Alaska Blind Trust Agreement

Description

How to fill out Blind Trust Agreement?

You can spend hours online trying to find the correct legal document format that complies with your state and federal requirements.

US Legal Forms provides thousands of legal templates that have been vetted by professionals.

It is easy to download or print the Alaska Blind Trust Agreement from this service.

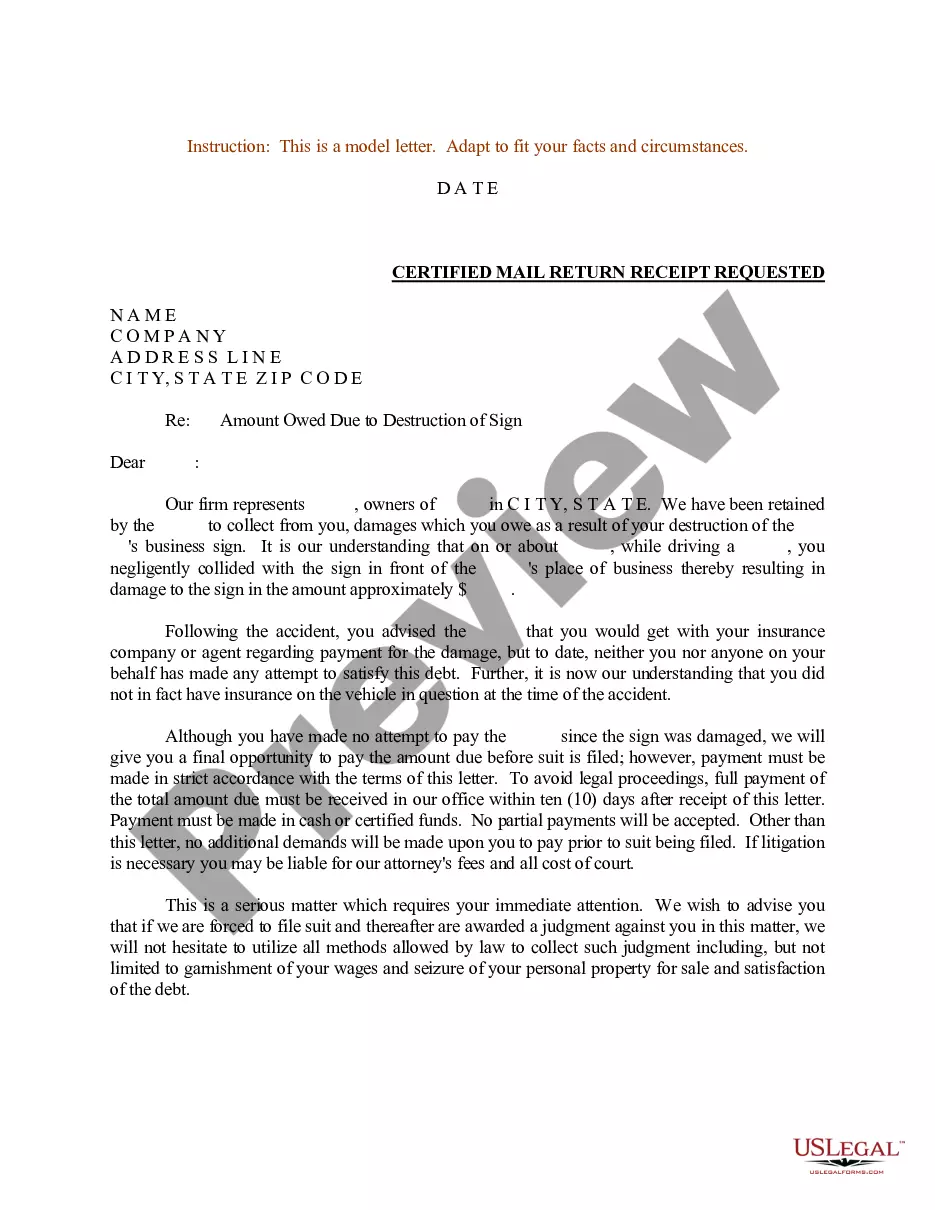

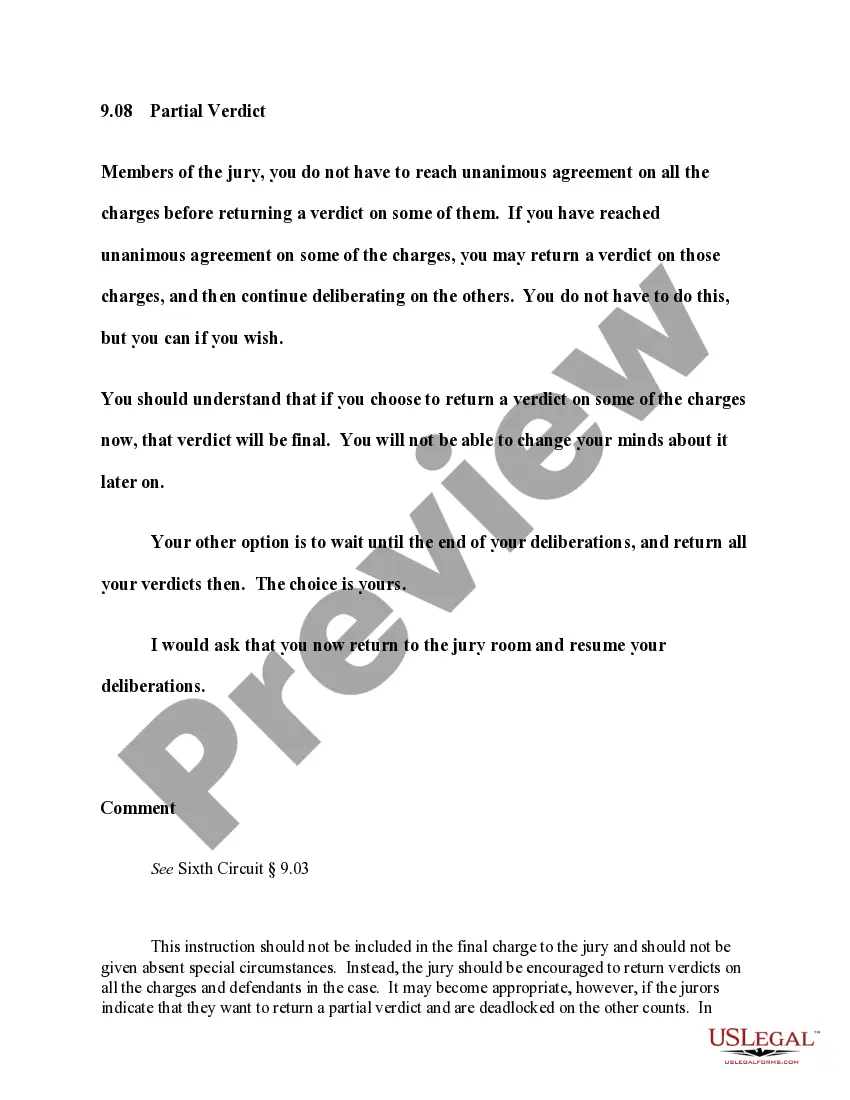

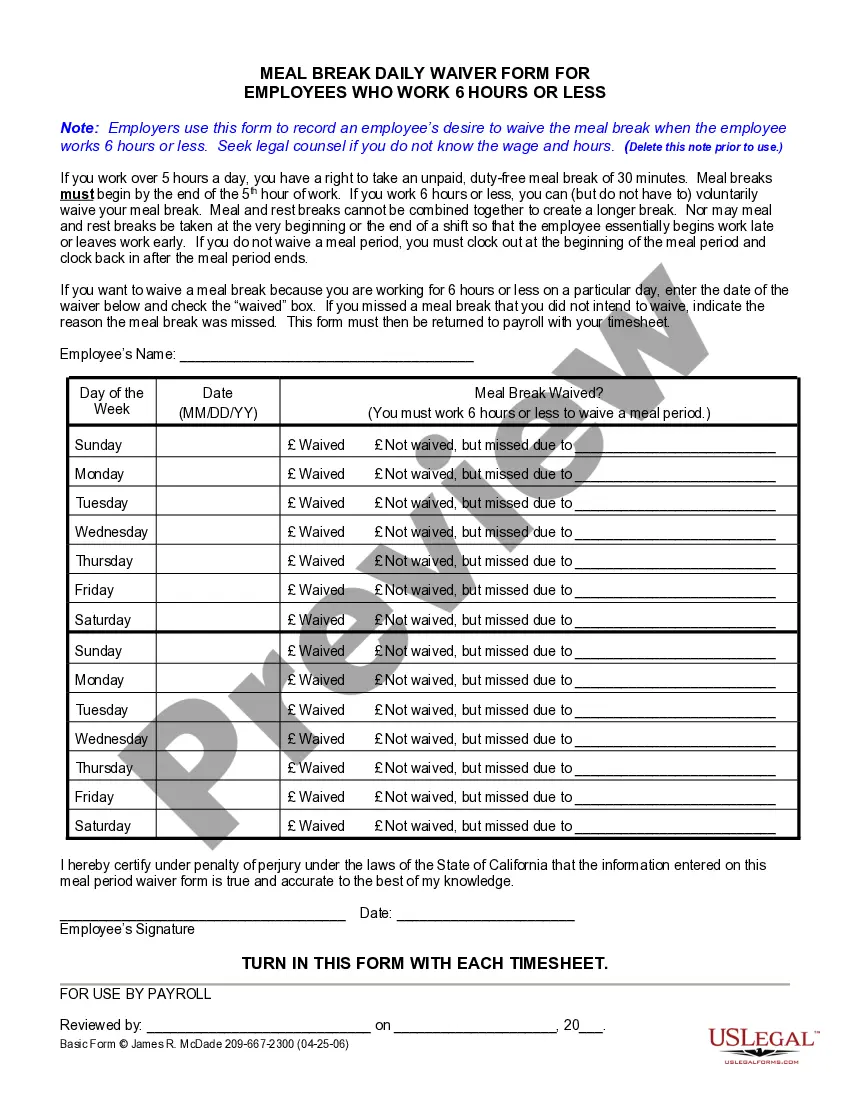

If available, use the Preview option to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can complete, edit, print, or sign the Alaska Blind Trust Agreement.

- Every legal document format you download is yours permanently.

- To get another copy of a purchased form, visit the My documents tab and select the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the state/city of your preference.

- Examine the form outline to confirm you have selected the right template.

Form popularity

FAQ

One of the biggest mistakes parents often make when setting up a trust fund is failing to clearly communicate their intentions to their children. This lack of communication can lead to misunderstandings about the trust's purpose and how it will be managed. Moreover, neglecting to review and update the trust regularly can result in outdated provisions that no longer align with the family's goals. Using an Alaska Blind Trust Agreement can add layers of security and clarity to your estate planning.

A common example of a blind trust is when a public figure or a high-profile individual creates a trust so they can avoid conflicts of interest. In this scenario, the individual transfers assets, such as stocks or real estate, into the trust and appoints a trustee to manage the portfolio. The individual does not receive updates on the trust's activities or holdings, allowing them to focus on their responsibilities without external influences. Establishing an Alaska Blind Trust Agreement can protect your interests in similar ways.

