Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

Locating the appropriate legal document format can pose a challenge. Of course, there are numerous templates accessible online, but how can you find the legal form that you require? Utilize the US Legal Forms platform.

The service provides thousands of templates, including the Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, which can be utilized for both business and personal needs. All forms are verified by professionals and comply with federal and state regulations.

If you are already a member, Log In to your account and click the Download button to access the Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

Complete, modify, print, and sign the obtained Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to access well-crafted papers that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

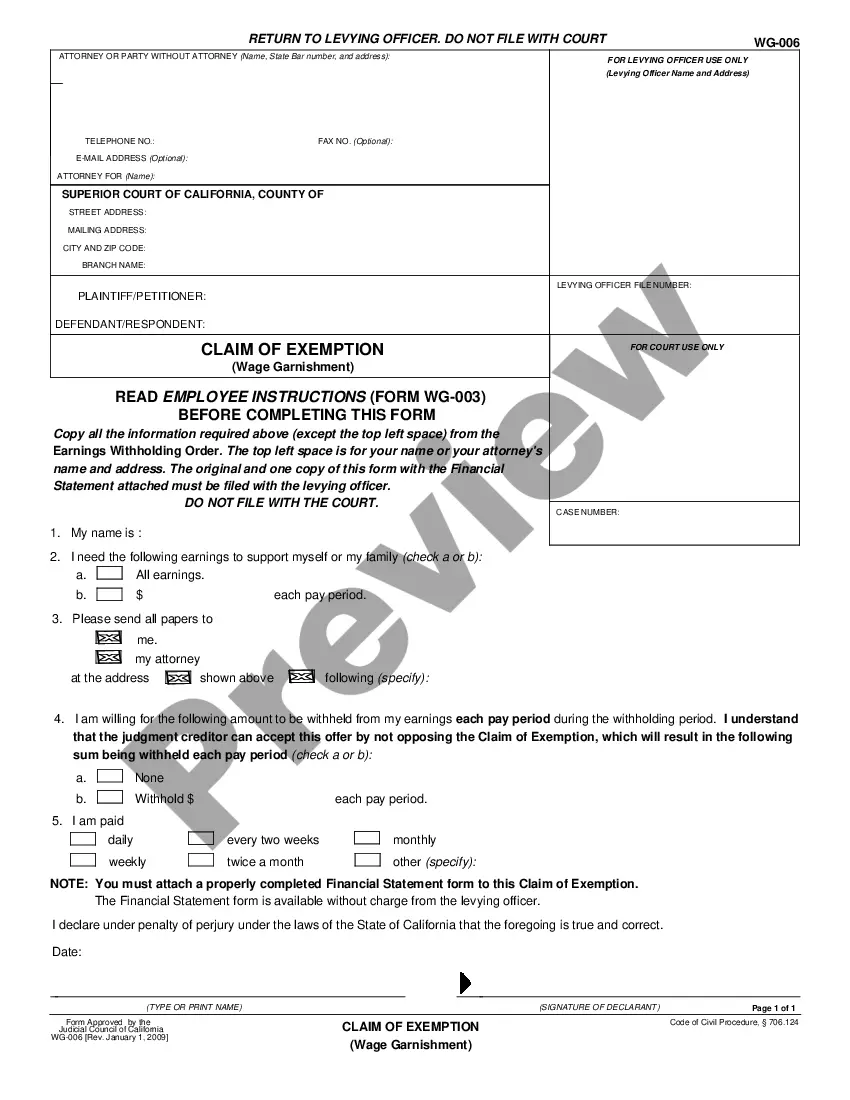

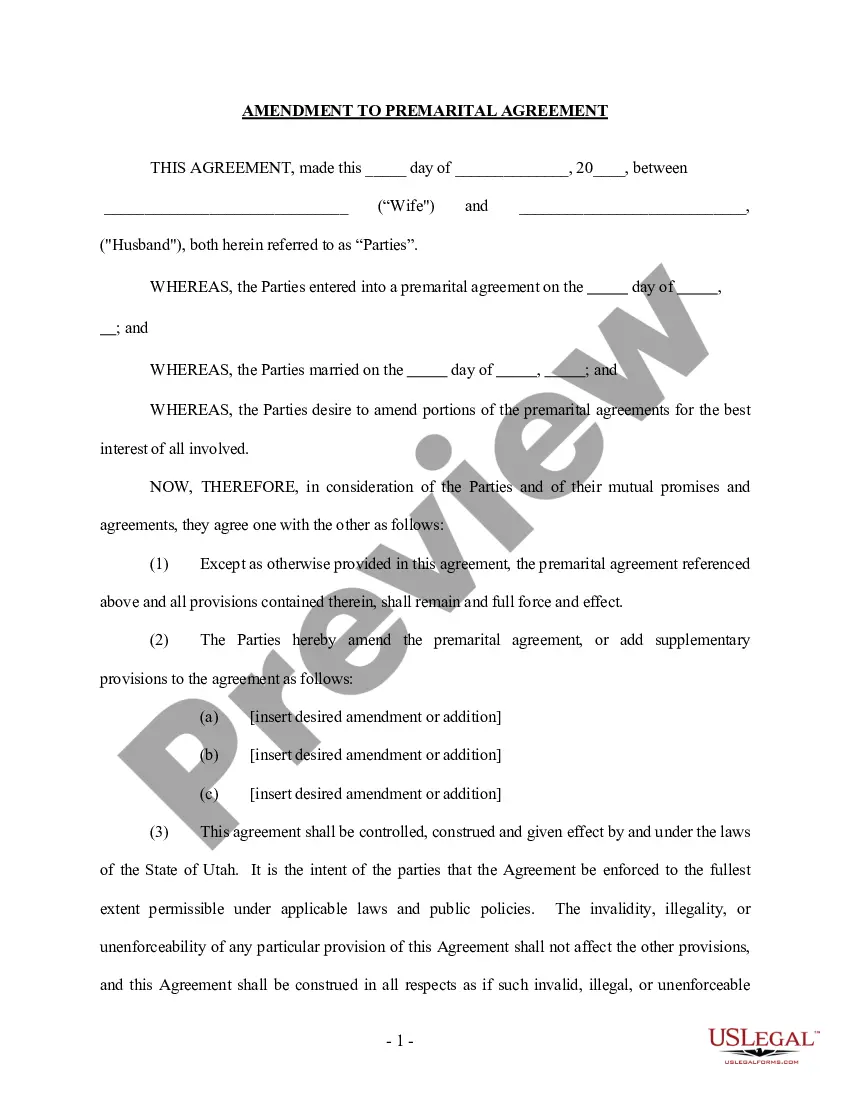

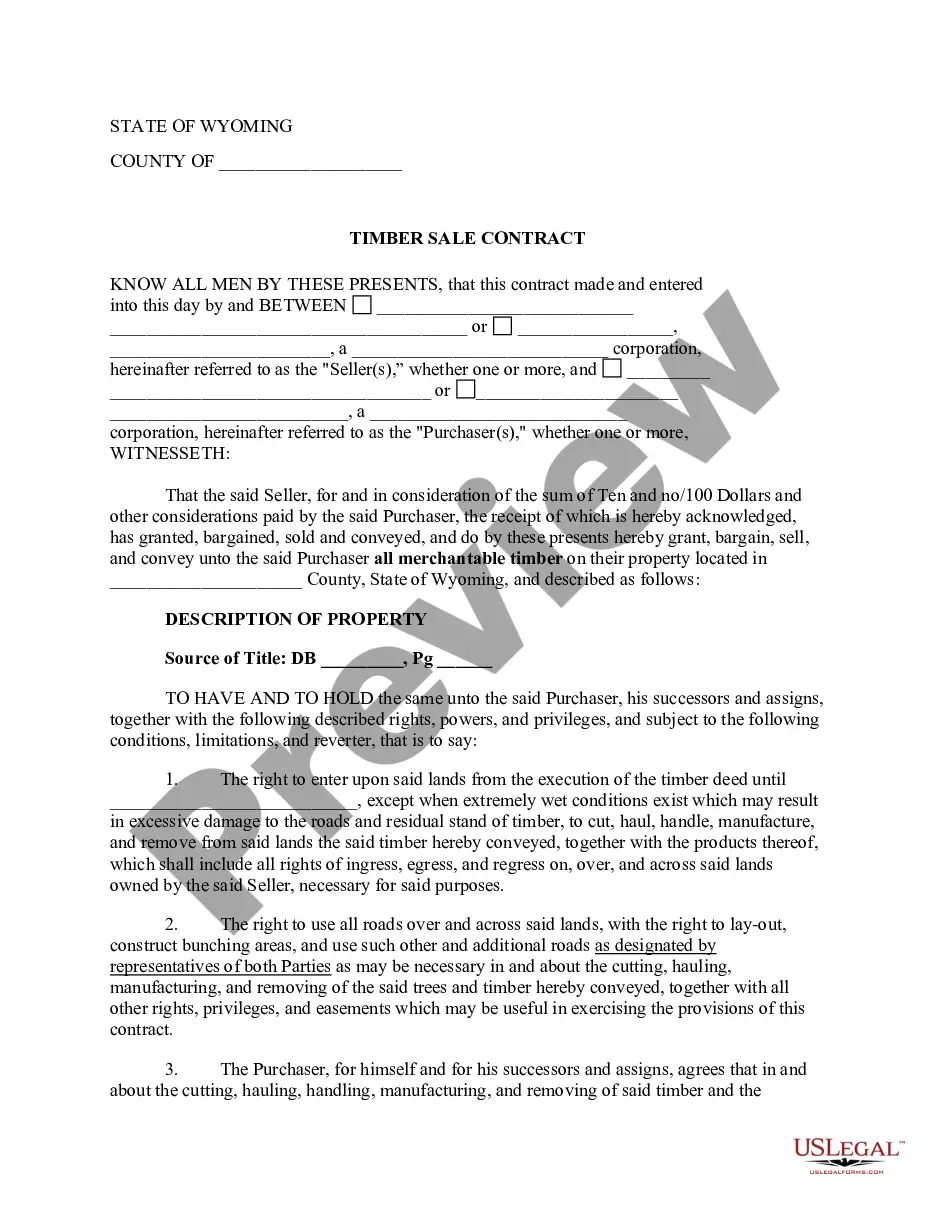

- First, ensure that you have chosen the correct form for your locality/region. You can review the form by using the Review button and read the form description to confirm it is suitable for your needs.

- If the form does not fulfill your requirements, use the Search field to find the appropriate form.

- Once you are certain the form is suitable, click the Buy now button to obtain the form.

- Select your preferred pricing plan and enter the required information. Create your account and complete the purchase using your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

