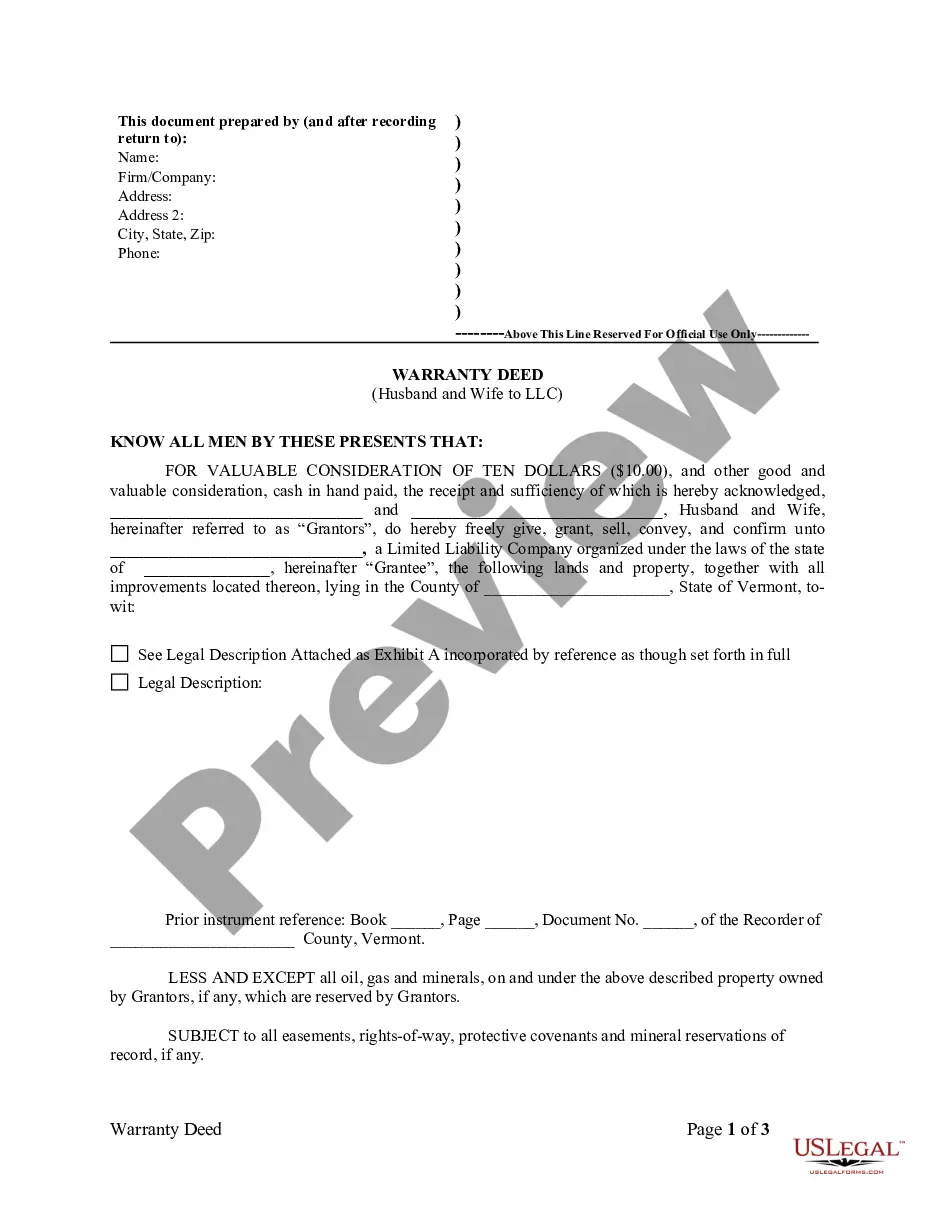

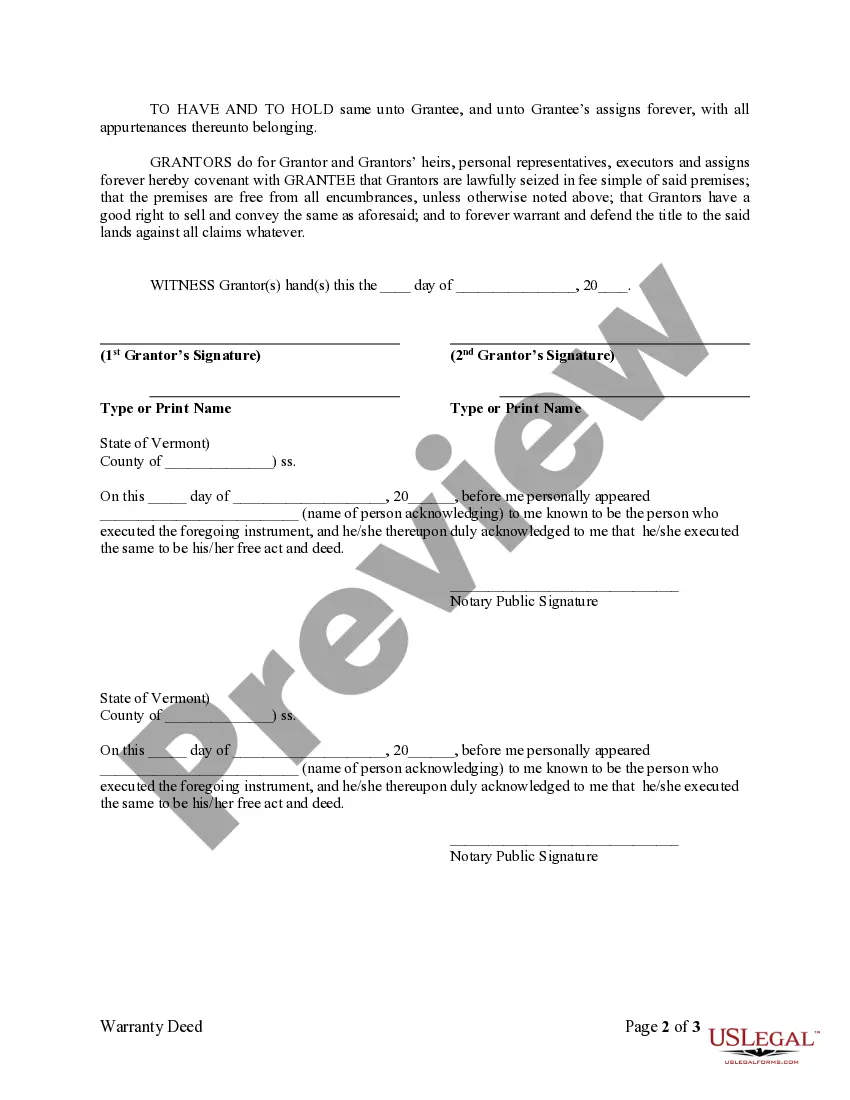

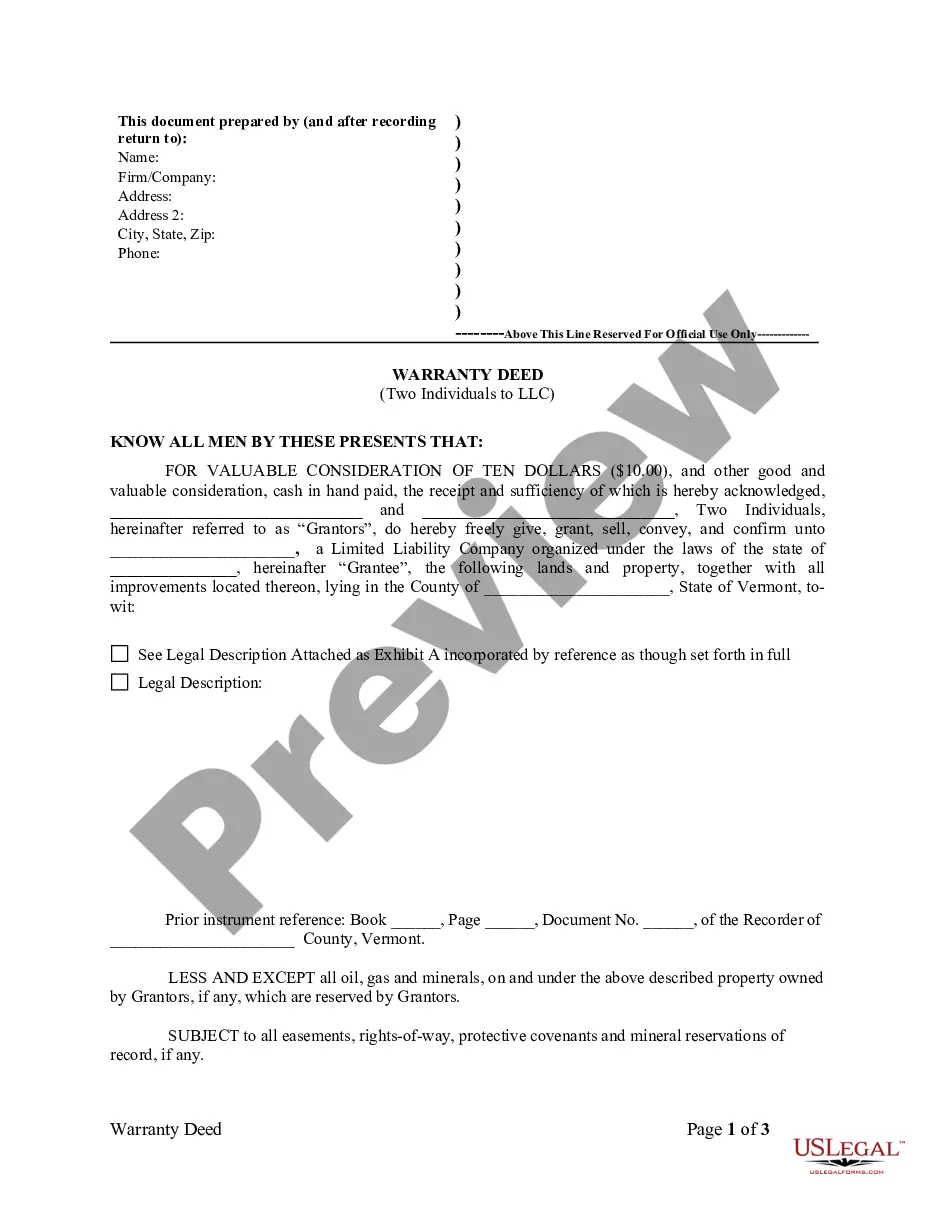

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

Vermont Warranty Deed from Husband and Wife to LLC

Description

How to fill out Vermont Warranty Deed From Husband And Wife To LLC?

Searching for a Vermont Warranty Deed from Husband and Wife to LLC online can be stressful. All too often, you see papers that you simply think are ok to use, but find out afterwards they are not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional legal professionals according to state requirements. Have any document you’re searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll immediately be added to your My Forms section. If you don’t have an account, you need to sign up and select a subscription plan first.

Follow the step-by-step recommendations listed below to download Vermont Warranty Deed from Husband and Wife to LLC from the website:

- Read the form description and hit Preview (if available) to verify if the template meets your expectations or not.

