Alabama Fax Form

Understanding this form

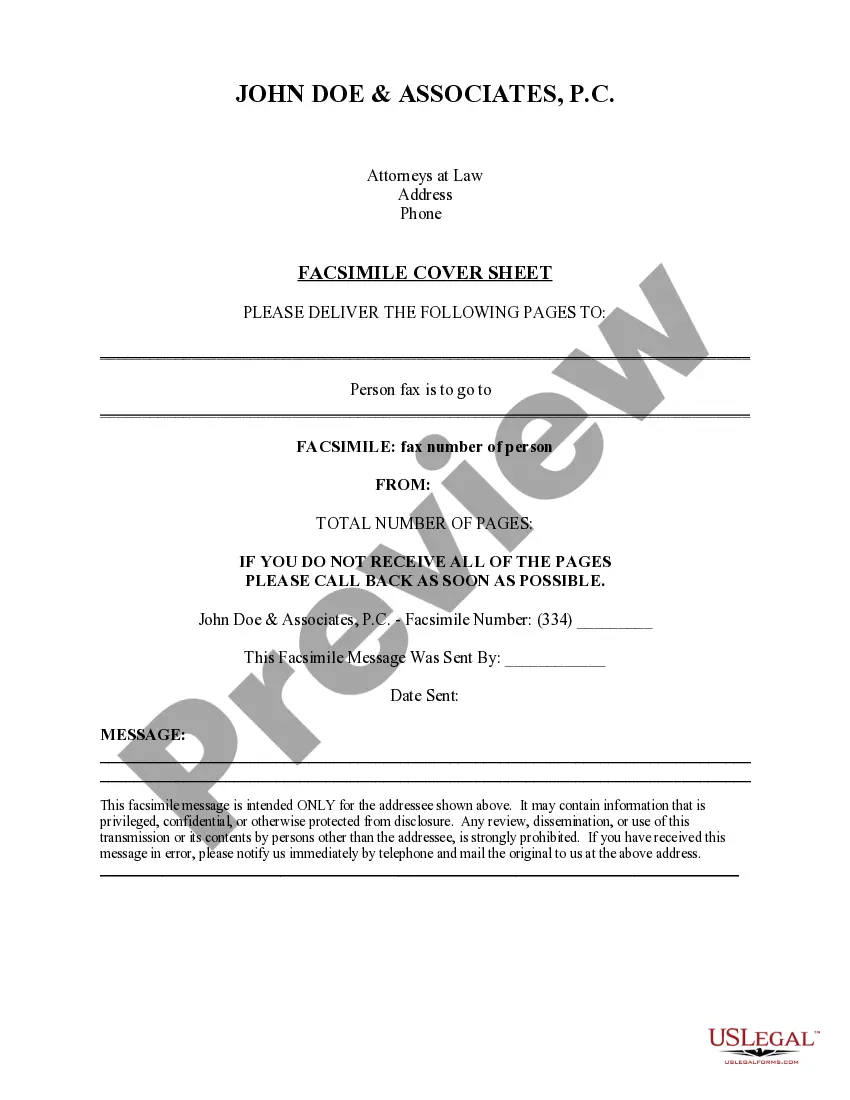

The Fax Form is a facsimile cover sheet specifically designed for law firms. It serves to ensure that the message contained within is intended solely for the addressee listed on the cover sheet, distinguishing it from more general fax forms.

Main sections of this form

- Attorney's name and law firm information

- Recipient's name and fax number

- Total number of pages being sent

- Confidentiality notice regarding the fax contents

- Sender's name and the date the fax was sent

- Instructions for contacting in case of transmission errors

When to use this document

This Fax Form is used whenever a law firm sends confidential information via fax. It is especially useful when legal documents need to be sent securely to other attorneys, clients, or courts, ensuring the information is received by the correct party and acknowledging its confidential nature.

Who should use this form

- Law firms sending faxes to clients or other legal professionals

- Attorneys transmitting sensitive documents

- Any legal staff involved in sending legal communications via fax

Instructions for completing this form

- Enter the name of the attorney and the law firm at the top.

- Fill in the recipientâs name and fax number in the designated fields.

- Specify the total number of pages included in the fax.

- Provide the sender's information and date sent.

- Review the confidentiality notice to ensure understanding of its importance.

Notarization requirements for this form

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include the recipient's fax number accurately.

- Not specifying the total number of pages, causing potential confusion.

- Omitting the confidentiality notice, which is vital for legal communications.

Advantages of online completion

- Convenient access to a professionally drafted fax form.

- Editability allows for quick customization before sending.

- Reliable format ensures compliance with legal standards.

Legal use & context

- Confidentiality claims are supported by this cover sheet.

- Reduces the risk of unauthorized disclosure of sensitive information.

- Provides a clear structure for attorneys communicating via fax.

Quick recap

- The Fax Form is essential for secure legal communications via fax.

- Key components help guide compliance with confidentiality standards.

- It is easy to use and can be customized quickly online.

Looking for another form?

Form popularity

FAQ

Business entities are liable for the Alabama business privilege tax for each taxable year during which the entity is in legal existence regardless of the level of business activity. With certain exceptions, the minimum business privilege tax is $100, and the maximum business privilege tax is $15,000.

40V. NOTE: This payment voucher can only be used to pay the tax liability for your Alabama individual income tax return, auto- matic extension, or amended tax return and cannot be used for any other kind of tax payment.

Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000.

General Information Filing Requirement for Business Privilege Tax:C-corporations, financial institution groups, insurance companies, REITs, and business trusts must file Alabama Form CPT. Limited liability entities taxed as corporations for federal income tax purposes must also file Alabama Form CPT.

ACH Debit: You may pay by ACH Debit by going to My Alabama Taxes. Pay Online: Alabama Interactive. Credit Card Payments: You may be able to use your credit card to pay your tax liability with Official Payments Corporation, or Value Payment Systems.

If you are not making a payment, mail your return to: Alabama Department of Revenue P.O. Box 154 Montgomery, AL 36135-0001.

Oregon Department of Revenue. 2020 Form OR-40. Oregon Individual Income Tax Return for Full-year Residents.

Contact the Alabama Department of Revenue at 334-353-7923 or www.revenue.alabama.gov/incometax/ bpt_index.

You MUST Use Form 40 If: You were a full or part-year resident of Alabama and do not meet ALL of the requirements to file Form 40A.