Alaska Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

If you need to finish, download, or print official document templates, utilize US Legal Forms, the largest collection of official forms, which is available online.

Utilize the website's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal applications are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing option you prefer and enter your details to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to find the Alaska Payroll Deduction Authorization Form for Optional Matters - Employee with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to retrieve the Alaska Payroll Deduction Authorization Form for Optional Matters - Employee.

- You can also access templates you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

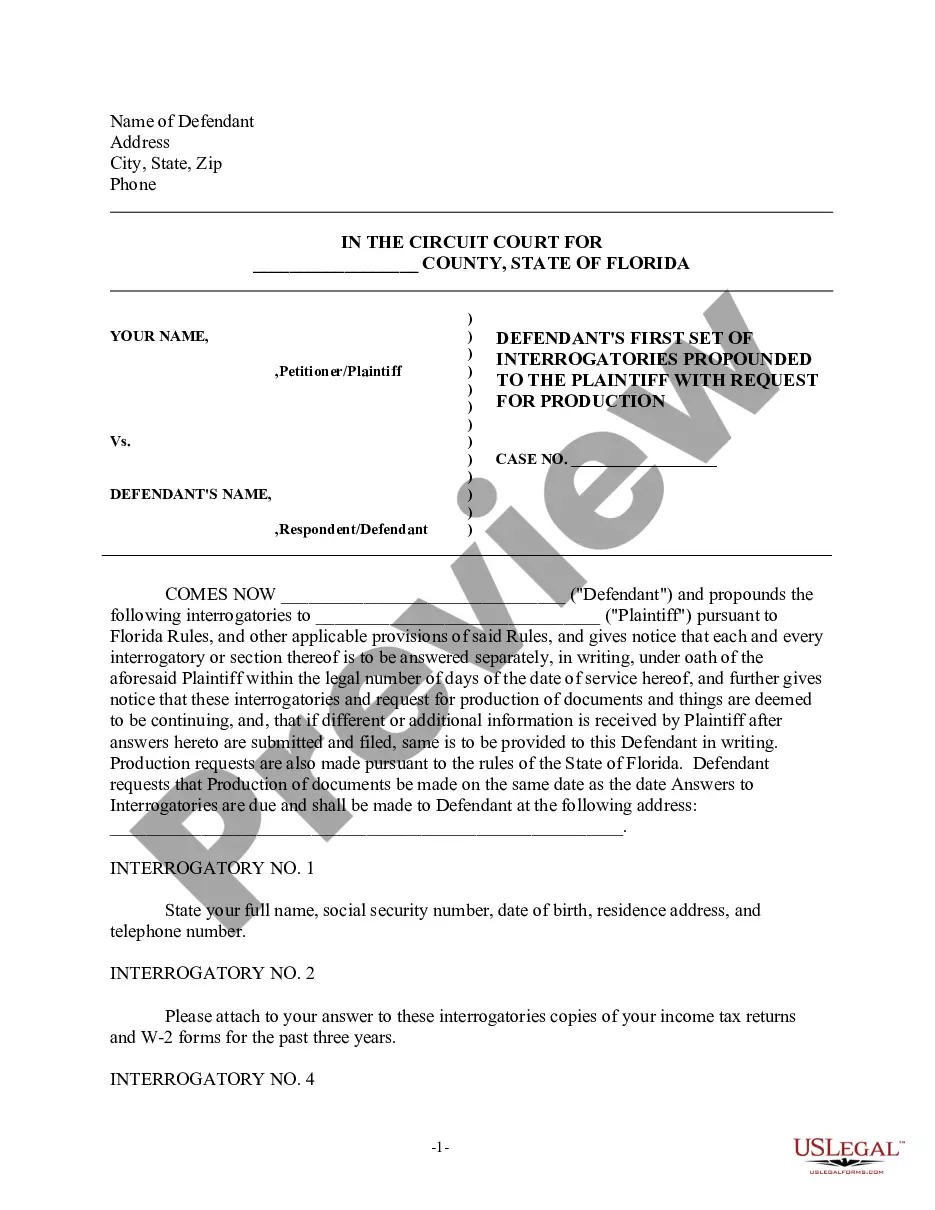

- Step 2. Take advantage of the Preview feature to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of your legal form template.

Form popularity

FAQ

Verifying employment for Alaska Airlines employees can often be done through official channels or through approved verification services. Employers may require a signed release form from the employee, which can sometimes include an Alaska Payroll Deduction Authorization Form for Optional Matters - Employee if salary information is needed. Utilizing reliable employment verification services simplifies this process, ensuring you receive accurate information. Always follow best practices to maintain privacy and confidentiality.

The Alaska Payroll Deduction Authorization Form for Optional Matters - Employee is essential for employees seeking salary deductions for specific purposes. This form allows employees to authorize their employer to deduct specific amounts from their paychecks for benefits or voluntary contributions. By completing this form, you can ensure that your deductions are handled correctly and according to your preferences. It streamlines the process and prevents any discrepancies in future deductions.

The minimum salary for exempt employees in Alaska for 2025 is expected to align with updated federal and state regulations. Employers must stay informed about potential changes to ensure compliance with labor laws. Using the Alaska Payroll Deduction Authorization Form for Optional Matters - Employee will help manage any adjustments needed in payroll deductions. For the most accurate information, checking with local labor agencies is recommended.

As of now, the minimum salary for exempt employees in Alaska aligns with federal guidelines, which is generally set at a specific threshold. This figure can vary based on the type of employment and the nature of the business. Properly completing the Alaska Payroll Deduction Authorization Form for Optional Matters - Employee is essential for managing payroll deductions in compliance with this structure. If you have specific concerns, it’s wise to consult HR for detailed guidance.

Yes, state of Alaska employees typically contribute to Social Security. This is part of their payroll deductions, which align with federal requirements. By providing the Alaska Payroll Deduction Authorization Form for Optional Matters - Employee, employees ensure that their contributions are accurately processed. Understanding these benefits is important for planning retirement.

Alaska Airlines employees may receive various bonuses based on performance and tenure. These bonuses can enhance their overall compensation and are typically outlined in employee agreements. Understanding how to maximize your benefits, including any applicable Alaska Payroll Deduction Authorization Form for Optional Matters - Employee, is crucial for optimizing your financial planning. For personalized assistance, consider using USLegalForms to navigate these employee-specific queries.