Revocable Trust for Real Estate

Description

Key Concepts & Definitions

Revocable Trust for Real Estate: A legal entity created to hold ownership of an individual's real estate properties. It is 'revocable' because the grantor (the person who establishes the trust) retains the ability to alter or dissolve the trust at any time during their lifetime.

Step-by-Step Guide

- Decide the Purpose of the Trust: Determine if the trust is primarily for privacy, ease of transfer upon death, or to manage real estate assets during incapacity.

- Select the Properties: Identify which properties you want to include in the trust. These can be residential or commercial assets.

- Choose a Trustee: Appoint a trustee who will manage the trust assets. This can be yourself, a family member, or a professional trustee.

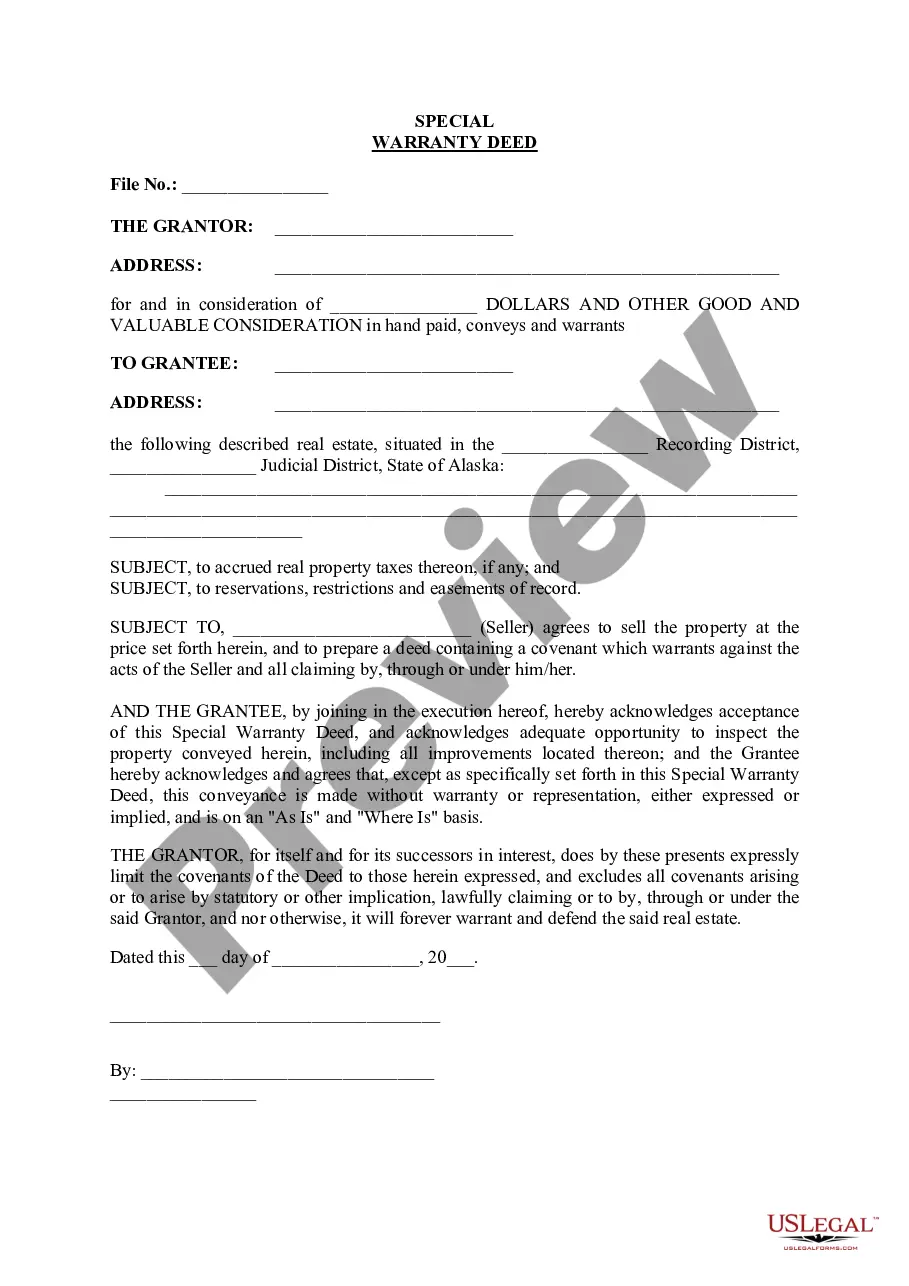

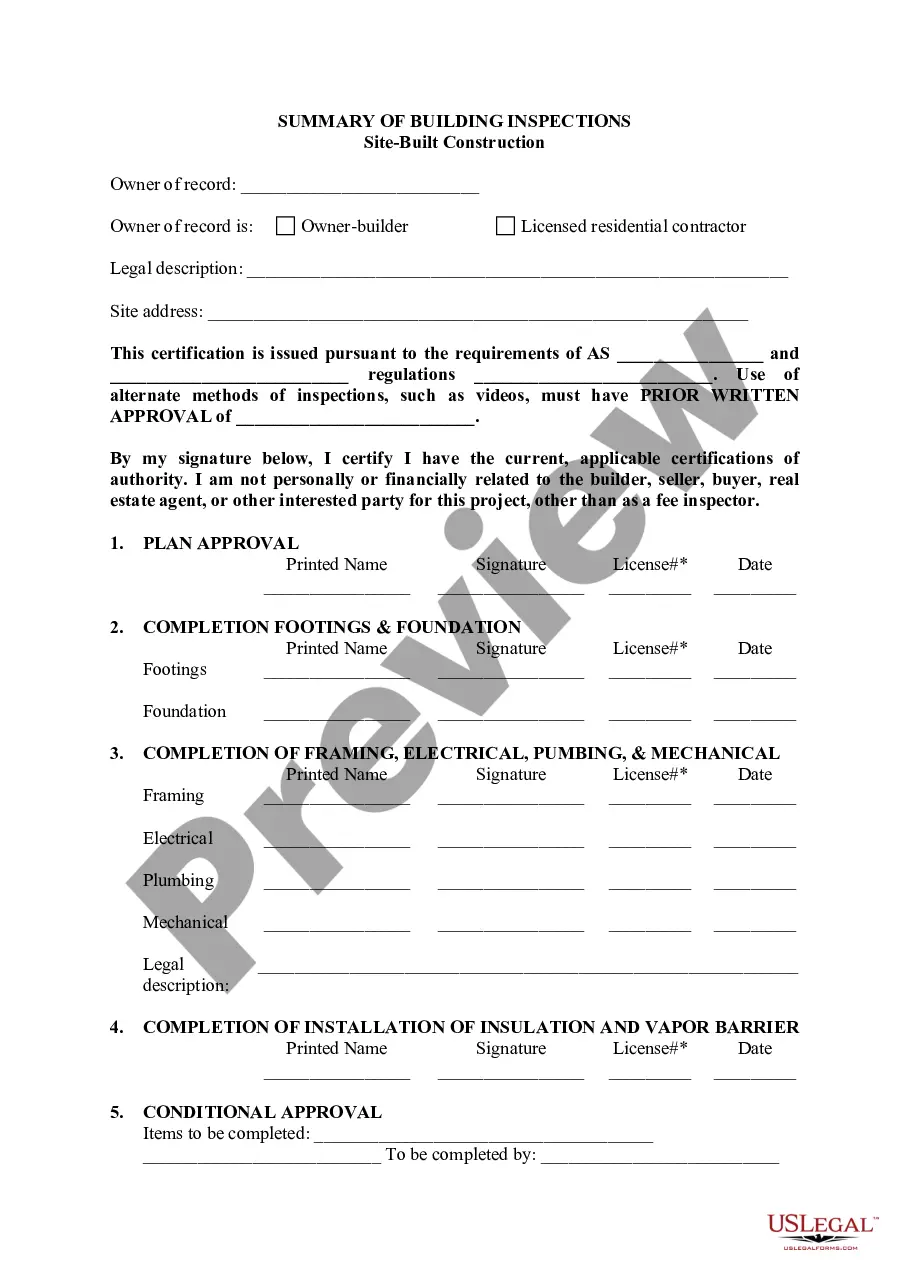

- Create the Trust Agreement: Draft the trust document with the help of an estate planning attorney to ensure all legal requirements are met.

