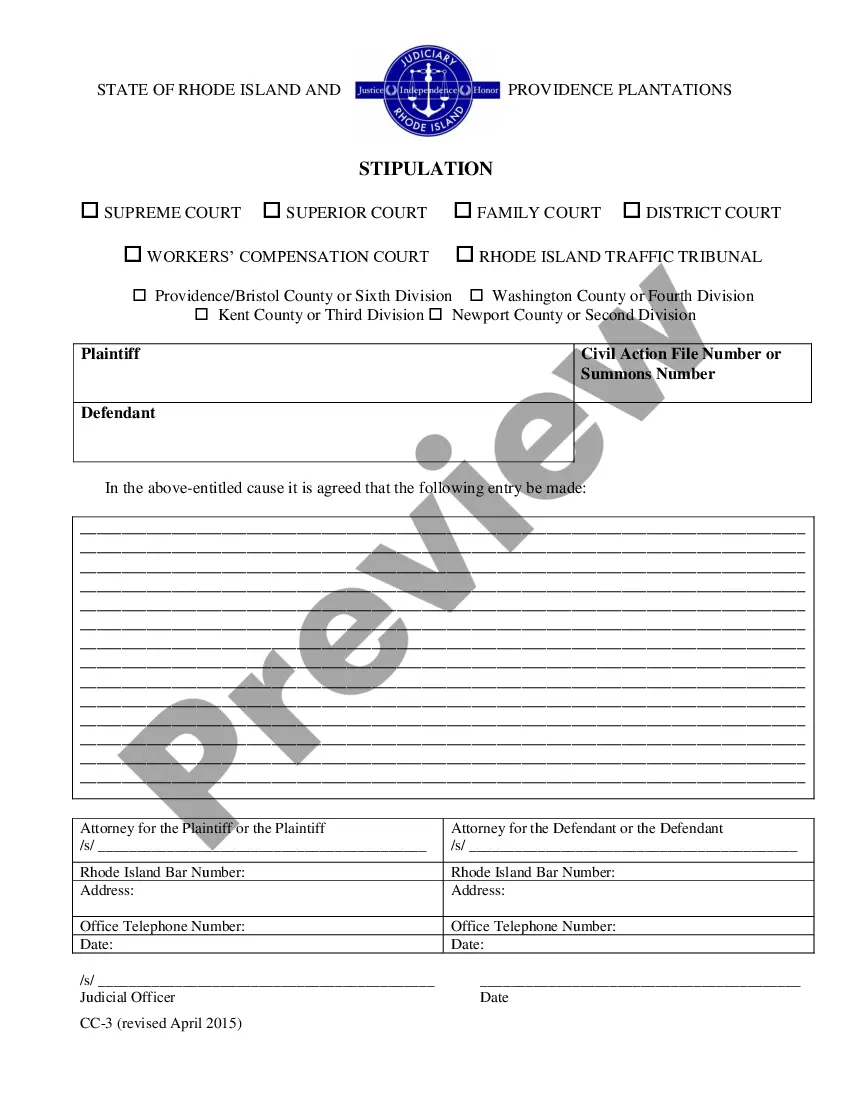

Use the Preview option and examine the description (if available) to determine if this specific template is needed, and if so, simply click Buy Now.

- If you currently possess a US Legal Forms subscription, simply Log In to your account and revisit the sample page.

- Locate the Download button adjacent to the templates you are reviewing.

- Once you download a template, you can access all your saved samples in the My documents section.

- If you lack a subscription, it’s not a significant issue.

- Just adhere to the steps below to enroll for your account online, obtain, and fill in your Alabama Assignment to Living Trust template.

- Ensure you are downloading the correct state-specific form.

