Alaska OEM Software Program License Agreement

Description

How to fill out OEM Software Program License Agreement?

Selecting the optimal legitimate documents template can be a challenge.

Certainly, there are numerous templates accessible online, but how do you find the official form you require.

Utilize the US Legal Forms website.

For new users of US Legal Forms, here are simple instructions to follow: First, ensure you have selected the right form for your city/state. You can view the form using the Preview button and read the form details to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the correct form. Once you are confident that the form is appropriate, select the Acquire Now button to download the form. Choose the pricing plan you want and input the required information. Create your account and make your purchase using your PayPal account or credit card. Select the file format and download the legal document template for your device. Complete, edit, print, and sign the downloaded Alaska OEM Software Program License Agreement. US Legal Forms is the largest collection of legal documents where you can find various document templates. Leverage the service to obtain professionally crafted documents that meet state requirements.

- The service provides thousands of templates, including the Alaska OEM Software Program License Agreement, suitable for both business and personal purposes.

- All forms are vetted by experts and comply with federal and state regulations.

- If you are already a member, Log In to your account and click the Download button to obtain the Alaska OEM Software Program License Agreement.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab in your account to download an additional copy of the document you need.

Form popularity

FAQ

While Alaska does not have a state income tax, businesses must still prepare for federal taxes and may have local tax obligations. It is essential to understand how these structures impact your finances. The Alaska OEM Software Program License Agreement can offer valuable insights into managing your tax responsibilities efficiently.

To form an S Corporation in Alaska, you first establish a standard corporation and then file IRS Form 2553. Ensure that you meet the eligibility criteria, such as shareholder limits and types. Utilize the resources from the Alaska OEM Software Program License Agreement to streamline the process and ensure compliance with all regulations.

Corporations in Alaska need to file Articles of Incorporation and annual reports to keep their status active. Additionally, they may need to file specific documents based on their business activities. The Alaska OEM Software Program License Agreement encompasses various tools that can assist you with understanding these requirements and ensuring timely filings.

Alaska does not impose a state corporate income tax, which can be beneficial for corporations operating there. However, businesses still need to plan for other taxes, such as federal taxes and local business licenses. Knowledge of the Alaska OEM Software Program License Agreement can help you navigate the necessary tax obligations efficiently.

Yes, limited liability companies (LLCs) in Alaska must file an annual report with the state. This report keeps your LLC in good standing and confirms its ongoing existence. Utilizing resources like the Alaska OEM Software Program License Agreement can streamline the filing process for your LLC.

Corporations in Alaska need to file several documents to remain compliant. Key filings include Articles of Incorporation, annual reports, and any necessary amendments. The Alaska OEM Software Program License Agreement may provide guidance on regulatory compliance for software solutions that assist in these filings.

A common example of an OEM license is when a computer manufacturer installs a specific operating system on their devices. This license permits the manufacturer to sell the system alongside the hardware, making it an integrated solution. Understanding examples like this can clarify how the Alaska OEM Software Program License Agreement can benefit your business by allowing smoother software distribution.

An OEM license works by granting manufacturers the right to pre-install software on their devices before selling them to end-users. This arrangement allows manufacturers to offer added value while ensuring software developers receive royalties. By leveraging the Alaska OEM Software Program License Agreement, businesses can streamline their licensing process and enhance product offerings.

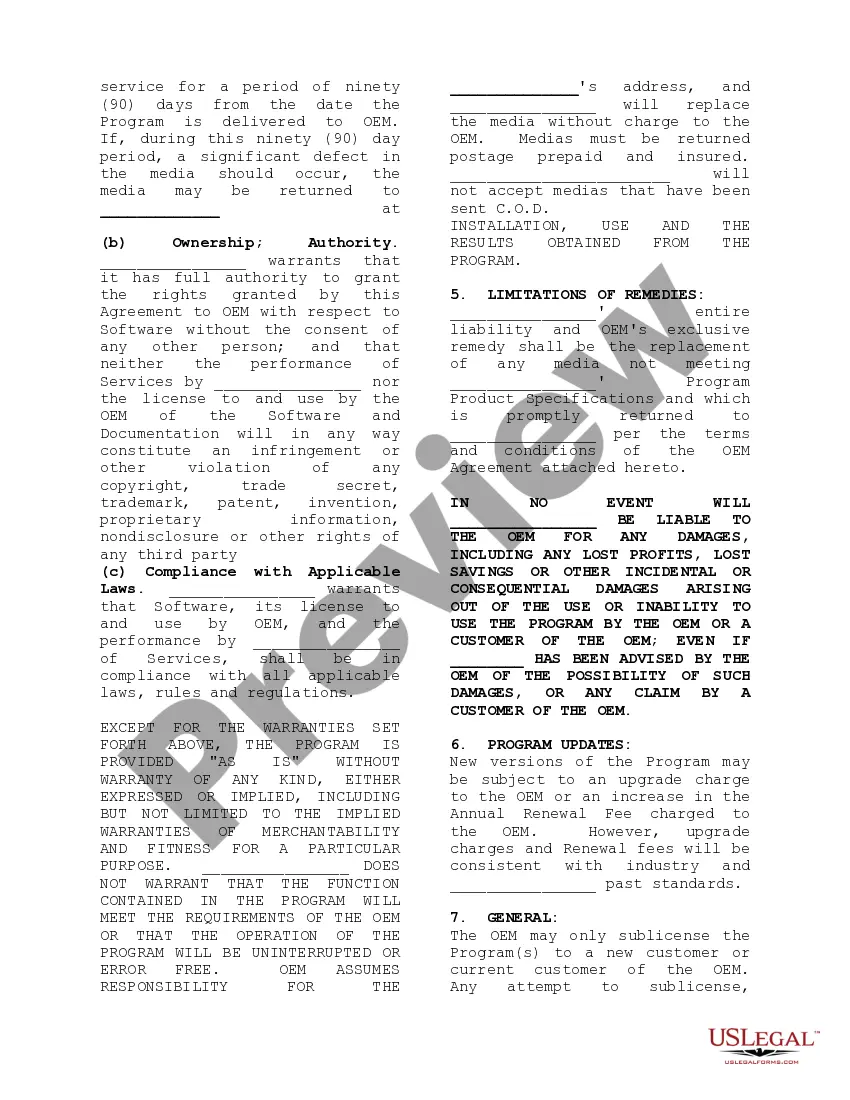

An OEM license agreement outlines the terms under which software can be used and distributed by a manufacturer. This agreement typically specifies the rights and responsibilities of both parties involved. For businesses in Alaska, having a clear understanding of the Alaska OEM Software Program License Agreement is vital for regulatory compliance and successful software integration.

When reviewing a software license agreement, look for terms regarding usage rights, restrictions, and duration. Additionally, consider clauses about updates, support, and termination. Understanding these aspects, especially within the Alaska OEM Software Program License Agreement, helps you protect your investment and make informed decisions.