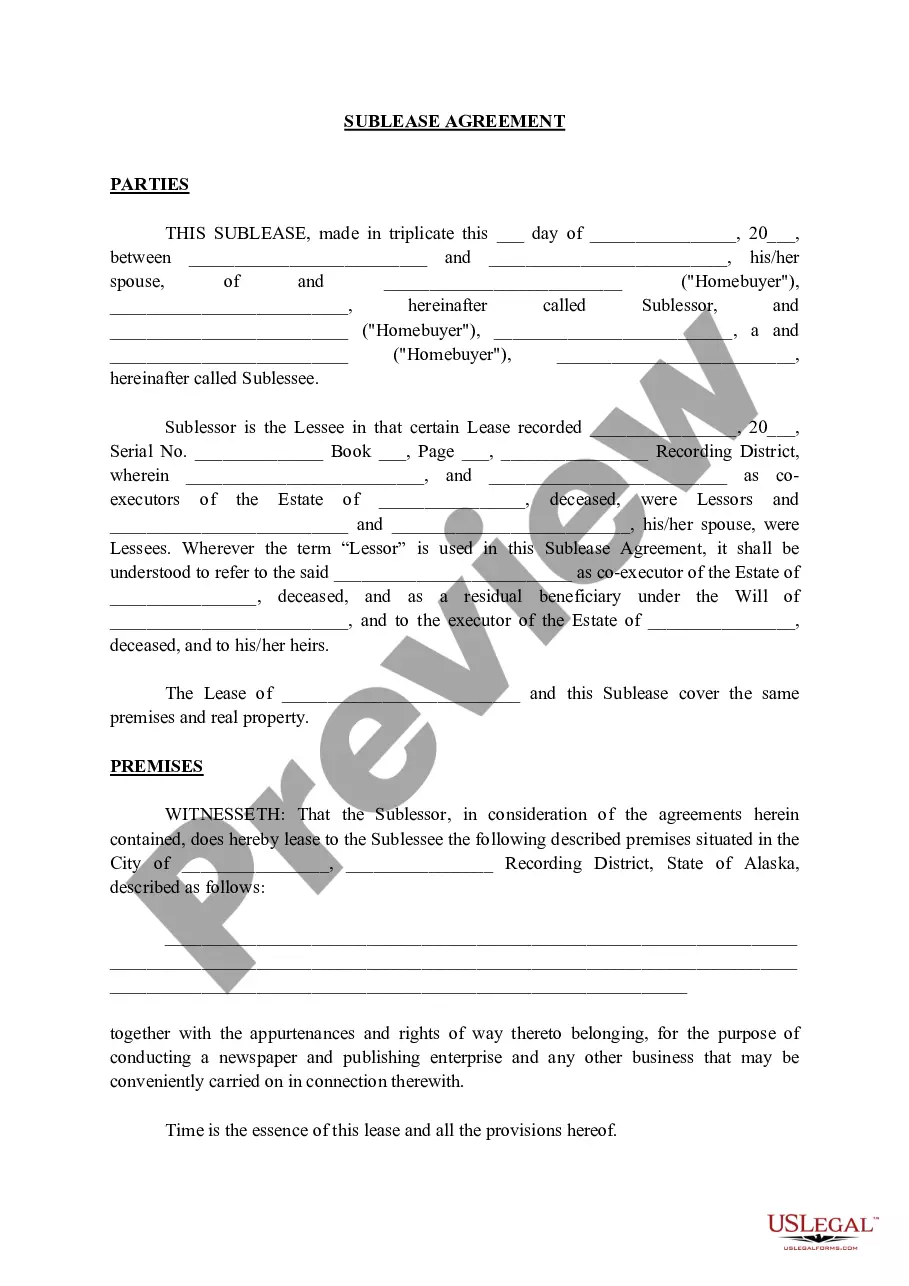

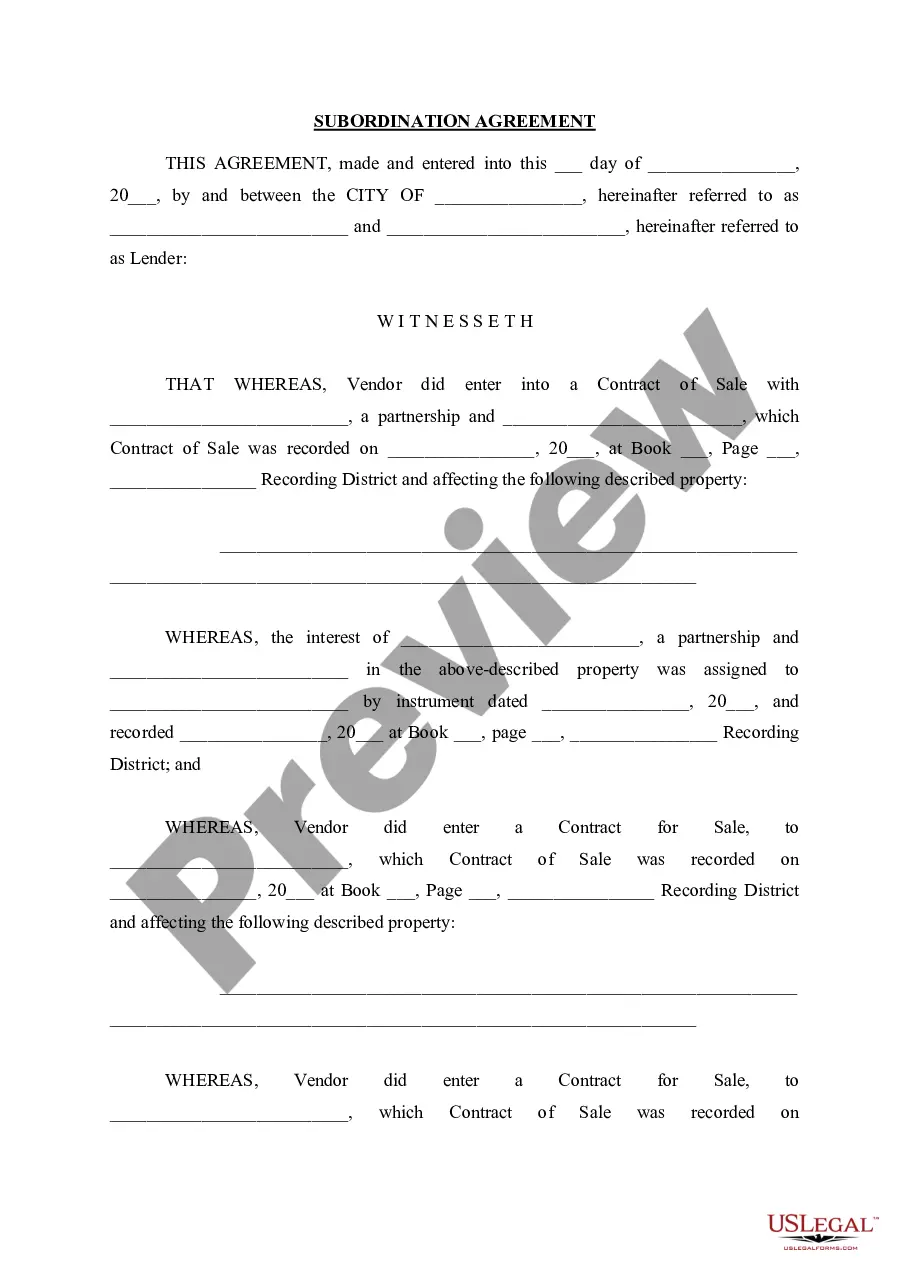

- Transfer the Property Titles: Legally transfer the property titles from your personal ownership into the name of the trust.

