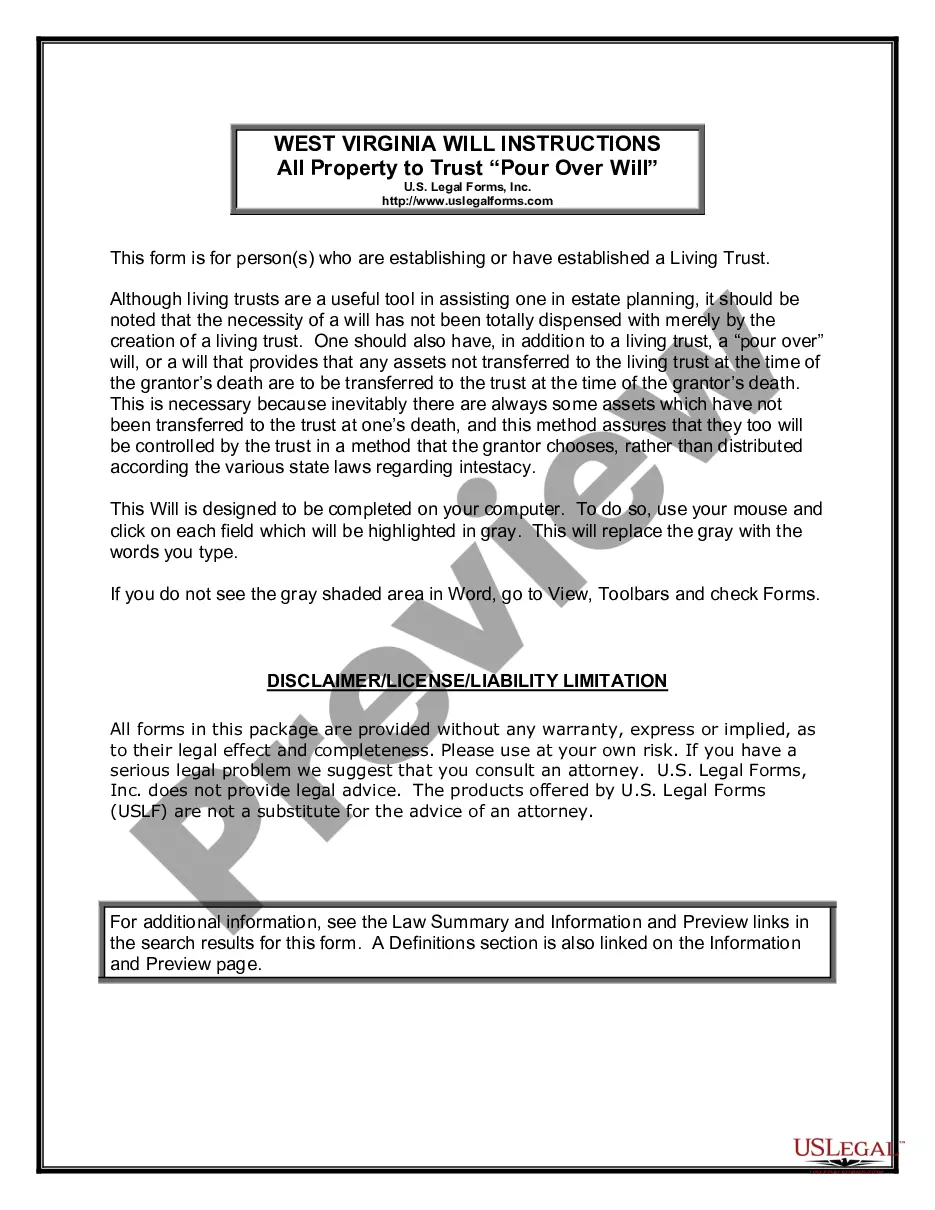

West Virginia Last Will and Testament with All Property to Trust called a Pour Over Will

About this form

The Last Will and Testament, also known as a Pour Over Will, is a crucial legal document for those who have established or are establishing a living trust. This form ensures that any property not already transferred to your trust will automatically go into the trust upon your passing. Unlike standard wills, a pour over will complements a living trust, allowing your assets to be managed according to your wishes, helping to avoid complications of state intestacy laws after your death.

What’s included in this form

- Conveyance to Trust: This section designates property to be transferred to your living trust.

