Alaska Request for Copy of Tax Form or Individual Income Tax Account Information

Description

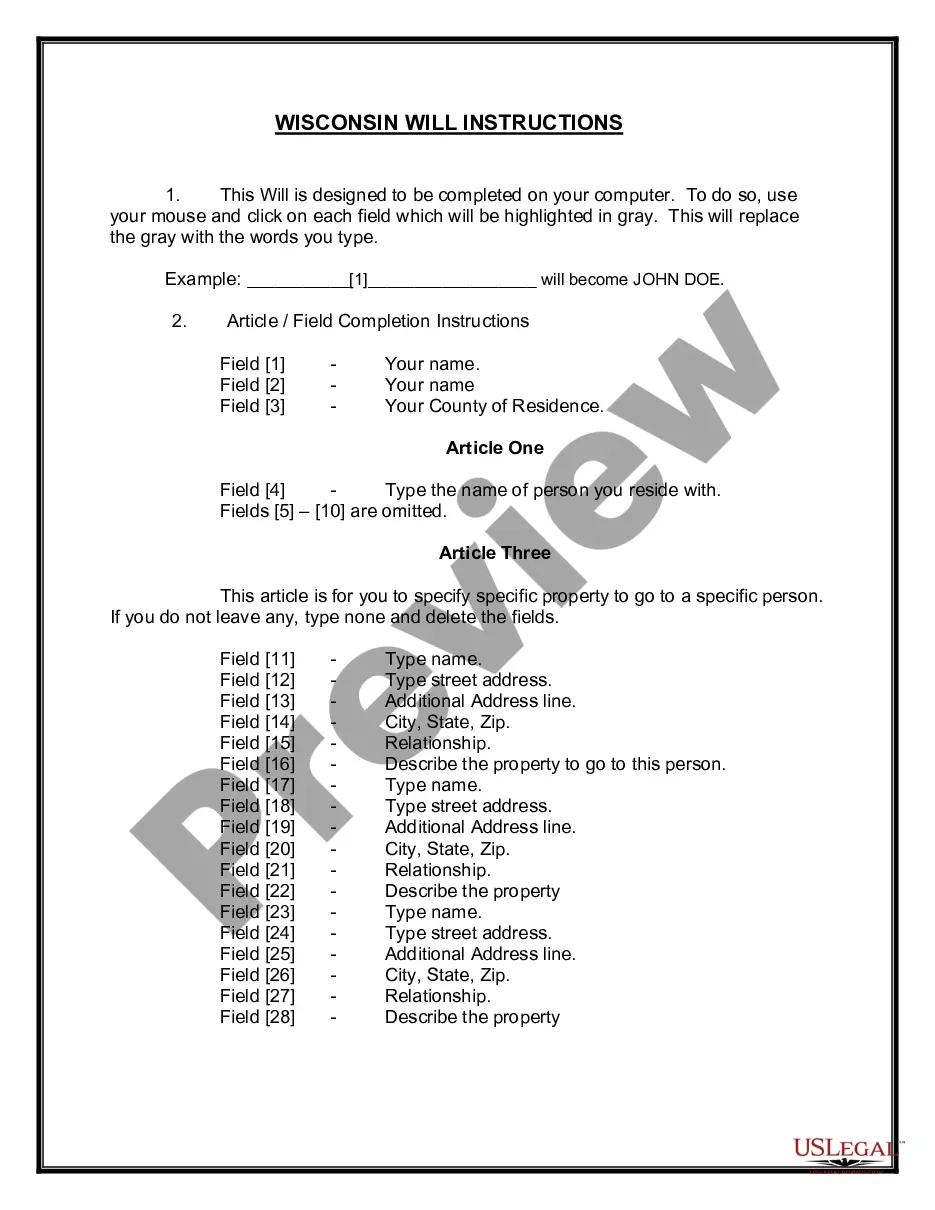

How to fill out Request For Copy Of Tax Form Or Individual Income Tax Account Information?

It is possible to devote hours on the web attempting to find the lawful document design which fits the federal and state needs you will need. US Legal Forms provides 1000s of lawful kinds that happen to be analyzed by experts. It is possible to download or print the Alaska Request for Copy of Tax Form or Individual Income Tax Account Information from our assistance.

If you have a US Legal Forms account, you may log in and click on the Acquire option. After that, you may complete, revise, print, or signal the Alaska Request for Copy of Tax Form or Individual Income Tax Account Information. Every lawful document design you get is your own forever. To have yet another duplicate for any acquired form, go to the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms site the first time, stick to the basic recommendations under:

- Initially, be sure that you have selected the right document design to the area/town of your choosing. Browse the form description to ensure you have picked the correct form. If available, use the Review option to check from the document design also.

- If you want to locate yet another version of your form, use the Search discipline to find the design that fits your needs and needs.

- After you have discovered the design you want, click Buy now to move forward.

- Choose the costs program you want, type in your qualifications, and register for a merchant account on US Legal Forms.

- Full the transaction. You may use your Visa or Mastercard or PayPal account to fund the lawful form.

- Choose the format of your document and download it to the gadget.

- Make alterations to the document if necessary. It is possible to complete, revise and signal and print Alaska Request for Copy of Tax Form or Individual Income Tax Account Information.

Acquire and print 1000s of document themes making use of the US Legal Forms Internet site, that provides the biggest assortment of lawful kinds. Use professional and condition-certain themes to handle your small business or individual needs.

Form popularity

FAQ

1. Tax Return Copies of Returns PREPARED via eFile.com. Description:The last three years of your returns are stored here for free. Select the PDF icon for the respective tax year; based on your browser settings, the PDF will either open in a tab or prompt you to download the file.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return. How long will it take? It may take up to 75 calendar days for us to process your request.

Access your individual account information including balance, payments, tax records and more. If you're a new user, have your photo identification ready. More information about identity verification is available on the sign-in page.

You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946. Visit our Get Transcript frequently asked questions (FAQs) for more information.

Alaska Tax Rates, Collections, and Burdens Alaska does not have an individual income tax. Alaska has a 2.0 to 9.40 percent corporate income tax rate. Alaska does not have a state sales tax, but has a max local sales tax rate of 7.50 percent and an average combined state and local sales tax rate of 1.76 percent.

How to access IRS transcripts online You must register or log in to your IRS Online Account. After signing in, click ?Get Transcript Online? here. Pick a reason from the drop-down menu. Select your IRS transcript by year and download the pdf.

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.