- Maintain the Trust: Manage the trust according to its terms and state laws, including paying taxes and maintaining insurance on the property.

Risk Analysis

- Legal Complications: Inaccurate drafting of the trust document can lead to legal challenges.

- Financial Overlook: Failing to properly manage trust-related expenses can lead to financial mismanagement.

- Trustee Issues: Choosing an unreliable trustee can result in mismanagement of the property.

Best Practices

- Work with Professionals: Engage with experienced lawyers and financial advisors to set up and manage the trust.

- Regular Reviews: Regularly review the trust documents and its operations to adapt to legal changes and personal circumstances.

- Clear Communication: Ensure all parties involved in the trust understand their roles and responsibilities to avoid conflicts.

Common Mistakes & How to Avoid Them

- Neglecting Proper Drafting: Ensure the trust document is thoroughly drafted by a legal professional to avoid ambiguity.

- Ignoring Tax Implications: Consult with tax professionals to understand and plan for any tax liabilities associated with the trust properties.

- Forgetting to Fund the Trust: Remember that the trust only controls assets that have been formally transferred into it. Make sure all intended properties are retitled into the trust's name.

FAQ

- Can I put my primary residence in a revocable trust? Yes, you can include your primary residence in a revocable trust to ensure smoother and private transfer of assets.

- What happens to the trust if I pass away? Upon death, the trust typically becomes irrevocable, and the property is transferred according to the terms outlined in the trust.

- Can the trust borrow money to invest in more properties? Yes, trusts can borrow money; however, this is subject to the lender's policies regarding trusts.

How to fill out Revocable Trust For Real Estate?

