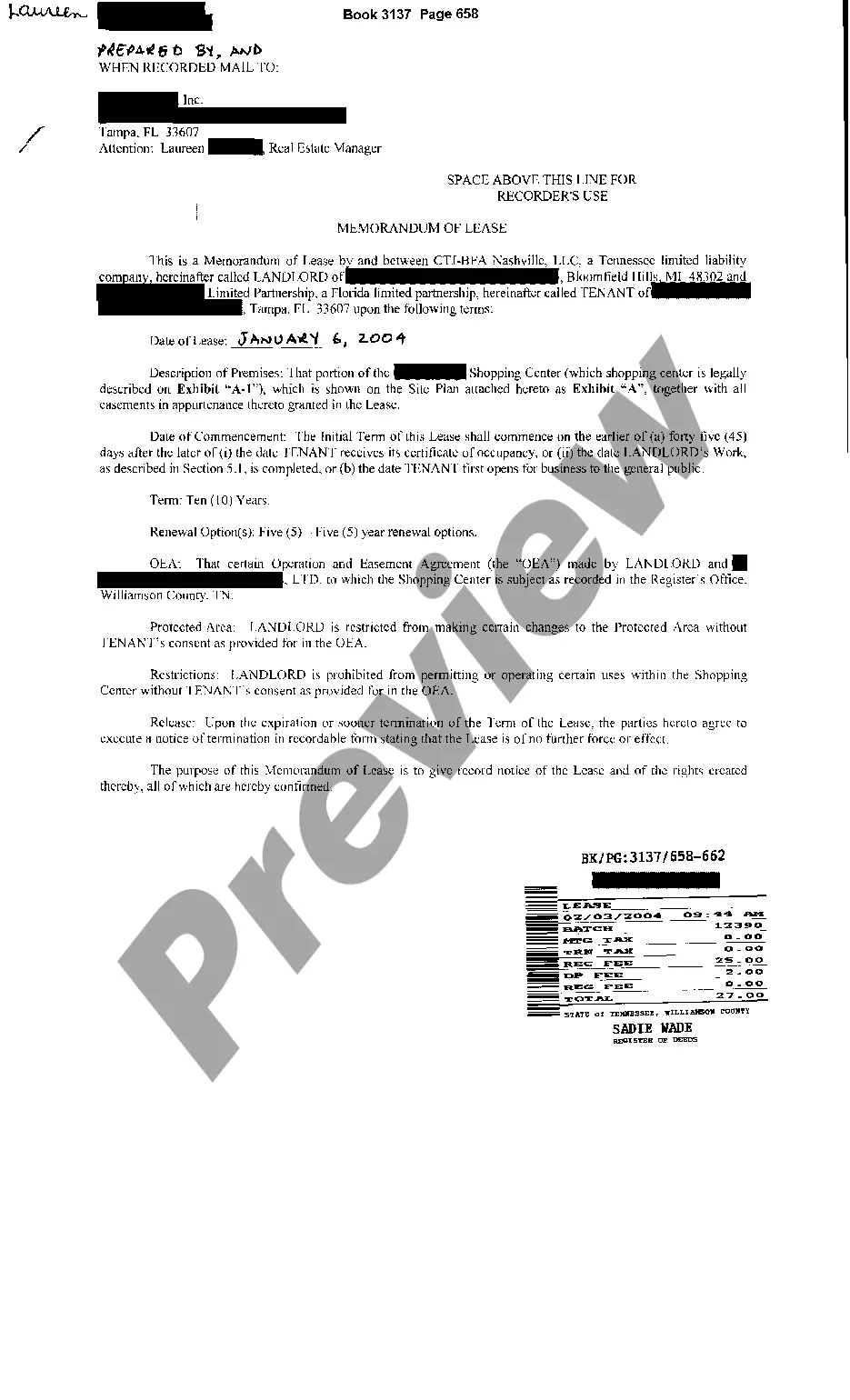

Tennessee Restaurant Lease Memorandum

Description

How to fill out Tennessee Restaurant Lease Memorandum?

Get access to top quality Tennessee Restaurant Lease Memorandum samples online with US Legal Forms. Prevent days of lost time searching the internet and dropped money on documents that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find above 85,000 state-specific legal and tax forms that you can save and submit in clicks within the Forms library.

To get the sample, log in to your account and click Download. The file will be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- Check if the Tennessee Restaurant Lease Memorandum you’re looking at is suitable for your state.

- See the form utilizing the Preview function and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to sign up.

- Pay by credit card or PayPal to complete making an account.

- Choose a preferred file format to save the file (.pdf or .docx).

Now you can open the Tennessee Restaurant Lease Memorandum example and fill it out online or print it and do it yourself. Consider mailing the papers to your legal counsel to make certain all things are filled out appropriately. If you make a mistake, print out and fill application again (once you’ve made an account every document you download is reusable). Make your US Legal Forms account now and get much more forms.

Form popularity

FAQ

Name the parties. A simple rental agreement form needs to name the parties signing the lease and where they live. Describe the premises. Define the term of the lease. Set how much rent is owed. Assign a security deposit amount. Finalize the lease.

The Introduction. The beginning of the lease agreement should contain the name of the landlord and tenant, as well as a statement of the agreement into which they are entering. Rent. Deposit. Taxes. Property Insurance. Utilities and Amenities. Remodeling and Improvements. Repairs and Maintenance.

What Is a Modified Gross Lease? A modified gross lease is a type of real estate rental agreement where the tenant pays base rent at the lease's inception, but it takes on a proportional share of some of the other costs associated with the property as well, such as property taxes, utilities, insurance, and maintenance.

A commercial lease where the tenant pays a base rent and the landlord pays for all operating expenses related to the tenant's occupancy of the space such as common area maintenance, utilities, property insurance, and property taxes.

The Gross Lease. The gross lease tends to favor the tenant. The Net Lease. The net lease, however, tends to favor the landlord. The Modified Gross Lease.

A triple net lease is a lease structure where the tenant is responsible for paying all operating expenses associated with a property.As we've seen throughout this article, the modified gross lease is a lease structure where the landlord and the tenant both share the cost of operating expenses.

The Lease Must be in Writing It does not matter if the lease is handwritten or typed. If the lease is for more than one year, it must be in written form and contain the following terms.

Industrial Gross (IG) Lease. Lease type in which tenant pays most but not all operating expenses in the base rate. In addition to base rent, tenant pays utilities, common area maintenance, and often the increase in property taxes and insurance over base year.