Yes, a blind trust can be an effective vehicle for managing lottery winnings. By establishing an Alaska Blind Trust Agreement, lottery winners can ensure their wealth is handled by a trusted party while maintaining privacy and minimizing public scrutiny. This structure can also assist in long-term financial planning, allowing winners to make informed decisions without the emotional burden that often accompanies sudden wealth.

While blind trusts have advantages, they also come with drawbacks. One significant con is the lack of control the grantor has over the assets, which may create uncertainty about their management. Additionally, the initial setup can be complex and requires professional assistance, leading to potential legal costs. Evaluating the pros and cons will help you determine if an Alaska Blind Trust Agreement fits your financial goals.

Withdrawing from a blind trust is not straightforward, as the purpose of a blind trust is to limit the grantor's involvement. Generally, the grantor cannot directly access or withdraw assets. However, you can request the trustee to manage assets according to the trust's terms, but this does not entail a withdrawal like in other trust structures. If you seek greater liquidity or flexibility, it may be wise to review your Alaska Blind Trust Agreement with a legal professional.

The primary difference between a blind trust and a regular trust lies in the transparency of asset management. In a blind trust, the grantor relinquishes control and knowledge of the assets, allowing a trustee to manage them without interference. Conversely, in a regular trust, the grantor typically retains some level of control and oversight. Understanding these differences is essential when establishing an Alaska Blind Trust Agreement.

