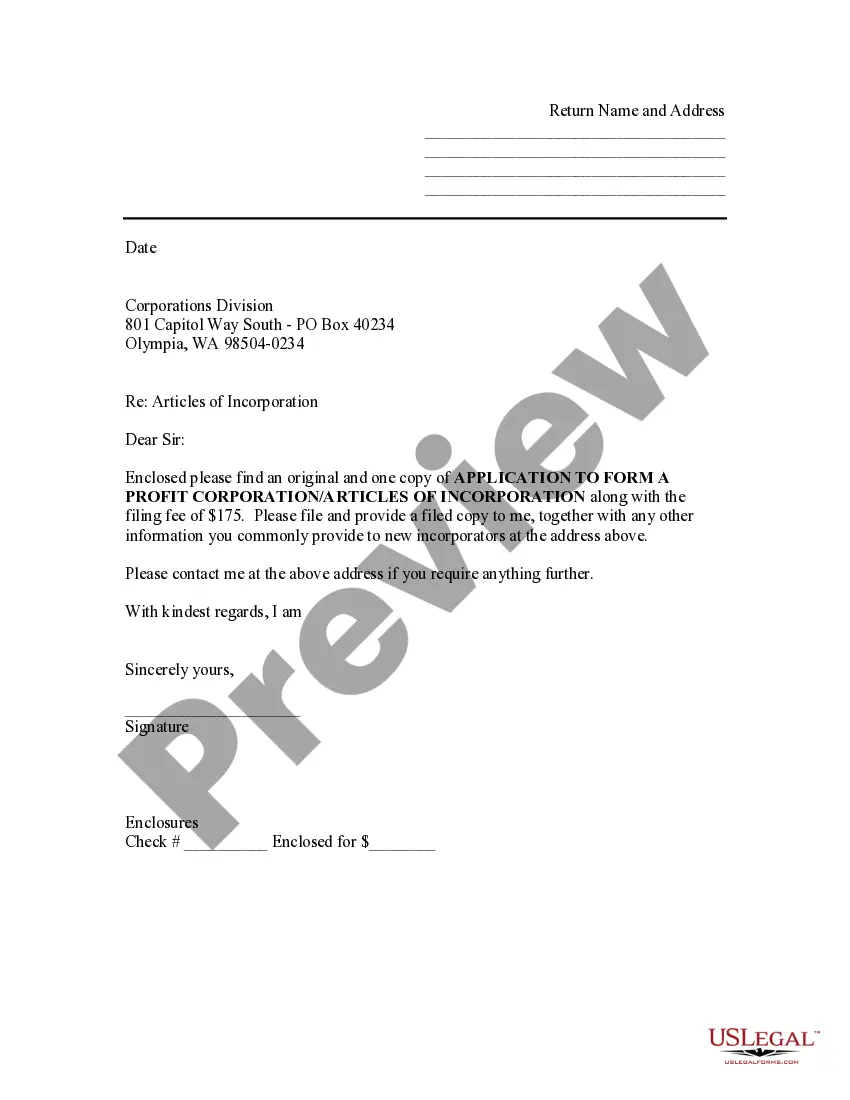

Use this sample letter as a cover sheet to accompany the Articles of Incorporation for filing with the Secretary of State's Office.

Washington Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation

Description

How to fill out Washington Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

Out of the large number of platforms that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates prior to buying them. Its complete library of 85,000 templates is categorized by state and use for efficiency. All the forms on the service have been drafted to meet individual state requirements by certified lawyers.

If you already have a US Legal Forms subscription, just log in, look for the form, click Download and gain access to your Form name in the My Forms; the My Forms tab holds your saved documents.

Stick to the tips listed below to get the document:

- Once you see a Form name, make sure it’s the one for the state you need it to file in.

- Preview the form and read the document description before downloading the template.

- Search for a new sample through the Search engine in case the one you’ve already found isn’t correct.

- Click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the document.

After you have downloaded your Form name, you may edit it, fill it out and sign it in an online editor that you pick. Any form you add to your My Forms tab might be reused many times, or for as long as it remains to be the most up-to-date version in your state. Our service provides quick and simple access to templates that suit both lawyers as well as their clients.

Form popularity

FAQ

The State of Washington requires you to file an annual report (also known as an annual renewal) for your LLC. The report must be filed online at the Secretary of State website. The initial annual report must be filed within 120 days of the date you filed to create your LLC.

To become an S corporation in the state of Washington, you have to file a Form 2553 with the Internal Revenue Service. State filing fees must be paid and official documents have to be filed to form a Washington corporation. Washington S corps can't have more than 100 shareholders.

To start an LLC in Oklahoma you will need to file the Articles of Organization with the Oklahoma Secretary of State, which costs $100. You can apply online, by mail, or in-person. The Articles of Organization is the legal document that officially creates your Oklahoma Limited Liability Company.

Find your Annual Renewal Notice. Go to Business Licensing Services. Enter your UBI Number and password (found on your renewal notice). Fill out the online form and sign electronically.

How to File Your Annual Report. If you do need to file an annual report for your LLC or corporation, you can normally do so online, through your state's website. In addition to filing your annual report, you will also need to pay a fee These fees do vary from state to state and could range between $50 and $400.

To file your Articles of Incorporation, the Washington Secretary of State charges a filing fee of $180 if filed by mail and $200 for online filing.. All corporations doing business in Washington must also file an annual report, which has a filing fee of $60.

Under Domestic Organizations, select Domestic Profit Corporation. Enter your name and email address. Complete the Oklahoma Certificate of Incorporation. Submit and pay the filing fee.

The State of Washington requires you to file an annual report (also known as an annual renewal) for your LLC. The report must be filed online at the Secretary of State website. The initial annual report must be filed within 120 days of the date you filed to create your LLC.

Federal Taxes for your LLC Most LLCs in Washington don't pay taxes directly to the IRS, as in the LLC doesn't have what's called a separate return. But instead, the LLC Members are responsible for reporting the income or losses from the LLC on their personal 1040 federal tax return.