Alaska Travel Expense Reimbursement Form

Description

How to fill out Travel Expense Reimbursement Form?

You can allocate hours on the web searching for the legitimate document template that aligns with the federal and state requirements you need.

US Legal Forms provides thousands of legal documents that are verified by experts.

You can download or print the Alaska Travel Expense Reimbursement Form from our service.

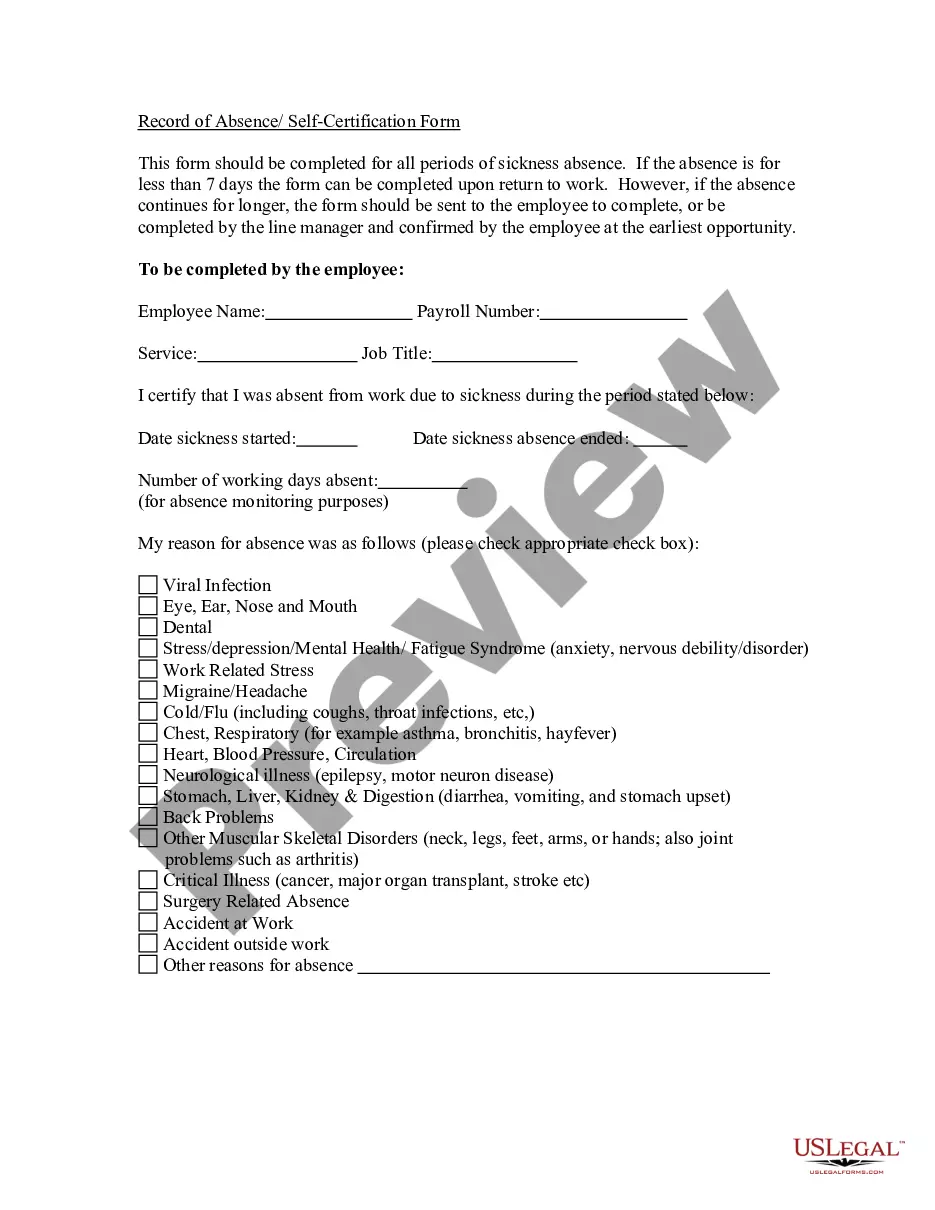

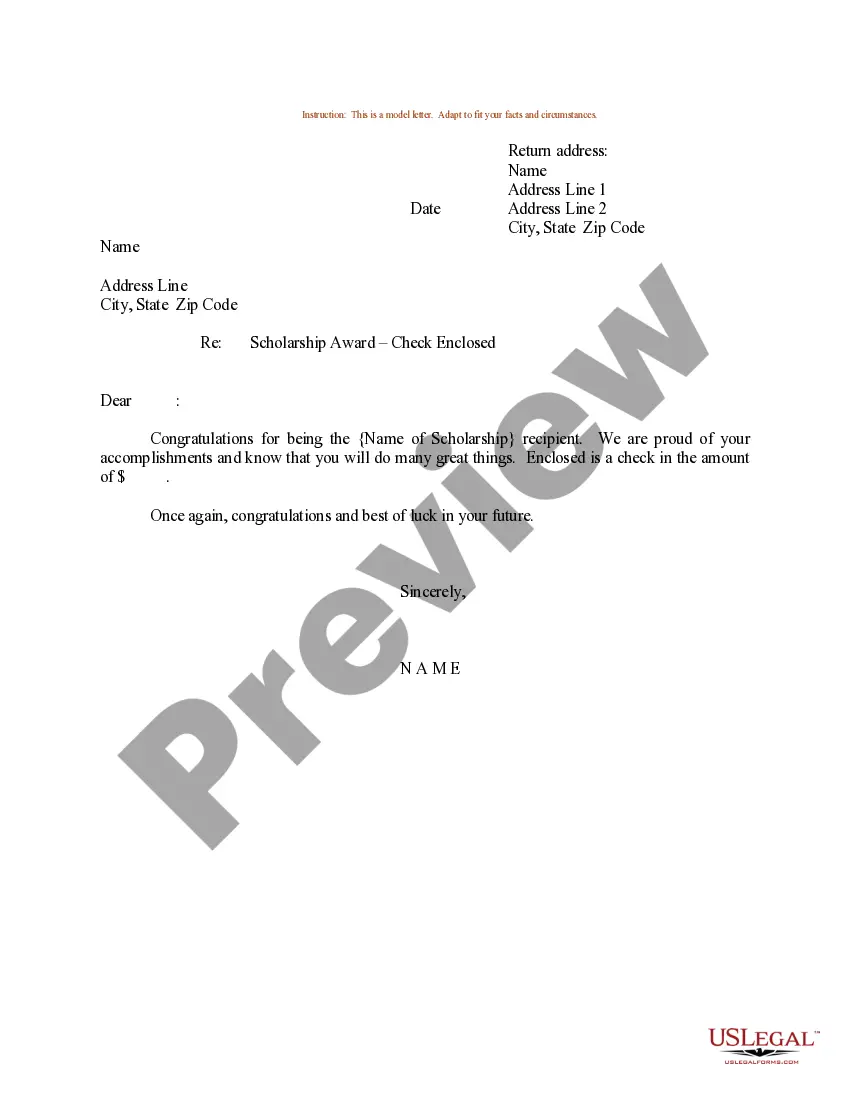

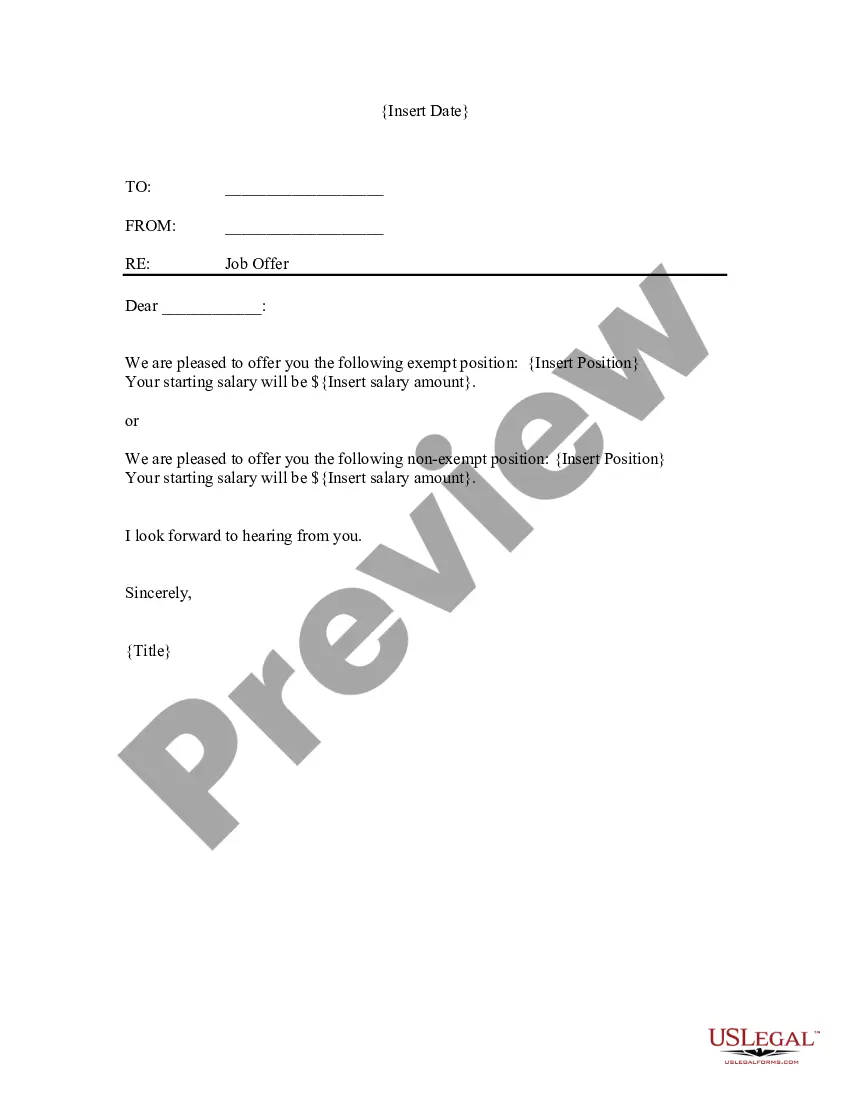

If available, utilize the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Alaska Travel Expense Reimbursement Form.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for the state/city of your choice.

- Review the form details to ensure you have chosen the correct document.

Form popularity

FAQ