Form popularity

FAQ

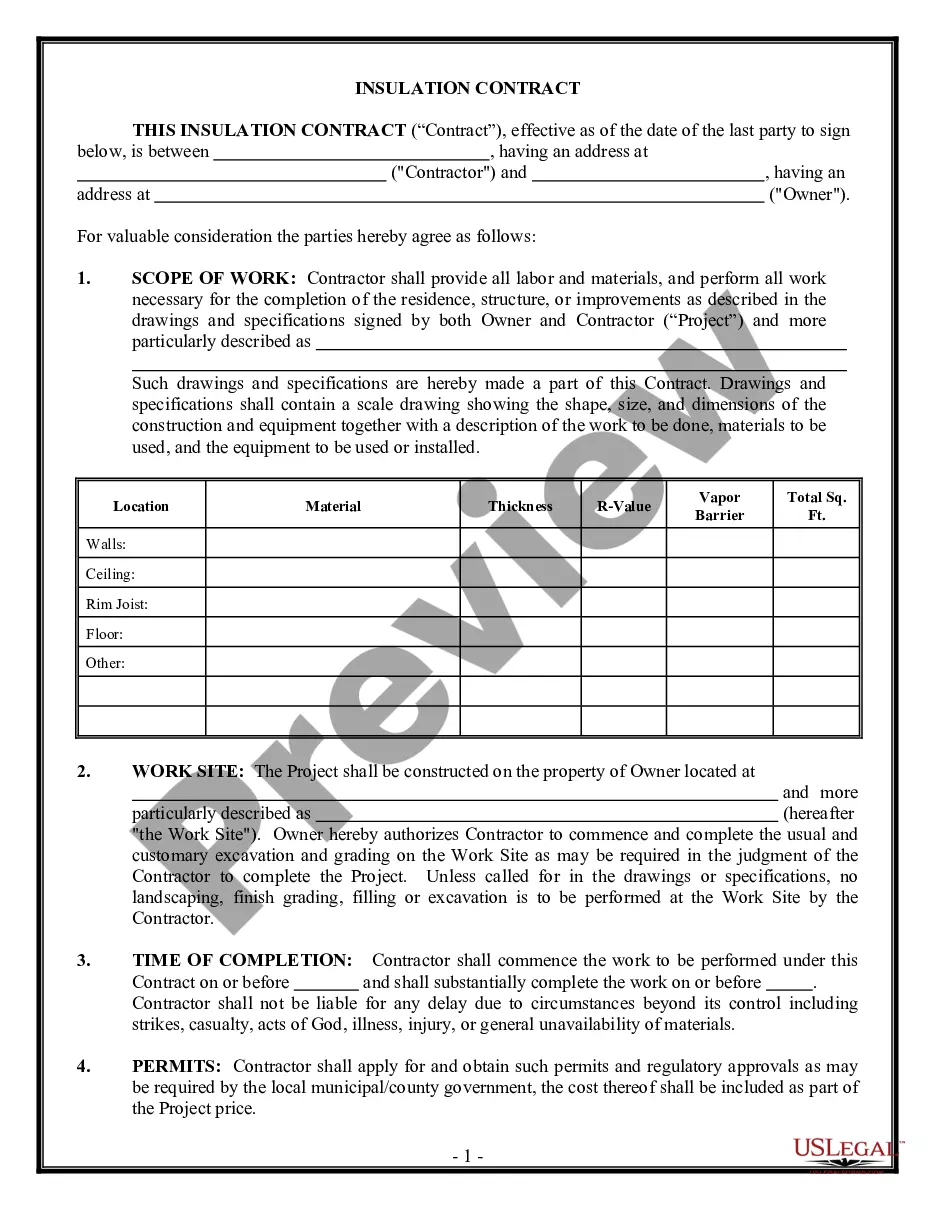

Setting up a living trust in Alabama requires several key steps. First, you will need to create the trust document, which outlines the terms and conditions of the trust. Next, you must designate a trustee to manage the assets and a beneficiary who will benefit from the trust. Finally, you should complete an Alabama Assignment to Living Trust to officially transfer your assets into the trust, ensuring that your wishes are followed and your estate is managed smoothly.

An assignment to a trust refers to the process of officially transferring assets to a trust, thereby designating the trust as the new owner. In the context of an Alabama Assignment to Living Trust, this allows you to maintain control over your assets while facilitating an efficient estate management strategy. This process helps ensure that your assets are managed according to your wishes, both during your lifetime and after your death. For assistance with this process, consider using the templates available on USLegalForms, which can guide you step-by-step.

To create an addendum to a living trust, you need to draft a document that details the changes you wish to make. Be sure to specify which sections of the Alabama Assignment to Living Trust you are modifying or adding to. Once completed, sign the addendum in accordance with your state's requirements, and keep it with your original trust documents. For added support, you can explore the resources available on the USLegalForms platform to ensure accuracy.

A trust assignment involves transferring ownership of property or assets into a trust, making the trust the legal owner. Specifically, an Alabama Assignment to Living Trust allows you to place your assets under the authority of the trust while you remain in control during your lifetime. This strategy can help manage your estate and simplify the distribution of assets after your passing.

