Connecticut Certificate of Dissolution (Stock Corp) is a document that is filed with the Connecticut Secretary of State to dissolve a corporation in the state. It is a formal declaration that a company's legal existence has been terminated, and it can no longer conduct business. The certificate must be signed by the corporation's president, vice president, treasurer, or assistant treasurer, and must include the company's name, registered office address, Connecticut registration number, and the date of dissolution. In Connecticut, there are two types of Certificate of Dissolution for Stock Corporations: Voluntary and Involuntary. Voluntary dissolution is initiated by the corporation's board of directors and requires approval by the shareholders. Involuntary dissolution is a court order, usually because of criminal activity or bankruptcy.

Connecticut Certificate of Dissolution (Stock Corp)

Description

How to fill out Connecticut Certificate Of Dissolution (Stock Corp)?

Creating legal documents can be quite a challenge if you lack readily available templates. With the US Legal Forms online library of official files, you can trust the forms you acquire, as all of them adhere to federal and state regulations and are reviewed by our experts.

Obtaining your Connecticut Certificate of Dissolution (Stock Corp) from our service is as straightforward as 123. Existing users with an active subscription just need to Log In and click the Download button once they find the appropriate template. Later, if needed, users can select the same document from the My documents section of their profile.

Haven’t explored US Legal Forms yet? Enroll in our service today to acquire any official document swiftly and easily whenever necessary, and maintain your paperwork in proper order!

