West Virginia Last Will and Testament for Married person with Adult Children

What is this form?

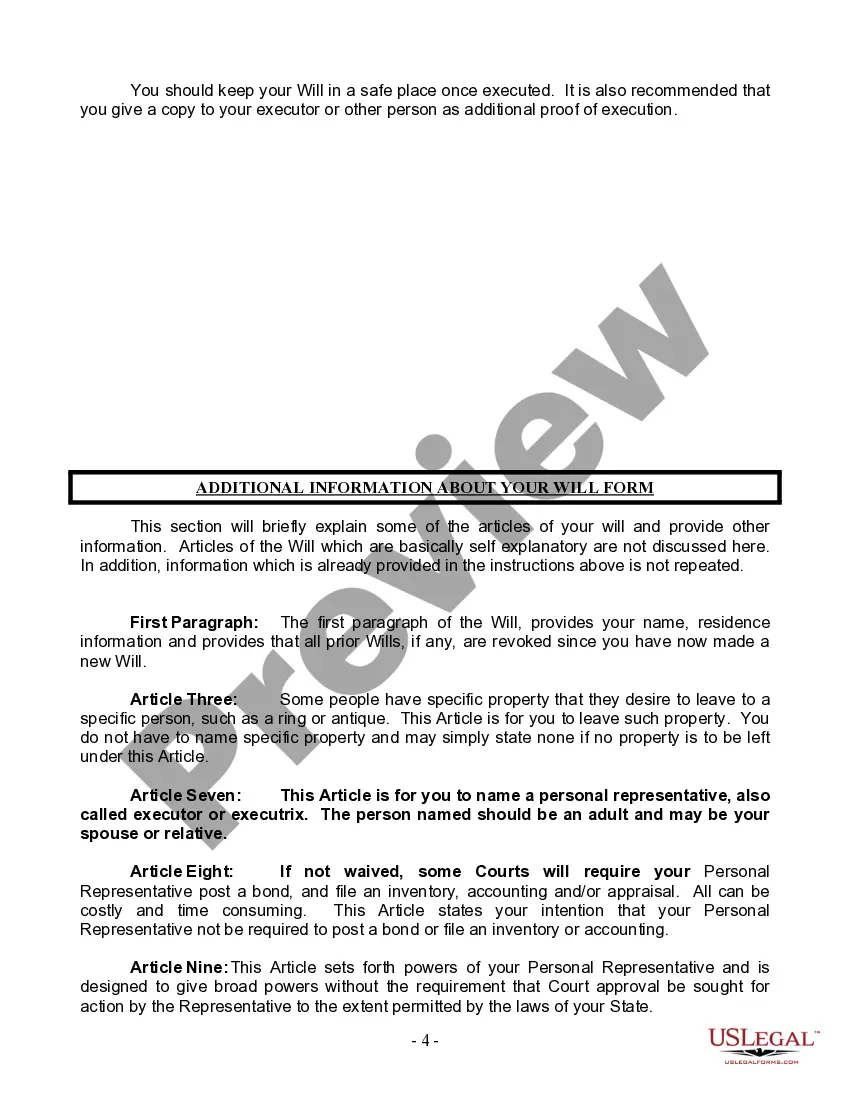

The Last Will and Testament for Married Person with Adult Children is a legal document that outlines how your assets will be distributed after your death. It is specifically designed for married individuals who have adult children, allowing you to appoint an executor, specify beneficiaries, and include provisions for your spouse and children. This form is essential in ensuring that your wishes are honored and offers peace of mind regarding your estate management.

