Alaska Multistate Promissory Note - Secured

Description

How to fill out Multistate Promissory Note - Secured?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an extensive variety of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the most recent editions of forms such as the Alaska Multistate Promissory Note - Secured in moments.

If you already hold a registration, Log In to obtain the Alaska Multistate Promissory Note - Secured from the US Legal Forms collection. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill in, modify, and print and sign the downloaded Alaska Multistate Promissory Note - Secured. Each template you add to your account does not expire and belongs to you forever. So, if you want to download or print another copy, just go to the My documents section and click on the form you need. Access the Alaska Multistate Promissory Note - Secured with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a vast array of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Before using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your location/region.

- Click the Preview button to look over the form's content.

- Review the description of the form to confirm you’ve selected the appropriate one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- When satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

A promissory note can indeed be made 'on demand,' meaning it requires repayment upon request. The Alaska Multistate Promissory Note - Secured can include this provision, offering flexibility in collection. Just ensure that all parties agree to this term upfront. If you're unsure how to craft such an agreement, uslegalforms can provide the necessary documentation.

Banks are not legally required to accept promissory notes, as their acceptance policies can vary. That said, an Alaska Multistate Promissory Note - Secured is often accepted, especially when it meets banking requirements. It's important to check with your specific bank to understand their criteria. Exploring platforms like uslegalforms can provide templates that align with bank standards.

Obtaining your promissory note is generally straightforward once the agreement is executed. If you use an Alaska Multistate Promissory Note - Secured, the document should be provided at signing. Ensure that you keep a copy for your records while also verifying its compliance with applicable laws. For added assistance, platforms like uslegalforms can help you navigate this process.

Yes, you can demand a promissory note, particularly if it is stipulated in your agreement. The Alaska Multistate Promissory Note - Secured provides legal grounds for ensuring repayment according to the terms you both set. If the borrower fails to comply, seeking legal advice may help enforce your rights. Using a structured approach with tools like uslegalforms can simplify this process.

Many people begin using promissory notes by understanding their basic structure and benefits, like those of the Alaska Multistate Promissory Note - Secured. Starting with clear terms and a solid repayment plan can create a secure investment avenue. Consulting resources, such as uslegalforms, can offer guidance during the setup process. It's about knowing your options and making informed decisions.

When you invest using an Alaska Multistate Promissory Note - Secured, you protect your interests through collateral backing. This added security can reduce risks compared to unsecured investments. However, like any investment, consider your borrower's creditworthiness and the legal implications of the note. It's always wise to consult a legal expert or utilize platforms like uslegalforms to ensure everything is set up correctly.

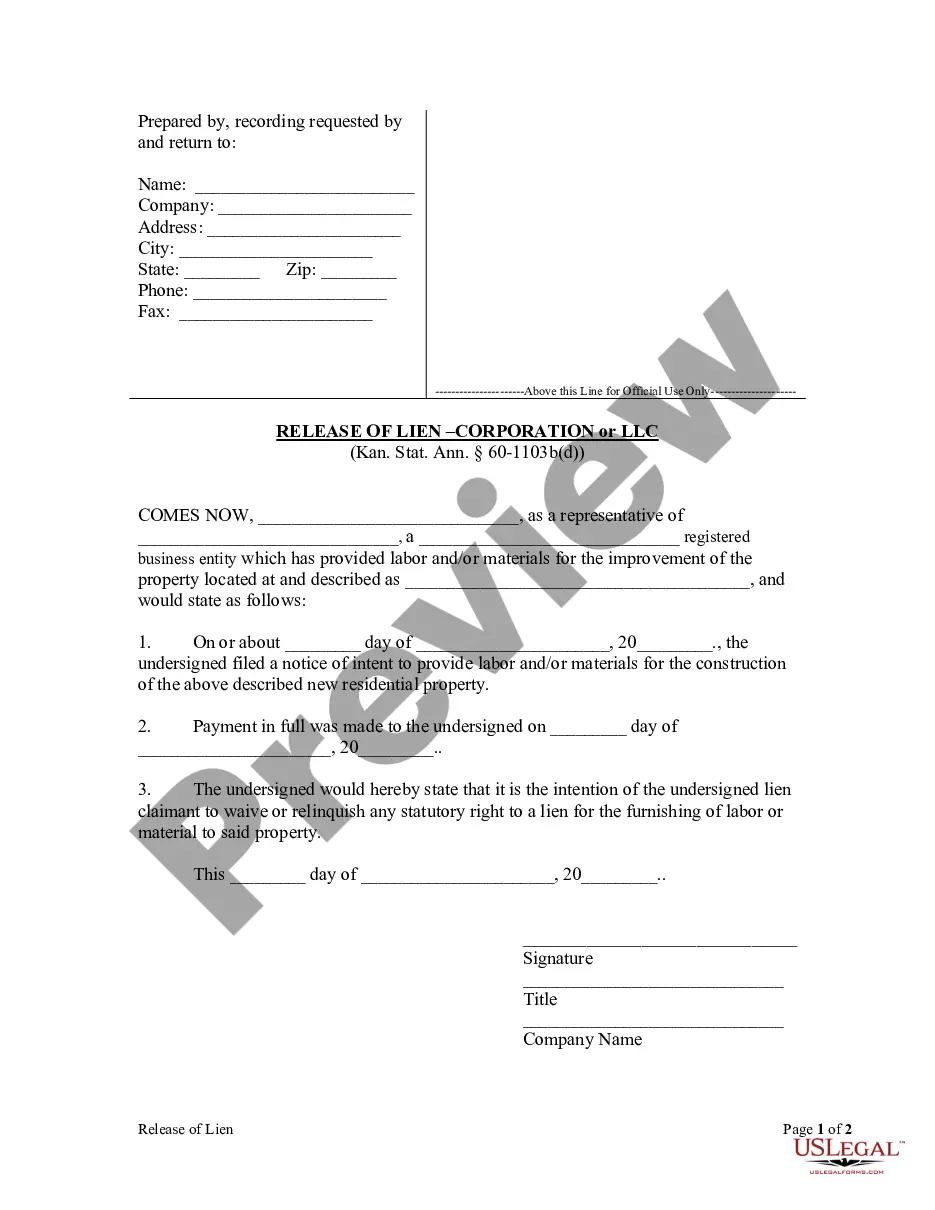

Filling out a promissory note involves providing essential information such as the lender and borrower's names, the amount loaned, and the repayment details. Be sure to include payment due dates and interest rates, if applicable. Utilizing an Alaska Multistate Promissory Note - Secured can help ensure you include all necessary clauses, making the document legally sound.

To write a simple promissory note, start by clearly stating the title as 'Promissory Note'. Next, include the names of both parties, the date, the principal amount, interest rate, repayment schedule, and the consequences of default. For added security and compliance, consider using the Alaska Multistate Promissory Note - Secured, which follows established legal standards and incorporates necessary terms.

The main difference between secured and unsecured promissory notes lies in the presence of collateral. An Alaska Multistate Promissory Note - Secured has collateral backing, providing lenders with a safety net if the borrower defaults. In contrast, unsecured notes rely solely on the borrower's promise, making them riskier for lenders.

Some disadvantages of promissory notes include the risk of default and the potential for disputes over terms. In the case of an Alaska Multistate Promissory Note - Secured, while collateral reduces risks, it does not eliminate them entirely. Lenders should also consider legal fees and the time it may take to resolve any disputes.