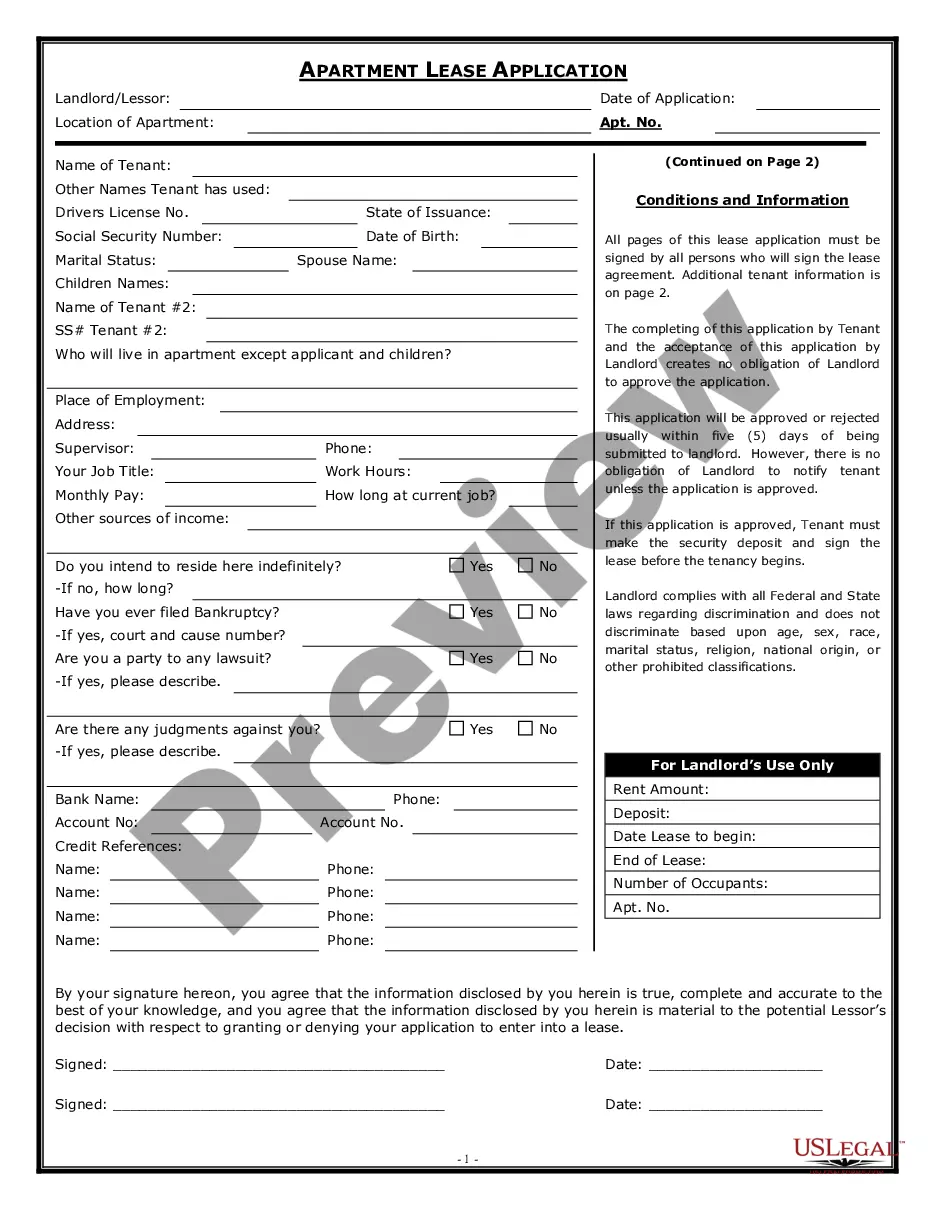

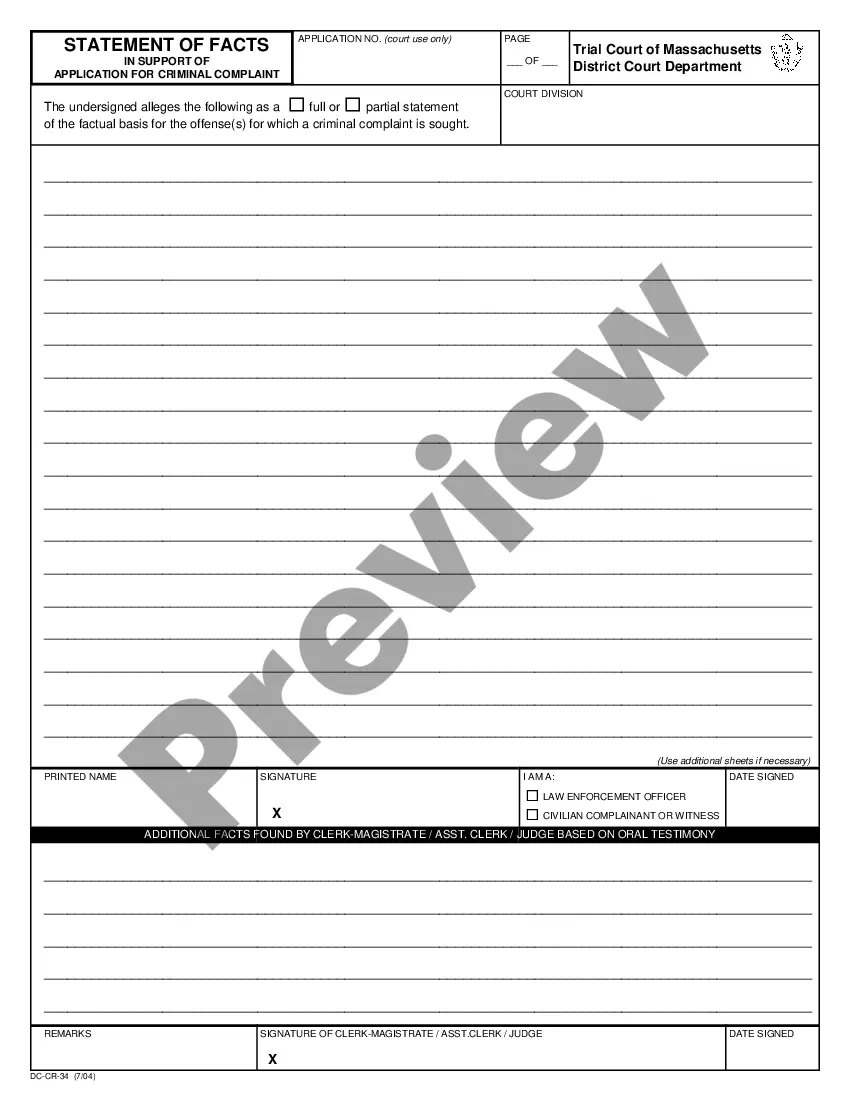

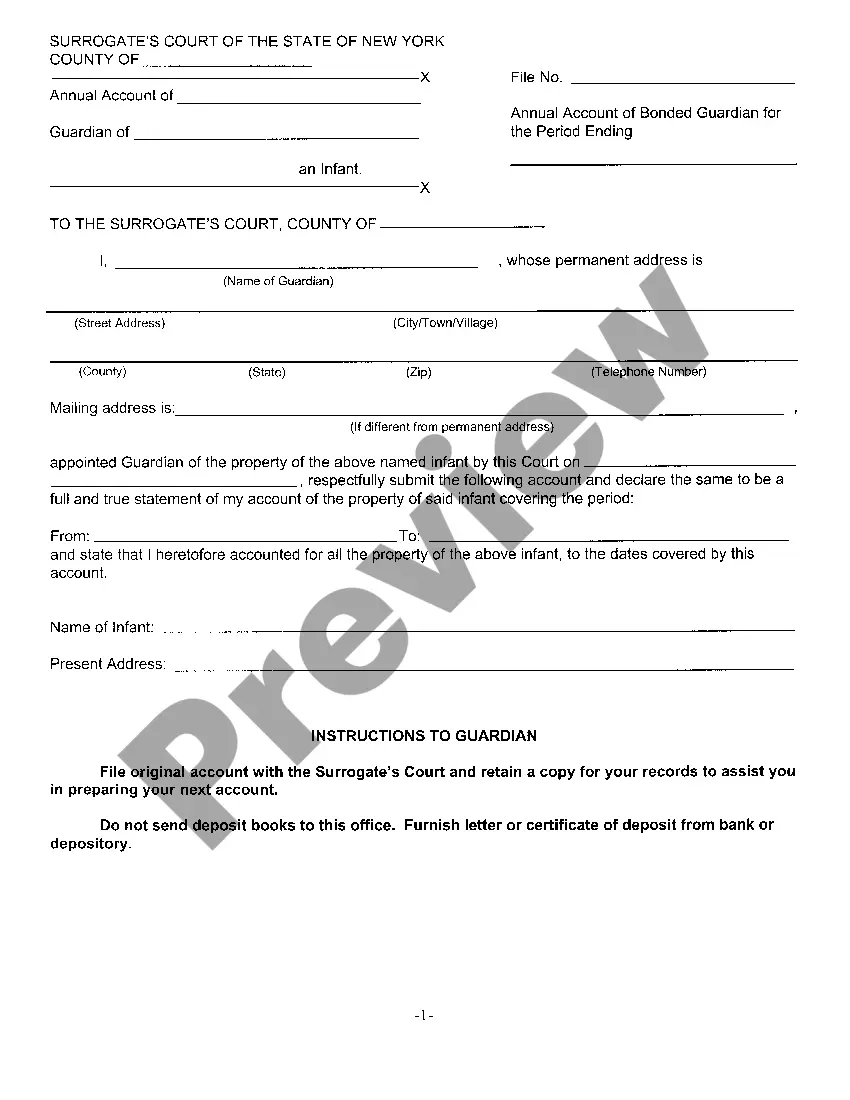

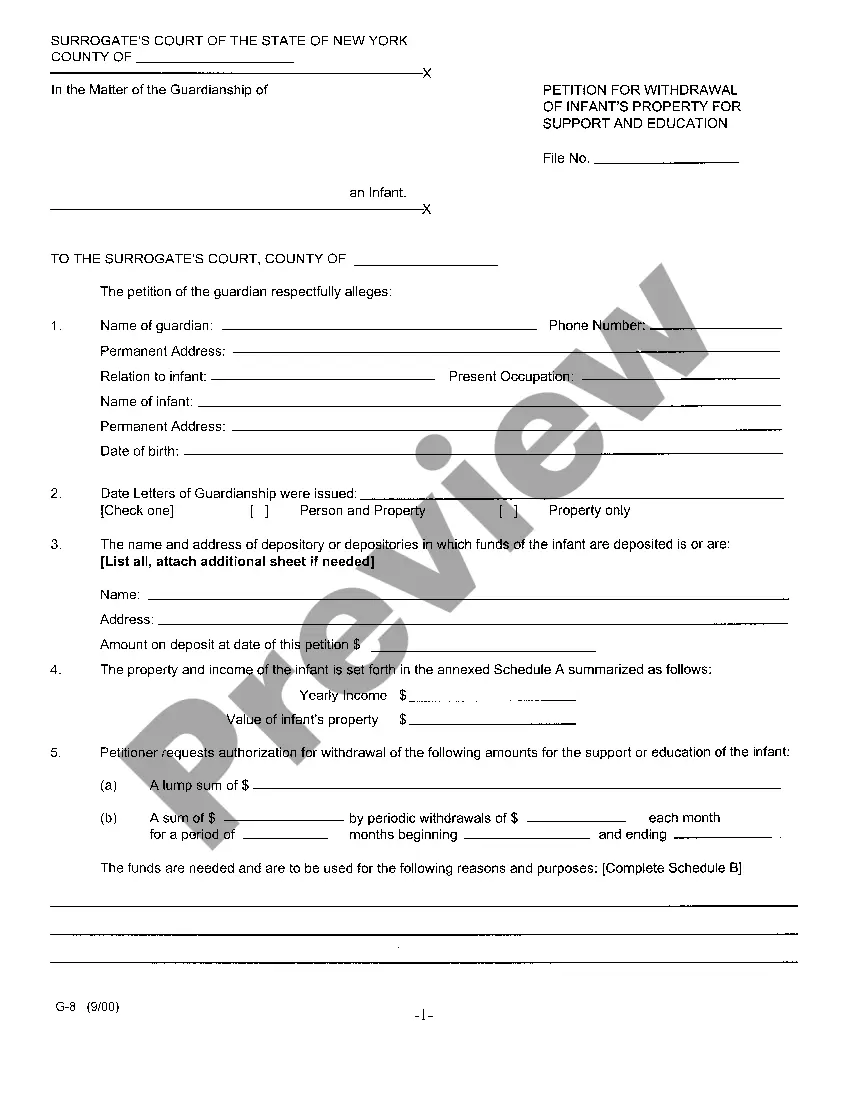

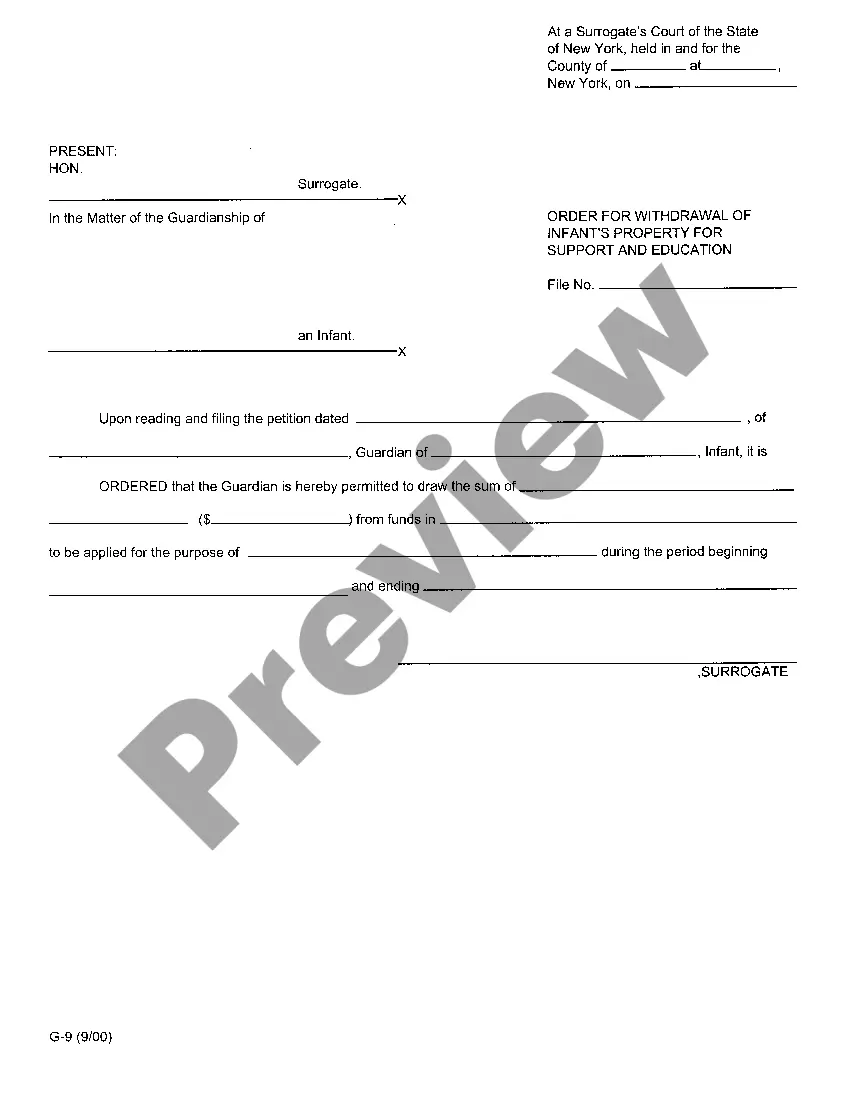

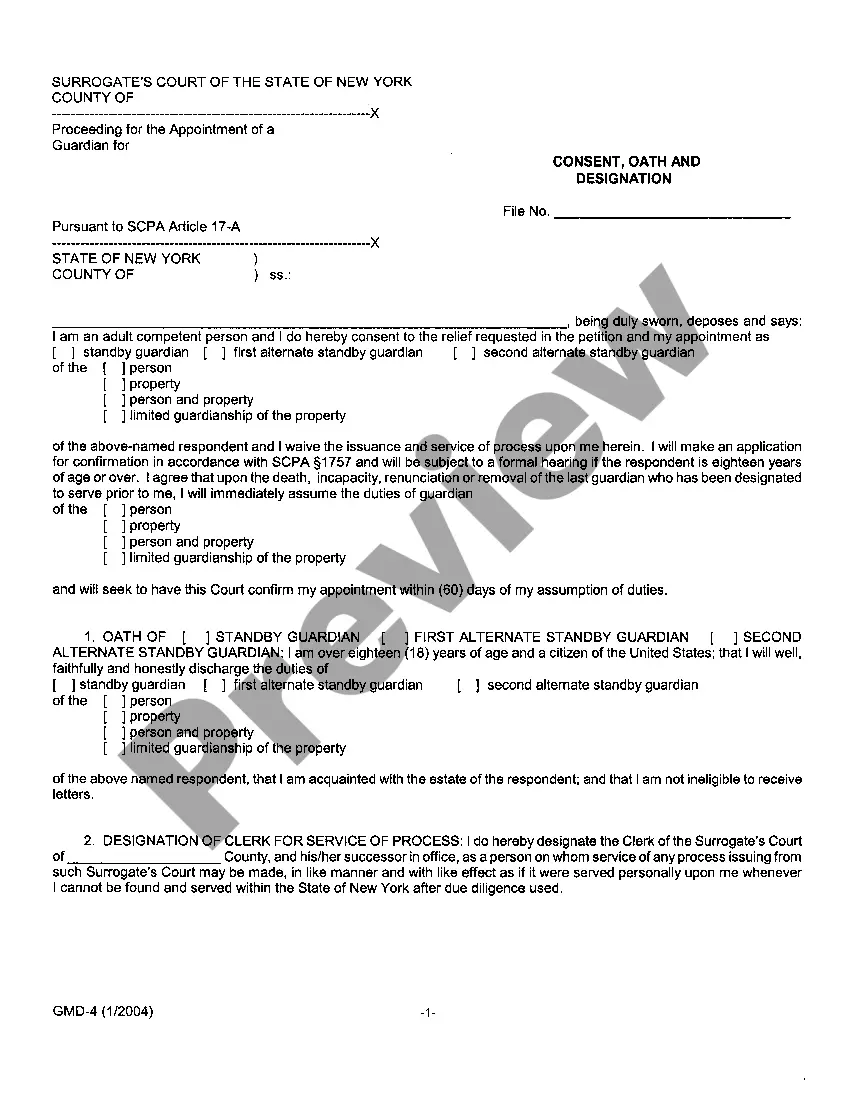

- Document compliance confirmation. You should thoroughly review the content of the form you wish to use and ensure it meets your requirements and adheres to your state laws. Previewing your document and examining its general overview will assist you in doing this.

- Alternate search (optional). If you notice any discrepancies, explore the library via the Search tab above until you discover the suitable document, and click Buy Now once you find the one you need.

- Account creation and document purchase. Register for an account with US Legal Forms. After your account is verified, Log In and choose your desired subscription plan. Proceed with payment (options include PayPal and credit card).