Main sections of this form

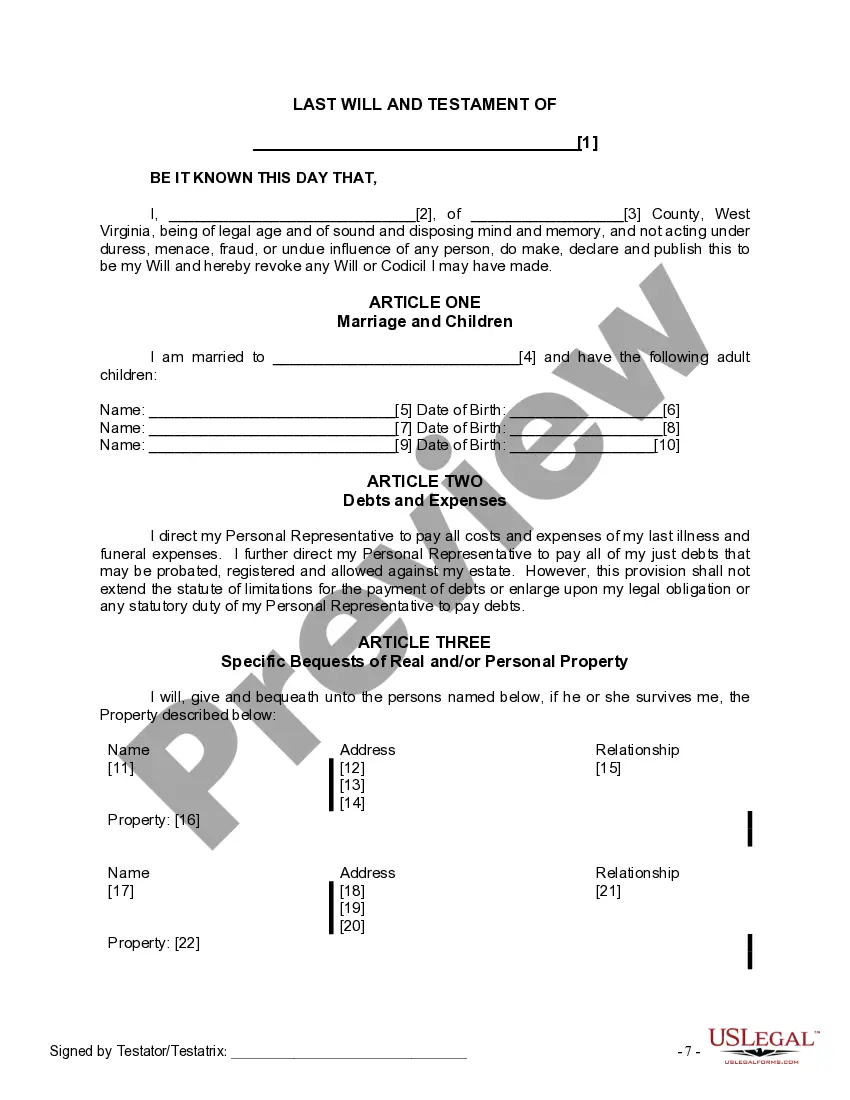

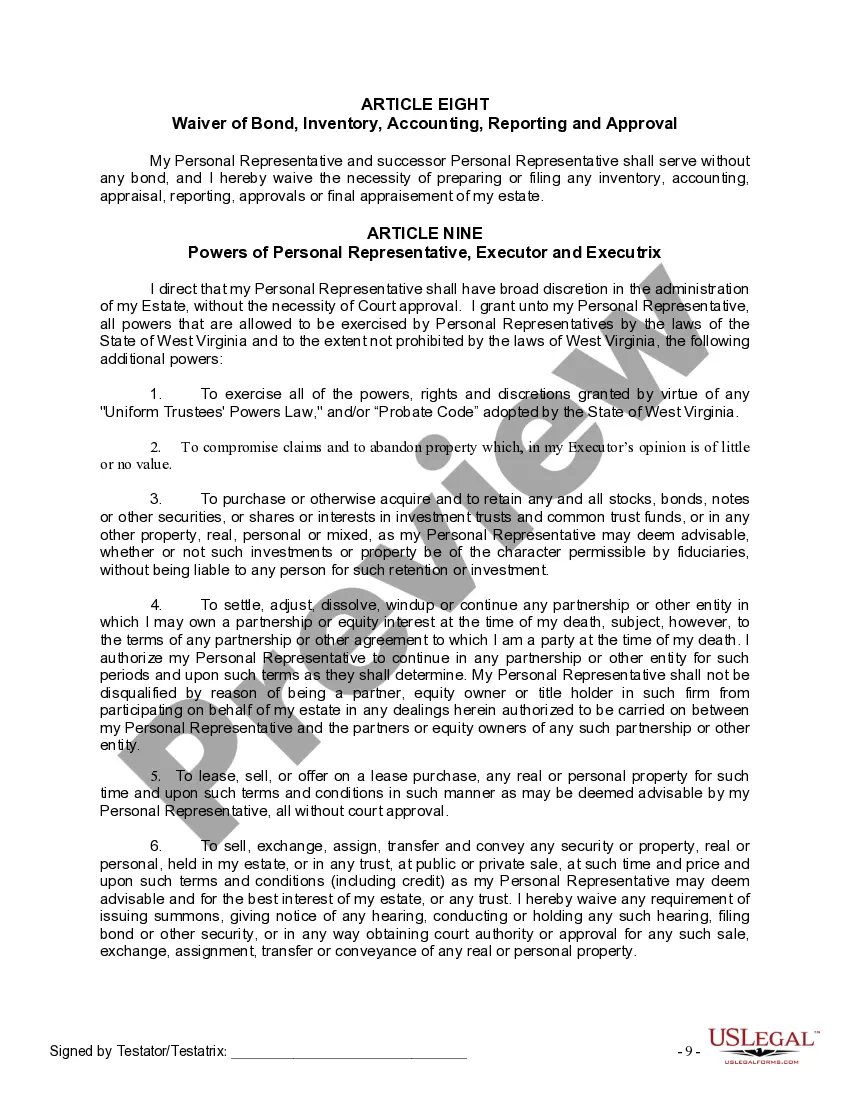

- Article One: Marriage and Children - States your marital status and names of your adult children.

- Article Three: Specific Bequests - Allows you to specify particular items of property for designated individuals.

