Alaska Checklist for Remedying Identity Theft of Deceased Persons

Description

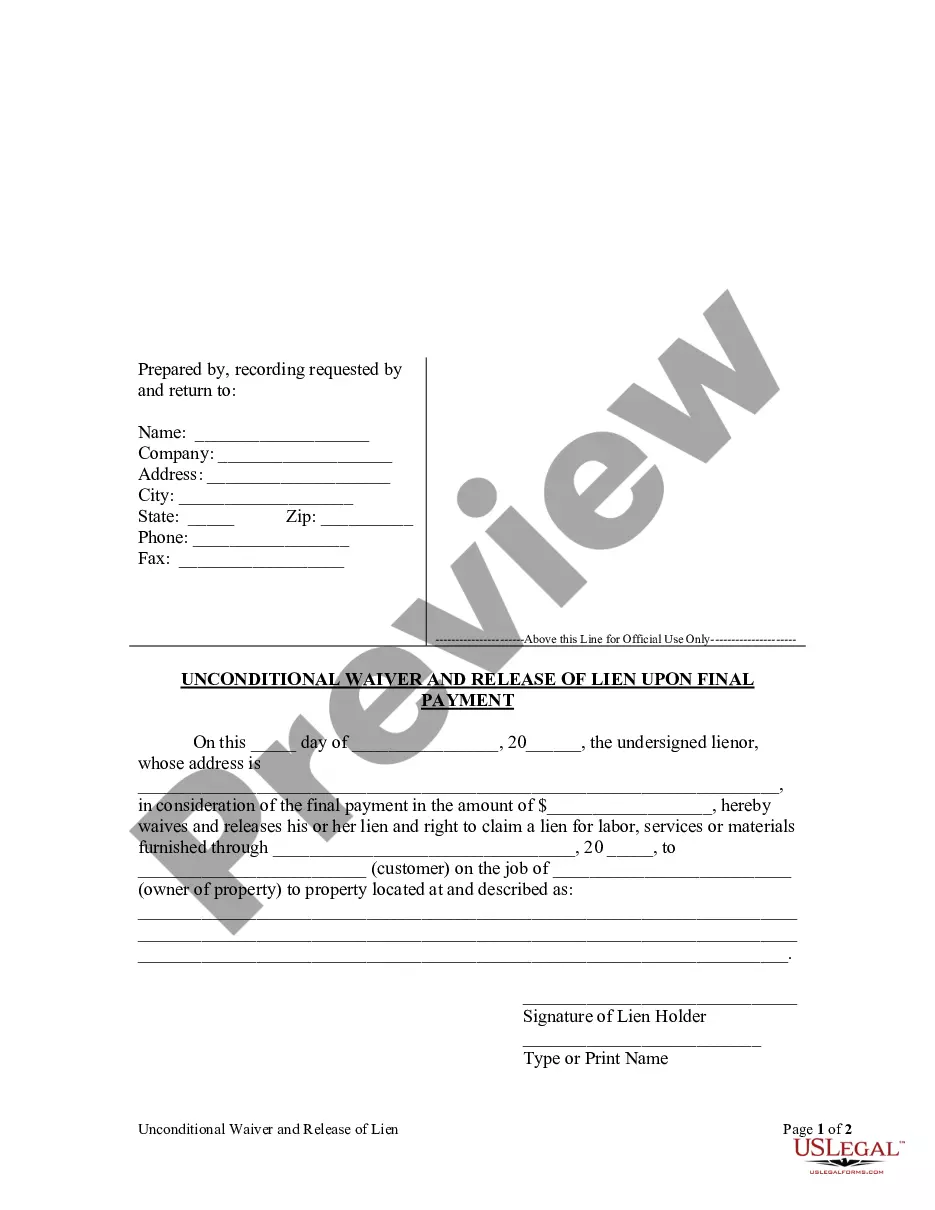

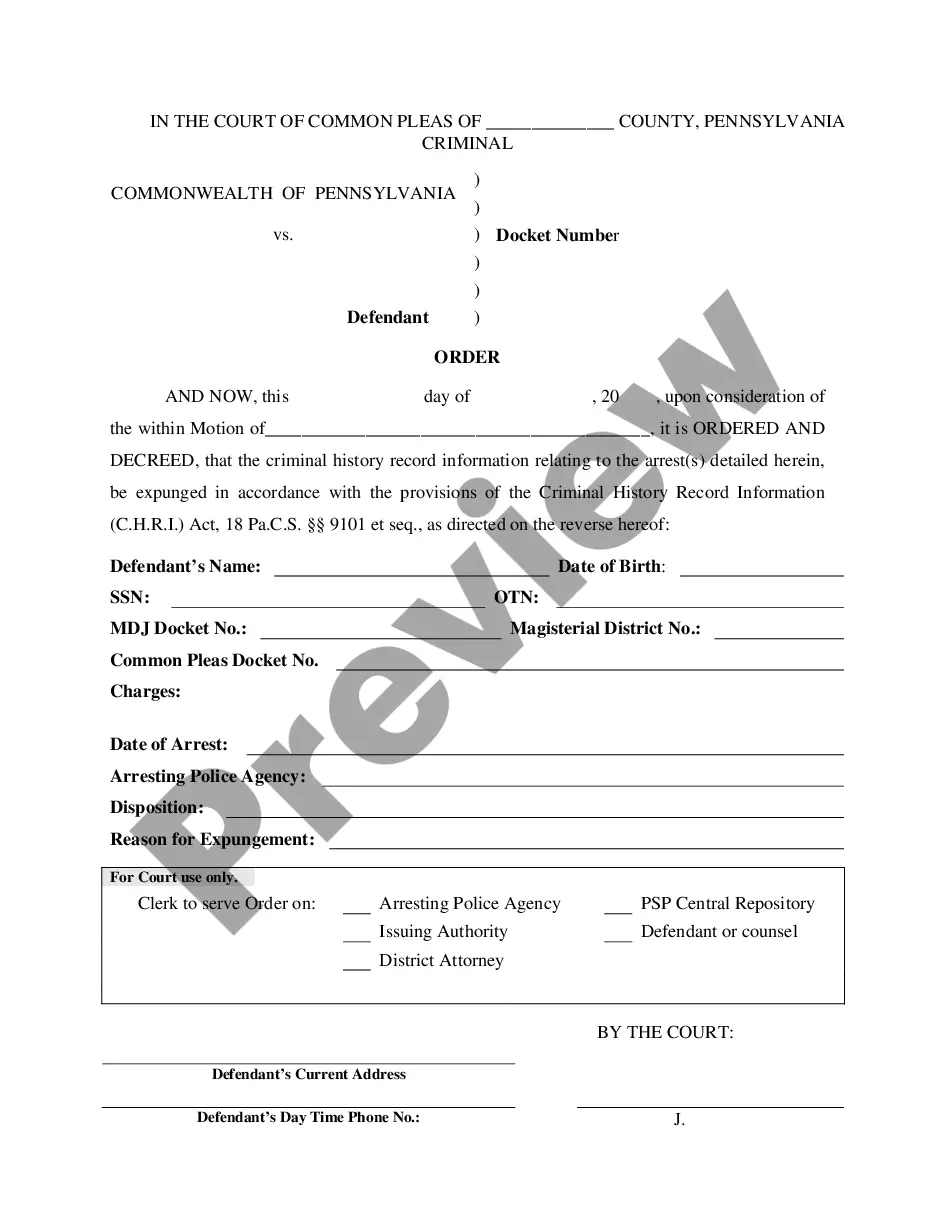

How to fill out Checklist For Remedying Identity Theft Of Deceased Persons?

If you wish to complete, down load, or print out legitimate file themes, use US Legal Forms, the largest variety of legitimate forms, that can be found online. Utilize the site`s basic and handy research to get the documents you need. Numerous themes for enterprise and personal purposes are sorted by groups and suggests, or keywords. Use US Legal Forms to get the Alaska Checklist for Remedying Identity Theft of Deceased Persons with a couple of click throughs.

When you are already a US Legal Forms consumer, log in for your accounts and click the Download switch to obtain the Alaska Checklist for Remedying Identity Theft of Deceased Persons. You may also access forms you in the past acquired from the My Forms tab of your respective accounts.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the shape to the appropriate town/country.

- Step 2. Make use of the Preview method to check out the form`s articles. Do not overlook to learn the description.

- Step 3. When you are not satisfied with all the form, take advantage of the Research field near the top of the screen to get other variations of your legitimate form design.

- Step 4. After you have located the shape you need, select the Purchase now switch. Choose the prices plan you favor and add your references to register to have an accounts.

- Step 5. Process the purchase. You can use your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Find the formatting of your legitimate form and down load it in your gadget.

- Step 7. Full, revise and print out or indication the Alaska Checklist for Remedying Identity Theft of Deceased Persons.

Each legitimate file design you acquire is your own property forever. You might have acces to each form you acquired inside your acccount. Select the My Forms segment and decide on a form to print out or down load once more.

Remain competitive and down load, and print out the Alaska Checklist for Remedying Identity Theft of Deceased Persons with US Legal Forms. There are thousands of expert and state-specific forms you can utilize for your personal enterprise or personal demands.