- Debts and Expenses: Outlines how your debts, funeral, and other expenses will be settled.

- Guardian of Minor Children: Designate a guardian for any minor children.

- Appointment of Personal Representative: Names an executor to carry out the terms of your will.

- Waiver of Bond: Specifies that your representative will serve without needing a bond.

- Powers of Personal Representative: Details the powers granted to the executor in managing your estate.

When to use this document

This form is essential for individuals who have a living trust and want to ensure that any assets not previously transferred to the trust will be managed according to their specified terms. It is particularly useful in situations where you may have overlooked assets that need to be included in your estate plan. By utilizing this form, you can simplify the distribution of your assets and minimize potential legal complications for your heirs.

Who needs this form

- Individuals establishing a living trust.

- Those who have already created a trust and need to ensure all assets are included.

- Anyone wanting to designate guardians for minor children within their estate plan.

- Persons who wish to avoid the complexities of intestate succession laws.

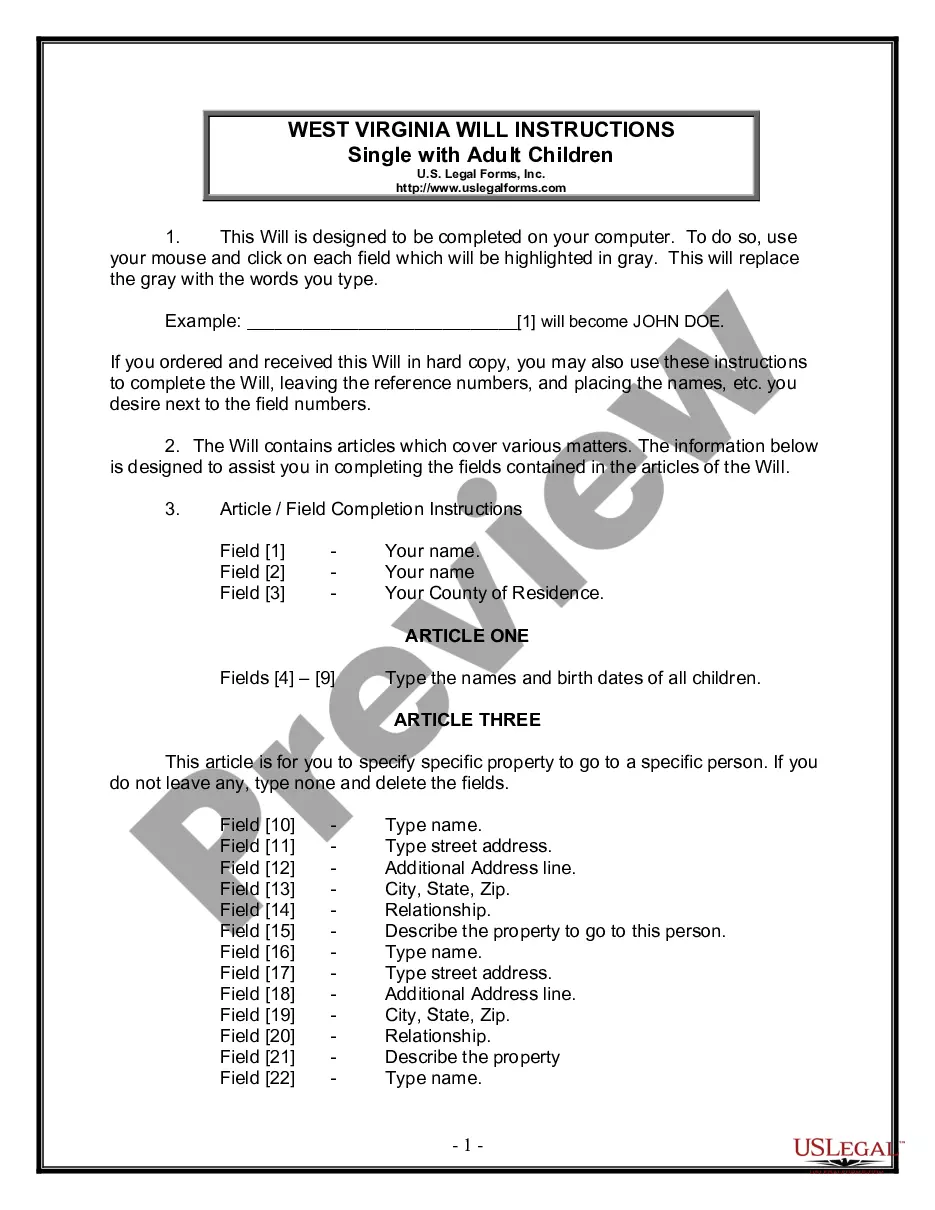

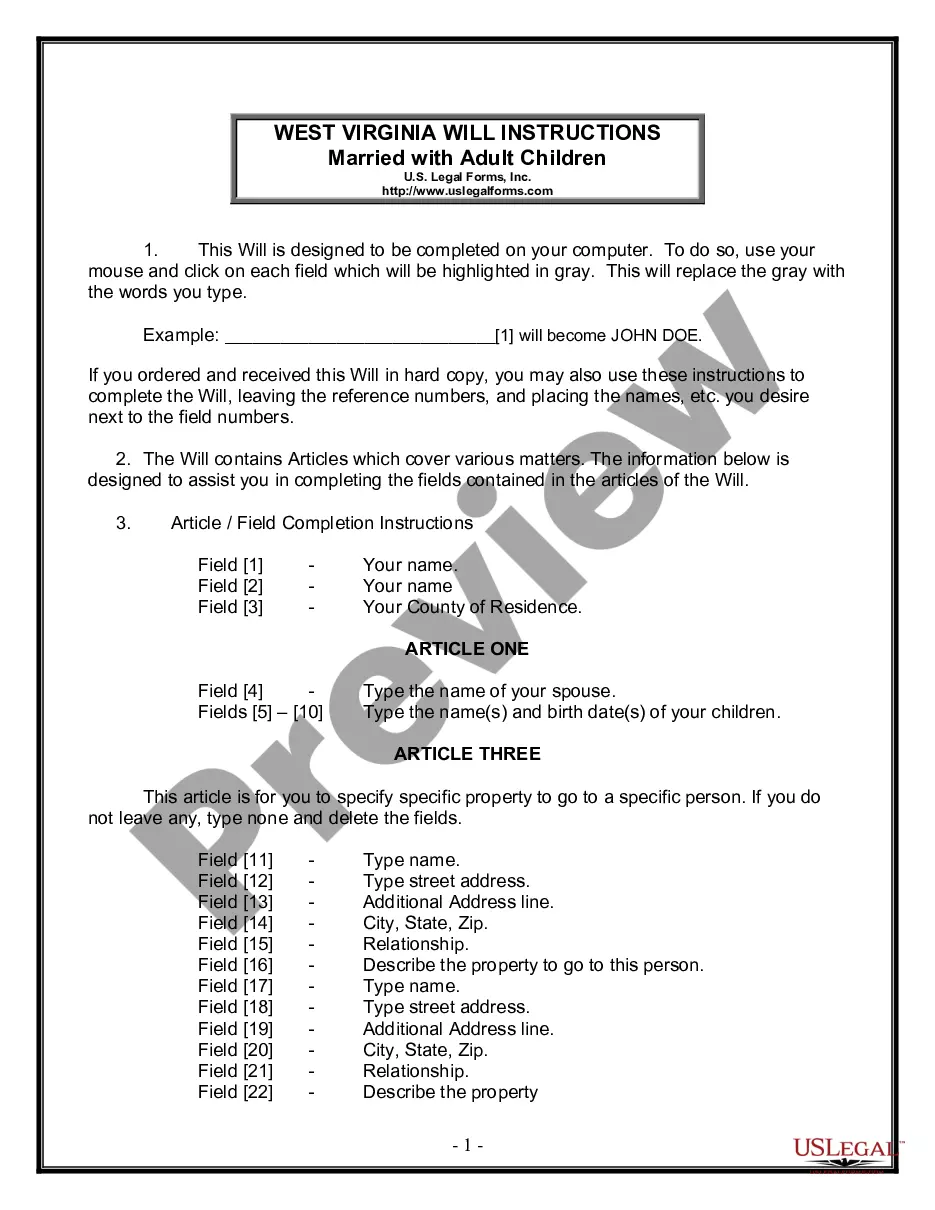

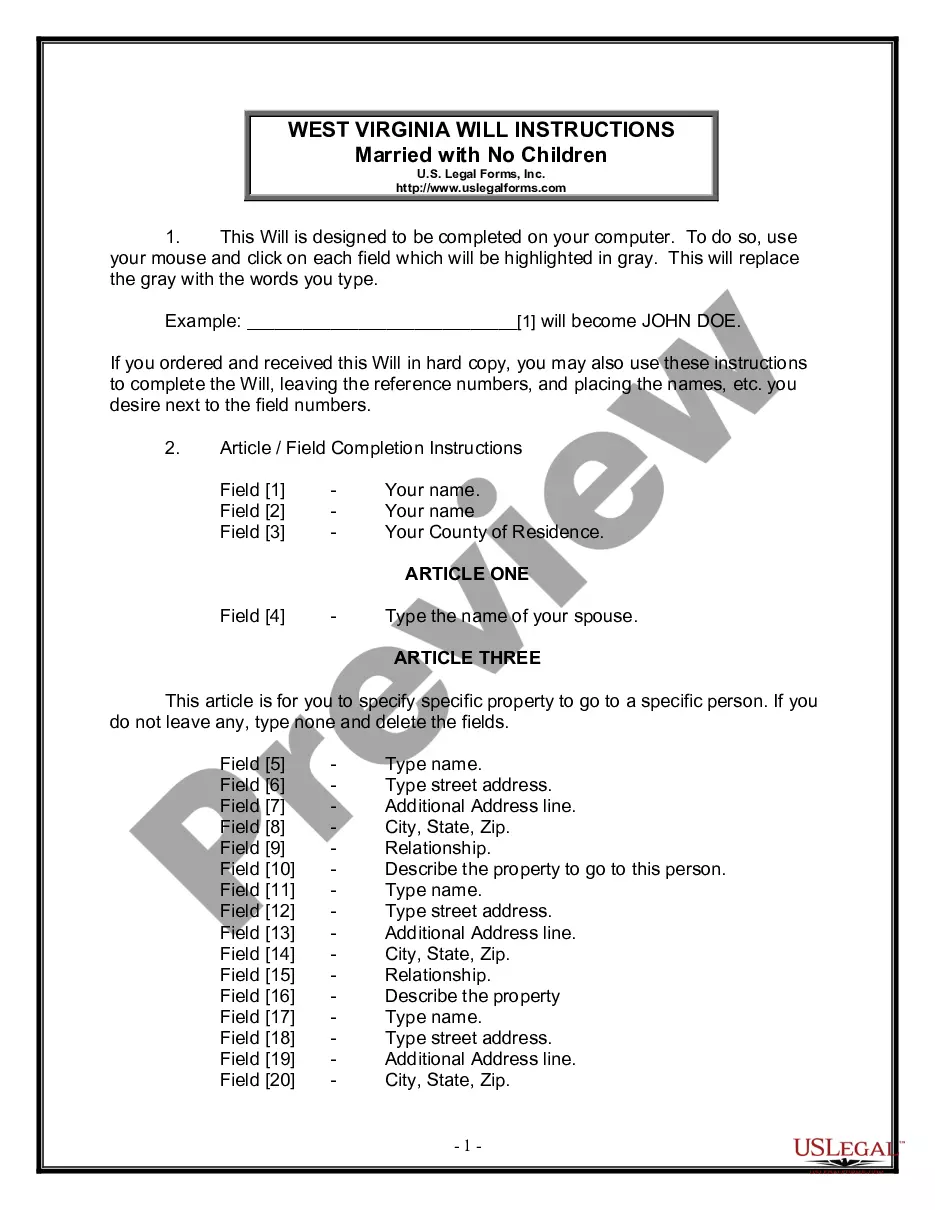

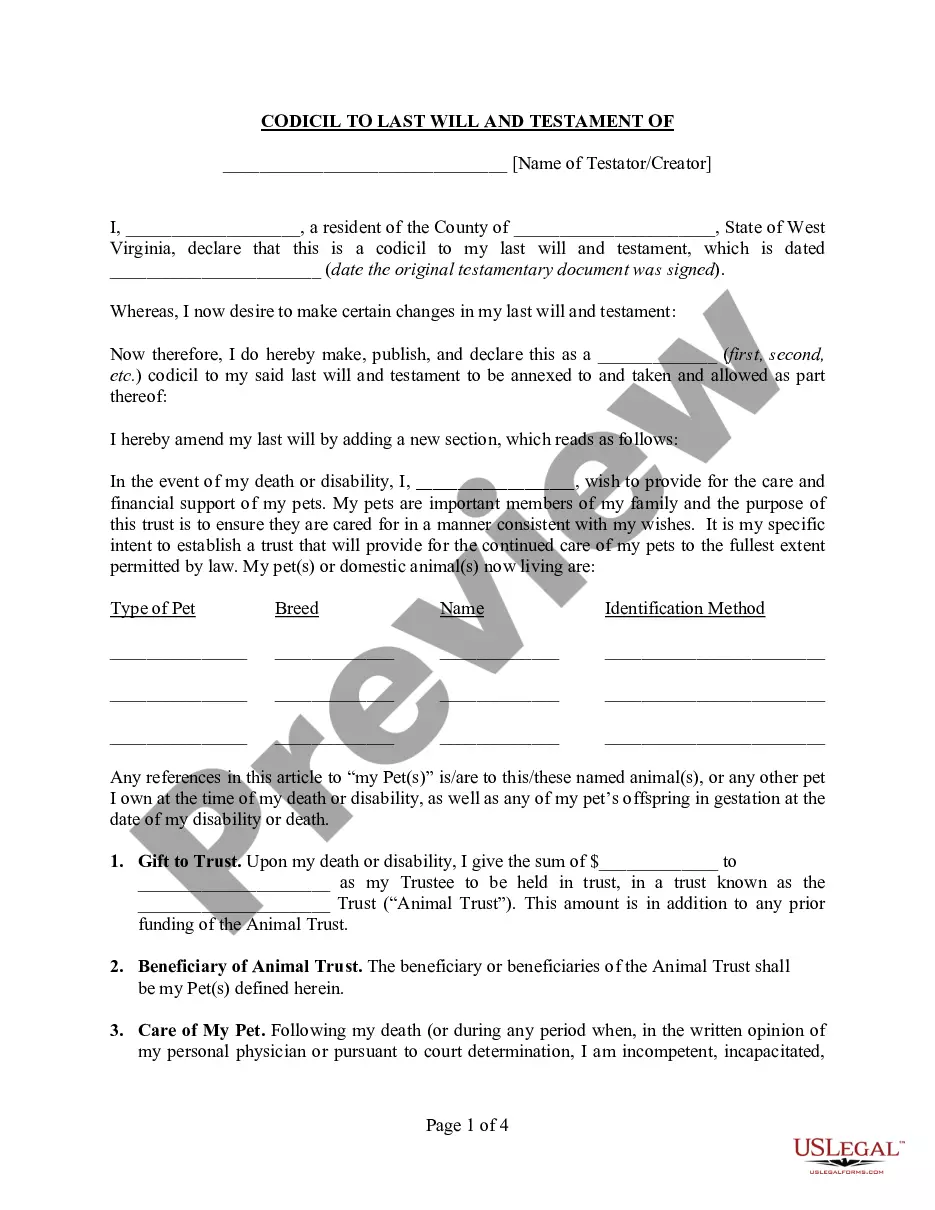

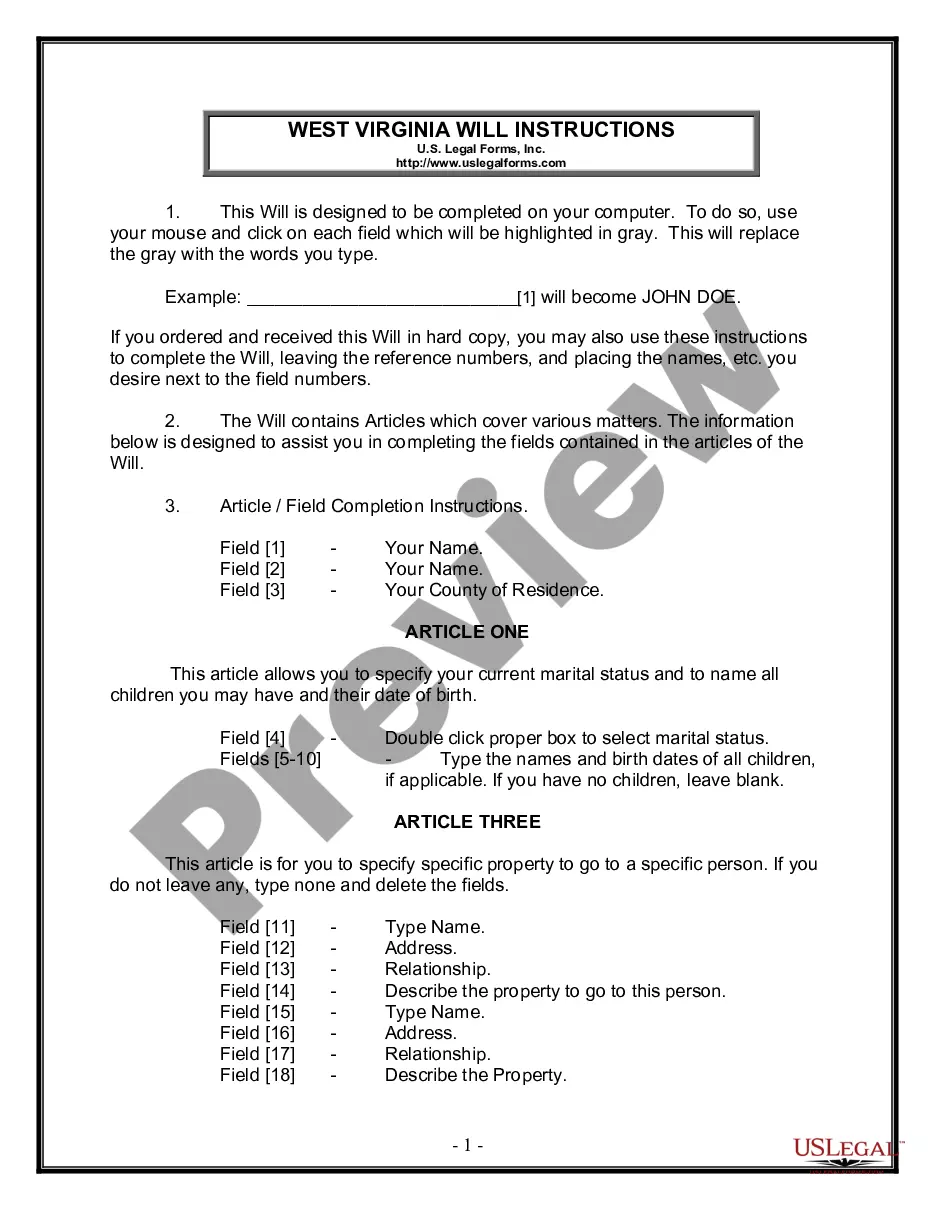

Steps to complete this form

- Identify yourself as the testator and provide your personal details.

