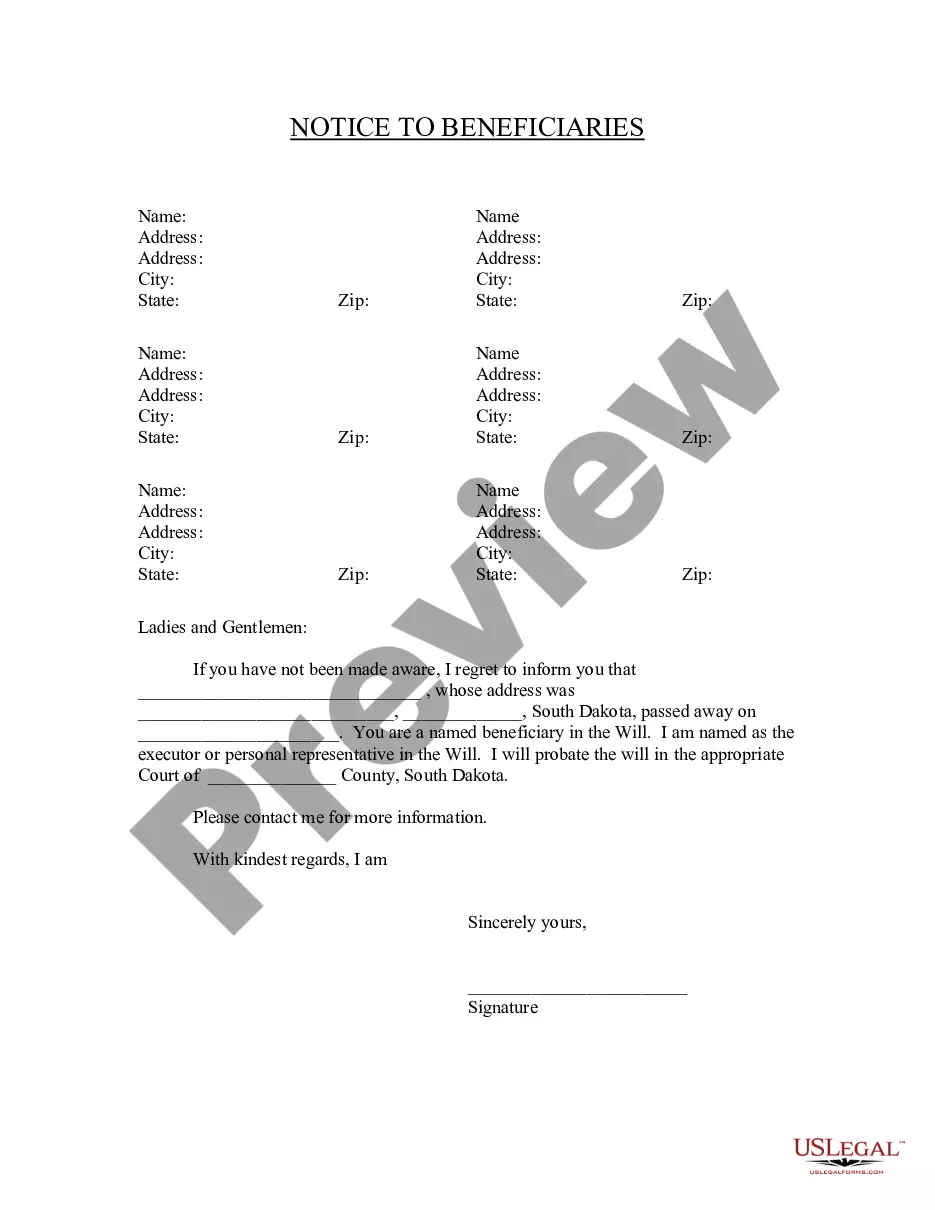

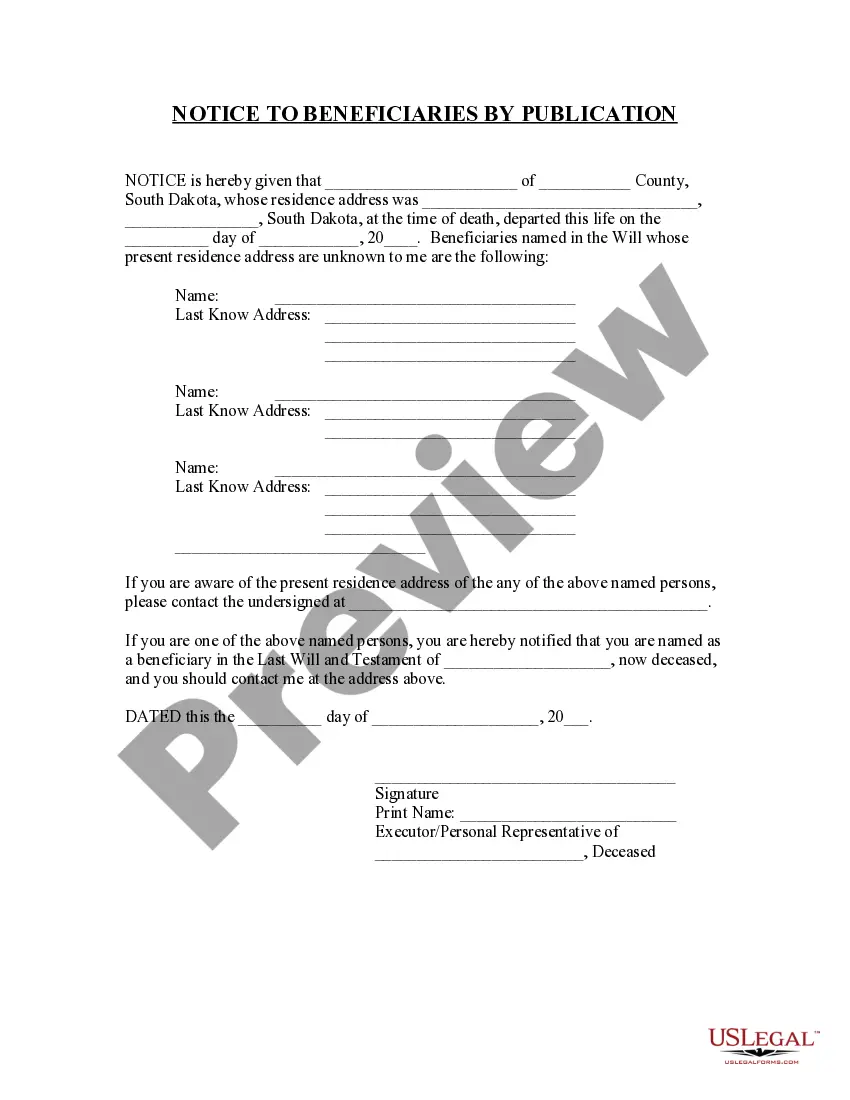

This Notice to Beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. A second notice is also provided for publication where the location of the beneficiaries is unknown.

South Dakota Notice to Beneficiaries of being Named in Will

Description

How to fill out South Dakota Notice To Beneficiaries Of Being Named In Will?

Access to top quality South Dakota Notice to Beneficiaries of being Named in Will samples online with US Legal Forms. Steer clear of hours of misused time browsing the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to just that. Find above 85,000 state-specific legal and tax samples that you could save and complete in clicks within the Forms library.

To receive the example, log in to your account and click on Download button. The document will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- See if the South Dakota Notice to Beneficiaries of being Named in Will you’re considering is suitable for your state.

- See the sample using the Preview option and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to sign up.

- Pay by card or PayPal to finish making an account.

- Select a preferred format to download the file (.pdf or .docx).

You can now open up the South Dakota Notice to Beneficiaries of being Named in Will sample and fill it out online or print it out and do it by hand. Consider mailing the papers to your legal counsel to make certain all things are filled out properly. If you make a error, print out and fill application once again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and get far more samples.

Form popularity

FAQ

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

As Executor, you should notify beneficiaries of the estate within three months after the Will has been filed in Probate Court. For beneficiaries of assets that are not included in the will (and therefore do not pass through Probate) there are no specific notification requirements.

What are my rights as a beneficiary?A beneficiary is entitled to be told if they are named in a person's will. They are also entitled to be told what, if any, property/possessions have been left to them, and the full amount of inheritance they will receive.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

Call the probate court to obtain the name and phone number of the executor, if you cannot obtain it from family members. Ask the executor of the will whether you are a beneficiary in your relative's will. Ask for a copy of the will so you can verify the information he provided.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements. 4feff This is relatively rare.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.