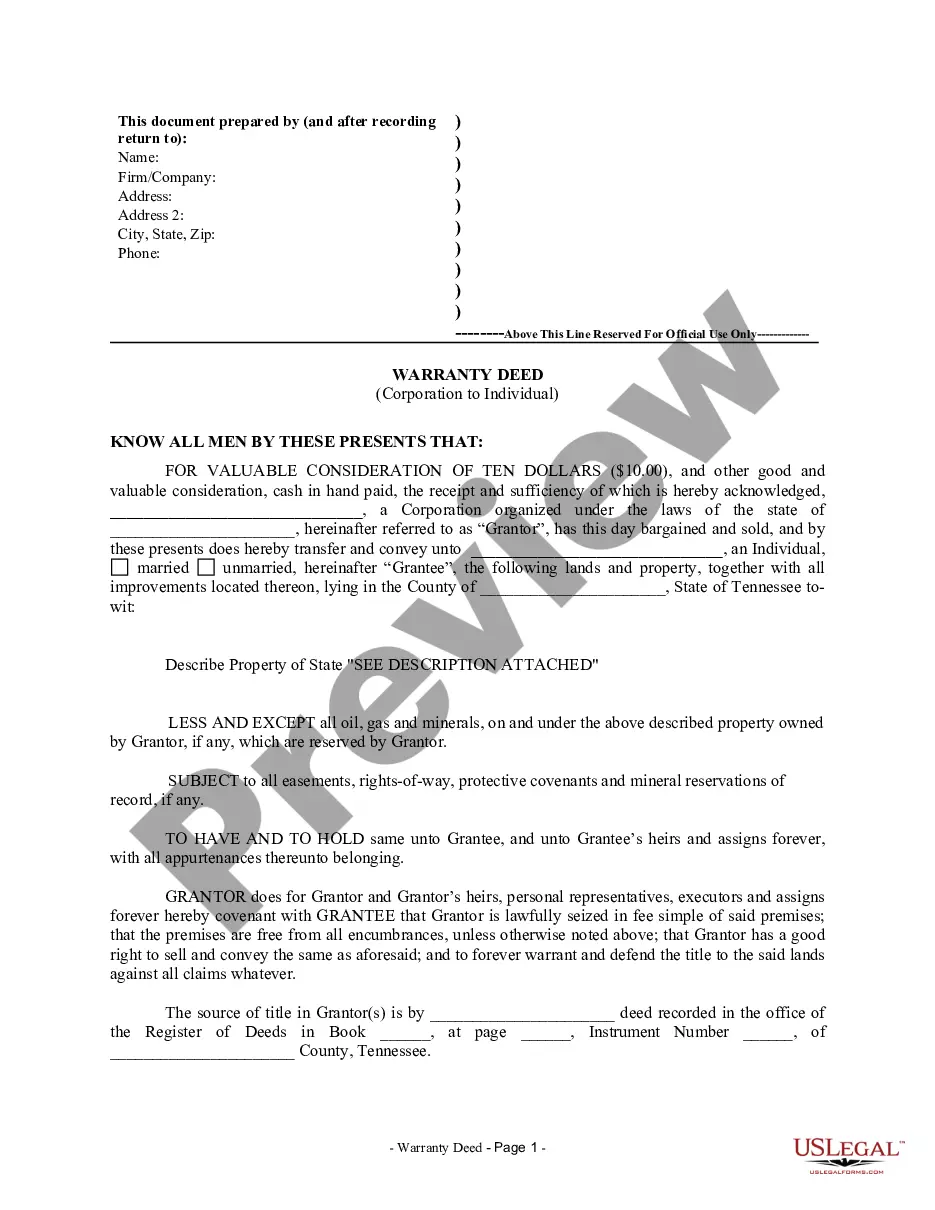

Tennessee Warranty Deed from Corporation to Individual

Definition and meaning

A Tennessee Warranty Deed from Corporation to Individual is a legal document used to transfer property ownership from a corporation to an individual. This type of deed asserts that the corporation (the grantor) holds a clear title to the property and guarantees that there are no encumbrances, unless specifically noted. It is important because it provides assurance that the property is being conveyed legally and without hidden claims.

How to complete a form

Completing a Tennessee Warranty Deed involves several key steps:

- Identify the parties: Clearly state the names and addresses of both the corporation (grantor) and the individual (grantee).

- Describe the property: Include a detailed description of the property being transferred to ensure there is no confusion regarding the boundaries or specifics.

- Consideration: Indicate the amount of consideration being exchanged, which can be a nominal amount.

- Signatures: Ensure that the deed is signed by an authorized officer of the corporation and include the date of execution.

- Notarization: The document must be notarized to verify the identities of the signers.

Follow these steps carefully to ensure the deed is valid and enforceable.

Legal use and context

This deed is commonly used in real estate transactions when a corporation relinquishes ownership of property to an individual. It provides legal documentation required for recording the property transfer in the local county's register of deeds. The Warranty Deed assures the buyer that the corporation has clear title to the property and offers protection against future claims.

Key components of the form

A Tennessee Warranty Deed includes several essential components:

- Grantor and Grantee Information: Full legal names and addresses of both parties.

- Property Description: A legal description of the property being transferred.

- Consideration: The amount exchanged for the property.

- Execution Details: Signing information, including the signature of the grantor.

- Notary Section: A section for a notary public to validate the signatures.

Each component is vital for the validity of the deed.

What documents you may need alongside this one

When executing a Tennessee Warranty Deed, you may need the following documents:

- The original title deed or warranty deed of the property held by the corporation.

- A corporate resolution authorizing the property transfer.

- Proof of identity for signers, which may include a driver's license or other government-issued identification.

- Any prior agreements or contracts related to the property that may impact the transfer.

Having all necessary documents prepared will facilitate a smoother transaction.

Common mistakes to avoid when using this form

A few common mistakes to avoid include:

- Inaccurate property description: Failing to provide a complete and correct description of the property can lead to future disputes.

- Not obtaining notarization: Skipping the notarization process can render the deed invalid.

- Incomplete or missing signatures: Ensure all required signatures are obtained to avoid legal complications.

- Forgetting to record the deed: Not filing the deed with the local register of deeds can result in issues with legal ownership.

By avoiding these mistakes, users can ensure that their transaction is legally sound.

Form popularity

FAQ

A warranty deed is a higher level of protection produced by the seller upon the real estate closing. It includes a full legal description of the property, and confirms the title is clear and free from all liens, encumbrances, or title defects. Most property sales make use of a warranty deed.Our title agents can help.

In order to convey any real property or an interest in property in Tennessee, the deed must be in writing, acknowledged by the grantor, and registered in the county where the property is located. The Annotated Code of Tennessee allows for the transfer of real property through the usage of a variety of deeds.

The Tennessee general warranty deed is a form that conveys real estate with a guarantee from a Seller to a Buyer that the title shall be free and clear of all liens and encumbrances (fee simple).

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

When recorded, a special warranty deed conveys an interest in real property to the named grantee with limited warranties of title. In Tennessee, special warranty deeds are statutory.This means that the deed will not protect the grantee against title issues that arose prior to the time the grantor acquired title.

Key Takeaways. A property deed is a legal document that transfers the ownership of real estate from a seller to a buyer.General warranty deeds give the grantee the most protection, special warranty deeds give the grantee more limited protection, and a quitclaim deed gives the grantee the least protection under the law

Tennessee deed forms convey interest in property from one party (the Grantor) to another (the Grantee). The documents can be prepared by anyone as long as the required information is written in the deed as outlined in § 66-5-103.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.