- If the form is not what you need, find others with the help of Search engine or the provided recommendations.

- If it is right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the template in a preferable format.

- Right after getting it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal templates straight from our US Legal Forms catalogue. In addition to professionally drafted templates, customers will also be supported with step-by-step instructions regarding how to find, download, and fill out templates.

Form popularity

FAQ

Step 1: Obtain a Federal Employer Identification Number. Step 2: Register your business with the Vermont Secretary of State. Step 3: Register for a business tax account. Step 4: Determine which taxes you need to pay.

LLC Taxes in CaliforniaCalifornia LLCs must pay an annual $800 LLC tax. California LLC taxes are due by April 15th, just like federal taxes, and should be paid to the California Franchise Tax Board. You must pay this tax even if your LLC doesn't earn any income.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

STEP 1: Name Your Vermont LLC. STEP 2: Choose a Registered Agent in Vermont. STEP 3: File the Vermont LLC Articles of Organization. STEP 4: Create a Vermont LLC Operating Agreement. STEP 5: Get a Vermont LLC EIN.

A Vermont LLC is created by filing Articles of Organization with the Vermont Secretary of State. The filing fee is $125.

You can file for a Vermont name reservation on the Vermont Secretary of State's website. The filing fee is $20. Once filed, your business name will be reserved in Vermont for 120 days. You can renew the name reservation when it expires.

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

A limited liability company's (LLC) owners are called members, so every LLC has at least one member. These business entities can also have multiple members.

Every state charges a fee to form a limited liability company, or LLC, but the amount varies from state to state, ranging from $50 to as high as $500. You can expect additional costs if you reserve a business name, receive expedited processing, get legal help, do business in multiple states, or hire a registered agent.