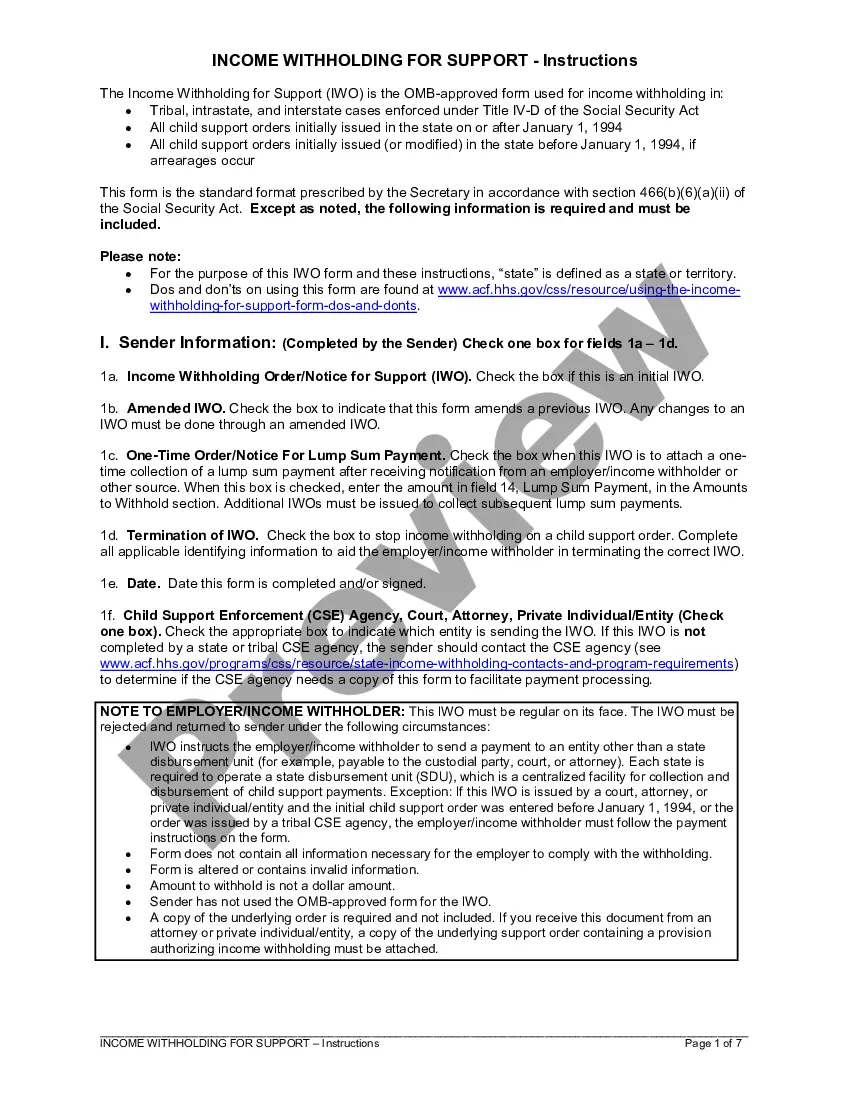

Alabama Income Withholding For Support (AIW FS) is a program used by the state of Alabama to collect court-ordered child support payments. AIW FS requires employers to withhold a portion of an employee's wages to ensure that the court-ordered child support payments are paid on time and in full. AIW FS can also be used to deduct alimony and other maintenance payments from an employee’paychecKIWIIFFSFS consists of two different types of income withholding: voluntary and mandatory. Voluntary income withholding is when an employer voluntarily agrees to deduct a portion of the employee’s wages to pay the court-ordered child support payments. Mandatory income withholding is when an employer is required by law to deduct a portion of an employee’s wages to pay the court-ordered child support payments.

Alabama Income Witholding For Support

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Income Witholding For Support?

Managing official paperwork necessitates focus, accuracy, and the use of properly prepared templates. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Alabama Income Withholding For Support template from our platform, you can be confident it complies with federal and state regulations.