Form popularity

FAQ

Identity Theft of a Deceased Person Identity thieves can get personal information about deceased individuals by reading obituaries, stealing death certificates, or searching genealogy websites that sometimes provide death records from the Social Security Death Index.

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Identity theft can victimize the dead. An identity thief's use of a deceased person's Social Security number may create problems for family members. This type of identity theft also victimizes merchants, banks, and other businesses that provide goods and services to the thief.

Deceased family member identity theft, also known as ghosting, occurs when someone uses the personal information of a deceased person to commit fraud. This can include opening new credit accounts, applying for loans or making other financial transactions in the deceased person's name.

File a police report Family identity theft is not okay; it's still a crime. If you're a victim, and there is substantial damage, going to the police might be the only way to get reimbursement. You can also help ensure this doesn't happen to someone else. Visit a local law enforcement office to file a police report.

Here are some steps you can take to prevent identity theft after someone you care about has passed away. Be mindful about expressions of grief online. Ensure social media accounts are properly shut down. Contact financial institutions and credit bureaus. Notify the federal government of the death.

Identity theft can have serious consequences for you and your family. It can negatively affect your credit, get you sued for debts that are not yours, result in incorrect and potentially health-threatening information being added to your medical records, and may even get you arrested.

Send a written notice to all financial institutions where the deceased had an account instructing them to close all individual accounts and remove the deceased's name from joint accounts: As soon as you receive the certified copies of the death certificate, send a letter and a certified copy to each of the financial ...