While unreimbursed work-related travel expenses generally are deductible on a taxpayer's individual tax return (subject to a 50% limit for meals and entertainment) as a miscellaneous itemized deduction, many employees won't be able to benefit from the deduction.

Within 30 days of completion of a trip, the traveler must submit a travel reimbursement form and supporting documentation to obtain reimbursement of expenses. An individual may not approve his or her own travel or reimbursement.

A travel expense is a cost incurred by an employee through travelling on work-related activities, away from their usual place of work. Travel expenses are reimbursed by the company when the employee makes a claim.

Reimbursable travel expenses include the ordinary expenses of public or private transportation as well as unusual costs due to special circumstances.

The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses from employee wages under an accountable plan; or (2) employers can consider all payments to employees as wages under a non-accountable

Under California labor laws, you are entitled to reimbursement for travel expenses or losses that are directly related to your job.

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.

A travel and expense policy's purpose is to eliminate or reduce the risk factors involved in the expense reporting process. It does so by specifying the rules and principles that the finance teams and the employees must follow while dealing with their business travel expenses.

Expense claim forms help companies monitor and record business expenses incurred by staff. Such forms help to tally all the money an individual spends on meals, training, travel, entertainment, and any other incidentals that may have been purchased using their own money as opposed to a previously provided per diem.