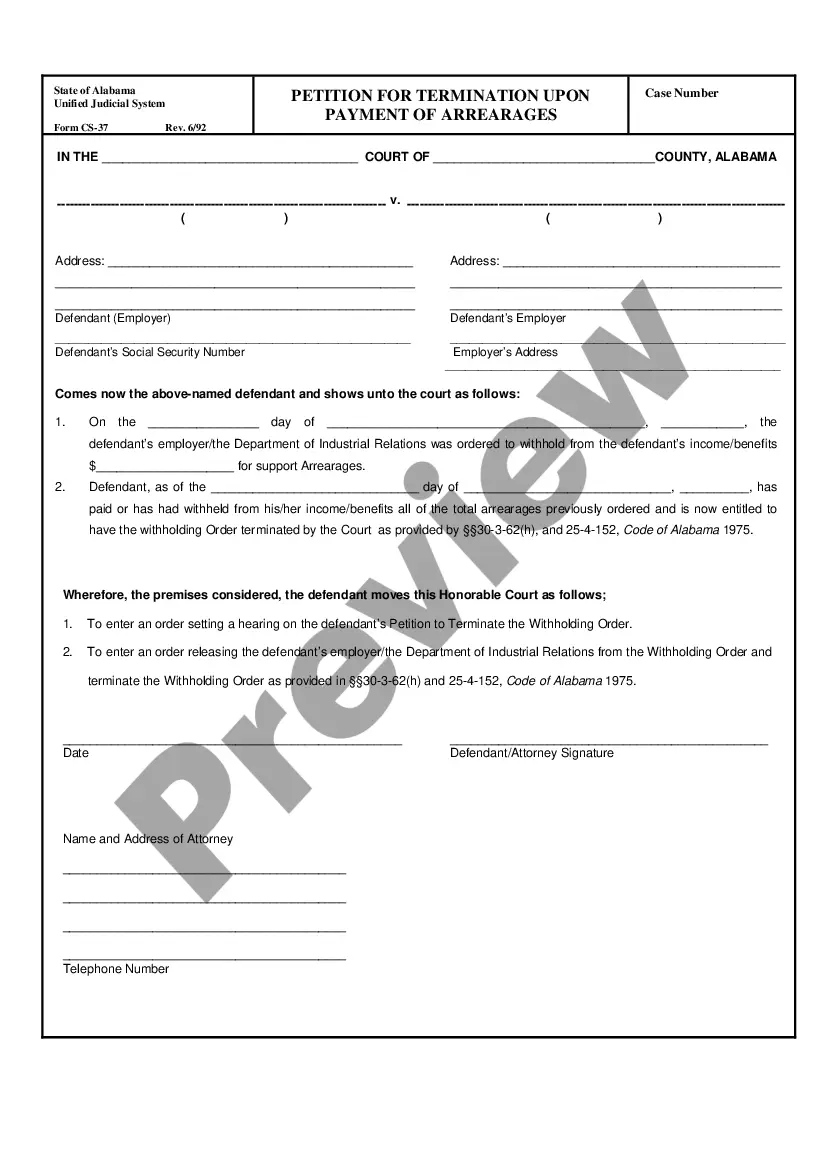

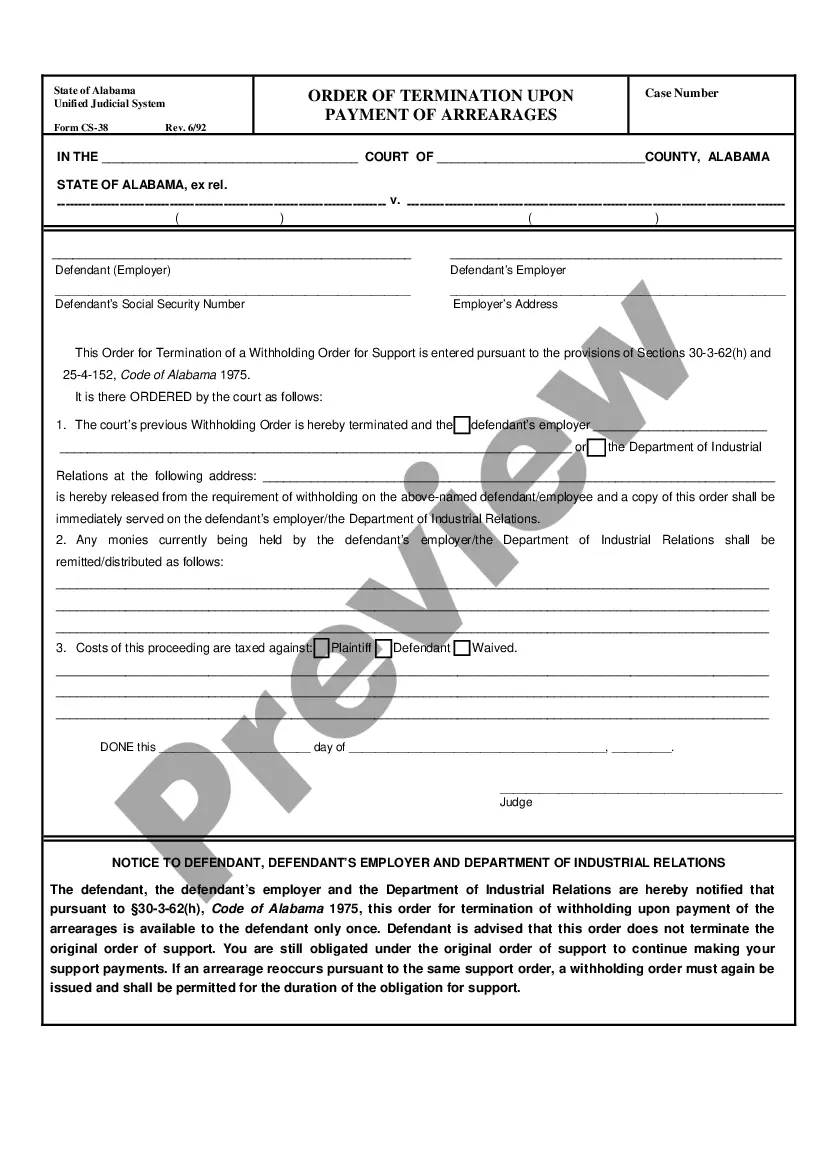

Order on Affidavit to Terminate Withholding Order of Support, is an official form from the Alabama Administrative Office of Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alabama statut

Alabama Order of Termination Upon Payment of Arrearages

Description

Key Concepts & Definitions

Order of Termination Upon Payment of Arrearages: This refers to a legal directive or court order that terminates an ongoing responsibility once overdue debts or payments (arrearages) are fully paid. In the context of U.S. legal systems, this usually pertains to situations such as child support, alimony, or lease agreements.

Step-by-Step Guide on Handling Termination Orders Upon Payment of Arrearages

- Review the Original Agreement: Understand the specific provisions related to arrearages and the conditions stated for the termination of obligations.

- Clear the Outstanding Amounts: Pay off all arrearages in full according to the terms of the original agreement or court order.

- Obtain Proof of Payment: Secure receipts, transaction records, or bank statements as proof of full payment.

- Request for Termination Order: Apply to the relevant authority or court for the issuance of a termination order, submitting all necessary payment proofs.

- Follow-up: Ensure that the order of termination is processed by keeping in touch with the authority handling the case.

- Record All Communications: Keep copies of all filed documents, correspondences, and official communications regarding your case for record-keeping.

Risk Analysis

- Legal Risks: Failure to comply with the process for termination upon payment might lead to legal repercussions, including penalties or continued obligations.

- Financial Risks: Incorrect calculation or non-verification of arrearages payment could result in continued accrual of interests or additional fees.

- Reputational Risks: Mismanagement of the termination process could adversely affect one's credit score or personal reputation in legal or business communities.

Best Practices

- Consult Legal Advice: Always consult with a legal expert specialized in family law or contract law to navigate the complexities of termination orders.

- Maintain Accurate Records: Keeping accurate financial and legal records ensures clarity and efficiency in the termination process.

- Clear Communication: Maintain open and clear communication with all parties involved, including legal authorities and opposing parties.

Common Mistakes & How to Avoid Them

- Delay in Payments: Avoid delays in clearing arrearages by setting reminders and allocating funds in advance.

- Insufficient Documentation: Always obtain and keep detailed receipts and legal documentation for every transaction made related to the payment of arrearages.

- Ignoring Legal Advice: Failure to seek proper legal consultation can be detrimental. Engage with legal professionals early in the process.

