The purpose of the non-employee director stock option plan is to attract and retain highly qualified people who are not employees of the company or any of its subsidiaries to serve as non-employee directors of the company, and to encourage non-employee directors to own shares of the company's common stock.

Alaska Nonemployee Director Stock Option Plan

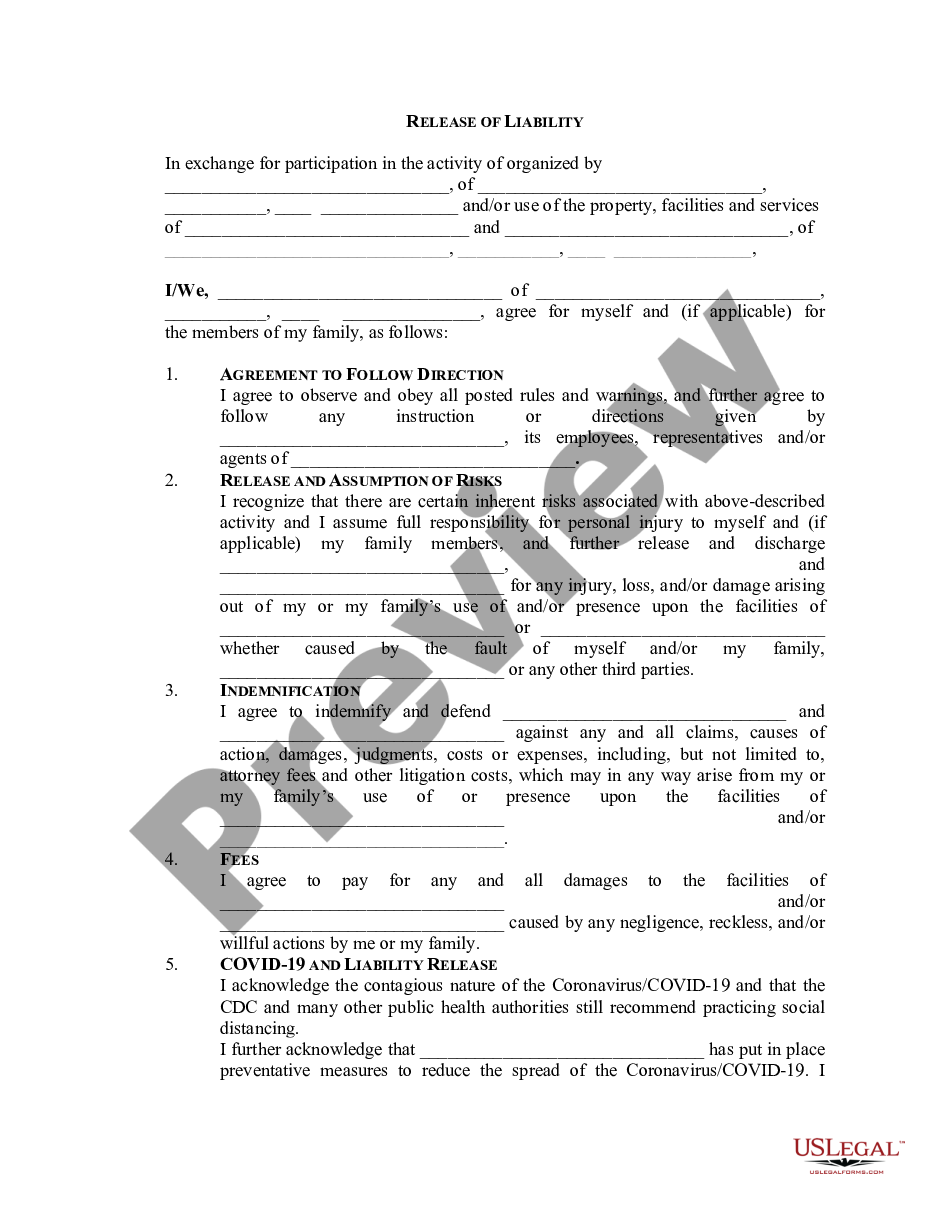

Description

How to fill out Nonemployee Director Stock Option Plan?

Have you been inside a placement the place you will need papers for possibly organization or person purposes nearly every working day? There are a lot of lawful record templates available on the net, but finding types you can trust is not straightforward. US Legal Forms provides a large number of develop templates, such as the Alaska Nonemployee Director Stock Option Plan, that are published to satisfy state and federal requirements.

When you are already familiar with US Legal Forms web site and get your account, just log in. Following that, you may download the Alaska Nonemployee Director Stock Option Plan web template.

Should you not have an accounts and wish to begin to use US Legal Forms, follow these steps:

- Discover the develop you will need and make sure it is to the appropriate city/area.

- Utilize the Preview switch to analyze the shape.

- Browse the outline to actually have chosen the proper develop.

- When the develop is not what you are trying to find, utilize the Research field to obtain the develop that fits your needs and requirements.

- Once you obtain the appropriate develop, just click Acquire now.

- Choose the costs program you would like, submit the required details to create your account, and purchase an order making use of your PayPal or bank card.

- Pick a handy file formatting and download your version.

Find every one of the record templates you possess bought in the My Forms menu. You can obtain a extra version of Alaska Nonemployee Director Stock Option Plan any time, if required. Just select the needed develop to download or produce the record web template.

Use US Legal Forms, by far the most considerable selection of lawful forms, to conserve some time and avoid mistakes. The services provides appropriately produced lawful record templates that you can use for a variety of purposes. Create your account on US Legal Forms and commence making your way of life a little easier.