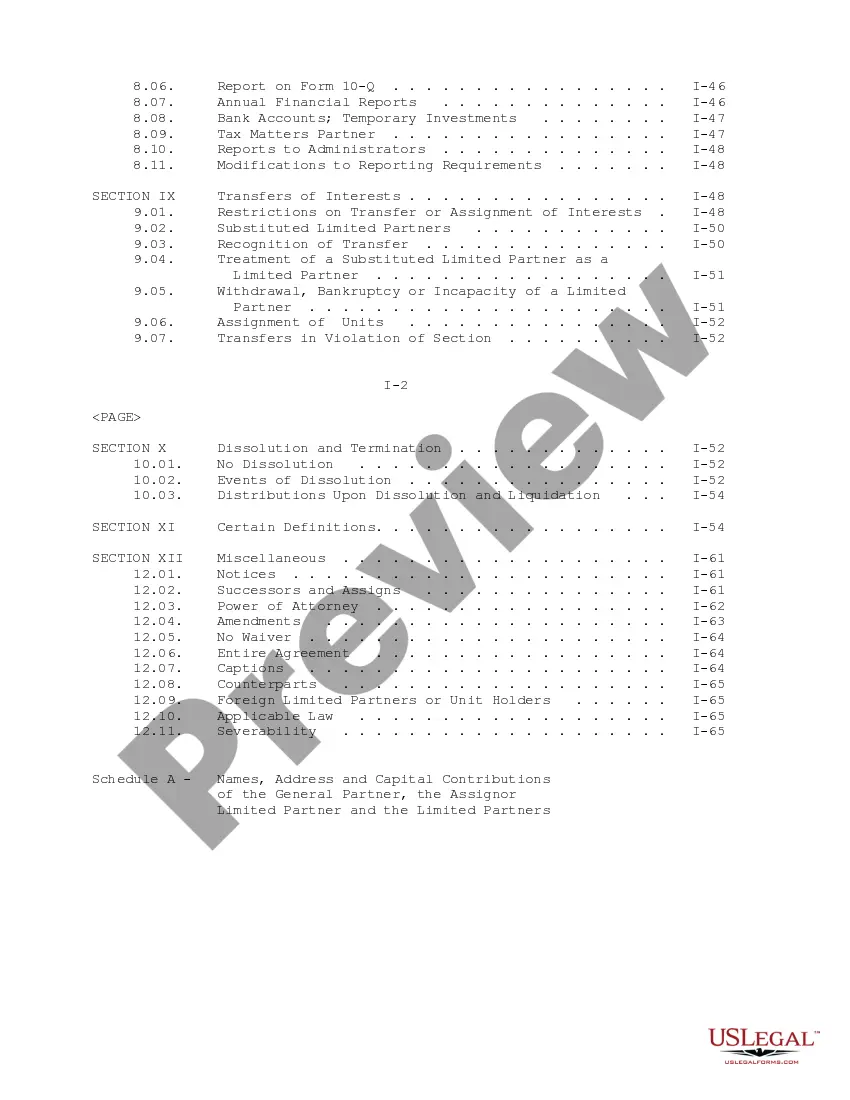

Sample Limited Partnership Agreement between Shearson Regional Malls, Inc. and Shearson Regional Malls Depositary Corp.

What this document covers

This document is a Sample Limited Partnership Agreement designed specifically for the partnership between Shearson Regional Malls, Inc. and Shearson Regional Malls Depositary Corp. This agreement outlines the structure and operation of the limited partnership, detailing the roles, rights, and obligations of both the general and limited partners. It is essential for establishing clear expectations and legal foundations among partners involved, ensuring compliance with the Delaware Revised Uniform Limited Partnership Act.

Key components of this form

- General provisions outlining the partnership's continuation, name, office, and purpose.

- Capital contributions from the general partner and assignor limited partner.

- Clauses detailing the allocation of income, losses, and distributions among partners.

- Management provisions that set forth the powers and duties of the general partner.

- Terms regarding the assignment of interests and rights of unit holders.

- Specifications on the dissolution and termination of the partnership.

When to use this form

This form should be used when forming a limited partnership in which one partner (the general partner) manages the business while the other partner(s) (limited partners) provide capital but have limited control over operations. It is particularly relevant for joint ventures involving multiple investors in real estate ventures, such as shopping malls, or when engaging in capital transactions requiring a structured partnership agreement.

Who needs this form

- Individuals or corporations looking to establish a limited partnership for investment purposes.

- General partners seeking to clarify their rights and responsibilities in managing the partnership.

- Limited partners wishing to understand their roles, investment allocation, and risk exposure within the partnership.

How to prepare this document

- Identify the partners: Include the names and addresses of all partners involved in the limited partnership.

- Specify the purpose of the partnership: Clearly define the business goals and activities the partnership will engage in.

- Detail capital contributions: Outline the monetary contributions and ownership percentages of each partner.

- Establish management roles: Assign responsibilities to the general partner and outline their authority.

- Include terms for dissolution: Determine the conditions under which the partnership may be dissolved.

Notarization requirements for this form

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to specify the roles and responsibilities of each partner clearly.

- Not detailing procedures for capital contribution and distributions.

- Neglecting to include dissolution terms and conditions.

Why complete this form online

- Convenience: Easily download the form and fill it out at your convenience.

- Editability: Make changes as needed to reflect your specific partnership structure.

- Reliability: Forms from USLegalForms are drafted by licensed attorneys, minimizing legal risks.

Legal use & context

- This agreement serves as a legally binding contract between the partners, outlining governance of the partnership.

- It is enforceable in a court of law, provided it is completed correctly and in accordance with applicable state laws.

- Understanding the terms can help partners avoid disputes regarding management and financial contributions in the future.

Quick recap

- A Limited Partnership Agreement is crucial for defining the structure and function of the partnership.

- Clear communication of each partner's roles and contributions helps mitigate potential conflicts.

- Be aware of state-specific regulations that might affect partnership formation and operation.

Looking for another form?

Form popularity

FAQ

A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their investment. An LP is defined as having limited partners and a general partner, which has unlimited liability.

If you're wondering, can a partnership be incorporated, the answer is yes. You can incorporate a general partnership and form a business entity with limited liability.

A limited partnership is usually a type of investment partnership, often used as investment vehicles for investing in such assets as real estate. LPs differ from other partnerships in that partners can have limited liability, meaning they are not liable for business debts that exceed their initial investment.

Pros of a Limited Partnership. Capital Amount is Quite Generous. Limited Partner Faces Limited Liability for Losses. Shared Responsibility of Work. Cons of a Limited Partnership. Breach in Agreement. General Partners Bear Maximum Risk in Case of Debts.

A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their investment.

Unlimited Shareholders. Certain Tax Advantages. Utilization of Financial/Managerial Strengths of Partners. Unlimited Cap on Capital Acquisition with Partnership Agreement. Liability Protection for Limited Partners.

A Limited Partnership is a business entity that consists of one or more General Partners, whose responsibilities include daily management of the company, and one or more Limited Partners, who do not participate in management. A General Partner may be an individual or an entity, such as a corporation.

In limited partnerships (LPs), at least one of the owners is considered a "general" partner who makes business decisions and is personally liable for business debts.The limited liability partnership (LLP) is a similar business structure but it has no general partners.

As a limited partner, you will use the K1 issued by the business to populate your Schedule E.Guaranteed payments differ from a salary or wages in that the business does not withhold taxes on guaranteed payments. However, the guaranteed payments are an expense to the business that will lower its taxable income.