The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

Alaska Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

How to fill out Request For Disclosure Of Reasons For Denial Of Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

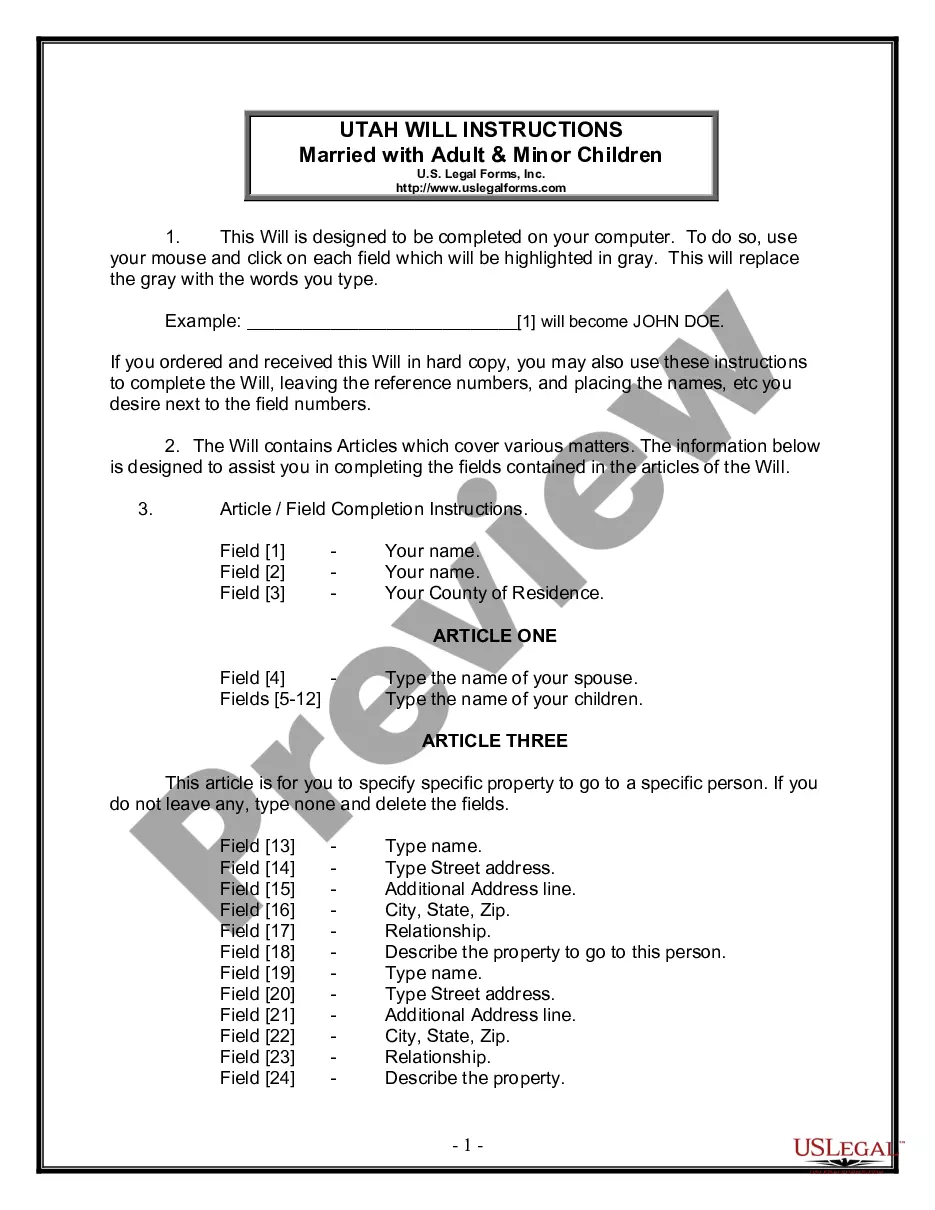

Are you currently within a situation that you will need documents for both company or personal functions just about every time? There are a variety of lawful file themes available online, but getting types you can rely isn`t easy. US Legal Forms gives 1000s of type themes, such as the Alaska Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency, which can be published to satisfy state and federal demands.

If you are presently informed about US Legal Forms website and possess your account, simply log in. After that, you can acquire the Alaska Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency template.

If you do not have an bank account and wish to start using US Legal Forms, adopt these measures:

- Get the type you require and make sure it is to the right metropolis/area.

- Use the Review key to analyze the shape.

- See the information to actually have selected the right type.

- When the type isn`t what you`re looking for, use the Lookup area to discover the type that suits you and demands.

- Whenever you find the right type, click Acquire now.

- Opt for the rates program you desire, fill out the desired info to generate your account, and pay for the order using your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file formatting and acquire your duplicate.

Find every one of the file themes you possess purchased in the My Forms menus. You may get a additional duplicate of Alaska Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency whenever, if required. Just click the needed type to acquire or printing the file template.

Use US Legal Forms, one of the most substantial variety of lawful varieties, to save time as well as avoid errors. The support gives expertly manufactured lawful file themes which you can use for a selection of functions. Create your account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account. 90 days after making a counteroffer to an application for credit if the applicant does not accept the counteroffer.

How To Send An Adverse Action Notice (with Sample) - YouTube YouTube Start of suggested clip End of suggested clip Name their address. And some other stuff then you should include a short message thanking theMoreName their address. And some other stuff then you should include a short message thanking the applicant for their time.

If the applicants' credit scores were used in taking adverse action, each individual should receive a separate adverse action notice with the credit score and related disclosures associated with his or her individual consumer report; however, an applicant should not receive credit score information about a coapplicant.

If you deny a consumer credit based on information in a consumer report, you must provide an ?adverse action? notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a ?risk-based pricing? notice.

The notice must either disclose the applicant's right to receive a statement of the specific reasons within 30 days or provide the primary reasons that each creditor relied upon in taking the adverse action, clearly indicating which reasons relate to which creditor.

The credit score exception notice (model forms H-3, H-4, H-5) is a disclosure that is provided in lieu of the risk-based-pricing notice (RBPN, which are H-1, H-2, H-6 & H-7). The RBPN is required any time a financial institution provides different rates based on the credit score of the applicant.

If your customer accepts any credit offer and you're able to seal the deal, an adverse action notice is not needed. And don't count on the lender to send an adverse action notice?they have their own set of rules, and a notice from them does not eliminate any obligations your dealership has to the consumer.

Regulation B A written statement of actual and specific reasons for the adverse action or, if not providing the specific reason within the written notice, a statement that the applicant has a right to receive the specific reason for adverse action if requested within 60 days of the notification.