Wisconsin Termination of Decedents Interest is the process by which the assets of a deceased person in the state of Wisconsin are distributed to their beneficiaries. This process involves the termination of any interest held by the deceased person in real estate, bank accounts, investments, and other assets. The process is overseen by the Probate Court in Wisconsin. There are two types of Wisconsin Termination of Decedents Interest: formal and informal. Formal termination is done through the Probate Court and involves filing a petition for a formal application of termination. Informal termination is done without involving the court. Beneficiaries must submit a written request to the person or entity holding the estate assets, and the assets will then be distributed according to the terms of the will or other legal documents.

Wisconsin Termination of Decedents Interest

Description

How to fill out Wisconsin Termination Of Decedents Interest?

If you’re searching for a way to properly complete the Wisconsin Termination of Decedents Interest without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every personal and business situation. Every piece of paperwork you find on our web service is designed in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these simple guidelines on how to acquire the ready-to-use Wisconsin Termination of Decedents Interest:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and choose your state from the dropdown to find another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Wisconsin Termination of Decedents Interest and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

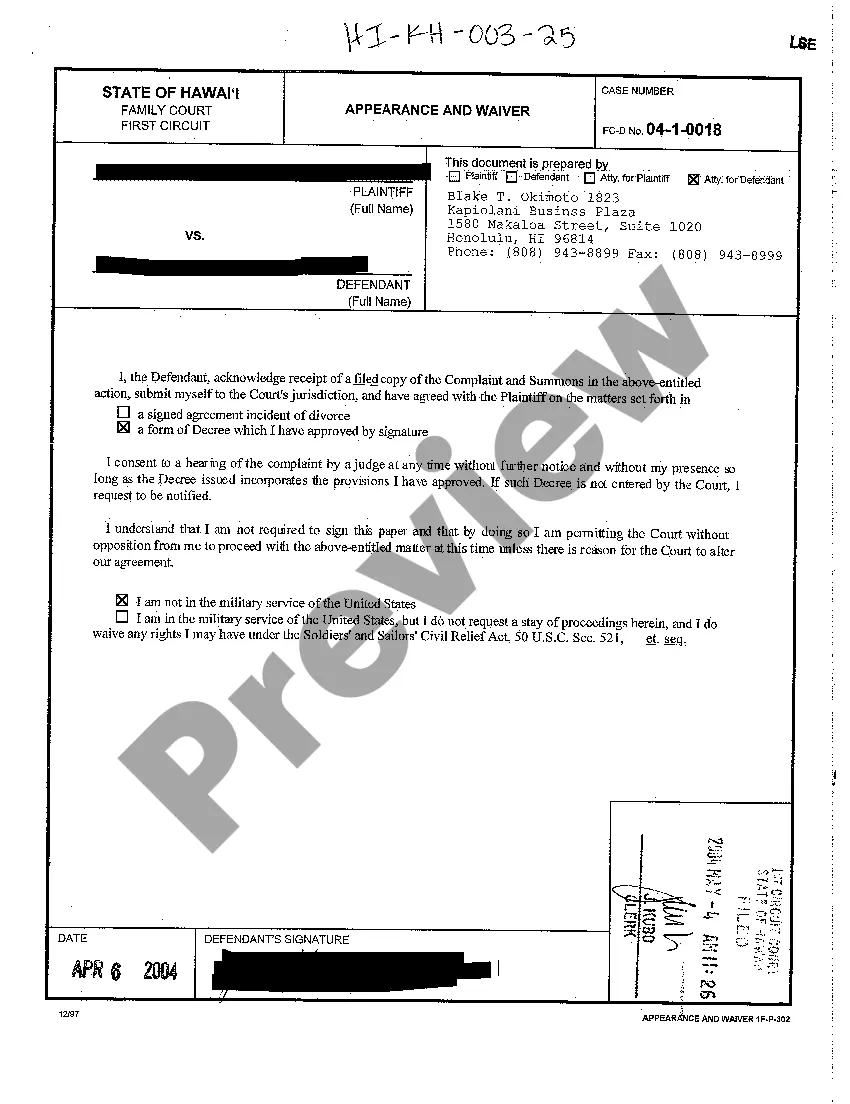

Pros and Cons of a TOD Deed: Such deferral of transferring the property to the trust may make management, including sale of the real estate, less cumbersome while the owner is alive and still allows the owner's trust to control all of the assets of the owner's estate, upon the owner's death, without probate.