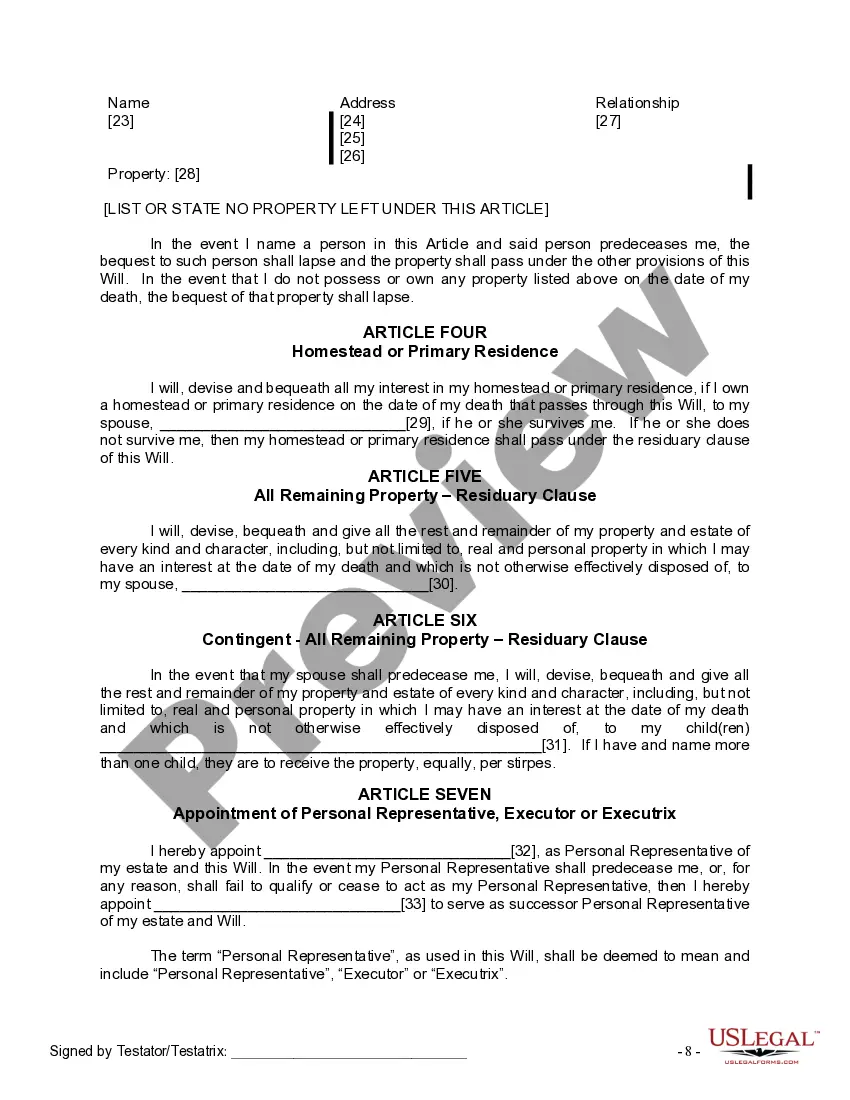

- Article Four: Homestead - Designates who will receive your primary residence.

- Article Seven: Personal Representative - Appoints an executor to manage your estate.

- Ending and Signature - Requirements for signing and witnessing the Will.

Legal requirements by state

This Last Will and Testament is intended for use in multiple states. Each state's laws regarding Wills may vary, particularly concerning witness requirements and the need for notarization, so it's advised to verify local regulations before finalizing the document.

When to use this form

This form is necessary when a married individual with adult children wants to create a legally binding document that details how their estate should be handled after their passing. It is particularly useful when you have specific desires regarding the distribution of assets or wish to ensure that your spouse and children are taken care of financially. Additionally, it can prevent disputes among family members regarding asset distribution.

Who should use this form

- Married individuals who have adult children.

- People who wish to establish clear, legal instructions regarding their estate.

- Those who want to ensure that their spouse and children are adequately provided for after their death.

- Individuals who are looking to avoid disputes over their assets among family members.

