Alaska Guide for Protecting Deceased Persons from Identity Theft

Description

How to fill out Guide For Protecting Deceased Persons From Identity Theft?

You can spend time online searching for the authentic document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can obtain or create the Alaska Guide for Safeguarding Deceased Individuals from Identity Theft through the service.

If available, utilize the Preview button to review the document template as well. If you wish to find another version of the form, use the Search field to locate the template that fulfills your requirements.

- If you already possess a US Legal Forms account, you may sign in and click on the Download button.

- Subsequently, you can fill out, modify, print, or sign the Alaska Guide for Safeguarding Deceased Individuals from Identity Theft.

- Every legal document template you purchase is yours permanently.

- To retrieve another copy of any purchased form, go to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Read the form description to confirm that you have chosen the right form.

Form popularity

FAQ

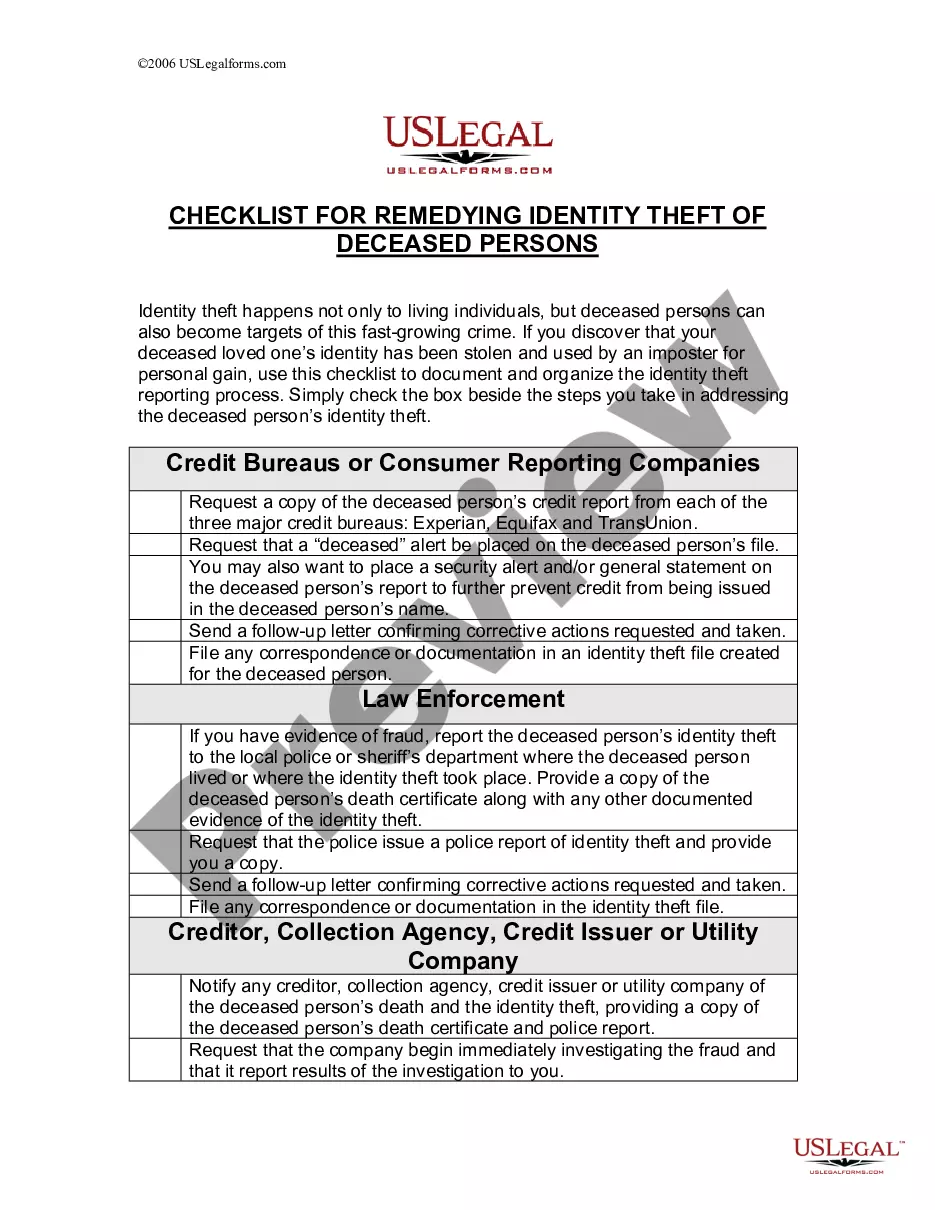

Avoid listing birth date, maiden name, or other personal identifiers in obituaries as they could be useful to ID thieves. Report the death to the Social Security Administration by calling 800-772-1213. Order multiple certified copies of the death certificate with and without cause of death.

Visit .irs.gov/lp60. .irs.gov and search key word ?deceased.? .irs.gov/forms-pubs or call 800-TAX-FORM (800-829-3676). If you need assistance, please don't hesitate to contact us.

Submit the following with your information request as proof that you're authorized to receive deceased person's information: The full name of the deceased, their last address and Social Security Number. A copy of the death certificate. Either: A copy of Letters of Testamentary approved by the court or.

If a refund is due on the individual income tax return of the deceased, claim the refund by submitting Form 1310, Statement of a Person Claiming Refund Due a Deceased Taxpayer.

A deceased person's social security number can no longer be used in transactions, which is why bank accounts in the deceased person's name are often frozen shortly after their passing.

If the IRS did not provide you with a specific phone number, you can call IRS taxpayer assistance at 1-800-829-1040. Follow these instructions to reach a live representative: Press 1 for English.

The IRS doesn't need a copy of the death certificate or other proof of death. Usually, the representative filing the final tax return is named in the person's will or appointed by a court.

Contact banks, credit unions, credit card companies, and other financial institutions that hold accounts in your loved one's name, and notify those companies of your family member's death. This way, the system can flag any attempts to use the deceased person's identity via their financial accounts.