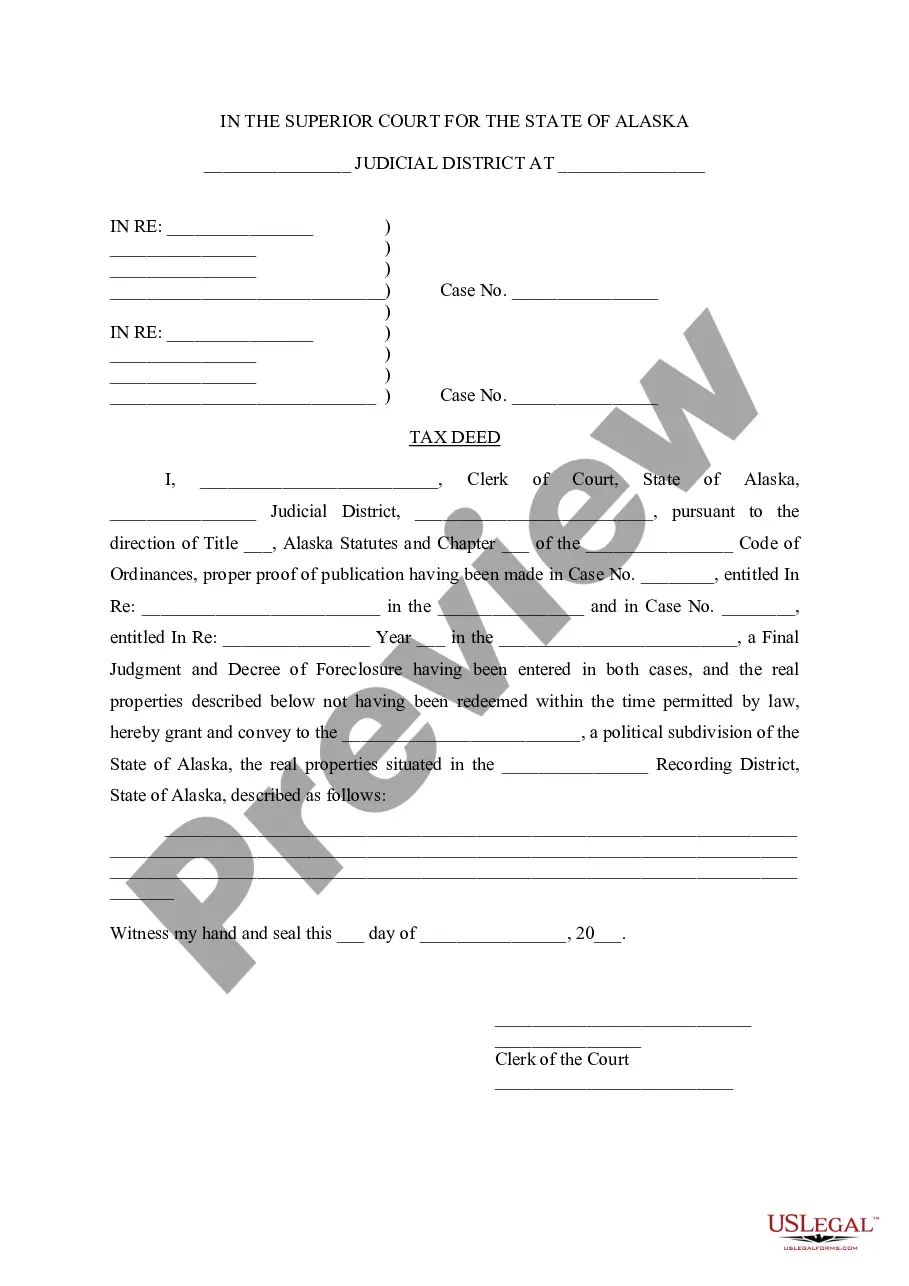

Use US Legal Forms to get a printable Revocable Trust for Real Estate. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms library online and provides affordable and accurate templates for consumers and attorneys, and SMBs. The templates are categorized into state-based categories and a few of them can be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Revocable Trust for Real Estate:

- Check to ensure that you have the proper form in relation to the state it’s needed in.

- Review the form by looking through the description and using the Preview feature.

- Click Buy Now if it is the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Revocable Trust for Real Estate. Over three million users already have utilized our service successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Form popularity

FAQ

As far as the Internal Revenue Service is concerned, trust property belongs to the grantor. The grantor names a trustee to manage the assets, but during their lifetime, most people name themselves in this position. A successor trustee is named to carry on when the grantor dies or becomes incapacitated.

When the maker of a revocable trust, also known as the grantor or settlor, dies, the assets become property of the trust. If the grantor acted as trustee while he was alive, the named co-trustee or successor trustee will take over upon the grantor's death.

Many people use a revocable living trust because it gives them more control over the trust assets. Putting your house in a revocable trust still allows you to change the terms of the trust or remove the house from the trust if you want to.

Trust property refers to the assets placed into a trust, which are controlled by the trustee on behalf of the trustor's beneficiaries.Estate planning allows for trust property to pass directly to the designated beneficiaries upon the trustor's death without probate.

Many people use a revocable living trust because it gives them more control over the trust assets. Putting your house in a revocable trust still allows you to change the terms of the trust or remove the house from the trust if you want to.

A revocable trust is a part of estate planning that manages and protects the assets of the grantor as the owner ages. The trust can be amended or revoked as the grantor desires and is included in estate taxes.

Continuity of Management During Disability. Flexibility. Avoidance of Probate. Availability of Assets at Death. No Interruption in Investment Management. May Not Automatically Adapt to Changed Circumstances.

Due to changes in the tax laws, most revocable trusts can now be treated as part of a decedent's estate for federal income tax purposes.

Creation of a Trust To create a trust, the property owner (called the "trustor," "grantor," or "settlor") transfers legal ownership to a family member, professional, or institution (called the "trustee") to manage that property for the benefit of another person (called the "beneficiary").