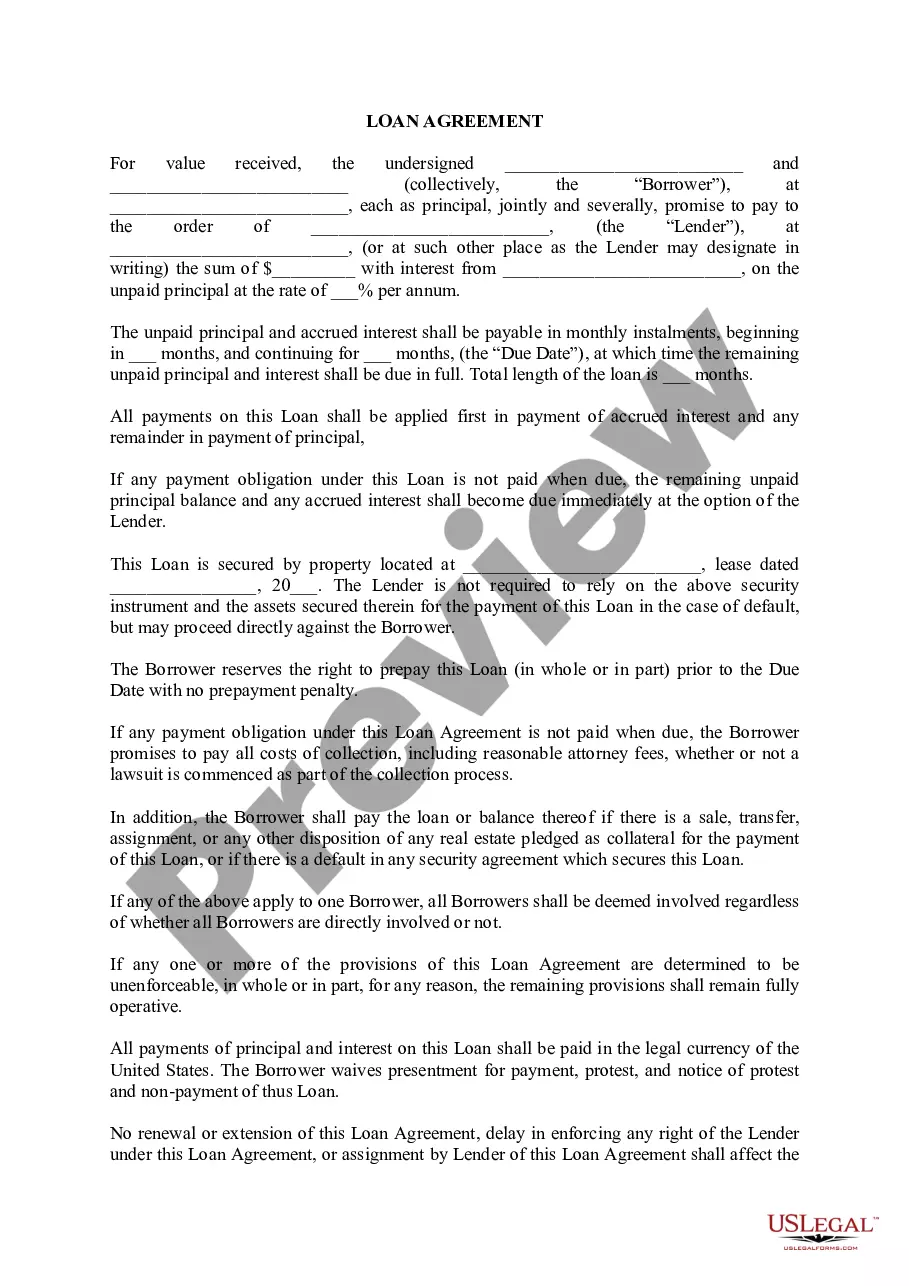

Alaska Loan Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alaska Loan Agreement?

