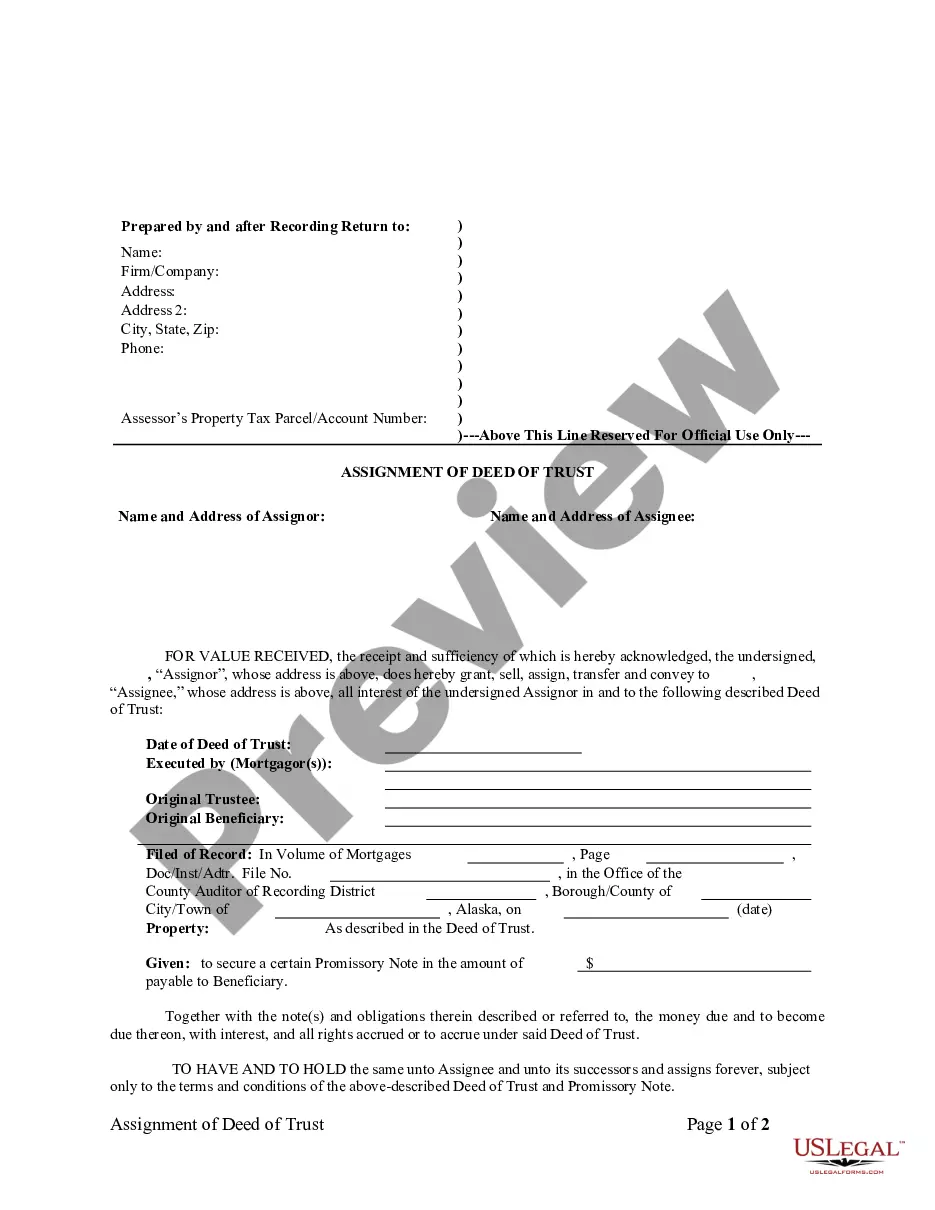

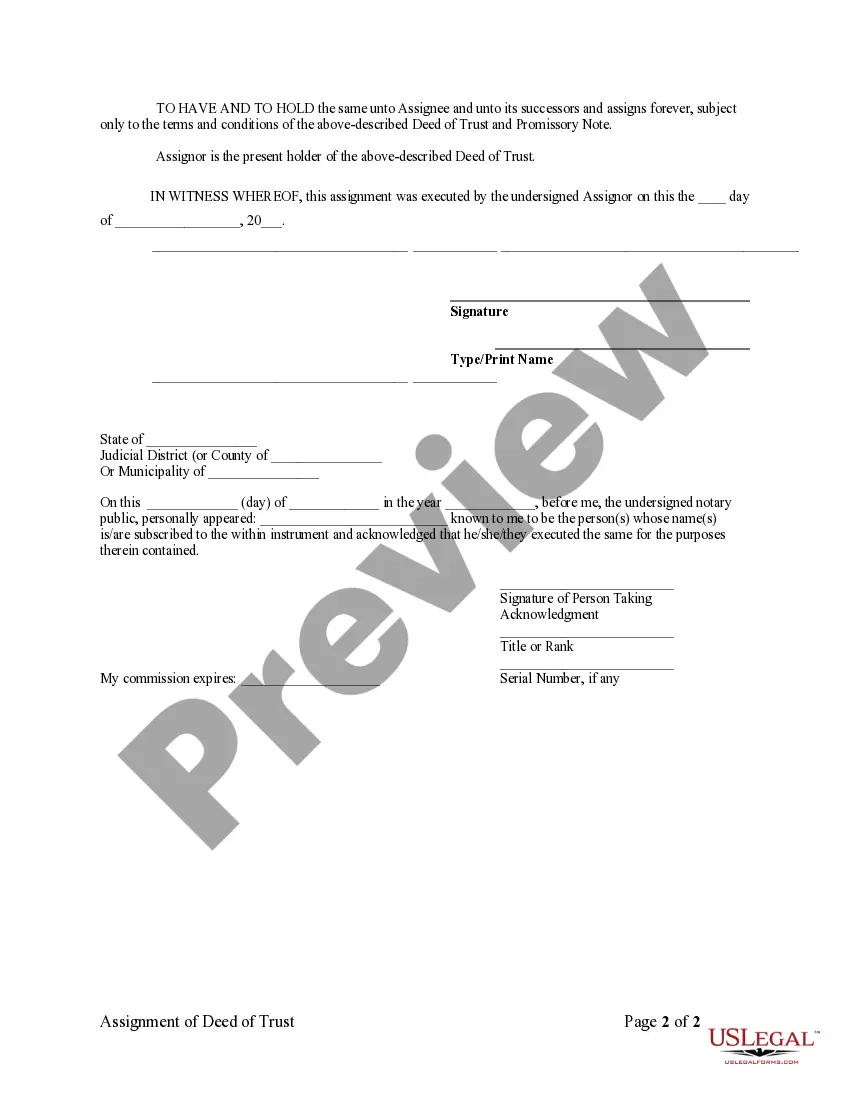

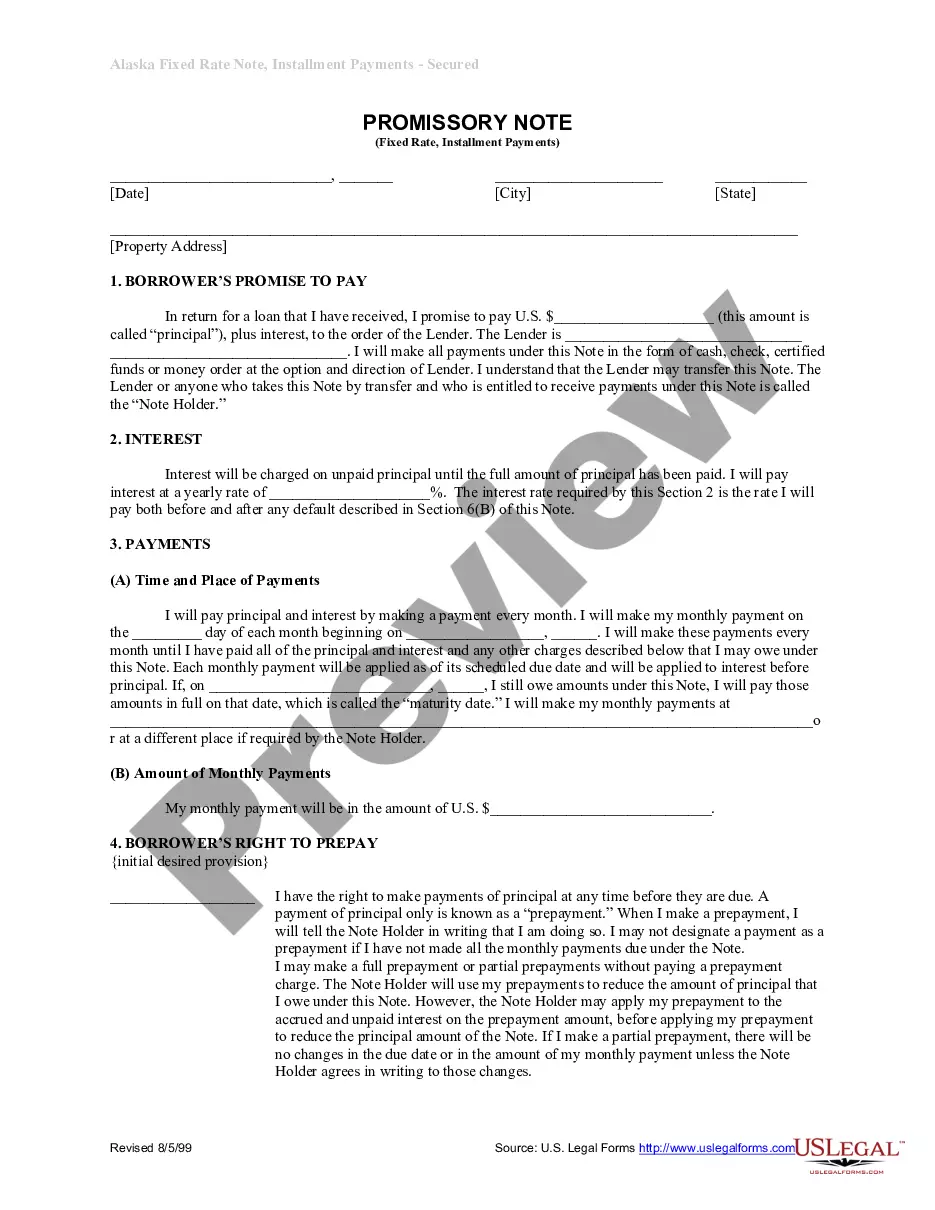

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Alaska Assignment of Deed of Trust by Individual Mortgage Holder

Description

How to fill out Alaska Assignment Of Deed Of Trust By Individual Mortgage Holder?

Utilizing Alaska Assignment of Deed of Trust by Individual Mortgage Holder instances created by experienced attorneys provides you the chance to avert stress when completing paperwork.

Simply download the template from our site, fill it in, and request a lawyer to review it.

By doing this, you can save considerably more time and effort than searching for an attorney to create a file from scratch for you.

Utilize the Preview feature and review the description (if available) to determine whether you require this specific template; if it is what you need, click Buy Now. Find another document using the Search field if necessary. Choose a subscription that suits your requirements. Begin the process using your credit card or PayPal. Select a file format and download your document. Once you have completed all the aforementioned steps, you will be