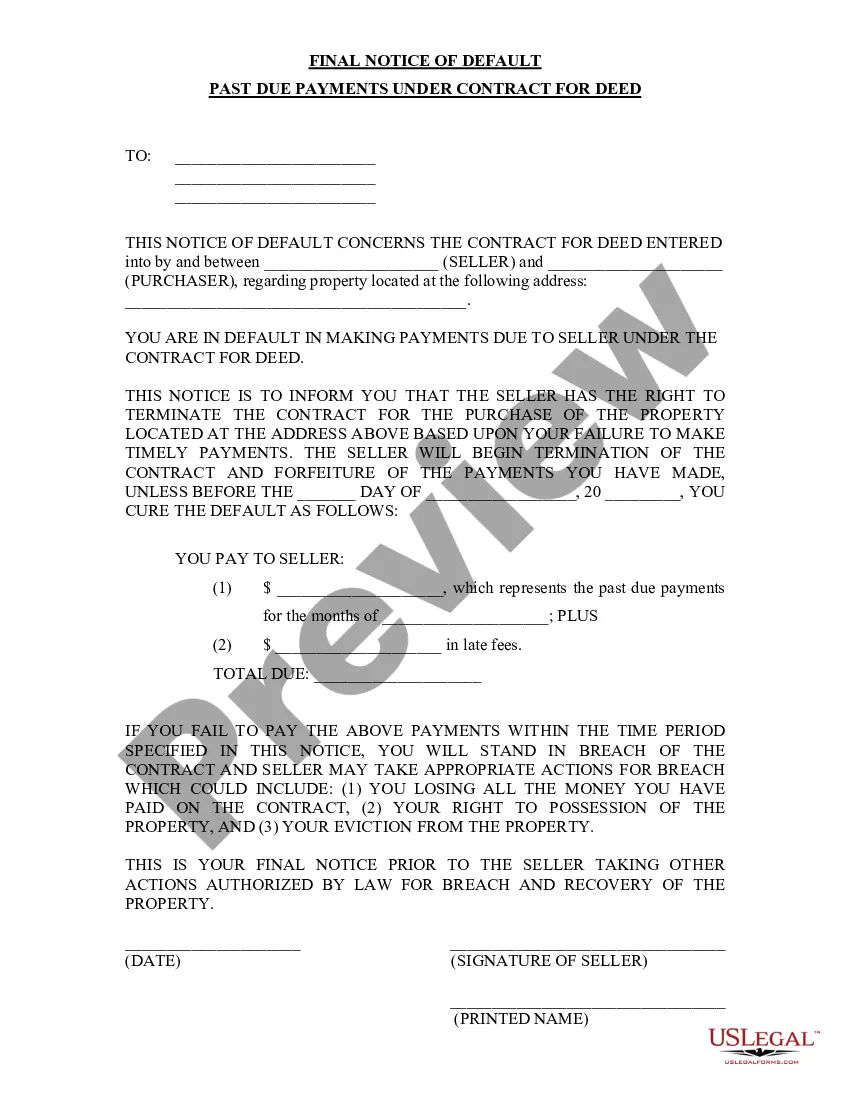

The possibility of mismanagement is a notable downfall of having a trust. If the trustee does not act in the best interests of the beneficiaries, it can lead to poor asset management and disputes. Moreover, trusts require ongoing administration and can lead to unexpected costs. However, with the right guidance, the Alabama Assignment to Living Trust can provide a structured framework, minimizing these risks.

One of the biggest mistakes parents make when setting up a trust fund is not properly funding the trust. This means they might overlook transferring assets into the trust, rendering it ineffective. Additionally, failing to communicate their intentions and wishes can lead to confusion or conflict among beneficiaries. An Alabama Assignment to Living Trust assists in effectively funding and managing the trust for long-term peace of mind.

Whether your parents should put their assets in a trust depends on their financial goals and family circumstances. A trust can provide control over asset distribution, minimize probate costs, and protect assets from creditors. However, they should also weigh the management responsibilities and potential costs. The Alabama Assignment to Living Trust offers practical solutions that align with their objectives, making it a sound choice.

Placing assets in a trust might limit your control over them during your lifetime. For example, once assets are transferred to a trust, you may face restrictions on how you can access or use them. Additionally, some individuals may experience emotional difficulties letting go of direct ownership. The Alabama Assignment to Living Trust can help you manage these concerns effectively.

One potential disadvantage of a family trust is the complexity involved in its setup and management. Maintaining a trust can require ongoing paperwork and might lead to additional expenses, such as legal fees. Moreover, if not properly managed, it could lead to disputes among family members. Considering the Alabama Assignment to Living Trust can help streamline this process and provide clarity.

To create a living trust in Alabama, start by determining the assets you wish to include. Next, draft the trust document that outlines how your assets will be managed and distributed. It is crucial to name a trustee and consider designating a successor trustee. Finally, transfer your assets into the trust to complete the Alabama Assignment to Living Trust process.