- Template download and further use. Choose the file format for your Connecticut Certificate of Dissolution (Stock Corp) and click Download to save it on your device. Print it to manually complete your documents, or utilize a versatile online editor to prepare an electronic version more quickly and effectively.

Form popularity

FAQ

Yes, dissolution refers to the formal process of closing a business, which legally ends its existence. This involves filing a Certificate of Dissolution with the state and addressing any remaining obligations, such as debts and taxes. It's crucial to distinguish between dissolution and simply ceasing operations, as the former ensures all legal ties are properly severed. For businesses navigating this path, obtaining a Connecticut Certificate of Dissolution (Stock Corp) is a vital step toward completing the process.

S Corporations are generally not taxed at the corporate level in Connecticut, as their income passes through to the individual shareholders, who then report it on their personal tax returns. However, they may still be subject to certain state taxes, including the Connecticut Business Entity Tax. Understanding how these taxes apply can greatly aid in financial planning, especially if you are considering the dissolution of an S Corporation and require a Connecticut Certificate of Dissolution (Stock Corp).

Companies often choose to incorporate in Connecticut due to its favorable business climate, strong legal protections, and accessible resources for entrepreneurs. The state also offers various incentives, such as tax exemptions and programs that support innovation and growth. These benefits make Connecticut an attractive option for businesses, whether they are starting out or transitioning, including the potential step of obtaining a Connecticut Certificate of Dissolution (Stock Corp) when needed.

The 2% rule refers to the limit on the amount of deductions for employee benefits provided by an S Corporation to shareholders who own more than 2% of the stock. Under this rule, these shareholders must include certain benefits in their income, which could affect their overall tax obligations. Therefore, it's crucial for S Corporation owners to be aware of how this rule impacts their tax situation while also considering possible dissolution. A Connecticut Certificate of Dissolution (Stock Corp) can be pursued if the business needs to close operations.

An S Corporation must meet specific criteria to qualify, including being a domestic corporation and having 100 or fewer shareholders. Furthermore, all shareholders must be U.S. citizens or residents, and the corporation can only have one class of stock. These criteria ensure that the S Corporation maintains its tax status. Business owners should carefully consider these points, especially when contemplating obtaining a Connecticut Certificate of Dissolution (Stock Corp).

S Corporations face several restrictions, including limitations on the number of shareholders, which cannot exceed 100. Additionally, shareholders must be individuals, certain trusts, or estates, but cannot be non-resident aliens or other corporations. S Corporations also cannot have more than one class of stock, which can limit financial structuring options. Understanding these restrictions is critical for anyone considering the dissolution of their S Corporation and seeking a Connecticut Certificate of Dissolution (Stock Corp).

To dissolve a corporation in Connecticut, you need to file a Certificate of Dissolution with the Secretary of State. It's important first to settle any outstanding debts and obligations, as well as notify shareholders of the dissolution. Once the Certificate of Dissolution is submitted, it will take effect, and you'll receive a confirmation. This process is essential for businesses planning a formal end to operations and may involve obtaining a Connecticut Certificate of Dissolution (Stock Corp) as part of the procedure.

In Connecticut, an S Corporation must adhere to specific eligibility criteria, including having no more than 100 shareholders, all of whom must be US citizens or residents. Moreover, S Corporations in Connecticut must file an election to be taxed as an S Corporation using IRS Form 2553. Additionally, these corporations must comply with state law requirements, such as maintaining proper records and filing necessary annual reports. Understanding these rules helps businesses facilitate their operations smoothly, especially when seeking a Connecticut Certificate of Dissolution (Stock Corp).

To obtain a divorce certificate in Connecticut, you will typically contact the clerk's office in the court where the divorce was finalized. Ensure you have your identification and relevant case details ready. You can also leverage online resources, like US Legal Forms, to help you prepare the necessary information and gain access to the required Connecticut Certificate of Dissolution (Stock Corp). This makes the process more efficient.

In Connecticut, you can acquire a divorce certificate by requesting it from the appropriate state office. It's crucial to have all relevant information handy, such as case number and dates, to expedite the process. US Legal Forms can assist you in obtaining the necessary documents, including the Connecticut Certificate of Dissolution (Stock Corp). By using their services, you can navigate the required steps smoothly.