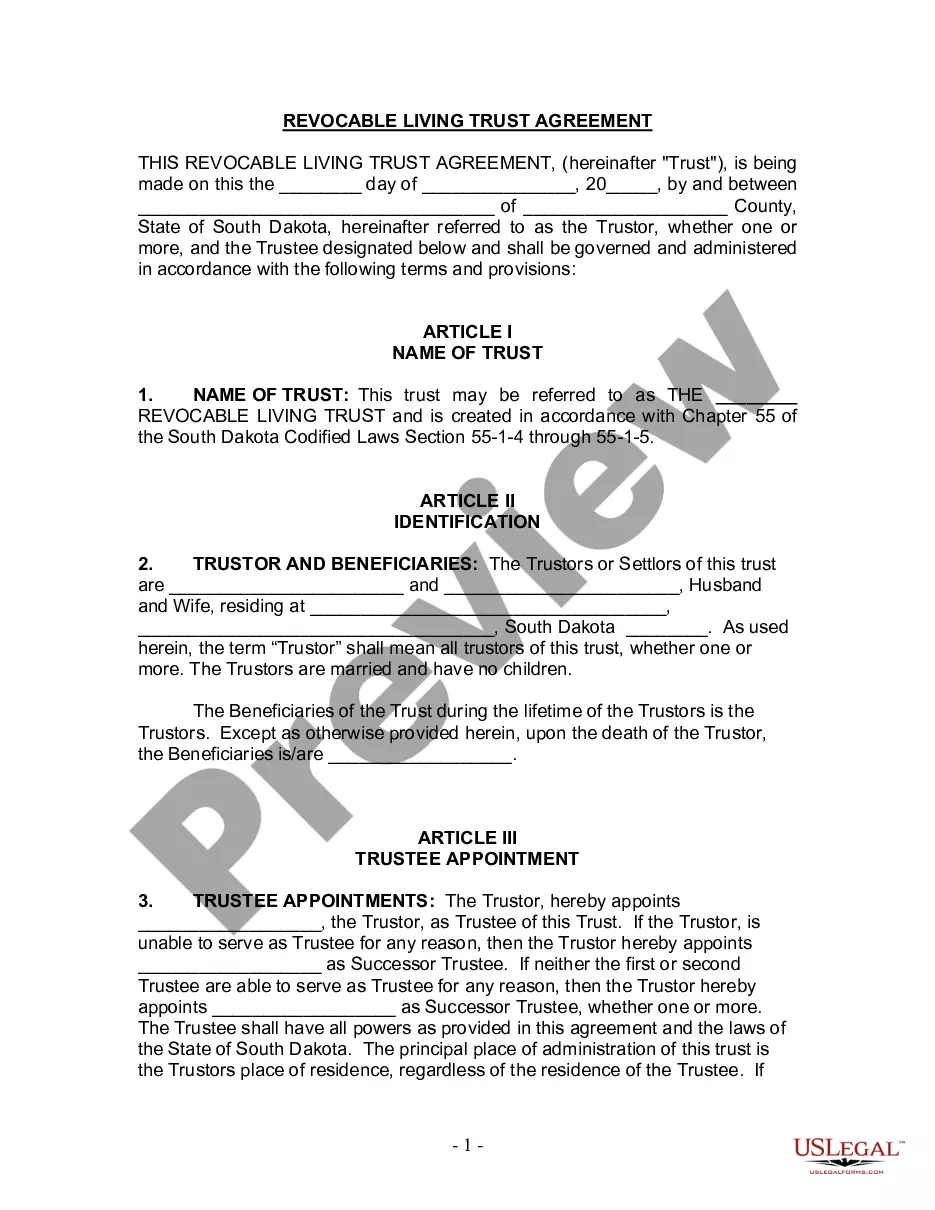

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

South Dakota Living Trust for Husband and Wife with No Children

Description

How to fill out South Dakota Living Trust For Husband And Wife With No Children?

Access to top quality South Dakota Living Trust for Husband and Wife with No Children forms online with US Legal Forms. Steer clear of days of wasted time seeking the internet and lost money on files that aren’t updated. US Legal Forms offers you a solution to just that. Get more than 85,000 state-specific authorized and tax samples you can download and fill out in clicks in the Forms library.

To find the example, log in to your account and click on Download button. The document is going to be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- See if the South Dakota Living Trust for Husband and Wife with No Children you’re looking at is appropriate for your state.

- View the sample using the Preview function and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to sign up.

- Pay out by card or PayPal to complete making an account.

- Select a preferred file format to save the file (.pdf or .docx).

Now you can open the South Dakota Living Trust for Husband and Wife with No Children template and fill it out online or print it and get it done by hand. Consider sending the papers to your legal counsel to make certain things are filled out correctly. If you make a mistake, print and fill sample again (once you’ve registered an account all documents you download is reusable). Create your US Legal Forms account now and get access to far more samples.

Form popularity

FAQ

An all-in fee will start between 1% and 2%, and usually covers the trust's investment manager, fiduciary and trust administration, and record-keeping and disbursements, but typically not asset-management fees. So, you might pay $30,000 to $50,000 a year on a $3 million trust.

A South Dakotan trust changes all that: it protects assets from claims from ex-spouses, disgruntled business partners, creditors, litigious clients and pretty much anyone else.And it shields your wealth from the government, since South Dakota has no income tax, no inheritance tax and no capital gains tax.

Choose the trust that best suits your financial situation. Take inventory of your property to determine what you'd like to include in the trust. Choose a trustee to manage your trust. Create the trust document. Sign the trust in front of a notary public. Transfer property into the trust to fund it.

Annual fees range from 0.50% to 1.0% of trust assets up to $1 million with minimum fees ranging from $100 to $8,000, with most in the $3,000 range. For the most part, these fees seem not to include investment management, which would then be an additional cost.

There is a non-refundable application fee of $5,000. A trust must have at least $200,000 of assets to receive a South Dakota charter. The company must file a 12-page application. Once chartered, there is an annual state fee of 7 cents per $10,000 of assets in the trust.

Choose the trust that best suits your financial situation. Take inventory of your property to determine what you'd like to include in the trust. Choose a trustee to manage your trust. Create the trust document. Sign the trust in front of a notary public. Transfer property into the trust to fund it.

In South Dakota, when a person dies without leaving a will, the surviving spouse is entitled to receive the entire intestate estate unless the decedent was survived by descendants of a prior marriage or other relationship, in which event, the spouse receives $100,000.00 plus half of the remaining estate, plus certain

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.