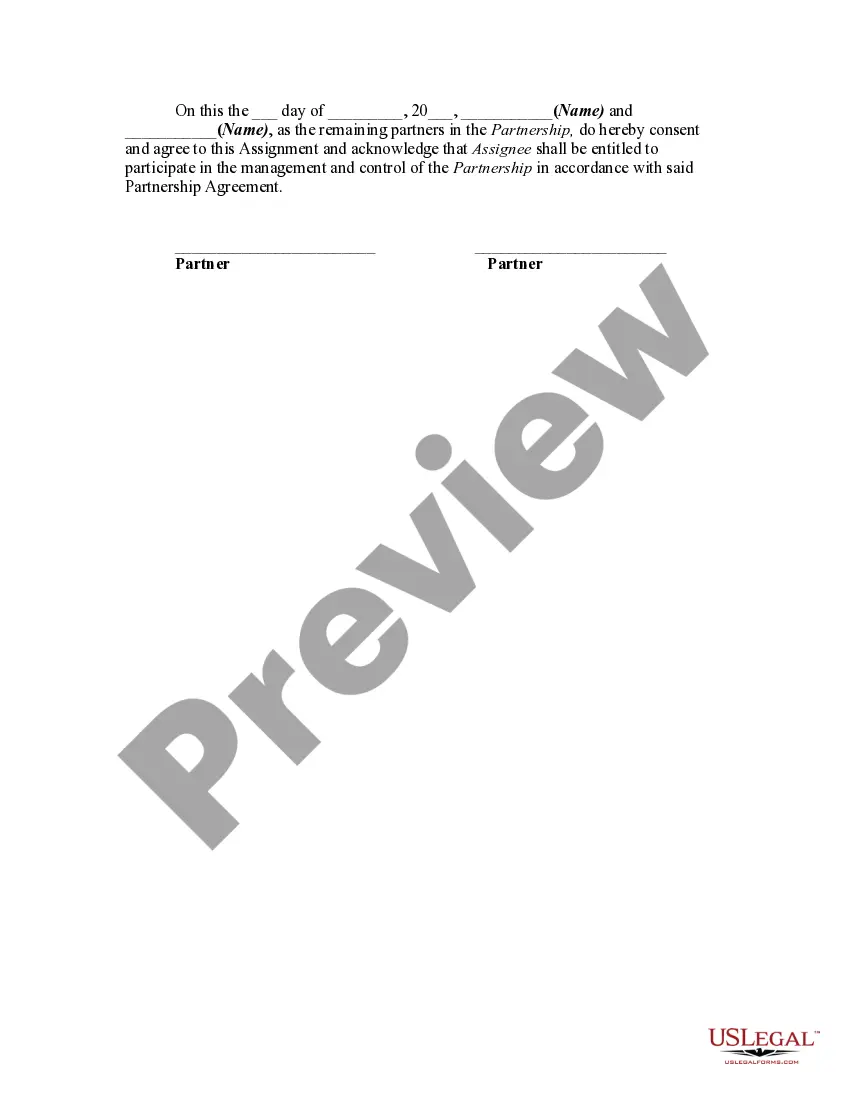

Alaska Assignment of Partnership Interest

Description

How to fill out Assignment Of Partnership Interest?

You can spend numerous hours online trying to locate the approved document template that meets the state and federal requirements you desire.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can download or print the Alaska Assignment of Partnership Interest from our services.

If you need to find another version of the form, use the Search field to locate the template that meets your requirements and specifications.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, modify, print, or sign the Alaska Assignment of Partnership Interest.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Review the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

The partner's interest in a partnership represents their financial stake and ownership share in the business. This interest can include a portion of the profits, losses, and assets of the partnership. When considering an Alaska Assignment of Partnership Interest, it is essential to understand how this interest can be transferred or assigned to another party. By using platforms like US Legal Forms, you can simplify the process of drafting necessary documents and ensure compliance with state laws.

A Section 751 gain, which arises from the sale of certain assets in a partnership, needs to be reported on your individual tax return. This gain is typically reported on Form 8949 and Schedule D, aligning with capital gain reporting requirements. For intricate situations involving the Alaska Assignment of Partnership Interest, consulting a tax professional is essential.

Transferring ownership interest within a partnership typically requires a written agreement documenting the terms of the transfer. All partners should consent to the transfer to maintain harmony and clarity in the partnership. Consider using a service like UsLegalForms to ensure compliance with legal standards when executing the Alaska Assignment of Partnership Interest.

Yes, when a partner sells their partnership interest, it must be reported on Schedule K-1 (Form 1065). The K-1 provides details about the income, deductions, and credits that the partner must report on their tax return. Be sure to consult with a tax advisor to understand the implications of your Alaska Assignment of Partnership Interest.

