This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

Alaska Supplemental Needs Trust for Third Party - Disabled Beneficiary

Description

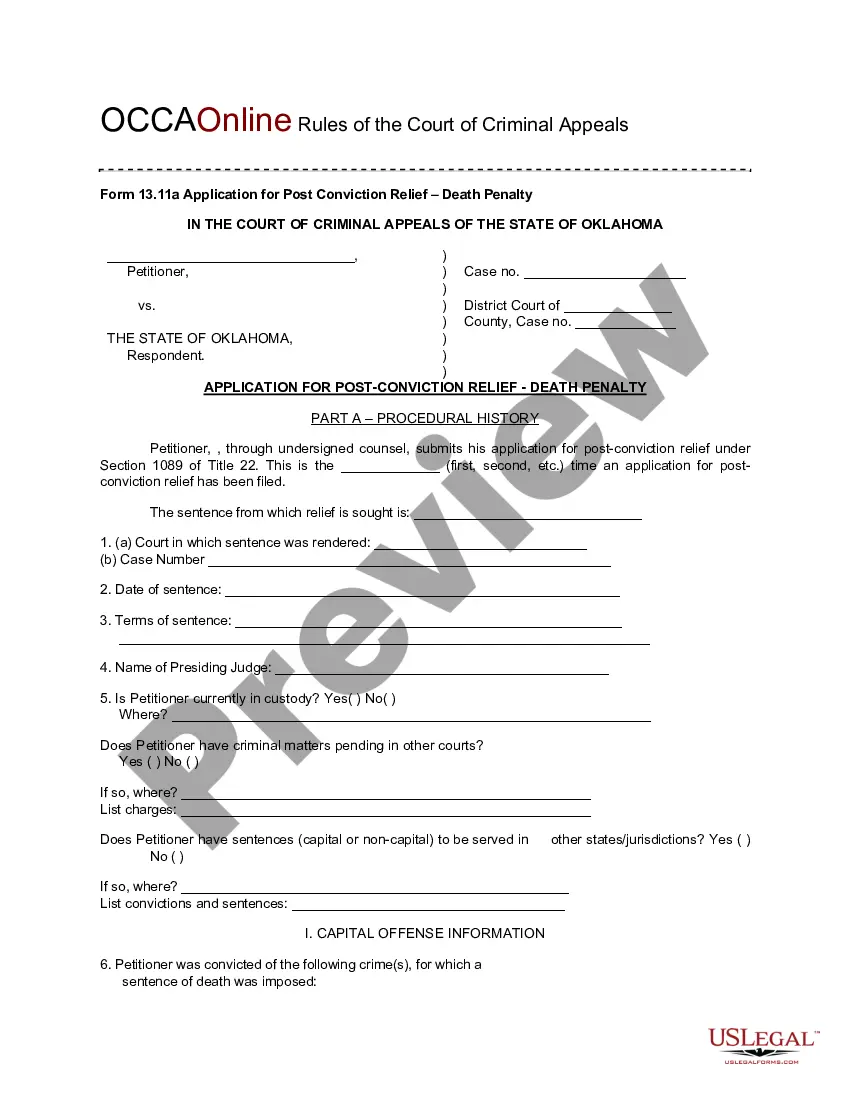

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

You may spend hours online searching for the legal document template that meets the federal and state requirements you desire.

US Legal Forms provides a vast array of legal forms that have been vetted by experts.

It is easy to obtain or print the Alaska Supplemental Needs Trust for Third Party - Disabled Beneficiary through our services.

If available, use the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Alaska Supplemental Needs Trust for Third Party - Disabled Beneficiary.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for the state/city of your choice.

- Review the form description to confirm you have selected the correct document.

Form popularity

FAQ

The beneficial owner of a special needs trust is the disabled individual who benefits from the trust's assets. In an Alaska Supplemental Needs Trust for Third Party - Disabled Beneficiary, the trust is designed to serve the financial needs of this individual. It's important to note that while the beneficiary enjoys the advantages of the trust, they do not own the assets, which helps protect their eligibility for resources and benefits.

The beneficiary of a supplemental needs trust, such as the Alaska Supplemental Needs Trust for Third Party - Disabled Beneficiary, is the disabled individual intended to receive support. This trust is structured to enhance the beneficiary's quality of life without affecting eligibility for government assistance programs. The trust provides much-needed funds for a variety of expenses, ensuring that the beneficiary's needs are met.

The owner of a supplemental needs trust is often referred to as the grantor or creator of the trust. In the case of an Alaska Supplemental Needs Trust for Third Party - Disabled Beneficiary, the grantor typically establishes the trust for the benefit of a disabled loved one. The grantor retains control over the trust terms, allowing them to dictate how and when funds may be used for the beneficiary.

A supplemental needs beneficiary is an individual who receives benefits from a supplemental needs trust, such as the Alaska Supplemental Needs Trust for Third Party - Disabled Beneficiary. This designation allows the beneficiary to access additional financial support without jeopardizing government assistance. The trust can provide funds for quality of life expenses, such as education, therapy, or unique experiences, ensuring a more fulfilled life.

When a beneficiary of an Alaska Supplemental Needs Trust for Third Party - Disabled Beneficiary passes away, the trust typically outlines how remaining assets are distributed. These assets may go to contingent beneficiaries specified in the trust document, or revert to the grantor, depending on the terms set. Importantly, the trust's purpose is to ensure financial security for the disabled beneficiary during their lifetime, and thoughtful planning can address these eventualities.

To set up an Alaska Supplemental Needs Trust for a Third Party - Disabled Beneficiary, start by consulting with a legal expert who specializes in trust law. They will guide you through the necessary steps and documentation needed to establish the trust. Ensuring proper legal setup is crucial for maintaining the beneficiary's eligibility for governmental support.

While an Alaska Supplemental Needs Trust for a Third Party - Disabled Beneficiary serves a similar purpose, it is not considered a qualified disability trust. Qualified disability trusts have specific tax benefits that may not apply to supplemental needs trusts. Understanding the differences can help you choose the right trust for your situation.

An Alaska Supplemental Needs Trust for a Third Party - Disabled Beneficiary works by holding and managing funds specifically for the benefit of the disabled individual. The trust allows the beneficiary to receive support without affecting their eligibility for public assistance programs. Trustees administer the trust according to its terms and ensure that expenditures are in line with the beneficiary's needs.

In an Alaska Supplemental Needs Trust for a Third Party - Disabled Beneficiary, the trust itself is generally responsible for paying taxes on any income it generates. However, distributions made to the disabled beneficiary may also result in taxable income for them. Consulting a tax professional can help clarify any specific obligations based on the trust's structure.

The ideal type of trust for a disabled beneficiary is an Alaska Supplemental Needs Trust for a Third Party - Disabled Beneficiary. This trust allows funds to be used for the disabled person's supplemental needs while preserving their eligibility for government assistance programs. It is a tailored financial tool that provides both security and flexibility.