Alaska Trust Agreement - Family Special Needs

Description

How to fill out Trust Agreement - Family Special Needs?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal paper templates available for purchase or printing.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Alaska Trust Agreement - Family Special Needs within moments.

If the form does not meet your needs, use the Search bar at the top of the screen to find the one that does.

Once you are happy with the form, confirm your choice by clicking the Purchase now button. Then, select your payment plan and provide your details to create an account.

- If you already have an account, Log In and download the Alaska Trust Agreement - Family Special Needs from your US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously saved forms under the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your city/state.

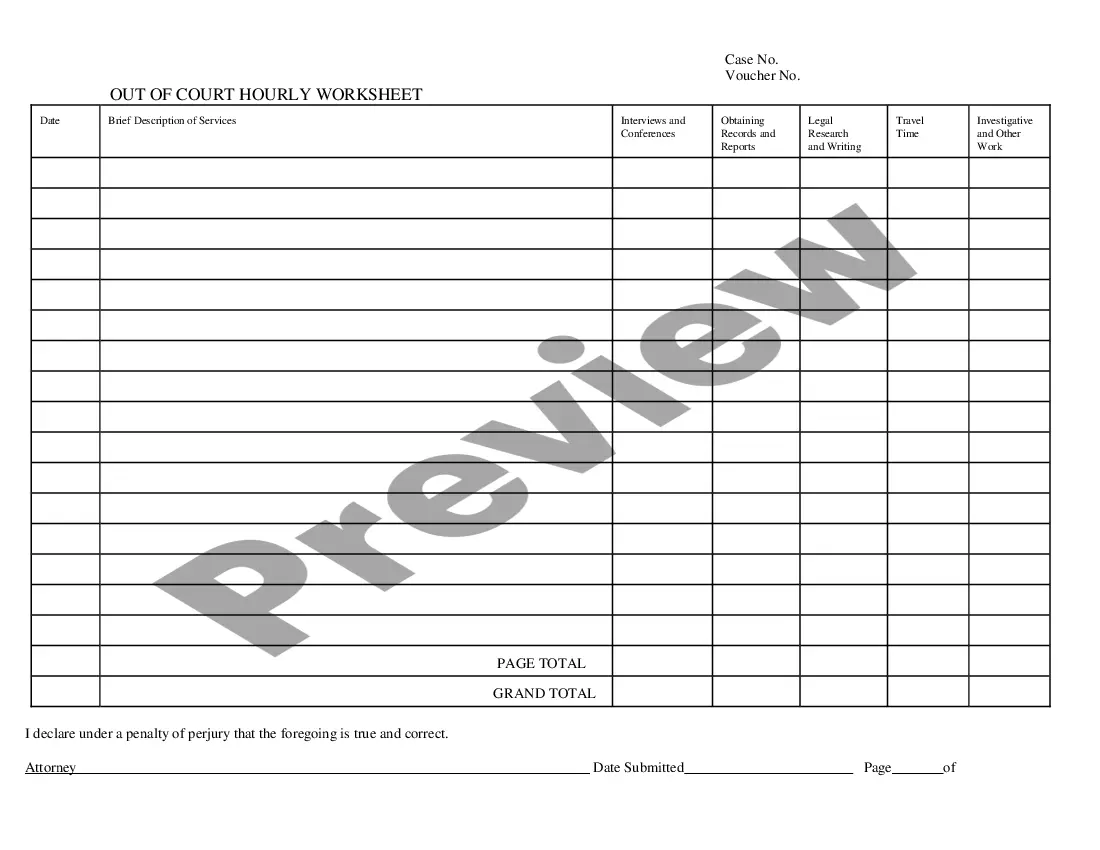

- Click on the Preview button to review the form's details.

Form popularity

FAQ

One danger of trust funds is the risk of mismanagement by trustees, which can lead to a loss of assets. Additionally, uninformed beneficiaries may not understand their rights or the trust's terms, leading to disputes. By creating an Alaska Trust Agreement - Family Special Needs, families can establish clear guidelines and support mechanisms to minimize these risks and enhance understanding among all parties involved.

Alaska’s trust laws are among the most progressive in the United States, allowing for flexible trust management and asset protection. These laws enable individuals to create trusts that can last indefinitely, which is particularly useful for families with special needs. Utilizing an Alaska Trust Agreement - Family Special Needs can help ensure compliance with state laws while providing targeted support to your beneficiaries.

The best type of trust for a disabled person often includes a special needs trust. This structure allows for financial support without jeopardizing government benefits. An Alaska Trust Agreement - Family Special Needs can be particularly beneficial because it aligns with state laws to help support the unique requirements of disabled beneficiaries.

One disadvantage of a family trust is the potential for complex tax implications and administrative burdens. Family trusts can sometimes require ongoing management and may incur fees, which could diminish the trust's assets over time. However, with a well-structured Alaska Trust Agreement - Family Special Needs, families can mitigate these issues while still protecting their loved ones.

In the UK, parents often make the mistake of not considering tax implications when setting up a trust. This oversight can lead to unexpected financial burdens down the line. It is essential to educate yourself about local laws and options for setting up trusts, such as consulting with experts in Alaska Trust Agreement - Family Special Needs, which may offer more favorable conditions for families.

One common mistake parents make is neglecting to clearly define their trust's terms. Ambiguities can lead to conflicts or misunderstandings among family members. Parents should ensure that their Alaska Trust Agreement - Family Special Needs explicitly details how the trust will be used to support beneficiaries, especially those with specific needs.

Alaska is frequently regarded as a favorable state for establishing an irrevocable trust. The laws governing trusts in Alaska offer unique benefits, including favorable asset protection features that can safeguard your family’s assets. This can be exceptionally advantageous for families needing a trust tailored to special needs considerations, as an Alaska Trust Agreement - Family Special Needs can provide security and peace of mind.

Filing a trust in Alaska involves preparing and executing the trust document according to state laws. You'll want to ensure that all needed information is present, especially for an Alaska Trust Agreement - Family Special Needs. Although you may not need to file the trust with the state, if it involves a property transfer, consider recording it with the local recorder's office. USLegalForms provides necessary templates and assistance to streamline this process.

To register an Alaska Trust Agreement - Family Special Needs, you generally need to create a written document outlining the trust’s terms. While registration with the state is not required, you should consider recording the trust if it holds real property. Additionally, utilizing a reputable platform like USLegalForms can simplify the creation and management process, ensuring you meet all legal standards.

In Alaska, a trust does not need to be filed with the state to be valid. However, certain legal documents may still need to be recorded if they involve real estate or other significant assets. It is wise to consult an attorney if you're establishing an Alaska Trust Agreement - Family Special Needs. They can provide guidance on necessary filings to protect your assets effectively.