Alaska Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool

Description

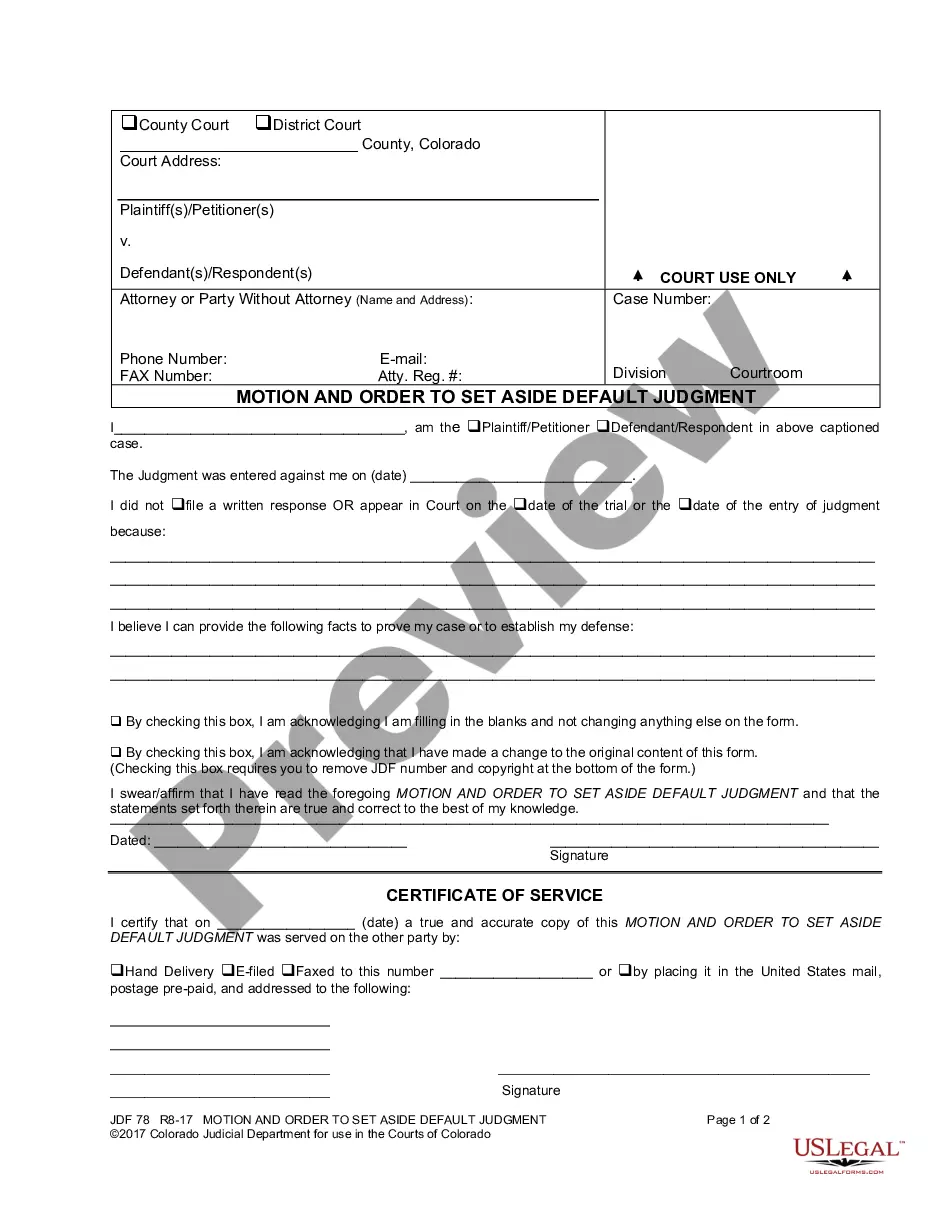

How to fill out Assignment Of Overriding Royalty Interest With Multiple Leases That Are Non Producing With Reservation Of The Right To Pool?

You may invest several hours on the web trying to find the legitimate document design which fits the federal and state requirements you need. US Legal Forms offers a large number of legitimate types which can be reviewed by specialists. It is simple to download or print the Alaska Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool from the service.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Acquire key. Afterward, you are able to full, modify, print, or signal the Alaska Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool. Each and every legitimate document design you buy is your own property forever. To get one more duplicate associated with a purchased form, proceed to the My Forms tab and then click the related key.

Should you use the US Legal Forms web site the very first time, stick to the easy instructions beneath:

- Initially, make sure that you have selected the right document design for the state/area that you pick. Read the form outline to ensure you have chosen the proper form. If available, make use of the Preview key to check from the document design also.

- If you want to find one more model of your form, make use of the Research area to find the design that meets your requirements and requirements.

- Once you have identified the design you would like, just click Acquire now to continue.

- Pick the prices strategy you would like, type your references, and register for a merchant account on US Legal Forms.

- Total the deal. You can use your charge card or PayPal accounts to purchase the legitimate form.

- Pick the file format of your document and download it to your system.

- Make modifications to your document if necessary. You may full, modify and signal and print Alaska Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool.

Acquire and print a large number of document themes while using US Legal Forms site, that offers the greatest assortment of legitimate types. Use professional and state-particular themes to handle your small business or individual needs.

Form popularity

FAQ

The political cost of the benefit is high. JUNEAU, Alaska (AP) ? Nearly every Alaskan will receive a $1,312 check starting this week, their annual share from the earnings of the state's nest-egg oil fund.

Alaska's oil royalty rate varies ing to the terms of the lease agreement. It can range from 5% to 60% but is most often 12.5%. Some leases receive royalty rate reductions for new discoveries or economic considerations.

While royalties on oil and gas produced from state territory generally hover between 12.5% and 16.67%, state law gives the commissioner of the Department of Natural Resources the authority to vary those terms if doing so is deemed in the state's best interest.

Alaska residents have been receiving annual dividend payments from the state's Permanent Fund for 41 years, but the 2022 payout is one of the largest in history. Every resident received $3,284 this year, with most payments issued in September and October.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

A royalty is the percentage of revenue paid to the federal government by energy companies from the sale of oil, gas, or coal extracted from the nation's public lands. The current royalty rate officially charged for oil, gas, and coal drilled or mined from U.S. public lands is 12.5 percent.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.