Nevada Filing System for a Business

Description

How to fill out Filing System For A Business?

You can spend hours online searching for the appropriate legal document template that meets the federal and state guidelines you require.

US Legal Forms offers a vast array of legal templates that are reviewed by professionals.

You can effortlessly download or generate the Nevada Filing System for a Business from your service.

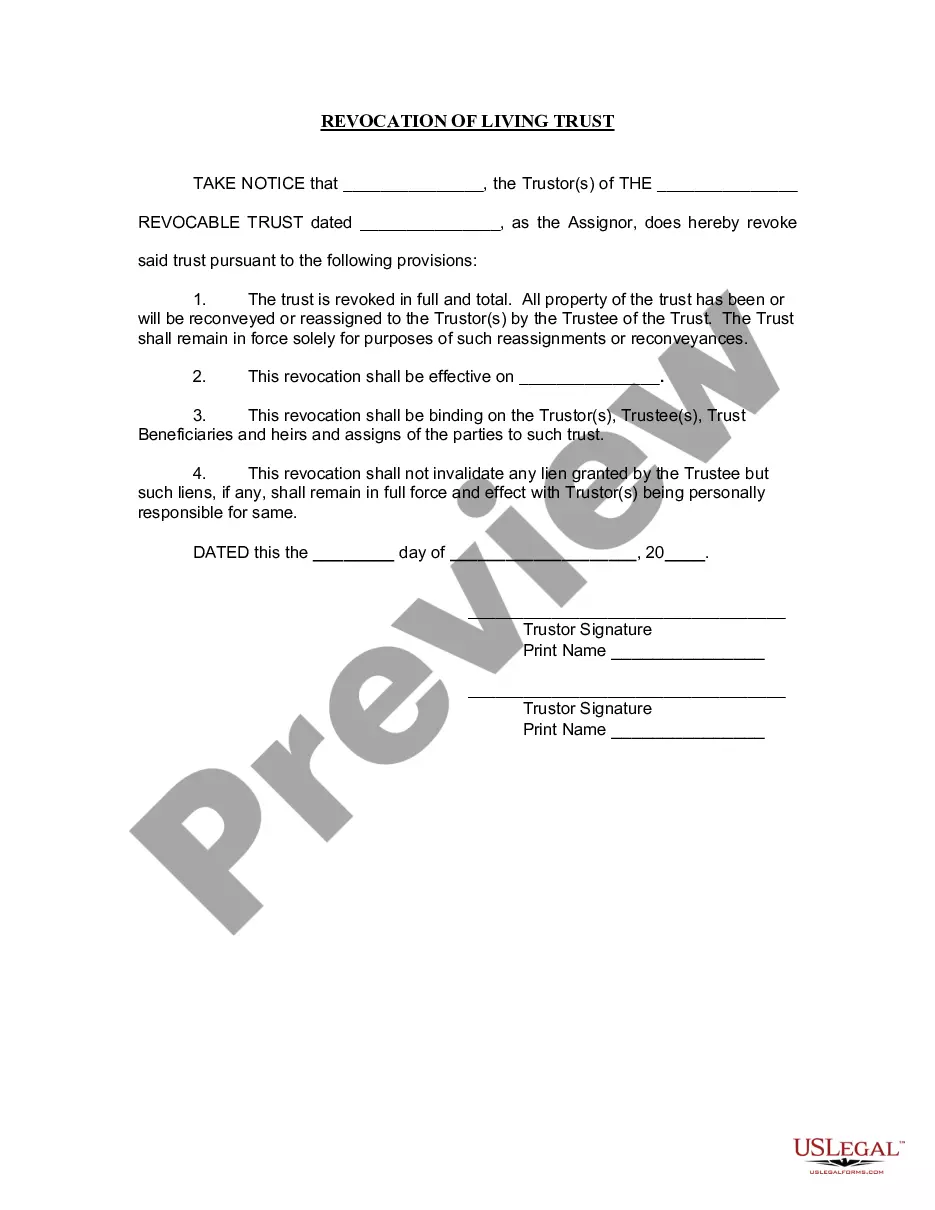

If available, use the Preview button to browse the document template as well.

- If you already have a US Legal Forms account, you may sign in and click the Obtain button.

- After that, you may fill out, modify, print, or sign the Nevada Filing System for a Business.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of a purchased document, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form summary to confirm that you have chosen the right document.

Form popularity

FAQ

To get your Nevada Account Number and MBT Account Number, register online with the Nevada Department of Employment, Training and Rehabilitation (DETR). Once you complete registration, you will receive your nine-digit (XXXXXXX.

UI Tax Services - Electronic Payment System. The Electronic Payment System (EPS) is an Electronic Fund Transfer (EFT) program, utilizing the Automated Clearing House (ACH) network, to initiate payments by either ACH debit or ACH credit methods, for Nevada Unemployment Insurance (UI) tax.

The State Unemployment Tax Act (SUTA) tax is a type of payroll tax that states require employers to pay. SUTA was established to provide unemployment benefits to displaced workers. States use funds to pay out unemployment insurance benefits to unemployed workers.

The Nevada Employment Security Division announced that, effective January 1, 2022, the state unemployment insurance (SUI) taxable wage base will increase to $36,600, up from $33,400. The SUI taxable wage base is calculated each year at 66 2/3% of the average annual wage paid to Nevada workers.

You can register for an account with the ESD either online or on paper. Once registered, you'll be issued a Nevada UI account number. To register online, go to the Employer Self Service (ESS) section of the ESD website and click on the link to register a new business.

To get your Nevada Account Number and MBT Account Number, register online with the Nevada Department of Employment, Training and Rehabilitation (DETR). Once you complete registration, you will receive your nine-digit (XXXXXXX. XX) Nevada Account Number and your ten-digit (10XXXXXXXX) MBT Account Number.

Employers who pay employees in Nevada must register with the NV Department of Employment, Training, and Rehabilitation (DETR) for an Employer Account Number and Modified Business Tax (MBT) Account Number. Register for an EAN online at the DETR's Employer Self Service site to receive the account number within 2 days.

You can easily acquire your Nevada Tax ID online using the NevadaTax website. If you have quetions about the online permit application process, you can contact the Department of Taxation via the sales tax permit hotline (800) 992-0900 or by checking the permit info website .

Registering to file and pay online is simple if you have your current 10 digit taxpayer's identification number (TID), a recent payment amount and general knowledge of your business....Register, File and Pay Online with Nevada TaxFile and Pay Online.Nevada Tax FAQ's.How-to videos for Nevada Tax.

Unemployment Insurance Information, Related Questions & Telephone Filing:Northern Nevada: (775) 684-0350.Southern Nevada: (702) 486-0350.Rural Areas and Out of State Callers: (888) 890-8211.ui.nv.gov.NVRehab@detr.nv.gov.