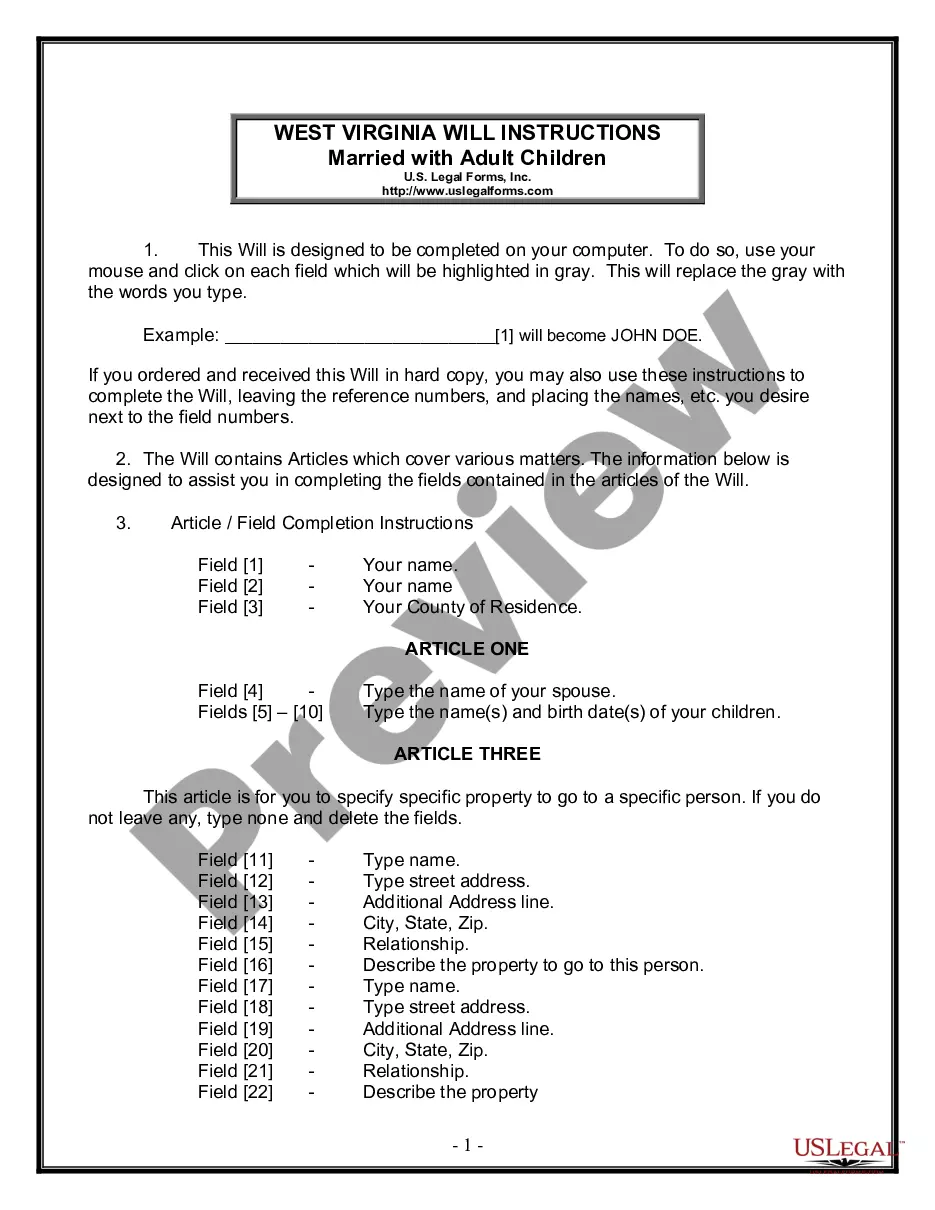

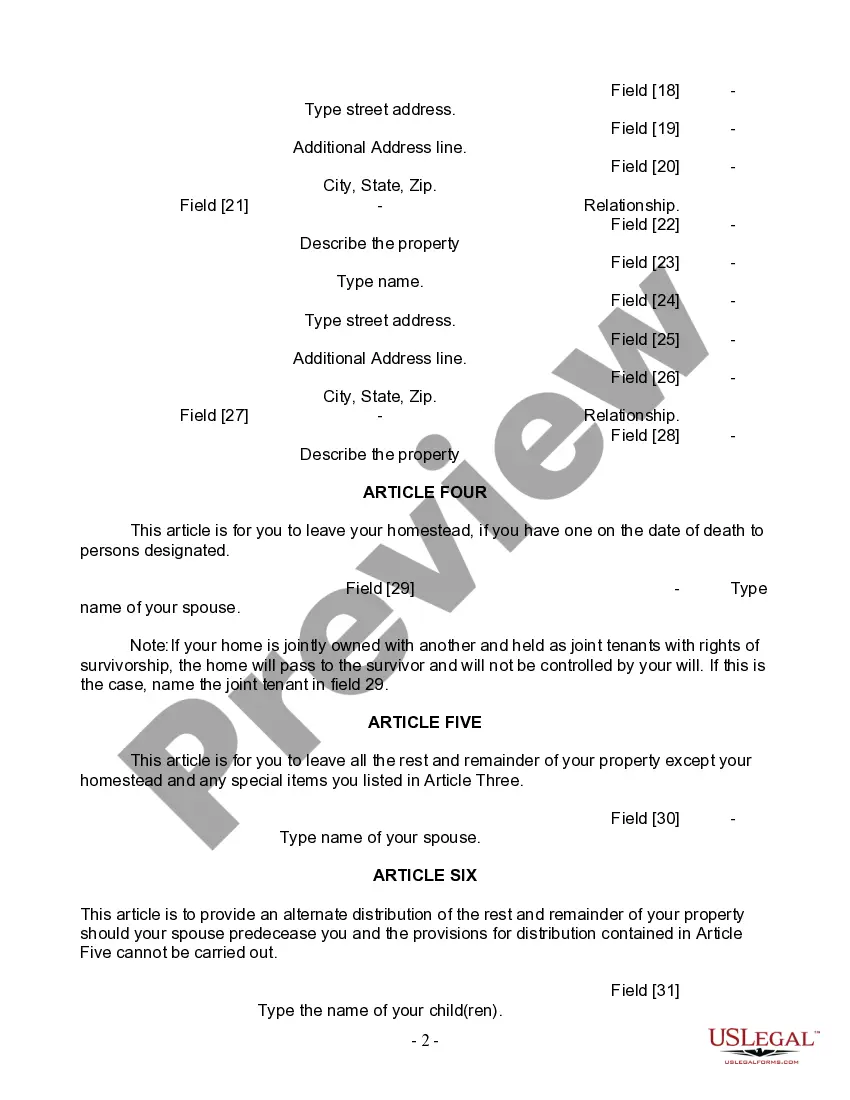

