Utah Correction Deed - Trust to an Individual

Understanding this form

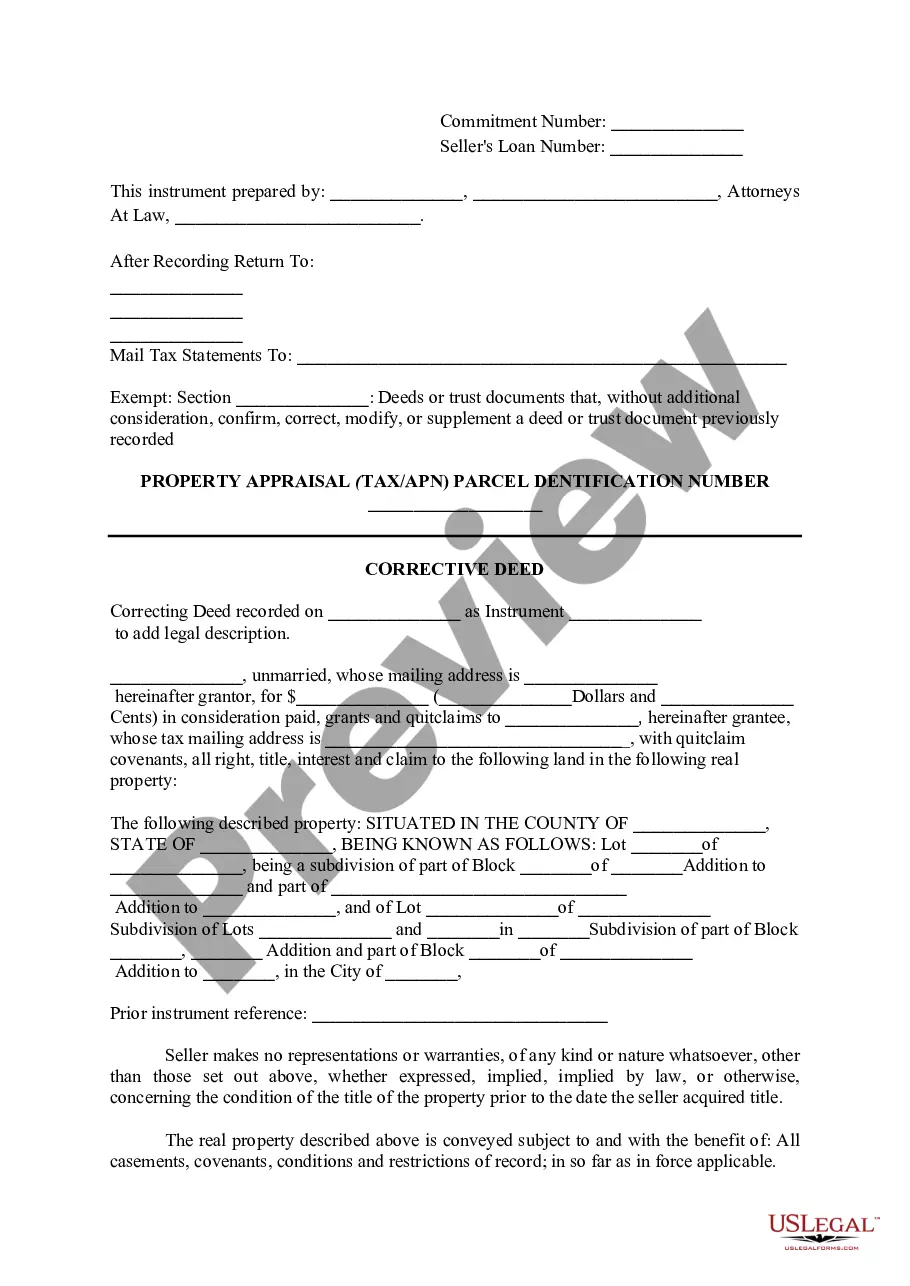

The Correction Deed - Trust to an Individual is a legal document used to amend a previously recorded deed due to a mutual mistake in the property's legal description. This form serves as a corrective measure, ensuring the accurate representation of the property and clarifying ownership. It differs from a standard deed by focusing specifically on rectifying errors instead of creating new ownership. This form is important for ensuring legal integrity in property transactions.

Main sections of this form

- Identification of the Grantor and Grantee involved in the transaction.

- Specific details of the original deed being corrected, including the previous legal description.

- A clear statement acknowledging the mutual mistake that necessitated the correction.

- The effective date of the original deed for legal reference.

- Signatures of both the Grantor and Grantee, along with dates of execution.

When this form is needed

This form is typically used when errors are discovered in the legal description of a property on a previously recorded deed. Common scenarios include discrepancies in boundaries, incorrect lot numbers, or incorrect names of the parties involved. If you need to resolve such issues to maintain clear title or to avoid legal disputes, this form is appropriate.

Who this form is for

This form is intended for:

- Property owners seeking to correct mistakes in prior deeds.

- Trustees of a trust who need to transfer property to an individual accurately.

- Individuals involved in real estate transactions where errors in legal documentation have occurred.

Completing this form step by step

- Identify the parties involved: Grantor and Grantee.

- Provide the details of the original deed that is being corrected.

- Clearly state the mutual mistake that led to the creation of this Correction Deed.

- Enter the effective date of the original deed.

- Sign and date the form by both Grantor and Grantee to finalize the correction.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes

- Failing to accurately describe the original mistake can lead to further confusion.

- Not including all required signatures or dates, which can invalidate the form.

- Incorrectly identifying the parties or properties involved in the deed.

Why use this form online

- Convenience of instant access and immediate downloads.

- Editability of forms using electronic tools to avoid errors.

- Reliability, as all forms are drafted by licensed attorneys to ensure compliance.

Form popularity

FAQ

To sign over property ownership to another person, you'll use one of two deeds: a quitclaim deed or a warranty deed.

Re-recording of the original document. With corrections made in the body of the original document. A cover sheet detailing the changes. Must be re-signed and re-acknowledged. Correction Deed. A new deed reflecting the corrections/changes. Must meet all recording requirements of a deed.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

Determine if the error is harmless or fatal to the transfer of title. Decide what instrument is best suited to the error. Draft a corrective deed, affidavit, or new deed. Obtain the original signature(s) of the Grantor(s). Re-execute the deed with proper notarization and witnessing.

A deed of trust is a legal contract between a lender and a borrower to transfer some interest of the borrower's land to a trustee (see References 1).Like most other legal contracts, it can be modified through an amendment.

Resolving Small Ambiguities: The Scrivener Affidavit. Sometimes an omission attracts attention just after recording. The Correction Deed: Stronger Than a Scrivener's Affidavit. Obtain your correction deed form. Execute the correction deed. Record the correction deed.

You can correct an error on a California deed through a Correction Deed or Corrective Deed. Usually deed errors are as a result of someone attempting to prepare a deed without proper knowledge or professional help.