Form popularity

FAQ

To start a corporation in Alaska, you first need to choose a unique name for your business. Next, prepare and file your Articles of Incorporation with the Alaska Division of Corporations, Business, and Professional Licensing. After that, create corporate bylaws to guide your operations and hold an initial board meeting. Finally, consider using the Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets to facilitate smooth transactions in the future.

To form an S Corp in Alaska, start by registering your corporation with the state and obtaining an Employer Identification Number (EIN). After establishing your corporation, you must file Form 2553 with the IRS to elect S Corporation status. Following this process can help ensure your company is compliant, especially if you intend to enter an agreement, such as the Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

Statute 11.46 484 in Alaska outlines laws concerning theft and dishonesty in business practices. This statute is crucial for understanding what constitutes fraud or deceit in corporate operations. Awareness of such laws is beneficial when drafting the Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

To dissolve a corporation in Alaska, you must file Articles of Dissolution with the Division of Corporations, Business, and Professional Licensing. It's essential to follow the legal requirements to ensure that your corporate obligations are met, especially regarding any remaining assets. This is particularly relevant in the context of the Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

Statute 10.06 490 deals specifically with the transfer of assets and liabilities during corporate transactions. This statute provides guidance on how assets should be allocated and valued, particularly in situations such as the Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. Understanding this can help you navigate sales effectively.

Statute 10.06 in Alaska addresses issues related to corporations and limited liability companies. This statute outlines the formation, governance, and dissolution of these entities. For businesses considering the Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, familiarizing yourself with this statute can be crucial.

In Alaska, a scheme to defraud refers to any plan designed to deceive someone for financial gain. These unlawful activities can involve misrepresentation or concealment of important information. Understanding the legal framework, like the Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, can help protect your interests in business transactions.

To look up Alaska statutes, visit the official website of the Alaska State Legislature. Use their online resources to access the complete text of laws, including the Alaska Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. Searching by keywords or statute numbers can help you find specific information quickly.