Alaska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a broad selection of legal document formats available for download or printing.

Through the website, you can access thousands of forms for business and personal use, organized by types, states, or keywords. You can find the latest editions of forms like the Alaska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in seconds.

If you have an existing subscription, Log In to download the Alaska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time from the US Legal Forms repository. The Download button will appear on each form you view. You can access all previously saved forms from the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Alaska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time. Every template you add to your account does not expire and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Alaska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time with US Legal Forms, one of the most extensive libraries of legal document formats. Utilize a vast array of professional and state-specific templates that cater to your business or personal requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

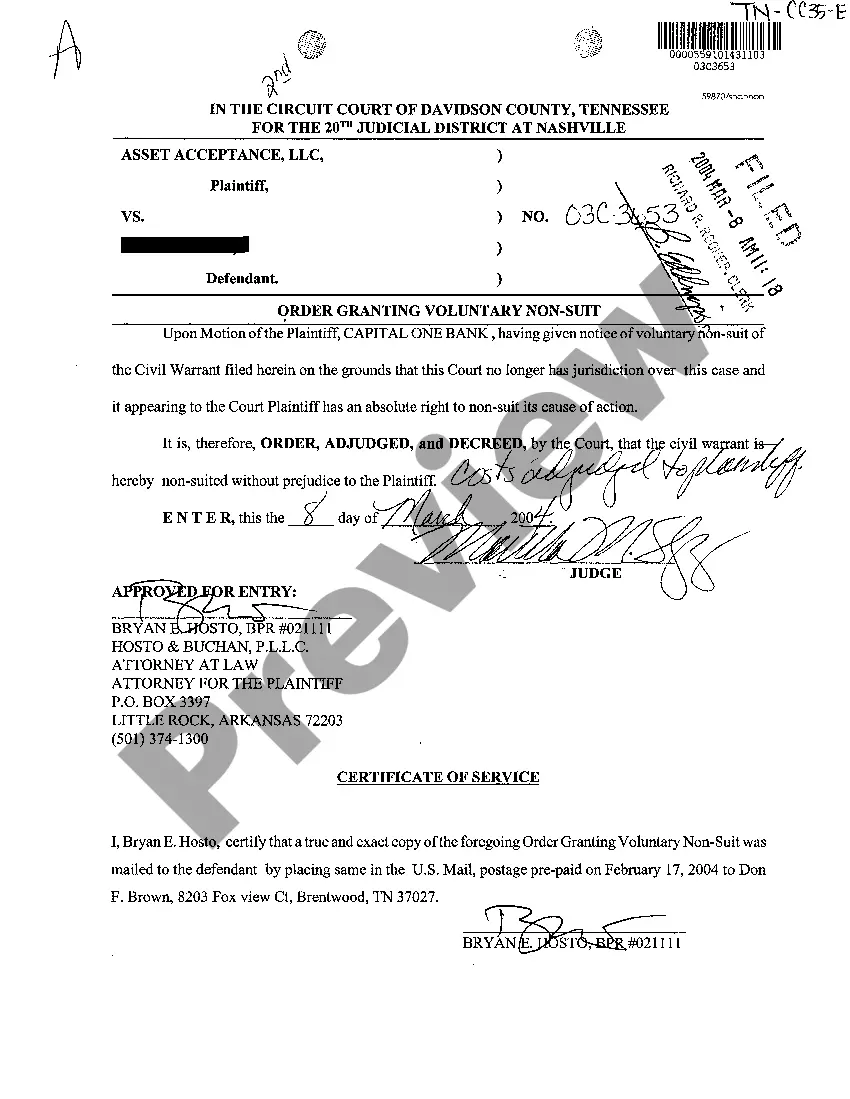

- Ensure you have chosen the correct form for your area/state. Click on the Preview button to check the form's details.

- Review the form information to confirm you have selected the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Under current law assets in a grantor trust do not receive a step up in basis upon the grantor's death and are not included in the taxable estate of the grantor.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

Too bad, says the IRS, unless you are an estate or trust. Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

Irrevocable trusts are primarily set up for estate and tax considerations. That's because it removes all incidents of ownership, removing the trust's assets from the grantor's taxable estate. It also relieves the grantor of the tax liability on the income generated by the assets.

The 65-Day Rule applies only to complex trusts, because by definition, a simple trust's income is already taxed to the beneficiary at the beneficiary's presumably lower tax rate.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Some of the grantor trust rules outlined by the IRS are as follows: The power to add or change the beneficiary of a trust. The power to borrow from the trust without adequate security. The power to use the income from the trust to pay life insurance premiums.

Who Controls an Irrevocable Trust? Under an irrevocable trust, legal ownership of the trust is held by a trustee. At the same time, the grantor gives up certain rights to the trust.

After the grantor of an irrevocable trust dies, the trust continues to exist until the successor trustee distributes all the assets. The successor trustee is also responsible for managing the assets left to a minor, with the assets going into the child's sub-trust.

Preservation Family Wealth Protection & Planning Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.