Wisconsin General Durable Power of Attorney for Property and Finances or Financial Effective Immediately

Understanding this form

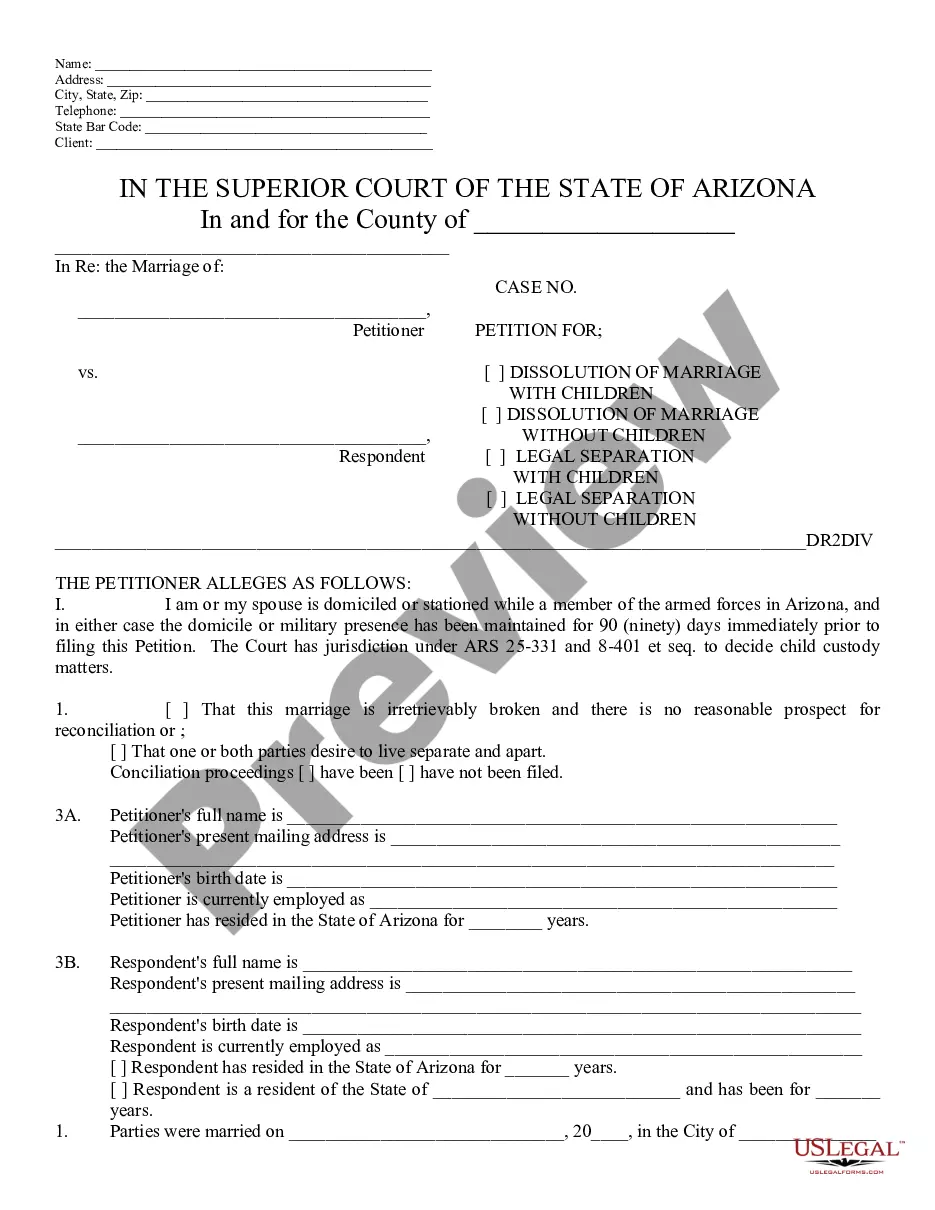

The General Durable Power of Attorney for Property and Finances or Financial Effective Immediately, commonly known as a Durable Power of Attorney (Durable POA), allows you to appoint an agent to manage your financial affairs and property decisions. This power of attorney becomes effective immediately and remains effective even if you become incapacitated. Unlike other powers of attorney, this form does not provide authority for health care decisions, making it distinct in its focus on financial matters.

Main sections of this form

- Your name and address as the principal.

- The agent's name and address whom you authorize to act on your behalf.

- Specific powers granted to the agent, including property management, financial transactions, and business dealings.

- Provisions for alternate agents in case the primary agent is unable to serve.

- Options for special instructions or limitations on the agent's authority.

