Alaska Account Executive Agreement - Self-Employed Independent Contractor

Description

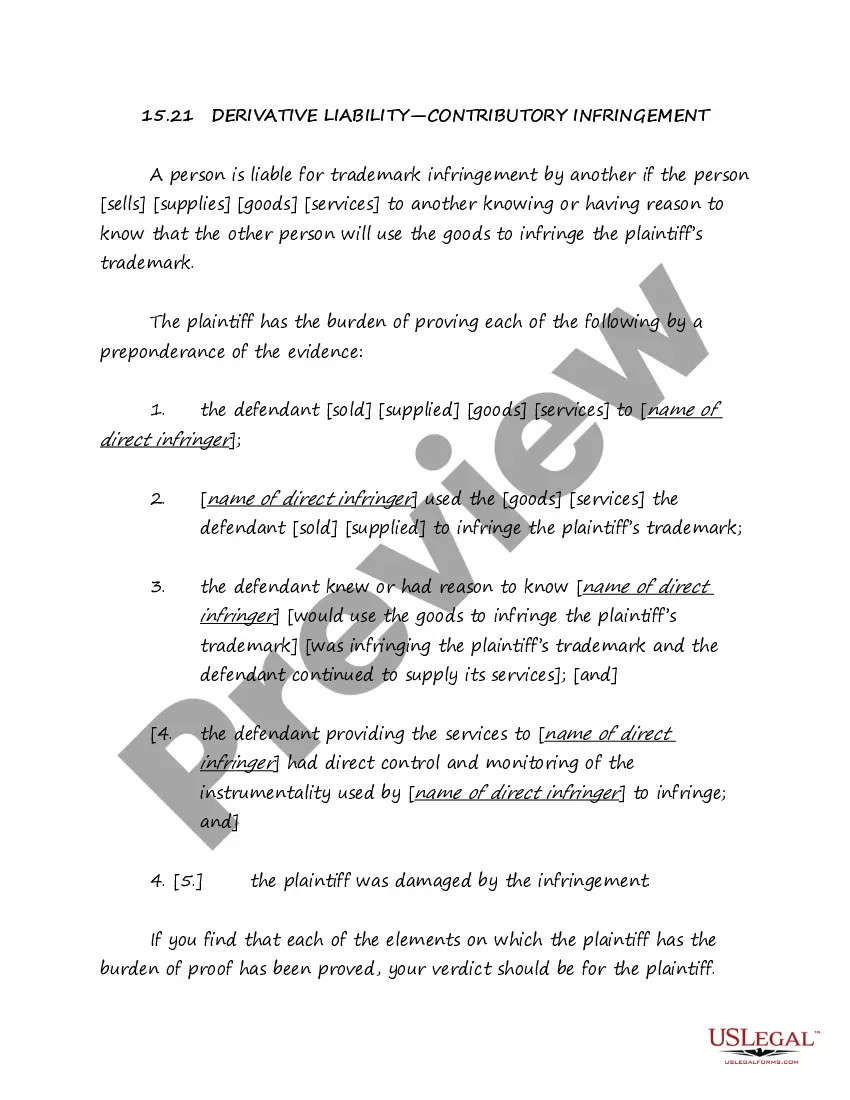

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

Finding the appropriate legal document template can be a challenge. Of course, there are numerous templates accessible online, but how can you locate the legal form you require? Utilize the US Legal Forms website. This service offers a multitude of templates, including the Alaska Account Executive Agreement - Self-Employed Independent Contractor, which can be utilized for both business and personal purposes. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already a member, Log In to your account and click on the Download button to access the Alaska Account Executive Agreement - Self-Employed Independent Contractor. Use your account to search through the legal forms you have previously purchased. Visit the My documents section of your account and retrieve another copy of the document you desire.

If you are a new user of US Legal Forms, here are simple steps you can follow: First, ensure you have selected the correct form for your locality/state. You can preview the form using the Preview button and review the form description to confirm it is the correct one for you. If the form does not satisfy your needs, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Buy now button to acquire the form. Select the payment plan you prefer and provide the necessary information. Create your account and place an order using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Finally, complete, edit, print, and sign the downloaded Alaska Account Executive Agreement - Self-Employed Independent Contractor.

Make the most of your legal documentation needs with US Legal Forms, ensuring you have the right forms at your fingertips.

- US Legal Forms is the largest collection of legal forms where you can access various document templates.

- Utilize the service to download professionally crafted documents that comply with state regulations.

- Ensure your legal documents meet all necessary legal standards with US Legal Forms.

- Access a wide range of templates for different legal needs.

- Get started quickly and efficiently with user-friendly navigation.

Form popularity

FAQ

Yes, having a contract is essential for independent contractors. An Alaska Account Executive Agreement - Self-Employed Independent Contractor outlines your relationship with clients clearly. This document defines your roles, responsibilities, and compensation, minimizing misunderstandings. Utilizing platforms like USLegalForms can help you create comprehensive and legally compliant agreements tailored to your needs.

The recent federal regulations clarify the classification of independent contractors. These rules may affect how the Alaska Account Executive Agreement - Self-Employed Independent Contractor is interpreted and implemented. By aligning with these regulations, you can ensure compliance and protect your business interests. Keeping abreast of these changes helps you maintain a sustainable independent contracting practice.

Yes, an independent contractor is considered self-employed. When you enter into an Alaska Account Executive Agreement - Self-Employed Independent Contractor, you are not tied to an employer. Instead, you manage your own business, set your own hours, and control how you deliver your services. This classification gives you flexibility but also requires you to handle your taxes and liabilities.

The primary difference between an independent contractor and an employee in Alaska lies in control and independence. Generally, independent contractors operate and manage their own businesses, while employees work under an employer's direction. Recognizing these distinctions is crucial when drafting agreements, and using the Alaska Account Executive Agreement - Self-Employed Independent Contractor can help clarify these roles.

In Alaska, the independent contractor agreement is designed to protect both the contractor and the client during a business arrangement. This agreement usually outlines key provisions specific to Alaskan laws and regulations, ensuring compliance. The Alaska Account Executive Agreement - Self-Employed Independent Contractor includes essential elements to create a fair and balanced contract.

A basic independent contractor agreement is a legal document that defines the working relationship between a contractor and a client. It typically specifies the services to be performed, payment terms, and timelines. The Alaska Account Executive Agreement - Self-Employed Independent Contractor serves as an excellent foundation for establishing clear expectations and safeguarding the interests of both parties.

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and responsibilities of both parties. It's essential to include details that reflect the nature of the services provided and the duration of the agreement. By using a comprehensive template like the Alaska Account Executive Agreement - Self-Employed Independent Contractor, you can ensure all critical aspects are covered.

Providing proof of employment as a self-employed independent contractor generally involves presenting documentation such as contracts, invoices, and payment records. These documents showcase your business relationship with clients and establish your professional status. Utilizing the Alaska Account Executive Agreement - Self-Employed Independent Contractor can help formalize your status and serve as proof of your work.

To work as a self-employed independent contractor in Alaska, you must adhere to specific legal requirements. This includes obtaining the necessary business licenses, adhering to tax regulations, and maintaining proper records of income and expenses. The Alaska Account Executive Agreement - Self-Employed Independent Contractor outlines key elements to ensure compliance with state laws.

Filling out an independent contractor agreement, such as an Alaska Account Executive Agreement - Self-Employed Independent Contractor, involves several key steps. First, clearly outline the scope of work, payment terms, and deadlines. Next, both you and the contractor should sign the document to ensure mutual understanding and commitment. Using a reliable platform like uslegalforms can simplify this process and provide templates that ensure you include all necessary elements.