Alaska Clauses Relating to Capital Withdrawals, Interest on Capital

Description

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

Have you been in the place the place you require files for both company or person uses nearly every day time? There are plenty of authorized file web templates available online, but finding types you can trust isn`t simple. US Legal Forms offers 1000s of type web templates, like the Alaska Clauses Relating to Capital Withdrawals, Interest on Capital, that happen to be published in order to meet federal and state needs.

If you are currently knowledgeable about US Legal Forms internet site and get a free account, basically log in. Next, you may down load the Alaska Clauses Relating to Capital Withdrawals, Interest on Capital design.

If you do not come with an profile and want to begin to use US Legal Forms, abide by these steps:

- Find the type you require and make sure it is to the correct city/region.

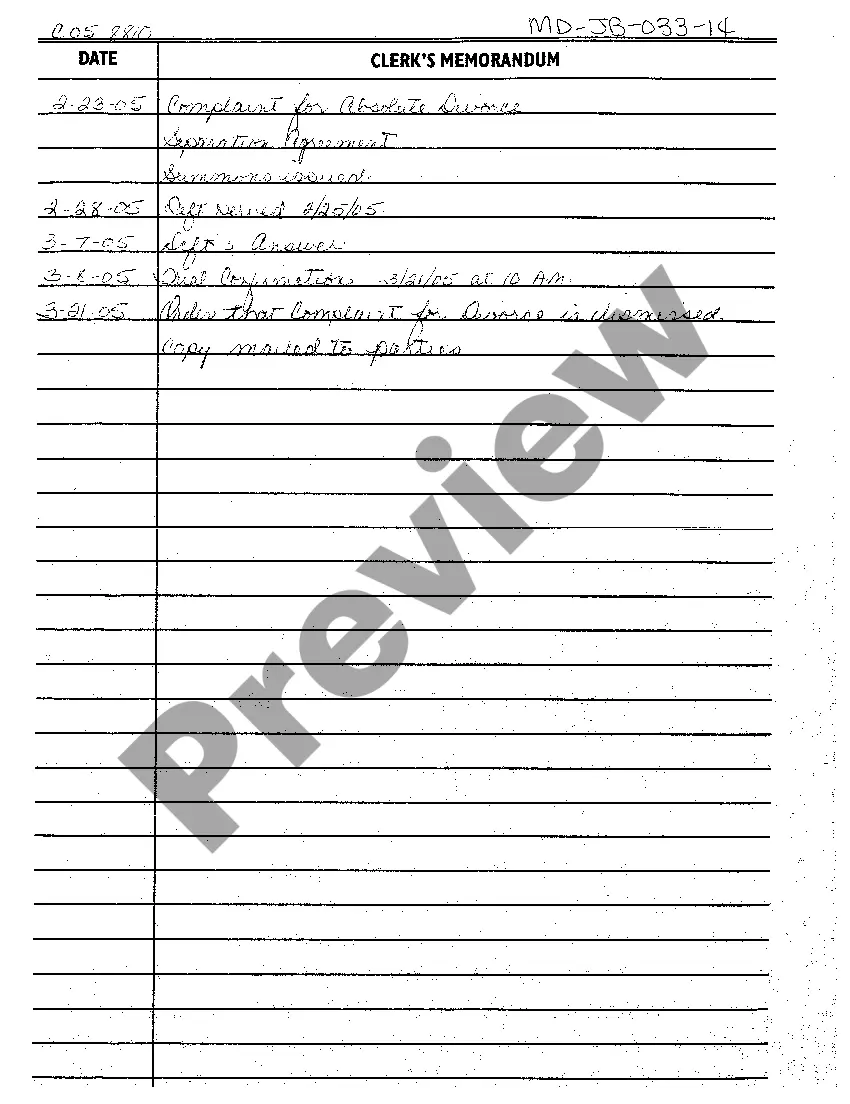

- Take advantage of the Review button to examine the shape.

- See the explanation to ensure that you have chosen the correct type.

- If the type isn`t what you are seeking, make use of the Search area to discover the type that meets your requirements and needs.

- When you find the correct type, click on Purchase now.

- Opt for the costs strategy you need, fill in the desired info to make your money, and pay for the transaction with your PayPal or bank card.

- Pick a handy file format and down load your copy.

Find all the file web templates you might have bought in the My Forms food selection. You can aquire a more copy of Alaska Clauses Relating to Capital Withdrawals, Interest on Capital anytime, if required. Just click the necessary type to down load or produce the file design.

Use US Legal Forms, by far the most comprehensive variety of authorized forms, to save lots of time and steer clear of mistakes. The support offers expertly produced authorized file web templates that can be used for a variety of uses. Make a free account on US Legal Forms and start creating your lifestyle easier.