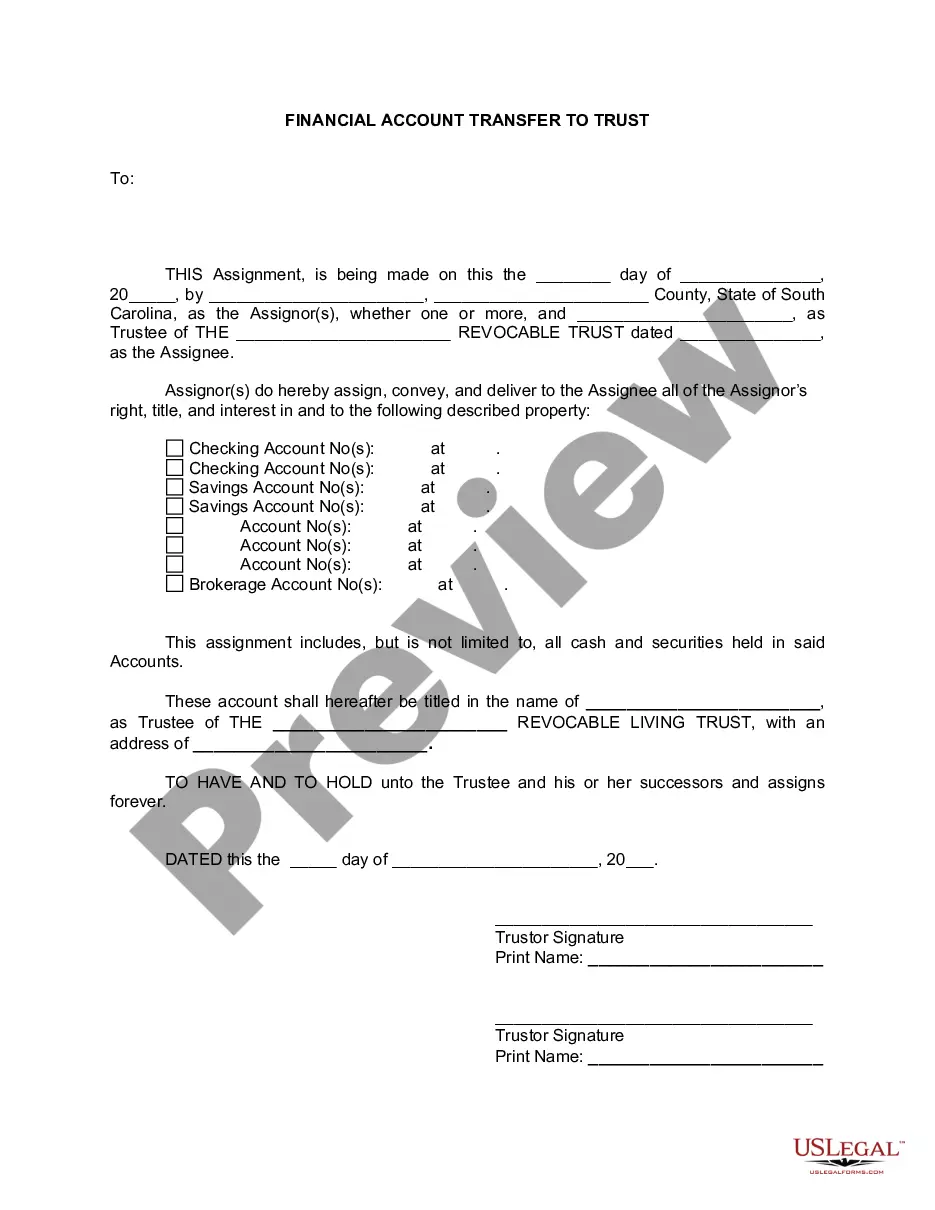

South Carolina Financial Account Transfer to Living Trust

Description

How to fill out South Carolina Financial Account Transfer To Living Trust?

Creating papers isn't the most uncomplicated process, especially for people who rarely work with legal papers. That's why we advise making use of accurate South Carolina Financial Account Transfer to Living Trust samples created by skilled lawyers. It allows you to avoid troubles when in court or working with formal institutions. Find the documents you need on our site for high-quality forms and correct explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the file web page. After downloading the sample, it will be stored in the My Forms menu.

Users with no an activated subscription can quickly get an account. Use this brief step-by-step guide to get your South Carolina Financial Account Transfer to Living Trust:

- Ensure that the document you found is eligible for use in the state it’s required in.

- Verify the document. Utilize the Preview feature or read its description (if offered).

- Click Buy Now if this template is what you need or return to the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After completing these simple actions, it is possible to fill out the form in an appropriate editor. Double-check filled in info and consider asking a lawyer to examine your South Carolina Financial Account Transfer to Living Trust for correctness. With US Legal Forms, everything becomes easier. Try it out now!

Form popularity

FAQ

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

To put checking or savings accounts into the trust, go down to your bank and fill out the institutional paperwork. You don't have to change the name on the checks. When you die, your successor trustee will assume control of the account and distribute the money to your heirs.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

Lifetime Gift Tax Exemption The IRS allows you, as of 2014, to give up to $5.34 million in gifts or, after you die, bequests free of estate tax. This means you can put additional money into your irrevocable trust and, as long as you stay below your lifetime limit, it'll be a tax-free transfer.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.