To form a blind trust, you will first need to consult with an attorney experienced in estate planning. They can help you draft the necessary documents for your Alaska Blind Trust Agreement. It is crucial to clearly outline the terms of the trust, specify the assets being placed into the trust, and appoint a reliable trustee to manage those assets. Once everything is in place, the trust becomes operational, and you maintain no control over the assets.

Establishing an Alaska Blind Trust Agreement involves several legal requirements to ensure its validity. You must create a trust document that outlines the arrangement, identifies the trustee, and defines the assets transferred into the trust. Additionally, the trust must adhere to state laws regarding blind trusts, which may include specific provisions for disclosure and management. Consulting with a legal professional can help you navigate these requirements effectively.

Using an Alaska Blind Trust Agreement for lottery winnings can enhance privacy and protect wealth management. When you win a substantial amount, a blind trust helps shield your identity and minimizes the risk of being targeted by unwanted attention or solicitations. Additionally, it allows for responsible asset management by a qualified trustee, ensuring that your winnings are handled wisely. This method also can lead to tax benefits, as the trust structure may provide strategic advantages.

In an Alaska Blind Trust Agreement, a designated trustee controls the trust assets. The trustee is a neutral third party who manages the assets independently, ensuring that your financial interests are prioritized. While you cannot make decisions regarding the trust, the trustee is responsible for adhering to legal guidelines and acting in good faith. Choosing a reliable trustee is crucial, as they play a significant role in managing your financial future.