Utilize US Legal Forms to acquire a printable Loan Agreement for Alaska.

Our legal documents are validated for court and are crafted and frequently revised by qualified attorneys.

We boast the most comprehensive library of Forms available online, providing economical and precise templates for both consumers and legal professionals, as well as small to medium-sized businesses.

US Legal Forms provides a vast selection of legal and tax templates and packages for both business and personal requirements, including the Alaska Loan Agreement. More than three million users have successfully accessed our platform. Choose your subscription plan and receive premium documents in just a few clicks.

- The templates are categorized by state, with some available for preview before downloading.

- To obtain templates, users must possess a subscription and Log In to their account.

- Select Download beside any desired template and find it in My documents.

- For users without a subscription, refer to the guidelines below for swift access to the Alaska Loan Agreement.

- Ensure you have the correct form applicable to your state's requirement.

- Examine the document by reviewing the description and using the Preview option.

- Press Buy Now if it is the template you require.

- Establish your account and process payment through PayPal or card|credit card.

- Download the document to your device and feel free to reuse it several times.

- Utilize the Search box if you are looking for another document template.

Form popularity

FAQ

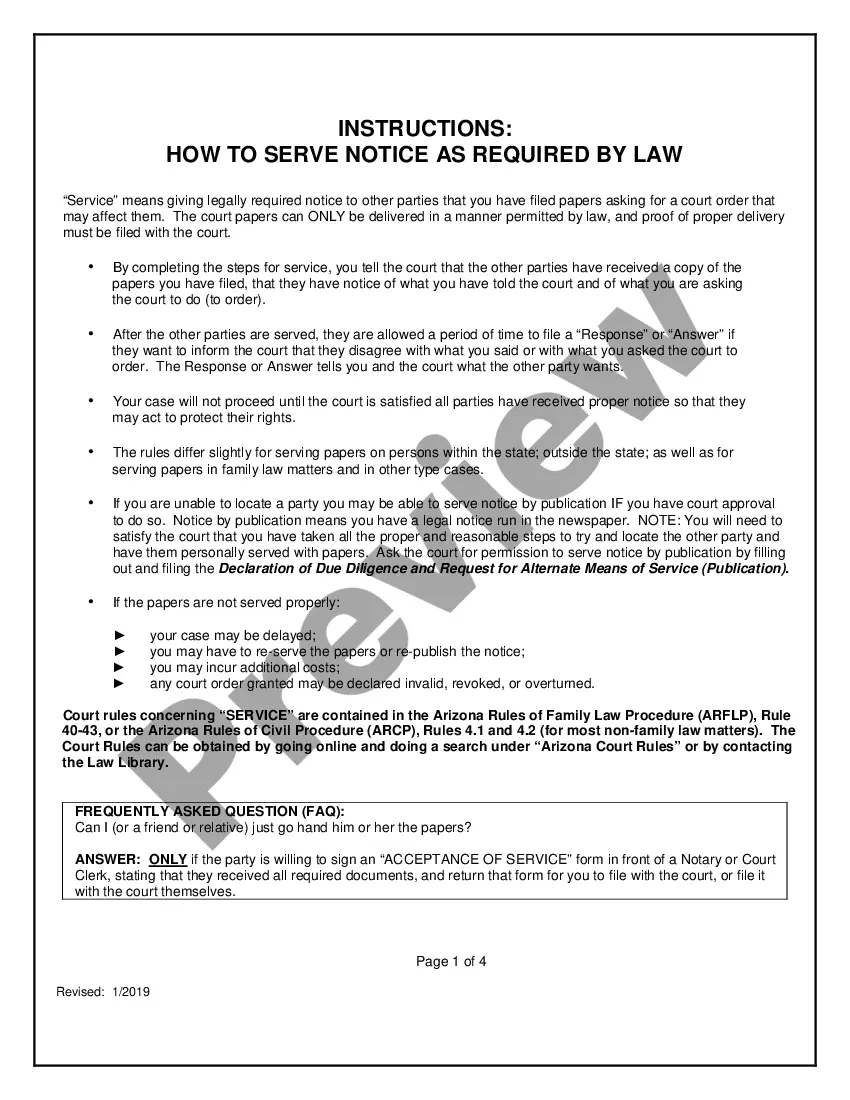

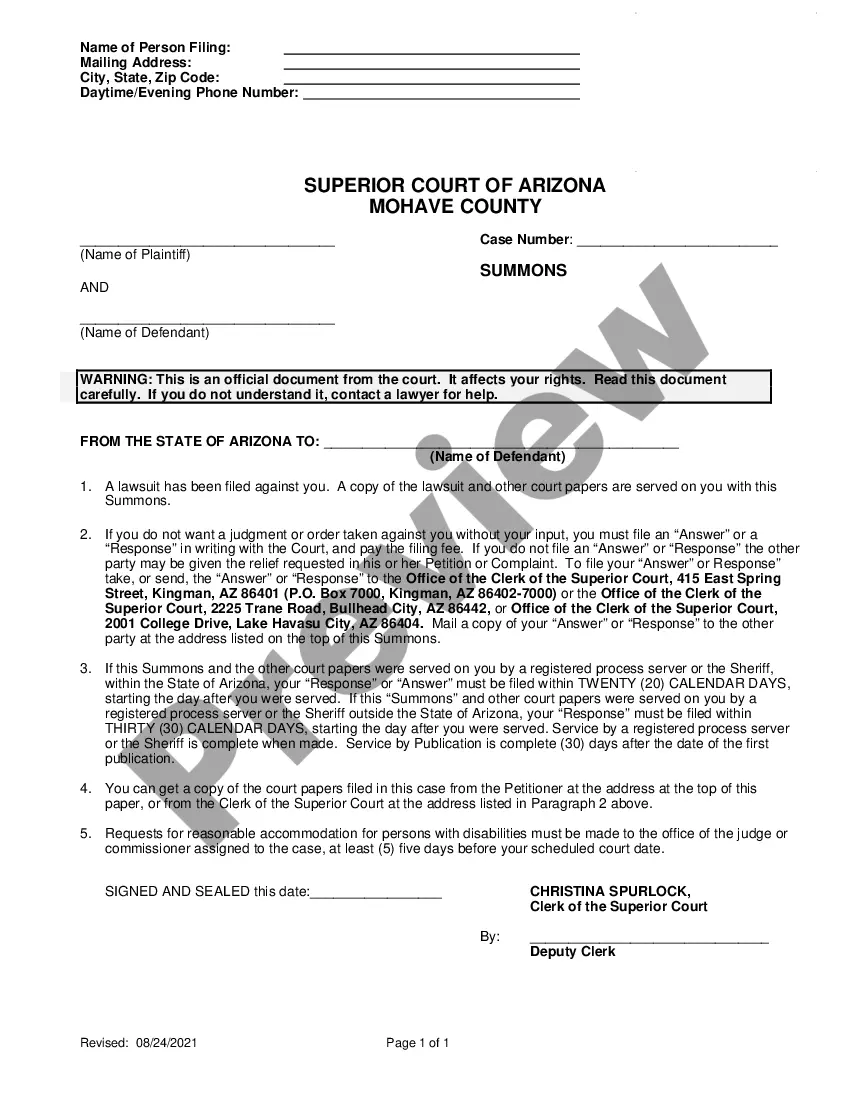

Once the loan documents have been signed, the escrow officer delivers them back to the lender for review. When the lender is satisfied that all required documents have been signed and all outstanding loan conditions have been met, the lender will notify escrow that they are ready to disburse the loan funds to escrow.

