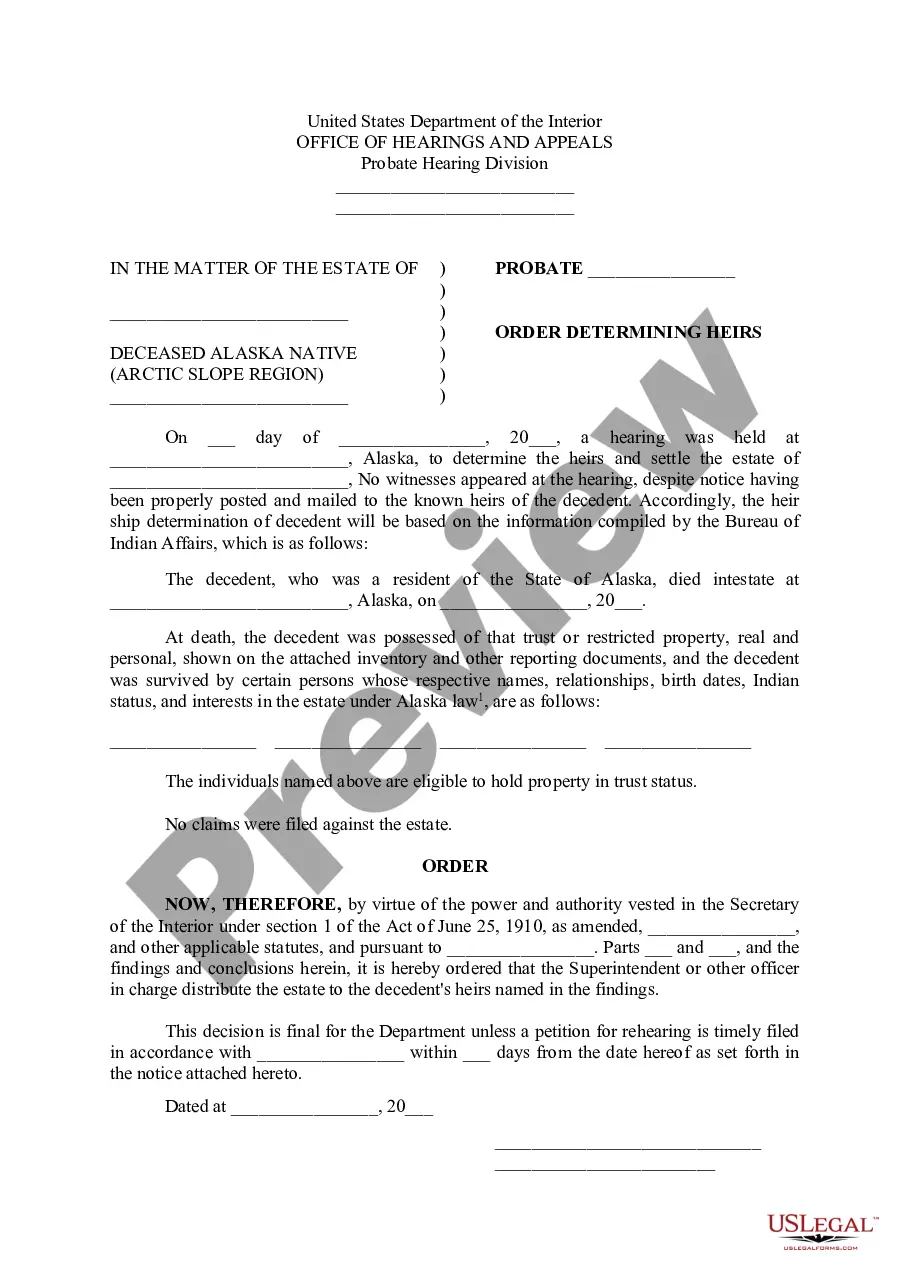

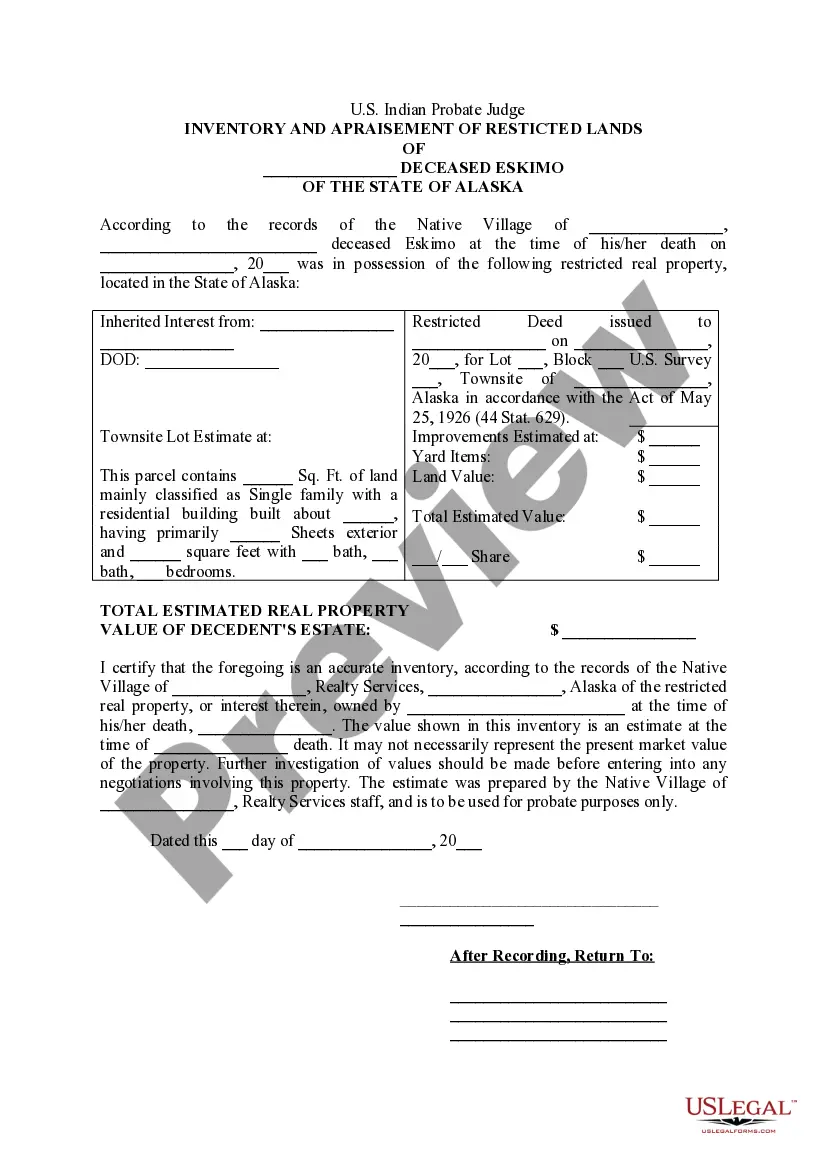

Alaska Order Determining Heirs

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alaska Order Determining Heirs?

Utilize US Legal Forms to obtain a printable Alaska Order Determining Heirs. Our court-accepted forms are composed and updated frequently by experienced attorneys.

Ours is the largest collection of forms available online, providing economical and precise templates for individuals, legal professionals, and small to medium-sized businesses.

The documents are organized into state-specific categories, and many of them can be previewed before downloading.

US Legal Forms offers thousands of legal and tax documents and packages for both business and personal requirements, including the Alaska Order Determining Heirs. Over three million users have successfully used our platform. Select your subscription plan and get high-quality forms with just a few clicks.

- Ensure you possess the correct form based on the state required.

- Examine the document by reading its description and utilizing the Preview feature.

- Click Buy Now if it is the document you need.

- Create your account and make payment via PayPal or credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the search engine if you wish to find another document template.

Form popularity

FAQ

If you are entitled to an inheritance, it doesn't just disappear if the probate case must be closed before you can receive it. Instead, it is deposited in a fund with the county in which the probate case was opened.

In many states, the required period is 120 hours, or five days. In some states, however, an heir need only outlive the deceased person by any period of time -- theoretically, one second would do.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

Once filed, the will is a matter of public record. Anyone can see it. Interested parties can also usually learn the name of the executor by getting a copy of the death certificate from the county registrar.

As an heir, you are entitled to a copy of the Will, whether you are named as a beneficiary or not. If there is a probate estate, then you should receive a copy of the Will. If you do not, you can always get it from the court. If there is no probate estate, then the Will is not going to do anything.

How long do you have to make a claim? The Act has a strict time limit for making a claim of six months from the date of the Grant of Probate or Letters of Administration. In very exceptional circumstances this may be extended to allow a late claim, but as a rule you must stick to the six month deadline.

There is a strict time limit within which an eligible individual can make a claim on the Estate. This is six months from the date that the Grant of Probate was issued. For this reason, Executors are advised to wait until this period has lapsed before distributing any of the Estate to the beneficiaries.

An inheritance that remains unclaimed will pass on the next person in the line of intestate succession. If the nonclaiming individual was the last in the intestate line, the property will escheat, or revert to the state.

All of the heirs must sign. The only way to get around a deadlock like this is to have the succession representative sell the house.