FAQ

- What constitutes arrearages? Arrearages refer to the backlog of payments not made as of their due date, often in the context of child support or leased properties.

- How can one apply for a termination upon payment of arrearages? Application can be made through filing a request with the court or responsible authority, supported by evidence of payment.

- Are there any exceptions to obtaining a termination order? Yes, some situations or agreements might have specific clauses that preclude immediate termination upon payment of arrearages.

How to fill out Alabama Order Of Termination Upon Payment Of Arrearages?

Utilizing Alabama Order on Affidavit to End Withholding Order of Support forms crafted by expert attorneys allows you to bypass frustrations when completing paperwork.

Simply download the sample from our site, fill it in, and seek legal advice to review it. This approach can save you significantly more time and expenses compared to finding a lawyer to create a document entirely from scratch tailored to your requirements.

If you have already purchased a US Legal Forms subscription, just Log In to your account and navigate back to the sample page. Locate the Download button close to the template you are reviewing.

Once you have completed all of the above steps, you will be able to fill out, print, and sign the Alabama Order on Affidavit to End Withholding Order of Support template. Remember to double-check all entered information for accuracy before submitting or mailing it. Reduce the time spent on completing documents with US Legal Forms!

- After downloading a document, you can access all your saved templates in the My documents section.

- If you do not possess a subscription, that's not an issue. Simply adhere to the step-by-step instructions provided below to create your account online, acquire, and complete your Alabama Order on Affidavit to End Withholding Order of Support template.

- Verify and make sure that you are downloading the appropriate state-specific form.

- Utilize the Preview feature and read the details (if available) to determine if this specific template is what you need, and if it is, click Buy Now.

- If necessary, locate another template using the Search bar.

- Choose a subscription that meets your requirements.

- Initiate the process using your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

Writing a letter to stop child support involves clearly stating your intent and providing evidence to support your request. Address the letter to the court or the child support agency, and include details about your case. Mention the Alabama Order of Termination Upon Payment of Arrearages to indicate your knowledge of the process. Ensure to keep a copy for your records.

To terminate child support in Alabama, file a petition with the court that issued your support order. It’s essential to demonstrate that you have fulfilled all payment obligations. Engaging with the Alabama Order of Termination Upon Payment of Arrearages can expedite your case and provide clear guidance. Consult legal resources for assistance during this process.

In Alabama, child support does not automatically stop. You need to formally request termination through the court system. Failing to take this step means payments may continue indefinitely. The Alabama Order of Termination Upon Payment of Arrearages helps facilitate the cessation of payments once conditions are met.

Stopping the child support process requires you to take specific legal steps. First, review your current court order and gather relevant documents. You can then file a motion or petition in court. Utilizing the Alabama Order of Termination Upon Payment of Arrearages can make this process smoother and more efficient.

Yes, you can stop the process of child support, but it requires a formal legal action. Whether you are the payer or the recipient, you must provide valid reasons for halting the process, such as changed circumstances. Utilizing the Alabama Order of Termination Upon Payment of Arrearages can facilitate the termination process. Consulting with a legal expert can help ensure you properly execute this process and understand all implications.

Rule 32 in Alabama outlines the guidelines for determining child support amounts. This rule takes into account the income of both parents, the needs of the child, and any special circumstances that may affect payment. Understanding Rule 32 is essential, especially if you're looking into the Alabama Order of Termination Upon Payment of Arrearages. Familiarity with this rule can help you navigate your child support case more effectively.

When writing a letter to terminate child support, be clear and concise about your request. Include your name, case number, and a statement explaining why you believe termination is appropriate, referencing the Alabama Order of Termination Upon Payment of Arrearages if applicable. This letter should be addressed to the court that issued your support order. It is recommended to seek guidance from a legal expert to ensure that your letter meets all necessary requirements.

To stop child support payments in Alabama, you must file a request with the court. This involves submitting appropriate documentation, such as proof of payments made or evidence showing a change in circumstances. The Alabama Order of Termination Upon Payment of Arrearages could be a helpful resource in this matter. Ensure you follow the legal procedures to avoid complications.

Yes, you can cancel child support in Alabama under certain circumstances. If you have fulfilled your obligations or if there has been a significant change in your financial situation, you may qualify for termination. The Alabama Order of Termination Upon Payment of Arrearages allows you to formally request this change in court. It is advisable to consult with a legal professional to assist you in this process.