Alaska Sample Letter for Purchase of Loan

Description

How to fill out Sample Letter For Purchase Of Loan?

Have you found yourself in a scenario where you require documents for either business or personal purposes almost daily.

There are numerous legitimate document templates accessible online, but locating ones you can trust isn’t simple.

US Legal Forms provides a wide array of form templates, such as the Alaska Sample Letter for Purchase of Loan, which can be completed to meet federal and state requirements.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download or print the Alaska Sample Letter for Purchase of Loan template anytime you need it. Simply click the relevant form to download or print it.

Utilize US Legal Forms, one of the most extensive collections of legal templates, to save time and avoid mistakes. The service offers expertly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you may download the Alaska Sample Letter for Purchase of Loan template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct area/region.

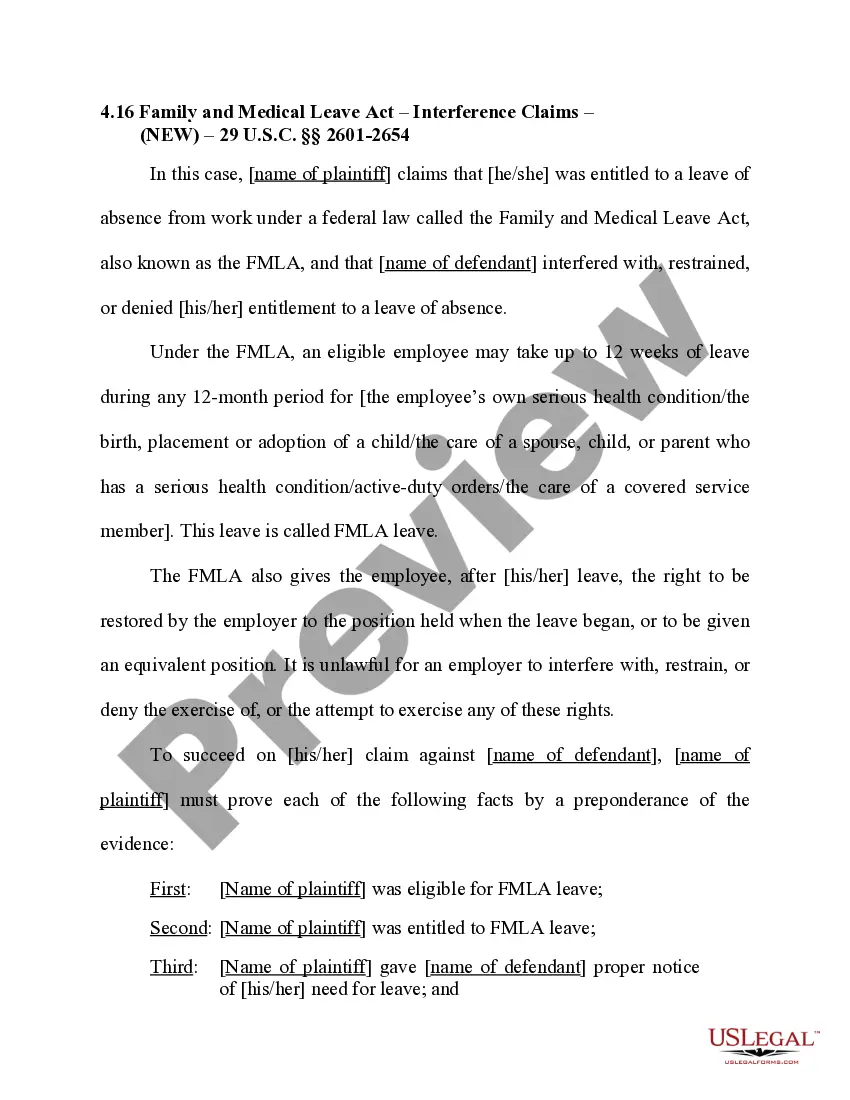

- Utilize the Review option to examine the form.

- Check the summary to confirm you have chosen the appropriate form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click on Buy now.

- Choose the pricing plan you want, fill in the required details to create your account, and finalize your purchase using your PayPal or credit card.

Form popularity

FAQ

A good explanation for late payments should be honest and straightforward, focusing on the reasons behind the situation. Acknowledge the delay and describe any mitigating circumstances that contributed to your financial issues. Leveraging an Alaska Sample Letter for Purchase of Loan can help you format your explanation effectively while providing assurance of your intent to rectify late payments.

Writing a letter explaining a financial situation involves providing a clear view of your current circumstances. Begin with a concise introduction that states the reason for your letter. Include relevant details, such as changes in income or unexpected expenses, and consider using an Alaska Sample Letter for Purchase of Loan to help formulate your letter effectively.

To write a letter of explanation for a loan, you need to articulate your circumstances clearly. Introduce the reason for the letter, followed by specific details that explain your financial history. The goal is to reassure the lender of your reliability, and utilizing an Alaska Sample Letter for Purchase of Loan can provide you with effective language and structure to enhance your letter.

Examples of letters of explanation typically include circumstances such as job loss, medical expenses, or credit report discrepancies. Each example should detail the situation, the actions taken, and the steps being undertaken to rectify it. Accessing an Alaska Sample Letter for Purchase of Loan can give you exemplary formats that you can tailor to your specific context.

To write a simple loan agreement letter, outline the loan amount, interest rate, repayment schedule, and any collateral involved. Make sure to include both parties' names and contact information, as well as a clear agreement on repayment terms. Utilizing an Alaska Sample Letter for Purchase of Loan can provide you with a solid framework for your agreement.

A simple loan letter should include the amount you wish to borrow, the purpose of the loan, and your repayment plan. Begin with a courteous greeting, followed by a clear introduction. Provide details that emphasize your reliability and financial responsibility, and an Alaska Sample Letter for Purchase of Loan from uslegalforms can help simplify the writing process.

Writing a letter of explanation for a loan involves acknowledging the reason for your request and providing context. Be honest and concise while addressing any concerns the lender may have. Clearly outline any changes in your financial situation that may affect your loan application, and consider using an Alaska Sample Letter for Purchase of Loan to guide your structure and content.

To write a letter of explanation, start by clearly stating the reason for your letter. Use a straightforward format, including your contact information, the date, and the recipient's information. Include specific details that support your explanation, as well as any necessary documentation. Downloading an Alaska Sample Letter for Purchase of Loan from uslegalforms could provide you with a practical template.

In Alaska, most lenders require a credit score of at least 620 to qualify for a conventional loan, although some programs may allow for lower scores. A good credit score can open doors to better interest rates and loan options. To help you navigate this process, consider utilizing an Alaska Sample Letter for Purchase of Loan to present your financial situation clearly to potential lenders.

Several factors can disqualify you from becoming a first time home buyer in Alaska. If you have owned a home in the last three years, or if your income exceeds the limits set by the state programs, you may not qualify. Understanding these criteria is essential, and using an Alaska Sample Letter for Purchase of Loan can help clarify your status with lenders.