Utilizing our platform is simple and efficient. To acquire the required document, all you need is an account with an active subscription. Here’s a concise guide for you to get your Alabama Income Withholding For Support in minutes.

All documents are designed for multiple uses, like the Alabama Income Withholding For Support you see on this page. If you require them later, you can fill them out without additional payment - simply navigate to the My documents section in your profile and complete your document whenever necessary. Experience US Legal Forms and achieve your business and personal paperwork efficiently and in full legal compliance!

- Ensure to meticulously review the form's content and its alignment with general and legal standards by previewing it or reading its description.

- Look for an alternative formal template if the one you initially accessed does not fit your circumstances or state laws (the tab for that is located in the upper page corner).

- Sign in to your account and save the Alabama Income Withholding For Support in your desired format. If this is your first time using our site, click Purchase now to continue.

- Establish an account, select your subscription plan, and complete the payment using your credit card or PayPal account.

- Choose the format in which you want to save your document and click Download. Print the blank or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

The formula for determining child support in Alabama involves calculating both parents' gross incomes, subtracting certain deductions, and applying the state guidelines. This formula is designed to ensure that child support meets the needs of the child while considering the financial capacity of both parents. It's essential to apply this formula correctly to avoid disputes and ensure compliance with Alabama income withholding for support. Resources like USLegalForms can guide you through the calculation process for accurate results.

The new child support law in Alabama for 2025 introduces changes aimed at making the support calculation process fairer and more transparent. It focuses on establishing clearer guidelines for determining support amounts based on current economic conditions and parental incomes. Keeping updated on these changes is crucial for fair compliance, especially regarding Alabama income withholding for support. Solutions like USLegalForms can provide supporting documents for navigating these adjustments.

In Alabama, child support payments are not considered income for tax purposes. This means that the recipient does not have to report these payments when filing taxes. However, for the paying parent, child support payments are also not tax-deductible. It’s essential to be aware of these distinctions when discussing finances related to Alabama income withholding for support.

An income withholding order for child support in Alabama is usually processed quickly once the court issues it. Typically, employers are required to begin withholding support within seven days of receiving the order. This means that, in most cases, support payments can start being deducted from the non-custodial parent's paycheck within a couple of weeks. Awareness of Alabama income withholding for support ensures that custodial parents receive timely payments.

Rule 32 in Alabama provides guidelines for calculating child support obligations based on the income of both parents. This rule outlines how to determine each parent's gross income and necessary deductions to arrive at a fair support amount. It's essential to follow these guidelines to ensure that child support is just and meets the child’s needs. Understanding how Alabama income withholding for support works can simplify compliance with these calculations.

In Alabama, the cut-off age for child support typically ends when the child turns 19. However, if the child is still in high school and is 'continuously enrolled', support may continue until graduation or the age of 19, whichever comes first. It's important to monitor these timelines closely as the court enforces them firmly. Understanding Alabama income withholding for support helps ensure payments are timely and compliant.

To drop child support in Alabama, you must file a petition with the court that issued the original support order. It is essential to demonstrate a significant change in circumstances, such as a loss of income or a change in the child's living situation. Additionally, consider using US Legal Forms to access reliable legal documents and guides tailored to Alabama Income Withholding For Support. This platform simplifies the process and helps ensure that you meet all legal requirements efficiently.

Wage garnishment for child support in Alabama is done through an Income Withholding Order. The court issues this order to the employer, who then deducts a specified amount from the employee’s paycheck. It's important to follow proper legal procedures to ensure compliance. Resources about Alabama Income Withholding For Support can guide you through this process effectively.

To calculate disposable income for child support in Alabama, subtract mandatory deductions from your gross income. These deductions may include taxes, health insurance premiums, and retirement contributions. Understanding how to properly calculate this helps ensure fair support obligations. Familiarizing yourself with Alabama Income Withholding For Support can aid in this calculation.

When a tax refund is intercepted for child support in Alabama, the process can take several weeks to complete. The funds get redirected to the state for disbursement to the custodial parent. This action ensures that child support obligations are met effectively. Utilizing resources about Alabama Income Withholding For Support can provide clarity on timelines and processes.