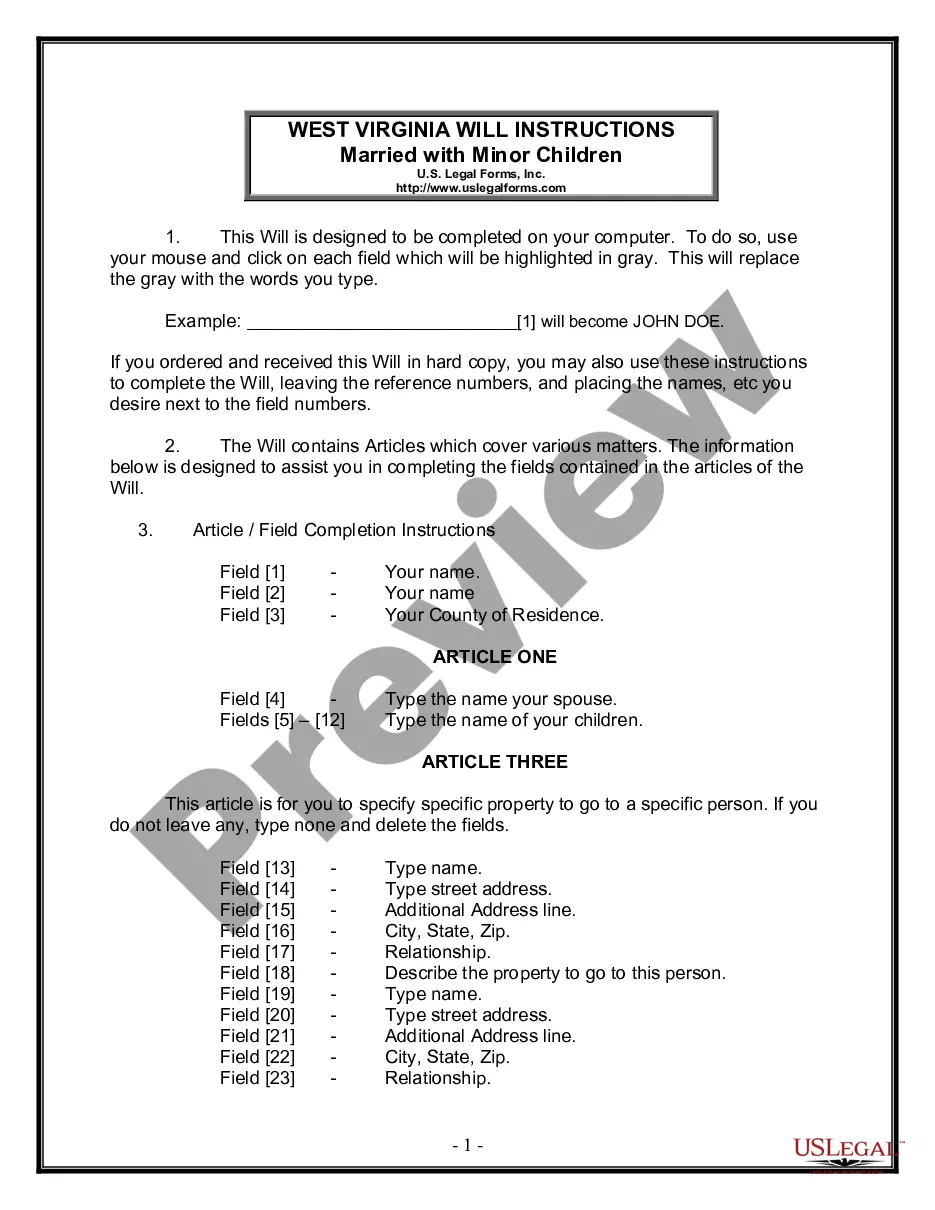

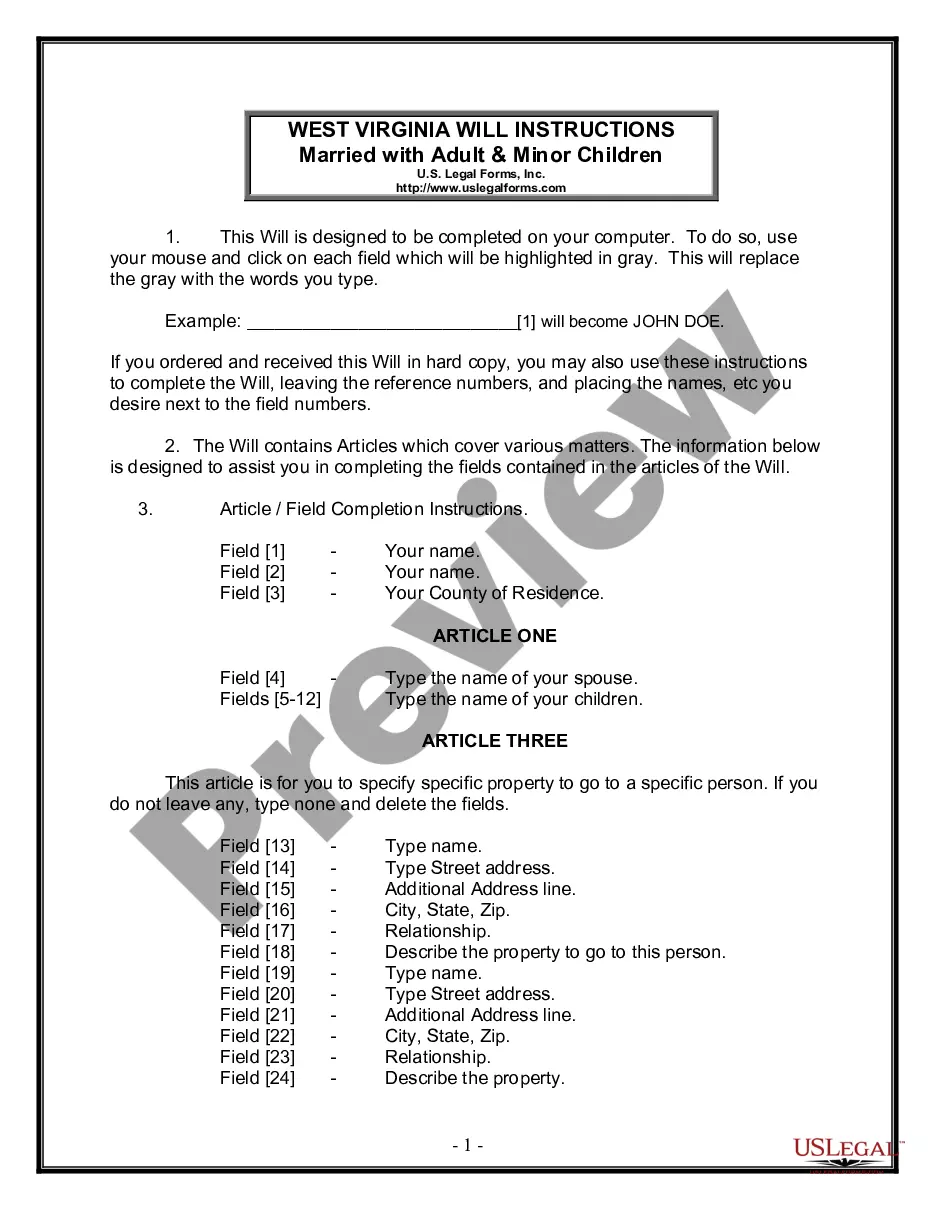

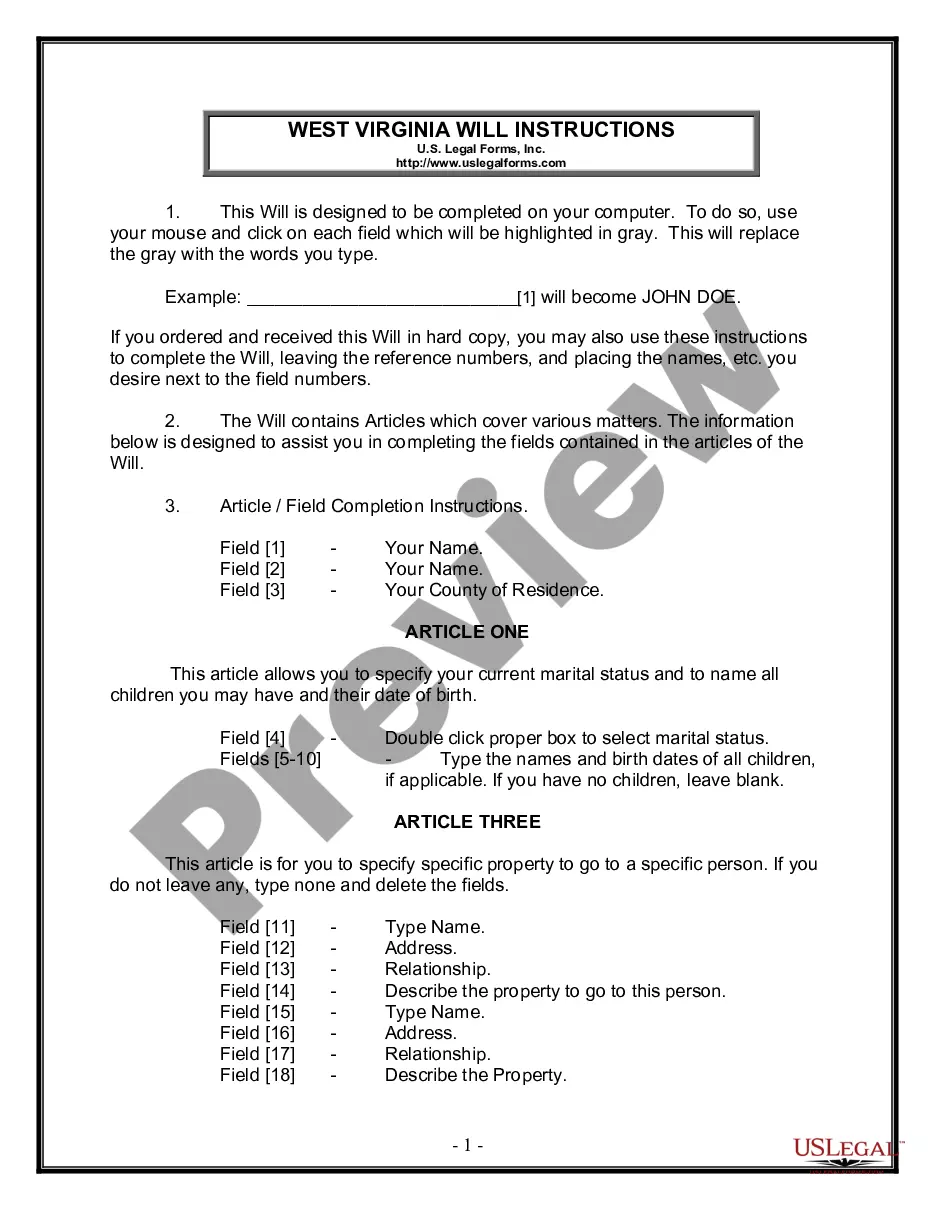

