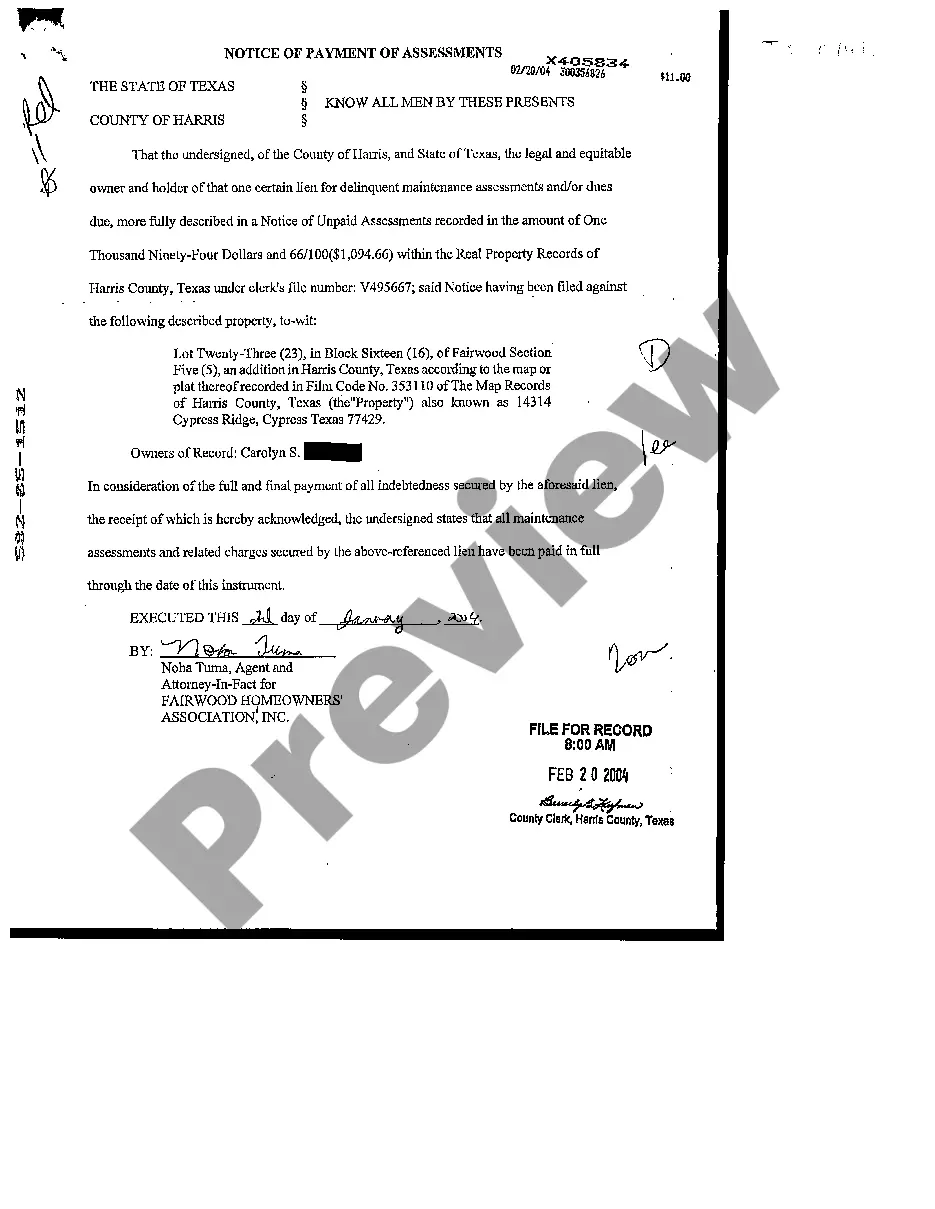

Texas Notice of Payments of Assessments

Description

How to fill out Texas Notice Of Payments Of Assessments?

Get access to high quality Texas Notice of Payments of Assessments forms online with US Legal Forms. Avoid days of lost time searching the internet and dropped money on documents that aren’t updated. US Legal Forms gives you a solution to just that. Find around 85,000 state-specific legal and tax samples that you can save and complete in clicks in the Forms library.

To get the sample, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide listed below to make getting started easier:

- Find out if the Texas Notice of Payments of Assessments you’re looking at is appropriate for your state.

- View the form utilizing the Preview function and browse its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay by credit card or PayPal to finish making an account.

- Select a favored file format to save the file (.pdf or .docx).

Now you can open the Texas Notice of Payments of Assessments template and fill it out online or print it out and do it by hand. Think about giving the papers to your legal counsel to make sure things are filled in appropriately. If you make a error, print out and complete sample once again (once you’ve created an account every document you download is reusable). Make your US Legal Forms account now and get access to more forms.

Form popularity

FAQ

Unless the board can be compelled to place the homeowner's complaint into the minutes, the board can choose to ignore the homeowner and there is no paper trail by using that approach.

Tip 1: Understand why the rules exist in the first place. Tip 2: Ask why you received the notice. Tip 3: Remember that notices are not an attack on your character. Tip 4: Understand that it is a progressive process. Tip 5: If there are extenuating circumstances, let the board know.

An assessment lien is a legal claim or "hold" on an owner's unit or lot making the property collateral against delinquent assessments, whether regular or special assessments, owed to the association.

Courts like to see that efforts have been made to settle disputes. Sending a demand letter by certified mail (with return receipt requested) and by regular mail provides proof that you made the effort. In some cases, sending a demand letter is required before going to court.

If you default on HOA or COA dues and assessments in Texas, the association may foreclose.If you don't pay, in most cases the HOA or COA can get a lien on your property that could lead to a foreclosure.

An HOA closing letter is a statement that provides information such as: initiation fees, annual dues, a balance of outstanding dues owes, transfer fees, capital contribution fees, and any fees that are required to join the homeowner's association.

Associations are required by law to mail a certified prelien letter to the delinquent homeowner at least 30 days prior to filing a lien on a property.This legal process helps ensure homeowners don't simply deny receipt of a certified letter to avoid having a lien placed on their properties.

Assessment fees are payments the homeowners' association (HOA) collects from owners to cover expenses the HOA is responsible for, but that aren't covered in the regular monthly fees. Take lawn care, for example.The HOA board of directors may vote to impose an assessment fee to pay for that expense.

Removal of Association's LienTo remove a lien on a property, homeowners must first satisfy the debt owed to the homeowners association. To pay off an HOA lien, the homeowner must make payment to the association in the amount of the delinquent assessments, plus interest and any applicable fees.