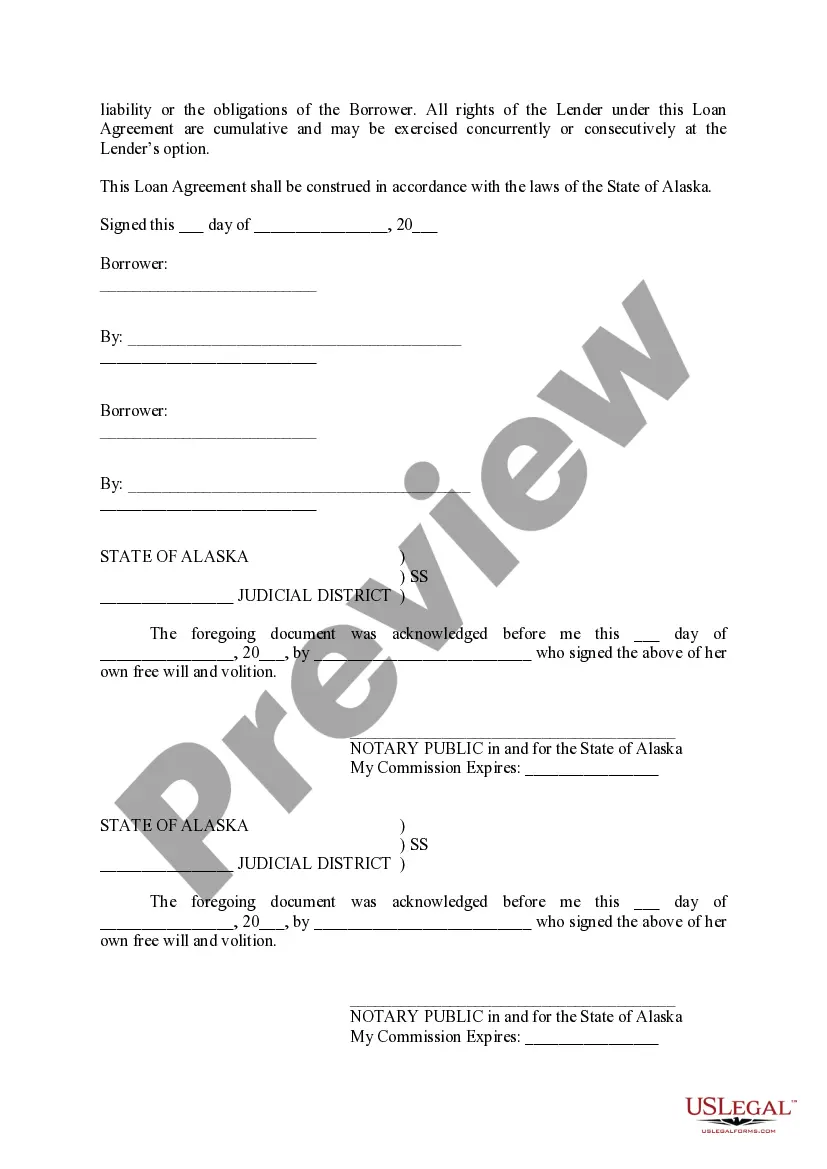

Generally speaking, there is no requirement for a witness or notary public to witness the signing of the Loan Agreement.Even if it is not required, having an objective third party witness the signing of the loan agreement will be better evidence when you need to enforce the repayment of the loan.

A personal loan agreement is a legally binding document regardless of whether the lender is a financial institution or another person.As a borrower, you could be sued by the lender or lose the asset or assets used to secure the loan.

The right of rescission is the right of a borrower to cancel a home equity loan, line of credit or refinancing agreement within a 3-day period without financial penalty. It was born out of the Truth in Lending Act (TILA).

A loan agreement is a contract between you, the borrower and the lender.If there are valid reasons such as fraud or a breech of contract, you should be able to get out of the loan. If you are unable to cancel the contract, you may be forced to take other measures to get out of the loan.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties.