Alaska Clauses Relating to Dividends, Distributions

Description

How to fill out Clauses Relating To Dividends, Distributions?

Are you within a place the place you will need files for sometimes business or personal reasons just about every working day? There are a lot of legal document layouts available online, but discovering kinds you can depend on isn`t effortless. US Legal Forms provides a large number of kind layouts, much like the Alaska Clauses Relating to Dividends, Distributions, which are written to meet federal and state specifications.

In case you are currently knowledgeable about US Legal Forms web site and get an account, just log in. Following that, you may download the Alaska Clauses Relating to Dividends, Distributions template.

If you do not have an bank account and would like to begin using US Legal Forms, adopt these measures:

- Obtain the kind you require and make sure it is for your appropriate metropolis/county.

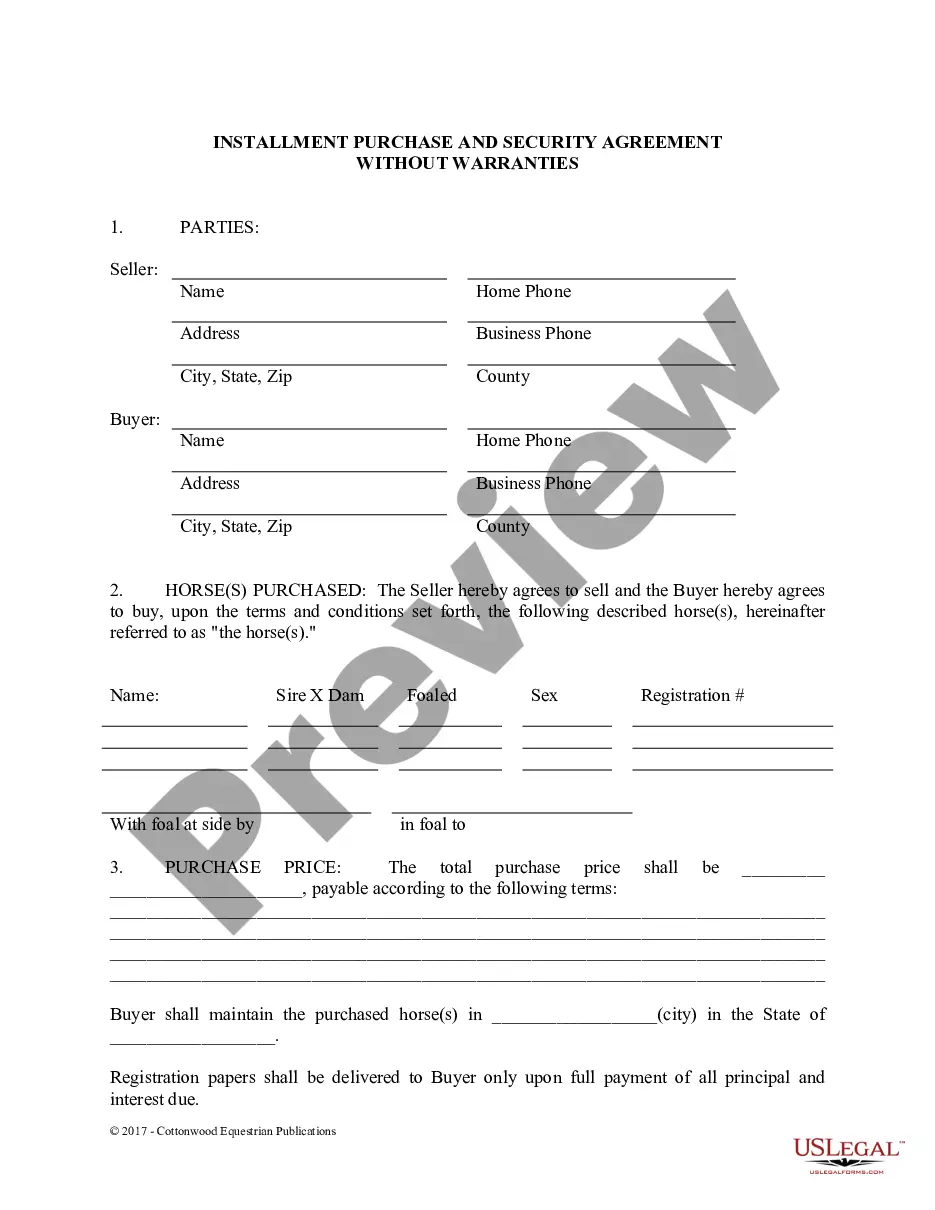

- Utilize the Review switch to analyze the form.

- Browse the explanation to ensure that you have selected the proper kind.

- In case the kind isn`t what you`re seeking, use the Search field to get the kind that suits you and specifications.

- Once you get the appropriate kind, simply click Buy now.

- Pick the costs prepare you want, submit the required details to produce your account, and buy an order utilizing your PayPal or Visa or Mastercard.

- Pick a hassle-free data file format and download your version.

Get each of the document layouts you might have bought in the My Forms food list. You can get a further version of Alaska Clauses Relating to Dividends, Distributions any time, if possible. Just click on the required kind to download or print the document template.

Use US Legal Forms, by far the most considerable variety of legal types, to save lots of time as well as steer clear of mistakes. The assistance provides professionally manufactured legal document layouts which can be used for a range of reasons. Create an account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

Alaska Permanent Fund Dividends and Resource Rebate payments are taxable to either an adult or a child recipient and must be reported on a federal income tax return.

Thursday, September 21, 2023 (Juneau, AK) ? Today the Department of Revenue announced the calculation of the 2023 Permanent Fund Dividend (PFD) as $1,312. The amount allocated for the dividend has been determined each year since 2016 by the Alaska Legislature.

Permanent Fund Dividends per Alaskan are set to be $1,304 in fiscal 2024. The fiscal 2024 budget prioritizes investments in public safety, public education, and economic development.

Adjusted for inflation. The 2023 Permanent Fund dividend will be $1,312, the Alaska Department of Revenue said Thursday. The annual payments to Alaskans will be disbursed beginning Oct. 5 and continue in the following weeks, the department said.

To be eligible for a PFD, you must have been an Alaska resident for the entire calendar year preceding the date you apply for a dividend and intend to remain an Alaska resident indefinitely at the time you apply for a dividend. There are other criteria for eligibility under Alaska Statute 43.23.

Thursday, September 21, 2023 (Juneau, AK) ? Today the Department of Revenue announced the calculation of the 2023 Permanent Fund Dividend (PFD) as $1,312. The amount allocated for the dividend has been determined each year since 2016 by the Alaska Legislature.

The State of Alaska funds the payment with interest on oil revenue earned by the State. Individuals are eligible to receive the payment if they reside in the State of Alaska for the entire year prior to applying for the Permanent Fund Dividend (PFD).

Residents have received the check known as the Permanent Fund Dividend since 1982, roughly six years after voters in the early days of oil development in Alaska created the nest-egg Permanent Fund to preserve some of the oil wealth for future generations.