When this form is needed

This form should be used when you want to give someone the authority to handle your financial affairs immediately, especially in situations where you anticipate needing assistance due to absence, disability, or other circumstances. It is particularly useful for managing property transactions, conducting banking activities, or overseeing business interests where timely decision-making is essential.

Intended users of this form

- Individuals seeking to appoint an agent to handle their financial matters.

- People who want their power of attorney to take effect immediately, rather than upon incapacity.

- Those who have financial assets or properties that require management.

- Anyone interested in ensuring their financial affairs are managed by a trusted individual.

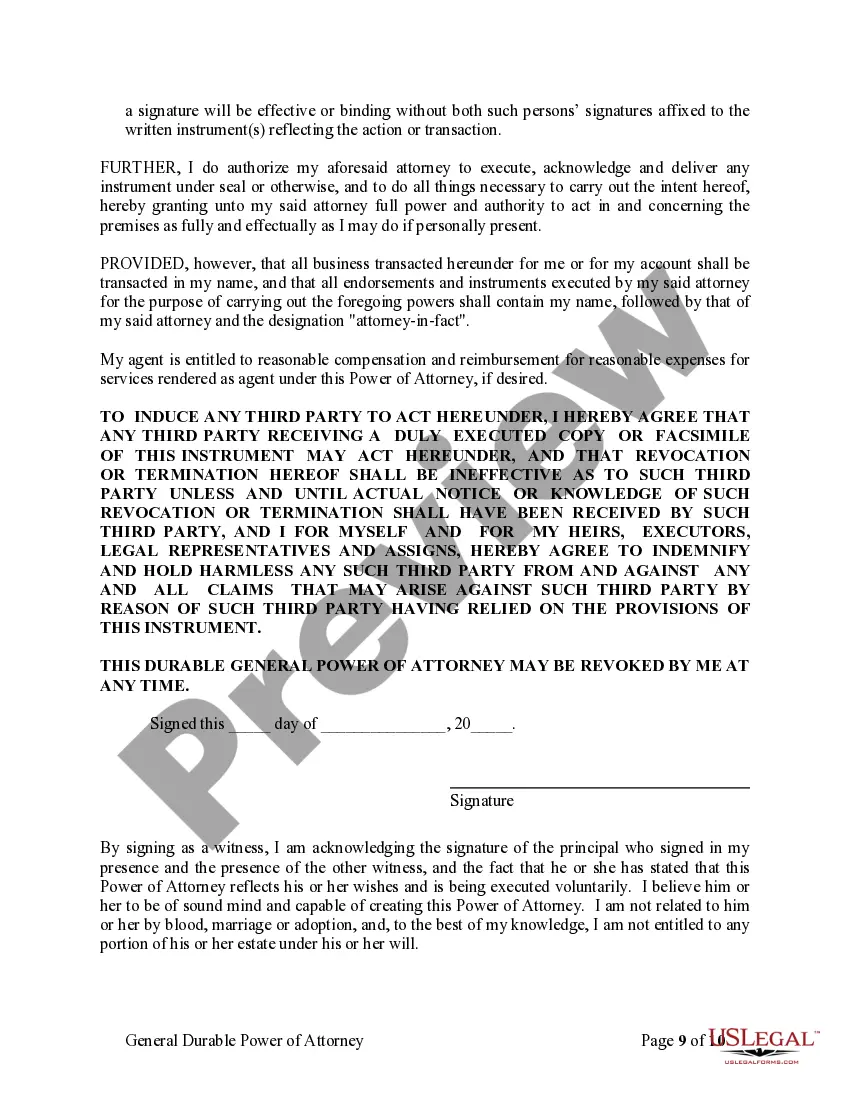

Instructions for completing this form

- Identify yourself as the principal by entering your name and address in the designated fields.

- Choose your agent by entering their name and address, ensuring they are someone you trust.

- Specify any additional alternate agents if you wish, by entering their information.

- Review and customize the powers granted to your agent, adding any necessary special instructions.

- Sign and date the document, and have it witnessed or notarized if required by your state.