Instructions for completing this form

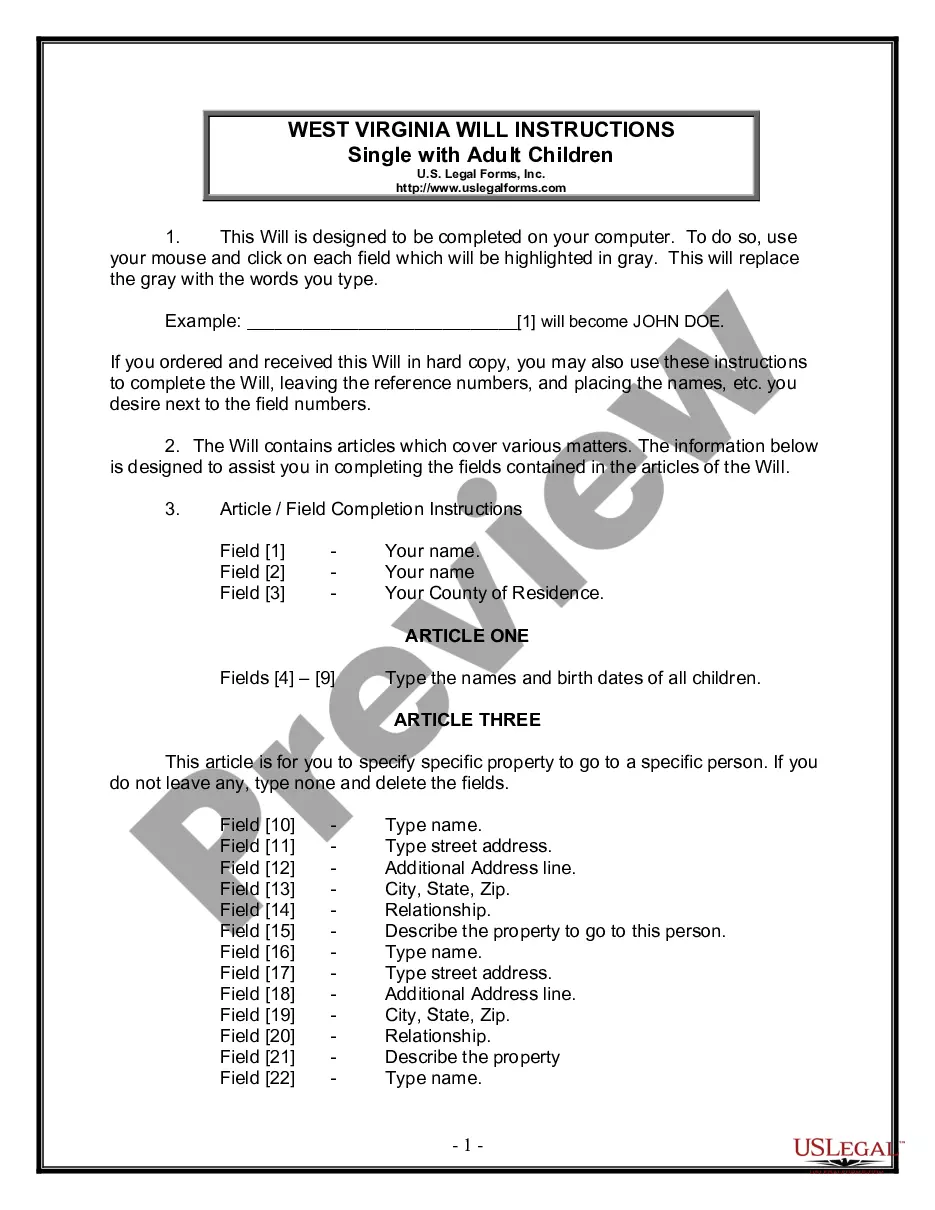