able to fill out, print, and sign the Alaska Assignment of Deed of Trust by Individual Mortgage Holder template. Remember to verify all entered information for accuracy before submitting or mailing it out. Reduce the time spent on document creation with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In to your account and navigate back to the form webpage.

- Locate the Download button next to the templates you are reviewing.

- Once you download a document, all your saved samples will be found in the My documents tab.

- If you lack a subscription, it's not a significant issue.

- Simply follow the instructions below to register for an account online, obtain, and finalize your Alaska Assignment of Deed of Trust by Individual Mortgage Holder template.

- Double-check to ensure that you are downloading the proper state-specific form.

Form popularity

FAQ

While a mortgage involves two parties, a deed of trust involves three: the trustor (the borrower) the lender (sometimes called a "beneficiary"), and. the trustee.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

Property cannot be conveyed to a grantee who does not exist. Thus, a deed to a grantee who is dead at the time of delivery is void. For example, a deed recorded by the grantor is presumed to have been delivered.For example, a deed is voidable if it was obtained by fraud in the inducement.

With a mortgage, the two parties that enter into the contract are: the mortgagor (the borrower) and. the mortgagee (the lender).

A deed of trust is a method of securing a real estate transaction that includes three parties: a lender, borrower and a third-party trustee.

A deed of trust includes most of the same information as a mortgage, including:A legal description of the property that's used as security or collateral for the mortgage. The names of parties: trustee, trustor, and beneficiary. The inception and maturity dates of the loan.

An assignment of trust deed is a document that lenders use when they sell loans secured by trust deeds. While they can freely sell the promissory notes between themselves, the trust deeds that give them the right to foreclose have to be assigned with a legal document.

There are two parties to a mortgage. You are the mortgagor, or borrower, and the lender is the mortgagee. lender's security for the debt.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.