Alaska Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan

Description

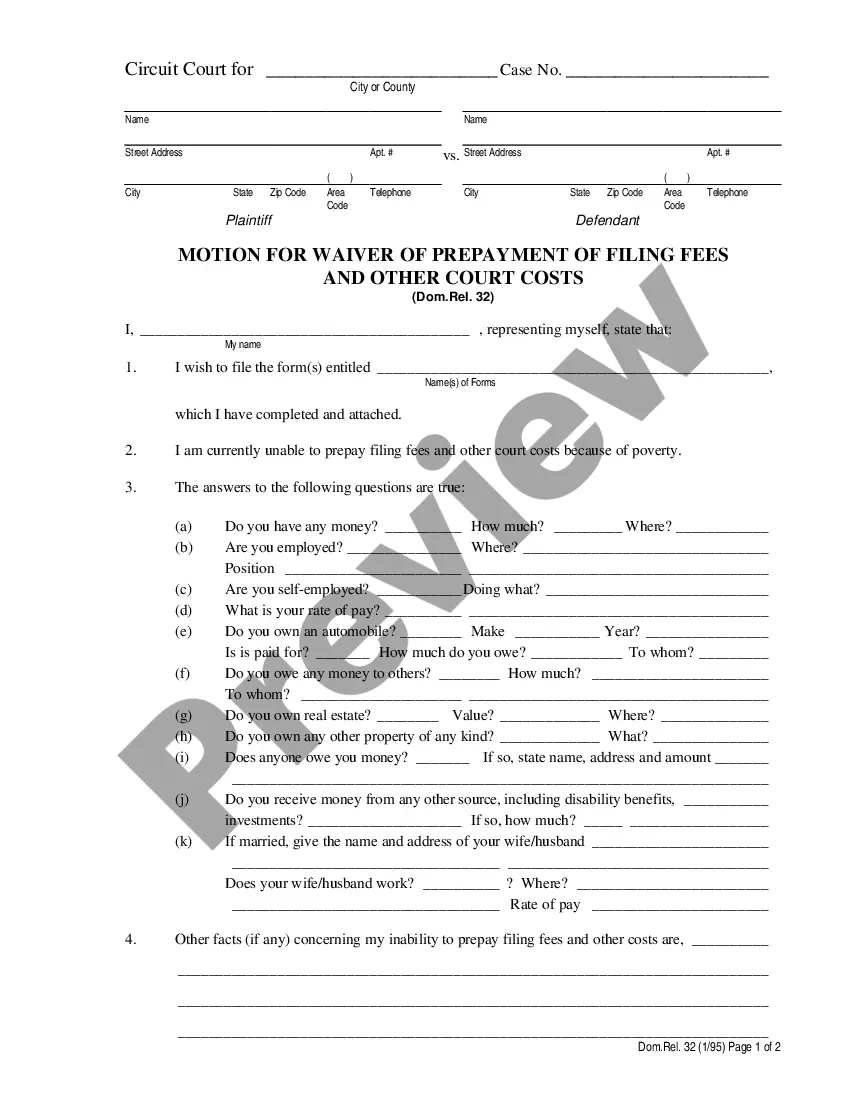

How to fill out Adoption Of Nonemployee Directors Deferred Compensation Plan With Copy Of Plan?

US Legal Forms - among the biggest libraries of lawful forms in America - provides a variety of lawful papers themes you may obtain or printing. Making use of the internet site, you can get 1000s of forms for organization and person reasons, sorted by categories, says, or search phrases.You can find the newest variations of forms much like the Alaska Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan in seconds.

If you have a registration, log in and obtain Alaska Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan in the US Legal Forms library. The Obtain button can look on every form you see. You get access to all earlier acquired forms from the My Forms tab of your own accounts.

If you wish to use US Legal Forms for the first time, here are basic guidelines to obtain began:

- Make sure you have picked out the best form to your area/county. Go through the Review button to review the form`s content. Look at the form outline to ensure that you have selected the proper form.

- When the form does not fit your needs, utilize the Research discipline on top of the screen to get the one who does.

- Should you be content with the form, affirm your decision by clicking on the Get now button. Then, choose the prices program you like and offer your qualifications to register for the accounts.

- Method the deal. Use your bank card or PayPal accounts to finish the deal.

- Select the file format and obtain the form on your own system.

- Make adjustments. Fill out, edit and printing and signal the acquired Alaska Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan.

Each design you included with your account does not have an expiration time and is your own property eternally. So, if you would like obtain or printing yet another backup, just check out the My Forms area and click on about the form you need.

Get access to the Alaska Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan with US Legal Forms, the most comprehensive library of lawful papers themes. Use 1000s of expert and status-certain themes that meet up with your small business or person needs and needs.

Form popularity

FAQ

If you leave your company or retire early, funds in a Section 409A deferred compensation plan aren't portable. They can't be transferred or rolled over into an IRA or new employer plan. Unlike many other employer retirement plans, you can't take a loan against a Section 409A deferred compensation plan.

The tax law requires the plan to be in writing; the plan document(s) to specify the amount to be paid, the payment schedule, and the triggering event that will result in payment; and for the employee to make an irrevocable election to defer compensation before the year in which the compensation is earned.

Put the plan in writing: Think of it as a contract with your employee. Be sure to include the deferred amount and when your business will pay it. Decide on the timing: You'll need to choose the events that trigger when your business will pay an employee's deferred income.

You have the ability to change your contribution amount for a specific payday, then have your deferral automatically revert to the prior contribution amount once that payday has passed. To do this, you can call (844) 523-2457 or log in to your account and do the following: Select the Account tab from the Home page.

The State of Alaska 457 Deferred Compensation Plan (DCP) allows you to set aside and invest a portion of your income for your retirement on a voluntary basis. It is designed to complement the Alaska SBS Supplemental Annuity Plan and the Alaska PERS/TRS Retirement Plan.