- Specify the name of your living trust and the asset details to be conveyed.

- Appoint a guardian for any minor children, if applicable.

- Choose your personal representative and any successor representatives.

- Review the completed form for accuracy and clarity before execution.

- Sign in the presence of witnesses to validate the will.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Typical mistakes to avoid

- Failing to update the will after significant life events, such as marriage or birth of children.

- Not including a guardian for minor children if applicable.

- Omitting to name an executor or personal representative.

- Neglecting to have the will witnessed properly, which could invalidate it.

Benefits of using this form online

- Convenience of completing the form at your own pace and from home.

- Editable fields allow you to make changes and updates easily.

- Access to trusted templates drafted by licensed attorneys ensures legal compliance.

- Immediate download saves time and provides quick access to your documents.

Legal use & context

- Pours-over wills are recognized as valid legal documents for estate planning.

- Improper execution can lead to disputes or invalidation of the will.

- It complements a living trust, ensuring all assets are managed per your wishes.

Form popularity

FAQ

The pour over will does not need to be notarized; however, in California it does need to be signed by two disinterested witnesses.

Important: Although a revocable trust supersedes a will, the trust only controls those assets that have been placed into it. Therefore, if a revocable trust is formed, but assets are not moved into it, the trust provisions have no effect on those assets, at the time of the grantor's death.

A pour-over will is a legal document that ensures an individual's remaining assets will automatically transfer to a previously established trust upon their death.

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

The pour over will does not need to be notarized; however, in California it does need to be signed by two disinterested witnesses.

Combining a Will and Trust Together: Should You Use Both? The use of a living trust and a will together as part of your estate planning is acceptable under California law. The benefit of this approach is that you can address separate issues on each document.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.