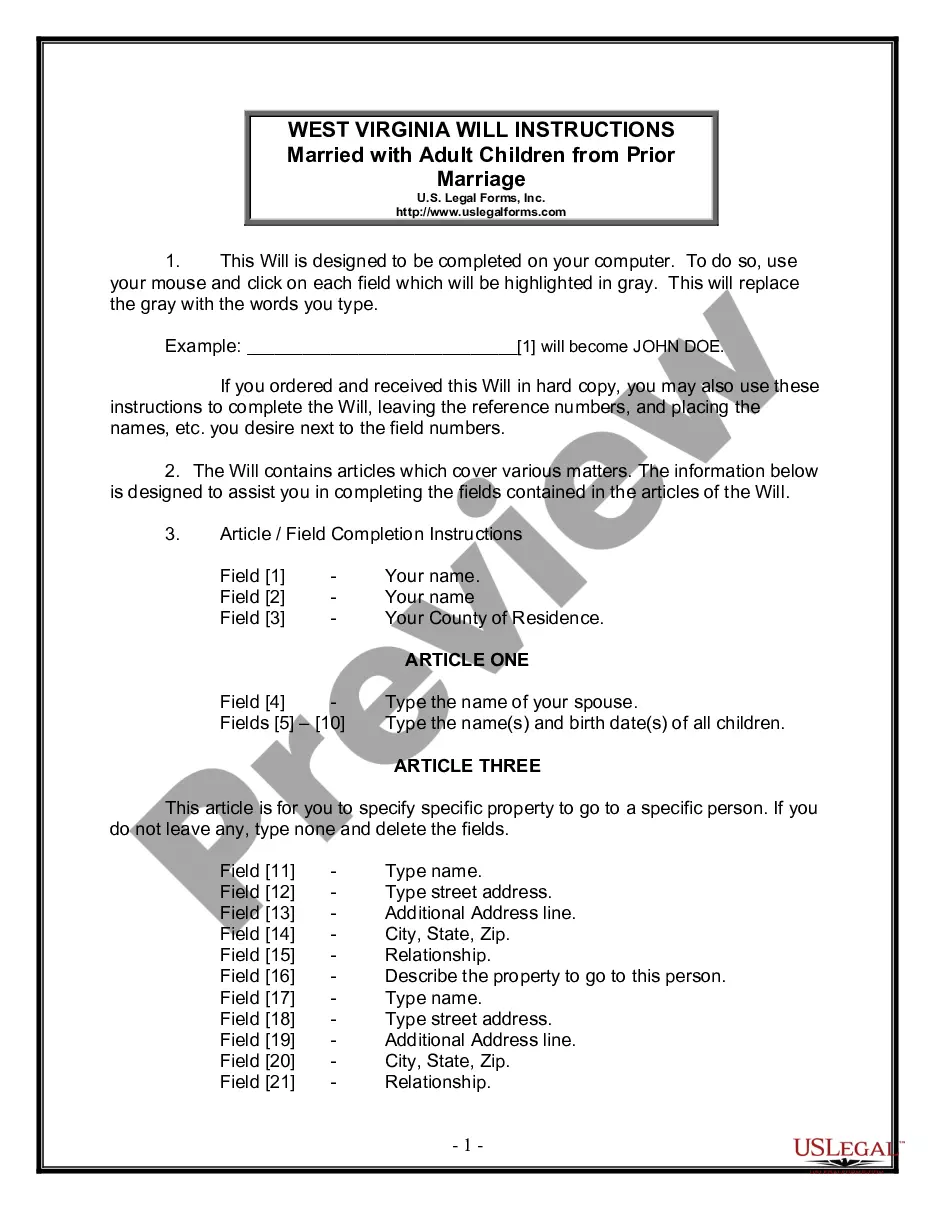

- Identify yourself by entering your name and county of residence.

