Alaska Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

If you seek thorough, acquire, or create valid document templates, utilize US Legal Forms, the largest compilation of valid forms available on the Internet.

Capitalize on the site’s user-friendly and straightforward search feature to find the documents you need.

A selection of templates for corporate and personal applications is organized by categories, states, or keywords.

Every legal document template you purchase is yours to keep indefinitely. You have access to every form you downloaded in your account.

Act promptly to acquire and print the Alaska Shareholders' Agreement with Special Dividend Allocation among Shareholders in a Close Corporation using US Legal Forms. There are numerous professional and state-specific forms available for your corporate or personal requirements.

- Utilize US Legal Forms to obtain the Alaska Shareholders' Agreement with Special Dividend Allocation among Shareholders in a Close Corporation in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Acquire button to retrieve the Alaska Shareholders' Agreement with Special Dividend Allocation among Shareholders in a Close Corporation.

- You can also access forms you previously submitted online within the My documents section of your account.

- If you are accessing US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

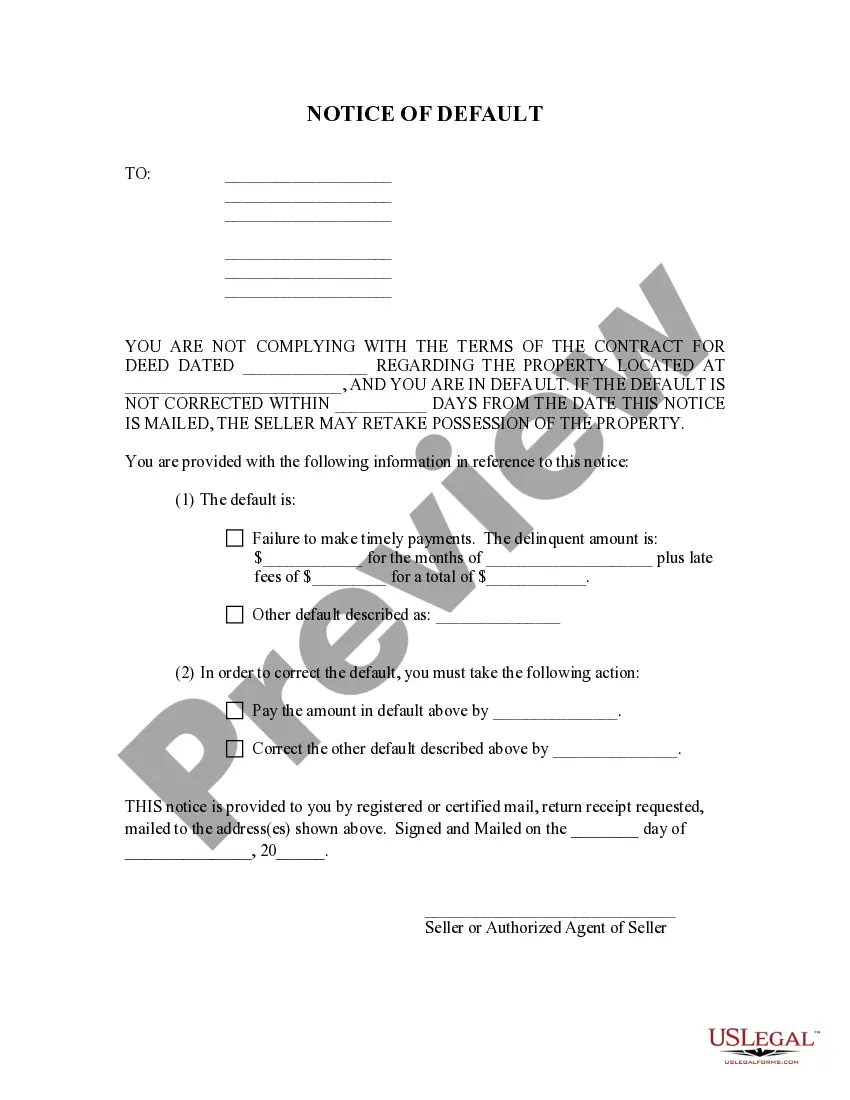

- Step 2. Use the Preview option to review the form’s content. Always remember to read through the details.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other types of your legal document template.

- Step 4. Once you find the form you need, click on the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Alaska Shareholders' Agreement with Special Dividend Allocation among Shareholders in a Close Corporation.

Form popularity

FAQ

Revenues originating from the Alaska Native Fund shall not be subject to any form of Federal, State, or local taxation at the time of receipt by a Regional Corporation, Village Corporation, or individual Native through dividend distributions (even if the Regional Corporation or Village Corporation distributing the

Important provisions within a Shareholders' Agreement include the decision-making powers of directors and shareholders, restrictions on the sale and transfer of shares, and the process for resolving disputes. If you're the only owner of your business, then you won't need to worry about a Shareholders' Agreement.

A shareholders agreement provides transparency and certainty in relation to the rights and responsibilities of the company, its shareholders and its directors, which can lead to a more efficiently and effectively managed company, reducing the potential for disputes to arise.

Having a shareholders' agreement is a cost effective way of minimizing any issues which may arise later on by making it clear how certain matters will be dealt with and by providing a forum for dispute resolution should an issue arise down the road.

Profits distributed to members (dividends) are not taxed in the members' hands, but, as with a company, the close corporation will need to pay dividend tax of 10% on the distributions (dividends) declared.

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.

Corporate Law and DividendsPublic corporations have no legal obligation to pay dividends to common shareholders, no matter how profitable they are or how much cash they have.

A close corporation is a corporation which does not exceed a statutorily defined number of shareholders and is not a public corporation. This number depends on the state's business laws, but the number is usually 35 shareholders.

Dividends are payments made by a corporation to one or more of its shareholders with respect to its stock. It is the portion of corporate profits paid out to stockholders. The distribution by the corporation must be in the ordinary course of the corporation's business.

Typically, money paid out by an S corporation is known as a distribution, and it is not taxable. C corporations pay out dividends, which are taxable to shareholders. A corporation is the only business structure responsible for paying its own taxes on profits.