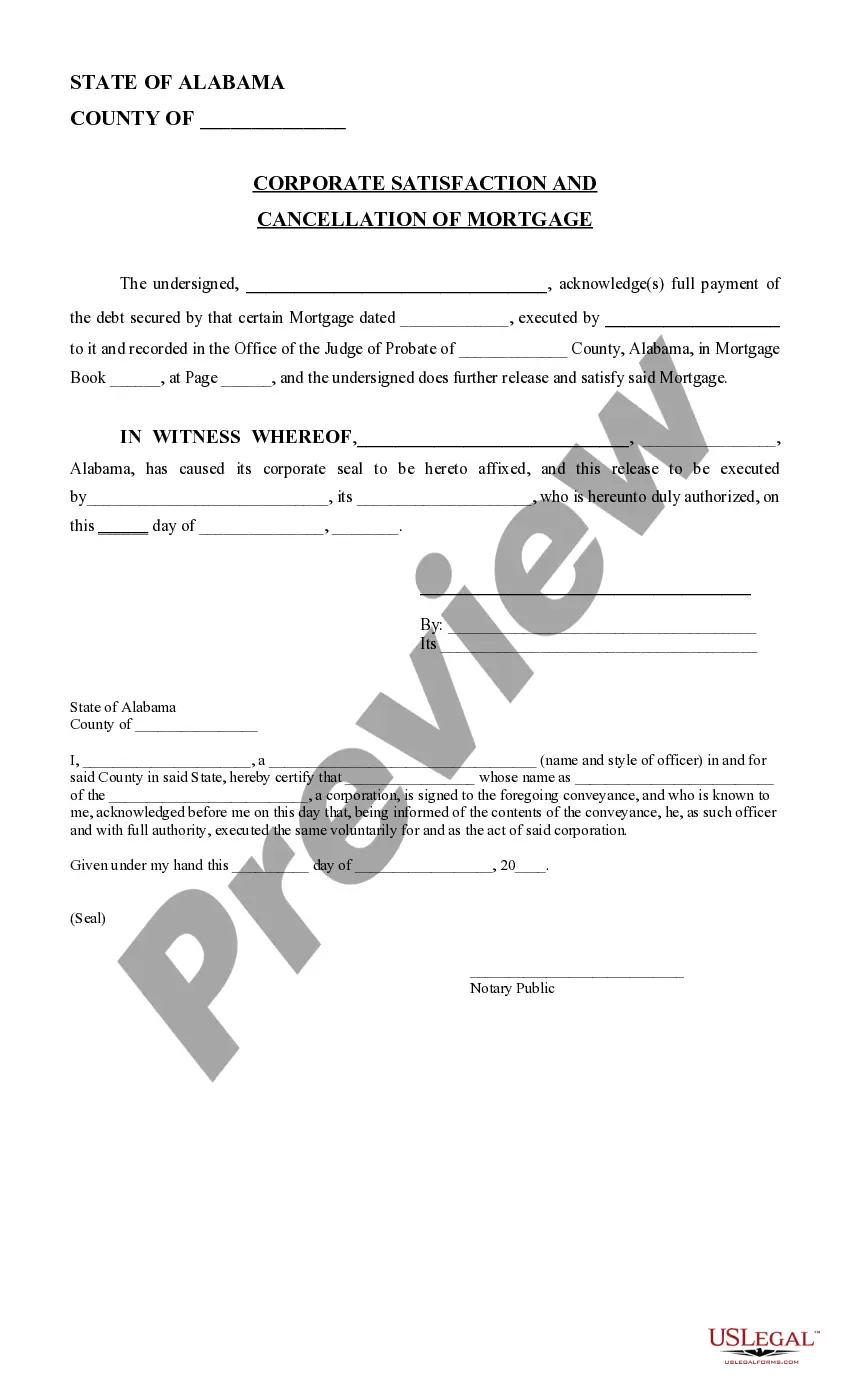

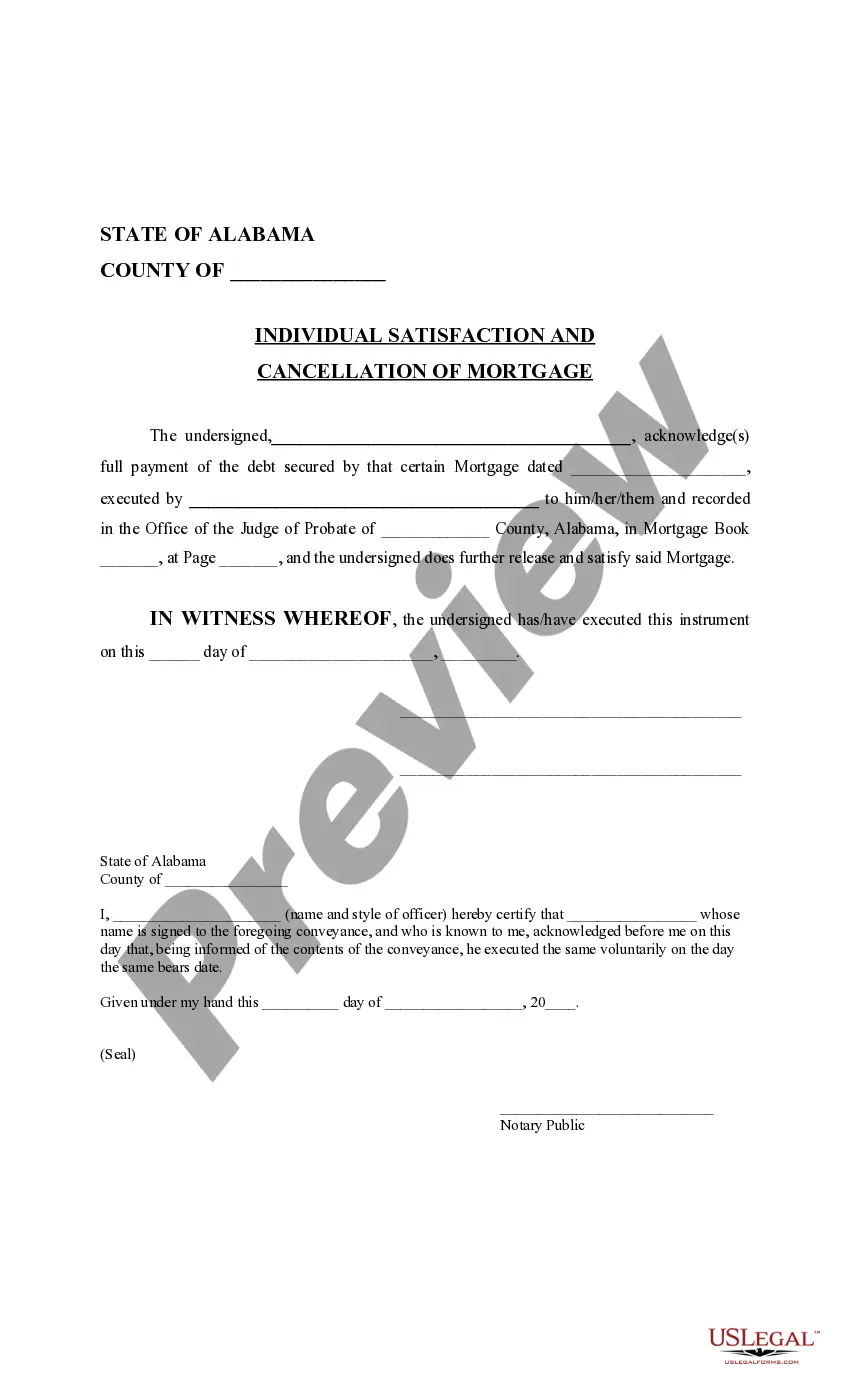

This form is used to release an individual from a mortgage once full payment of the debt secured by the mortgage has bee paid. This form is available in Word and Wordperfect formats.

Alabama Individual Satisfaction Mortgage

Description

How to fill out Alabama Individual Satisfaction Mortgage?

Employing Alabama Individual Satisfaction Mortgage templates crafted by expert attorneys provides you with the chance to avert complications when submitting paperwork.

Simply obtain the template from our site, complete it, and seek legal advice to verify it.

By doing this, you can conserve significantly more time and expenses than if you were to hire an attorney to prepare a document for you.

Verify and ensure that you are downloading the correct state-specific form. Use the Preview feature and examine the description (if available) to ascertain whether you require this specific example; if so, simply click Buy Now. If necessary, search for another file using the Search field. Select a subscription that suits your needs. Begin with your credit card or PayPal. Choose a file format and download your document. Once you have completed all the steps mentioned above, you will be able to fill out, print, and sign the Alabama Individual Satisfaction Mortgage template. Remember to double-check all entered information for accuracy before submitting or sending it out. Minimize the time spent on document preparation with US Legal Forms!

- If you already possess a US Legal Forms subscription, simply Log In to your account and revisit the sample page.

- Locate the Download button next to the templates you are reviewing.

- After you download a file, your saved samples can be found in the My documents section.

- If you lack a subscription, it’s not a significant issue.

- Just adhere to the instructions below to register for your account online, obtain, and complete your Alabama Individual Satisfaction Mortgage template.

Form popularity

FAQ

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

Once you've paid off your outstanding mortgage debt, the lender must prepare and issue a release of mortgage. This document officially discharges you from the debt obligation and removes the lien against the property.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.