- Complete Article One by listing your spouse's name and your adult children's names and birth dates.

- Fill out Article Three with the details of any specific property you want to bequeath to specific individuals.

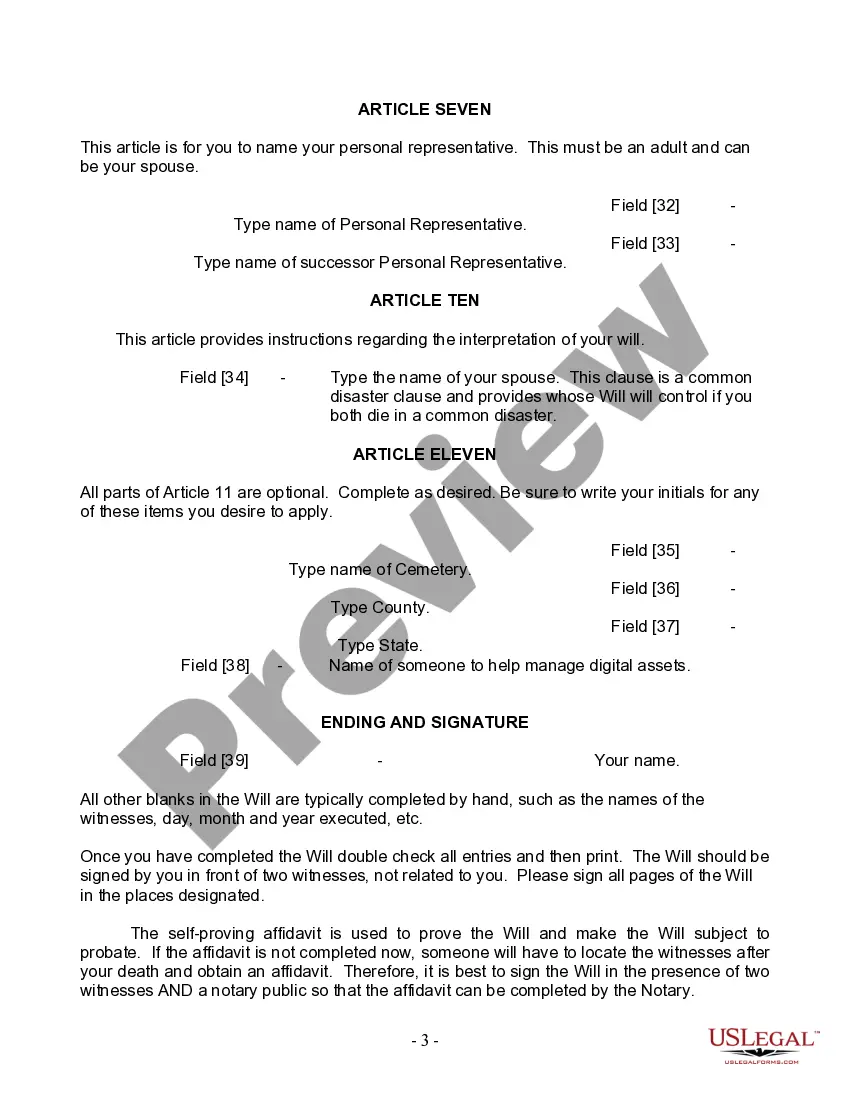

- Designate your personal representative in Article Seven to manage your estate after your passing.

- Ensure you sign the document in front of two witnesses and include a notary as per your stateâs requirements.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Mistakes to watch out for

- Not signing the Will in front of the required witnesses.

- Failing to update the Will after significant life events such as marriage or the birth of children.

- Not clearly specifying personal property or assets.

- Assuming joint property will be distributed according to the Will without clarifying ownership types.

Benefits of completing this form online

- Convenient access to legal forms from anywhere, without needing to visit a lawyer's office.

- Editable online format allows for easy corrections and adjustments.

- Instant download and printing provide immediate availability for personal use.

- Reliability from licensed attorneys who draft and review the forms.

Form popularity

FAQ

If you need to change or amend an accepted West Virginia State Income Tax Return for the current or previous Tax Year, you need to complete Form IT-140. Form IT-140 is the Form used for the Tax Amendment.Check the "Amended return" box to report that it's an amended tax return.

Call the Business Division - call (304) 558-8000 to speak with a Business Specialist for a non-binding check. File the application - Submit the Name Reservation (form NR-1) application and filing fee to the Business Division. Once approved, the name is reserved exclusively for the applicant for 120 days.

Nonresidents must file a West Virginia tax return if their federal adjusted gross income includes income from West Virginia sources. Part-year residents of West Virginia must file a tax return, even if only to receive a refund.

According to West Virginia Instructions for Form IT 140, you must file a West Virginia tax return IF: You are a full year resident or part year resident of West Virginia.You had West Virginia income tax withheld from your wages and are due a refund.