To amend or revoke a Wisconsin TOD deed, the property owner need only execute and record a new deed either naming a different beneficiary or revoking the prior designation. A revocation or amendment takes effect upon recording.

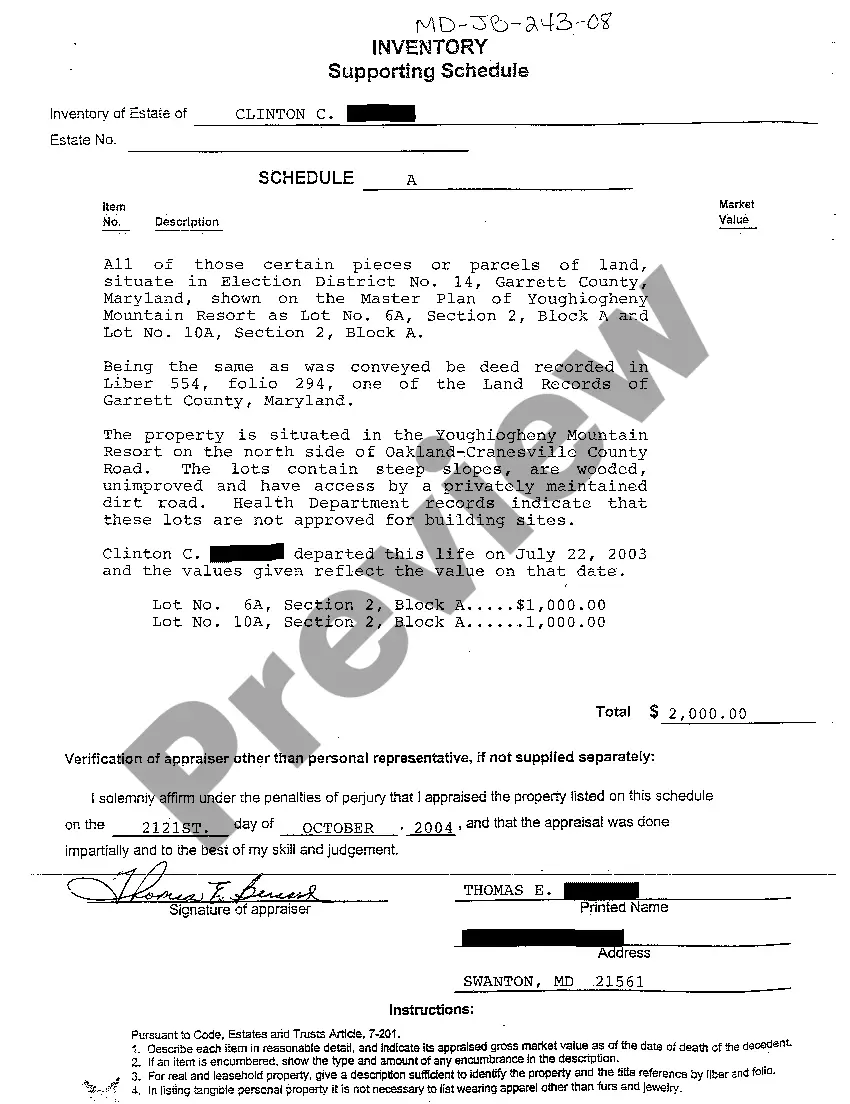

To terminate the decedent's interest in the property and to complete the distribution, file a form HT-110 under Wis. Stat. 867.045, with the register of deeds for the county where the property is located.

Section 867.045 - Administrative joint tenancy or life estate termination for certain property (1) Upon the death of any person having an interest as a joint tenant or life tenant in any real property or in the vendor's interest in a land contract or a mortgagee's interest in a mortgage, any person interested in the

To terminate the decedent's interest in the property and to complete the distribution, file a form HT-110 under Wis. Stat. 867.045, with the register of deeds for the county where the property is located.

You must sign the TOD designation and get your signature notarized, and then record (file) the designation with the county register of deeds before your death. Otherwise, it won't be valid. You can make a Wisconsin designation of transfer on death beneficiary with WillMaker.

A Wisconsin designation of TOD beneficiary, or ?transfer on death deed,? is used to name a person or entity who will receive ownership of a property once the current owner passes away.