To fill out a partnership agreement, start by identifying all partners involved and clearly outline the terms of the partnership. Include contributions, profit and loss distribution, and management responsibilities. It is beneficial to consult a legal expert or use platforms like UsLegalForms for templates and guidance, especially for matters like Alaska Assignment of Partnership Interest.

An assignment of partnership interest refers to the process where an existing partner transfers their ownership rights and obligations to another party. This move can occur through a sale, gift, or other transaction forms. It's crucial for all partners to approve this assignment to ensure smooth transitions within the partnership structure.

Yes, transferring a partnership interest can lead to tax implications. Generally, if you sell your interest, it could trigger capital gains taxes based on the amount received exceeding your basis in the partnership. For specific guidance on taxation, consulting a tax professional familiar with Alaska Assignment of Partnership Interest is advisable.

A partnership interest can be illustrated through ownership stakes such as having a 30% share in a local restaurant. This ownership grants you rights to a portion of the profits, as well as responsibilities for losses. Understanding your partnership interest is essential when considering an Alaska Assignment of Partnership Interest.

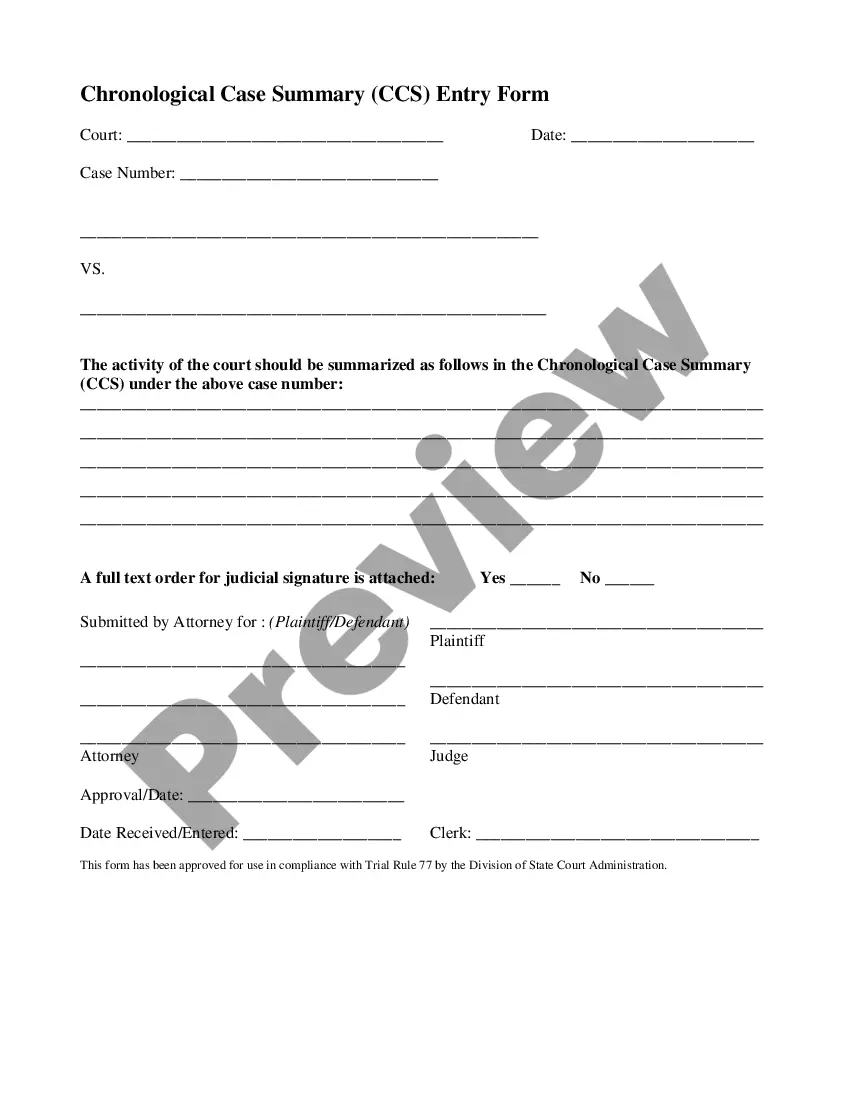

To report a transfer of partnership interest effectively, individuals must provide accurate documentation of the transaction. This usually involves filing a Form 1065, which is the partnership tax return, along with the appropriate schedules. Additionally, notifying the partnership is critical, as it helps in updating the partnership agreement and maintaining transparency in the business relationships.

A simple transfer of partnership interest involves a straightforward assignment of a partner's stake to another party without complex conditions. In context, this aligns with the Alaska Assignment of Partnership Interest, where clarity and compliance are key. You may streamline this process by using resources available on the uslegalforms platform, ensuring that all legal requirements are met.