This term sheet summarizes the principal terms with respect to a potential private placement of convertible preferred equity securities. It is not a legally binding document, but rather a basis for further discussions.

Alaska Convertible Preferred Equity Securities Term Sheet

Description

How to fill out Convertible Preferred Equity Securities Term Sheet?

Choosing the right legitimate record template can be quite a have difficulties. Obviously, there are tons of themes available online, but how would you obtain the legitimate form you need? Take advantage of the US Legal Forms web site. The service delivers a huge number of themes, including the Alaska Convertible Preferred Equity Securities Term Sheet, that you can use for business and personal needs. All the kinds are checked out by professionals and satisfy state and federal specifications.

In case you are presently listed, log in to your account and click the Down load button to get the Alaska Convertible Preferred Equity Securities Term Sheet. Make use of your account to look through the legitimate kinds you possess purchased in the past. Proceed to the My Forms tab of your own account and have another copy from the record you need.

In case you are a new user of US Legal Forms, here are basic guidelines that you can comply with:

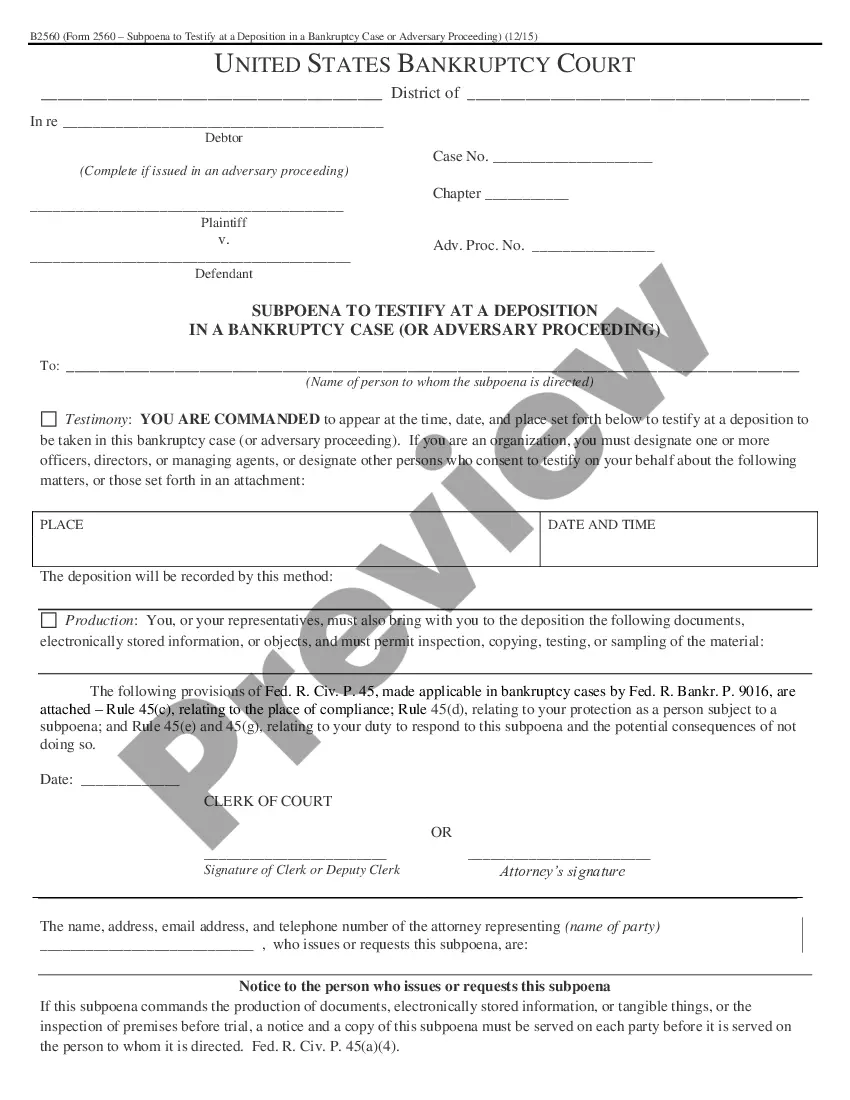

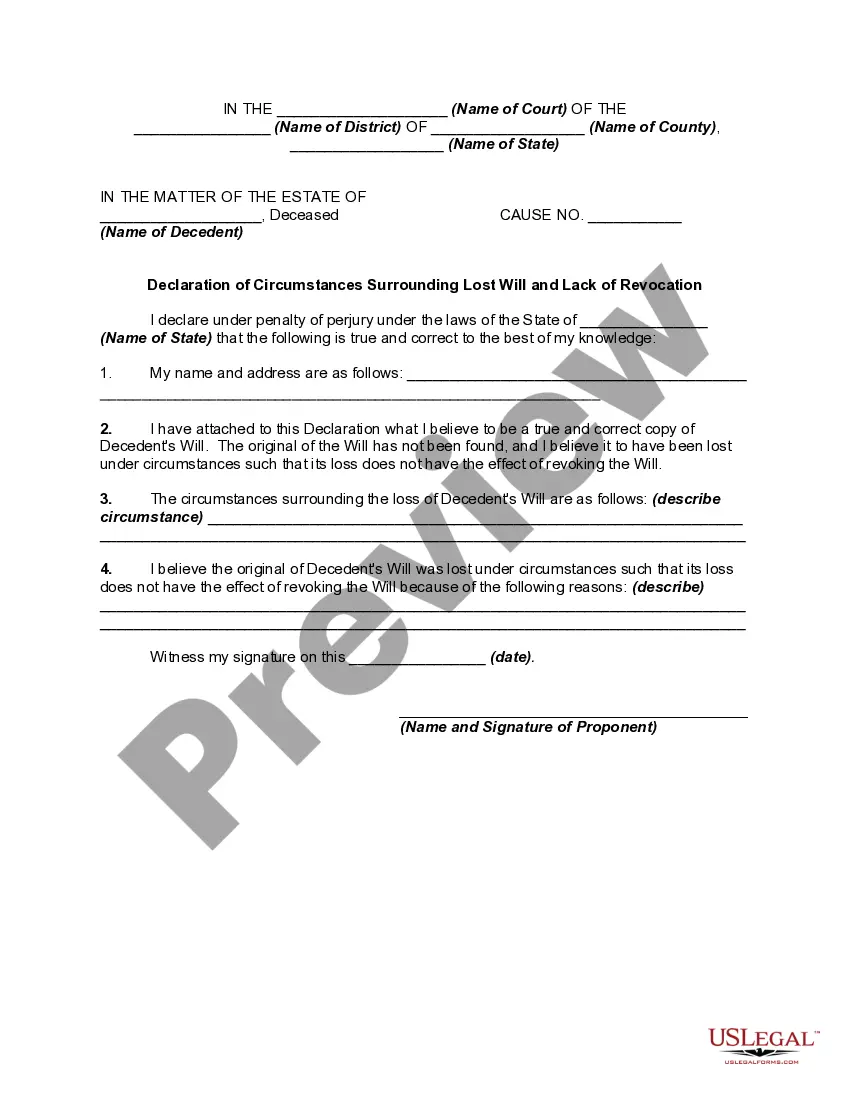

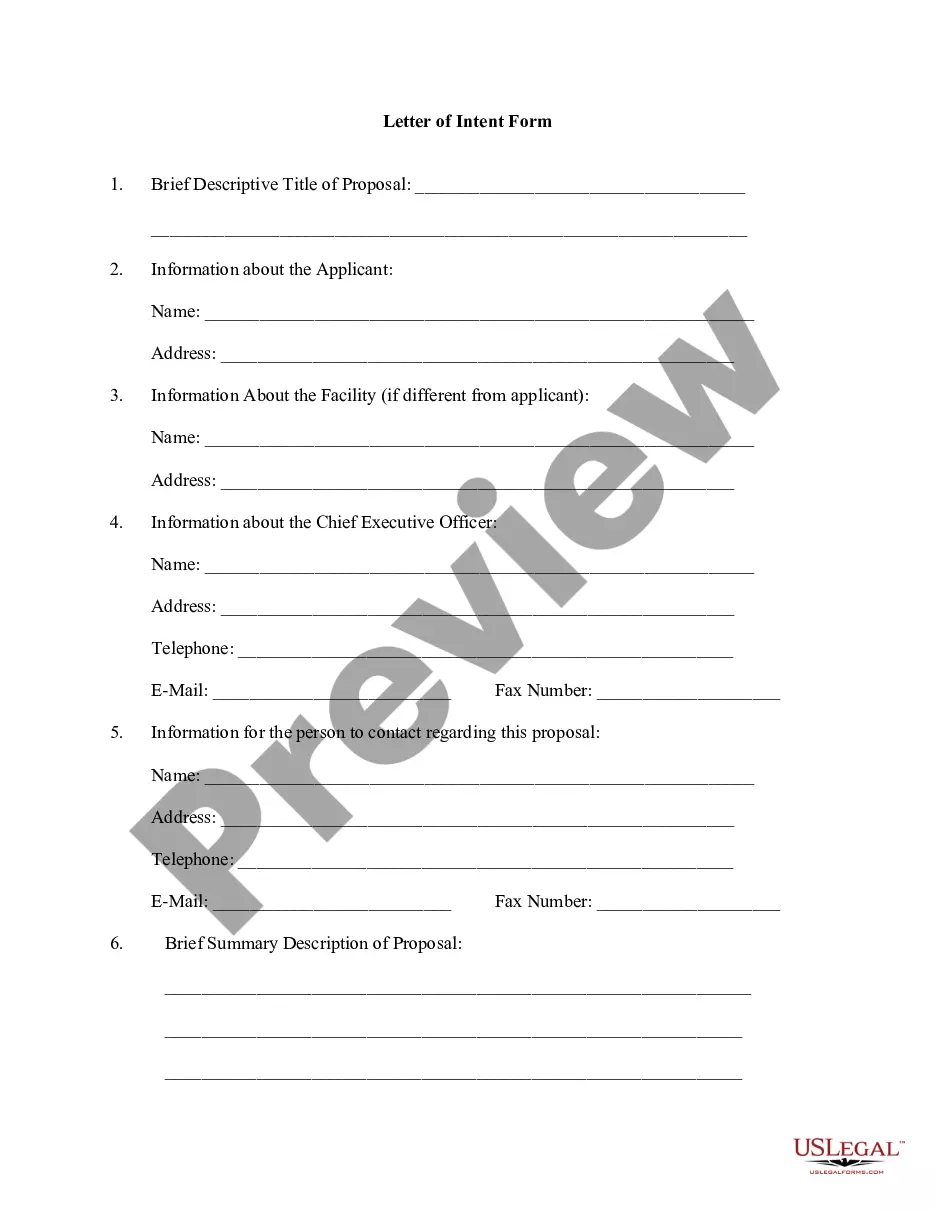

- Very first, be sure you have selected the appropriate form for your city/region. You are able to look through the shape utilizing the Review button and read the shape information to guarantee this is the right one for you.

- In the event the form is not going to satisfy your needs, use the Seach field to obtain the proper form.

- Once you are sure that the shape is proper, select the Acquire now button to get the form.

- Pick the prices program you want and enter in the required information. Design your account and pay for an order utilizing your PayPal account or bank card.

- Choose the file formatting and down load the legitimate record template to your gadget.

- Full, revise and produce and signal the obtained Alaska Convertible Preferred Equity Securities Term Sheet.

US Legal Forms may be the most significant collection of legitimate kinds where you can see different record themes. Take advantage of the service to down load appropriately-manufactured documents that comply with express specifications.

Form popularity

FAQ

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

Conversion price can be calculated by dividing the convertible preferred stock's par value by the stipulated conversion ratio. Conversion premium: The dollar amount by which the market price of the convertible preferred stock exceeds the current market value of the common shares into which it may be converted.

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock.

Convertible preferred shares can be converted into common stock at a fixed conversion ratio.

The preferred stock converts into a variable number of shares and the monetary value of the obligation is based solely on a fixed monetary amount (stated value) known at inception. ingly, it should be classified as a liability under the guidance in ASC 480-10-25-14a.

Convertible preference shares usually carry rights to a fixed dividend for a particular term. At the end of the term, the company can choose to convert it into ordinary shares or leave them as they are. Conversion prices must be specified in the company's constitution.

Redeemable convertible preference share It is liable to be redeemed by that body corporate. On redemption, the shareholder receives: an agreed cash amount; or. an agreed number of ordinary shares in the issuing body corporate.

However, convertible preferred stock also has several drawbacks, such as dilution of ownership, lower dividend rates, higher costs, and risk of conversion.