West Virginia Construction or Mechanics Lien Package - Corporation or LLC

About this form package

The West Virginia Construction or Mechanics Lien Package - Corporation or LLC is a comprehensive legal toolkit designed for corporations or limited liability companies (LLCs) that provide labor, materials, or services to improve real property. This form package aids in recovering unpaid debts through a construction lien placed on the improved property. Unlike similar packages, this one specifically caters to corporate entities and includes essential forms, information about lien procedures, and practical tips for completing the forms effectively.

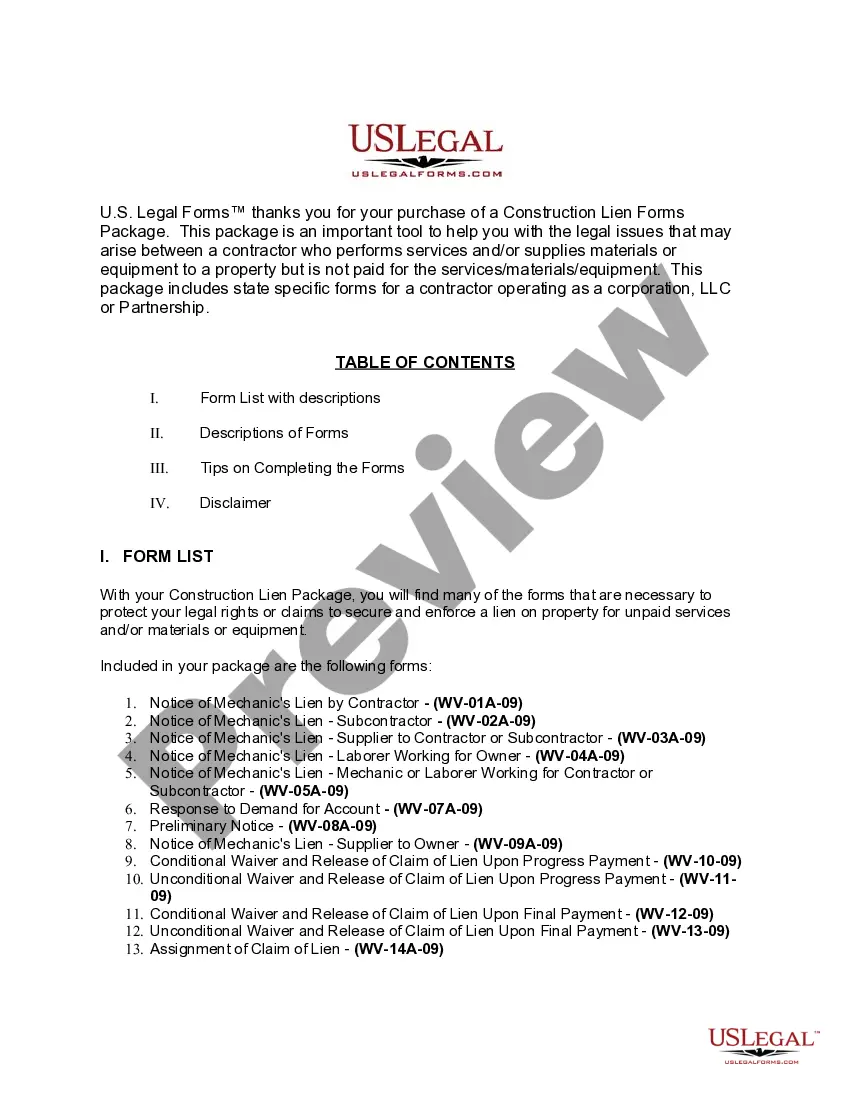

Forms included in this package

- Notice of Mechanic's Lien by Contractor - Corporation

- Notice of Mechanic's Lien - Subcontractor - Corporation

- Notice of Mechanic's Lien - Supplier to Contractor or Subcontractor - Corporation