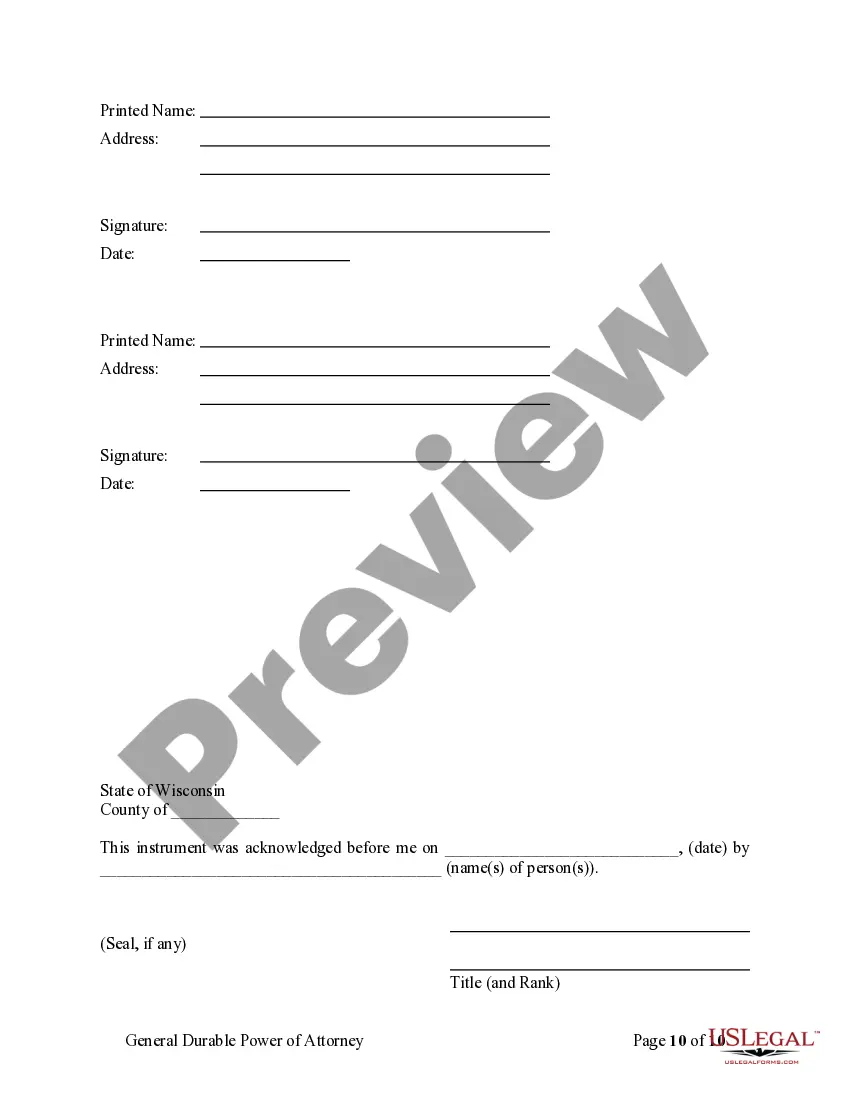

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Typical mistakes to avoid

- Failing to specify the agent's full name or using an incorrect address.

- Not reviewing the powers granted which could lead to unintended authority.

- Neglecting to sign or date the form appropriately.

- Forgetting to inform the agent of their appointment, leading to confusion later.

Benefits of using this form online

- Convenient access to legal forms without the need for in-person meetings.

- Editable templates allow for easy customization to fit your specific needs.

- Rapid completion and download options save time and effort.

- Reliable forms reviewed by licensed attorneys for legal accuracy.

Form popularity

FAQ

A limited or special power of attorney may also be restricted to a specific time period.Financial Power of Attorney: Also called a durable power of attorney for finances, this gives the person of your choice the authority to manage your financial affairs should you become incapacitated.

A Durable Power of Attorney acts as a permission slip, giving authority to a third party to do things on behalf of someone else who cannot do it for themselves. If done properly, the Durable Power of Attorney may very well prevent you from having to be declared incompetent in court if you something bad happens to you.

If the person still has capacity and would like to make arrangements in case they lose mental capacity, they can set up a Lasting Power of Attorney. Once submitted, it takes about eight to 10 weeks to register (though the Government says there may be delays currently due to the coronavirus pandemic).

Power of Attorney broadly refers to one's authority to act and make decisions on behalf of another person in all or specified financial or legal matters.Durable POA is a specific kind of power of attorney that remains in effect even after the represented party becomes mentally incapacitated.

In case you ever become mentally incapacitated, you'll need what are known as "durable" powers of attorney for medical care and finances.To cover all of the issues that matter to you, you'll probably need two separate documents: one that addresses health care issues and another to take care of your finances.

Bank Pays Price for Refusing to Honor Request Made Under a Power of Attorney.But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.

1. About the Power of Attorney. A Durable Power of Attorney may be the most important of all legal documents.It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

A financial power of attorney is a legal document that grants a trusted agent the power to make and execute financial decisions for a principal-agent. In some states, financial powers of attorney are automatically considered durable which meaning they remain in effect after the principal becomes incapacitated.