- Notice of Mechanic's Lien - Laborer working for owner - Corporation

- Notice of Mechanic's Lien - Mechanic or Laborer working for contractor or subcontractor - Corporation

- Response to Demand for Account by Corporation

- Preliminary Notice by Corporation

- Notice of Mechanic's Lien - Supplier to Owner - Corporation

- Conditional Waiver and Release of Claim of Lien Upon Progress Payment

- Unconditional Waiver and Release of Claim of Lien Upon Progress Payment

- Conditional Waiver and Release of Claim of Lien Upon Final Payment

- Unconditional Waiver and Release of Claim of Lien Upon Final Payment

- Assignment of Claim of Lien - Corporation

When to use this form package

This form package is ideal for situations where a corporation or LLC has provided services or materials for property improvements and has not been paid. Use this package when:

- You need to secure payment through a mechanics lien.

- You want to notify property owners of your unpaid claims.

- You are involved in construction projects and face nonpayment for labor or materials supplied.

Intended users of this form package

- Corporations engaged in construction or property improvement.

- Limited liability companies (LLCs) that supply materials or labor.

- Subcontractors and suppliers looking to secure their financial interests.

How to complete these forms

- Review the included forms and guidelines carefully.

- Identify the parties involved, including the property owner and contractor.

- Enter all required information into the designated fields on the forms.

- Make sure to date and sign the appropriate documents.

- Submit the completed forms as required by West Virginia law.

Do forms in this package need to be notarized?

Forms in this package usually don’t need notarization, but certain jurisdictions or signing circumstances may require it. US Legal Forms provides a secure online notarization option powered by Notarize, accessible 24/7 from anywhere.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all necessary parties in the lien notice.

- Not adhering to the deadlines for filing the lien.

- Incomplete or inaccurate information on the forms.

- Not providing proper notice to the property owner.

Benefits of using this package online

- Convenient access to essential legal forms anytime, anywhere.

- Edit and customize forms easily to fit your specific needs.

- Form fields allow quick input and eliminate handwritten errors.

- Reliable and formatted according to the latest legal requirements.

Looking for another form?

Form popularity

FAQ

Mechanic's liens are legal documents that essentially reserve the rights of the filer to seek unpaid compensation. They are usually filed by contractors, subcontractors, or suppliers that never received payment for work that they performed or materials that they provided on the property.

Get free mechanics lien form A construction mechanics lien is claimed against real estate property, and the lien must be filed in the appropriate office in order to be valid.Additionally, construction liens have strict timing and notice requirements. Machinery mechanics liens are possessory liens.

Mechanic's lien: A mechanic's lien is a lien placed on your property for nonpayment for work you had done on the property.A lis pendens isn't a lien but instead is a notice of a potential future lien. It's recorded in the public records to give notice to future buyers of the real estate.

A construction lien is a claim made against a property by a contractor or subcontractor who has not been paid for work done on that property. Construction liens are designed to protect professionals from the risk of not being paid for services rendered.

When a contractor files a mechanics' (construction) lien on your home, the lien makes your home into what's called security for an outstanding debt, which the contractor claims is due and unpaid for services or materials.

Prepare your West Virginia mechanics lien form. Record the West Virginia mechanics lien. Notify the property owner that you recorded a mechanics lien. Enforce/release the mechanics lien.

A mechanic's lien is a guarantee of payment to builders, contractors, and construction firms that build or repair structures. Mechanic's liens also extend to suppliers of materials and subcontractors and cover building repairs as well.

Posting a Bond Asselta says to expect to pay 110 percent of the lien amount. Submit the bond to the court. The lien will then transfer to the bond and clear the property's title. Wait for the contractor claimant to foreclose on the lien in the allotted period to dispute the lien in court.

To enforce the lien, the contractor must file a lawsuit within 90 days from the date of recording the lien. If this deadline is passed, the contractor may not be able to enforce the lien and may be required to remove the lien.