Rhode Island Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Understanding this form

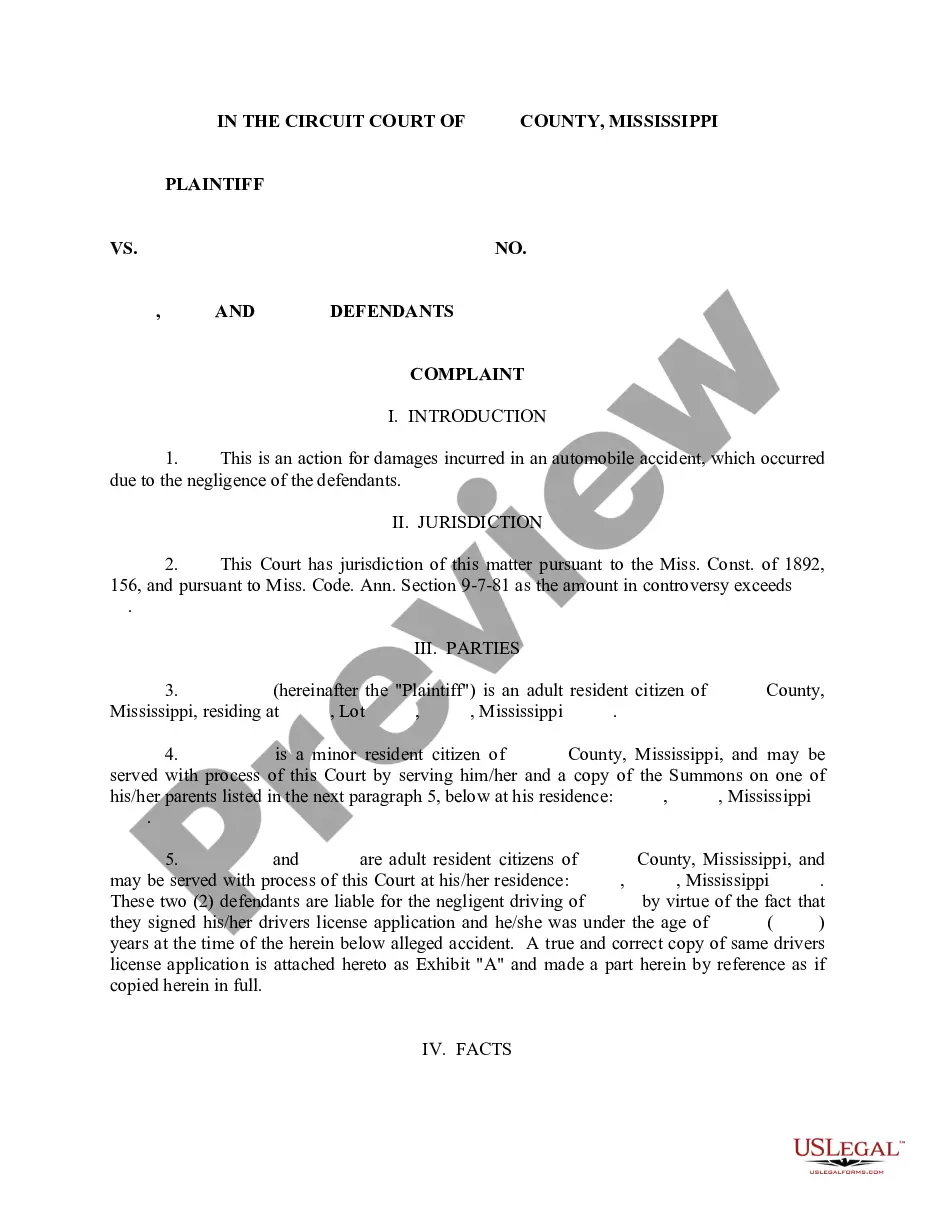

The Fiduciary Deed is a legal document used primarily by executors, trustees, trustors, administrators, and other fiduciaries to transfer real property on behalf of another party. Unlike standard deeds, this form is specifically crafted for fiduciaries acting under authority granted by a will or court order, ensuring that the deed reflects the grantor's legal capability to convey property. This ensures clarity and legality in property transactions managed by legal representatives.

Key parts of this document

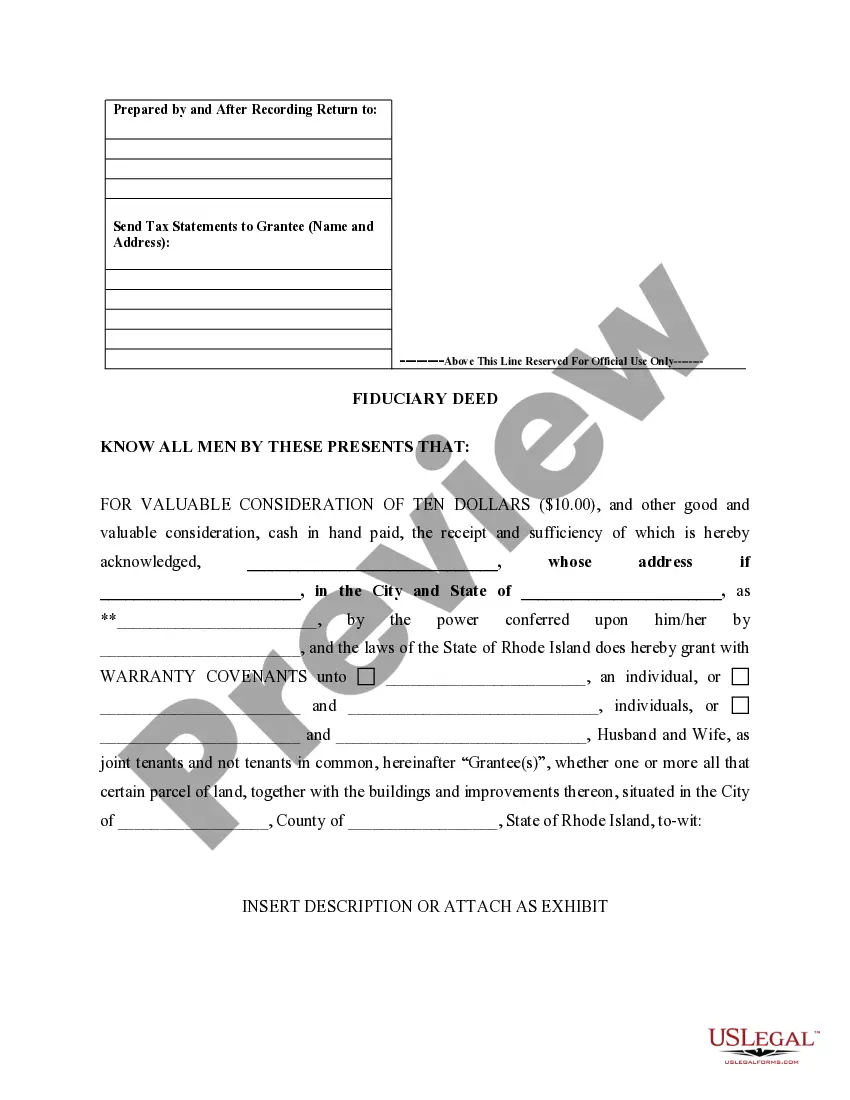

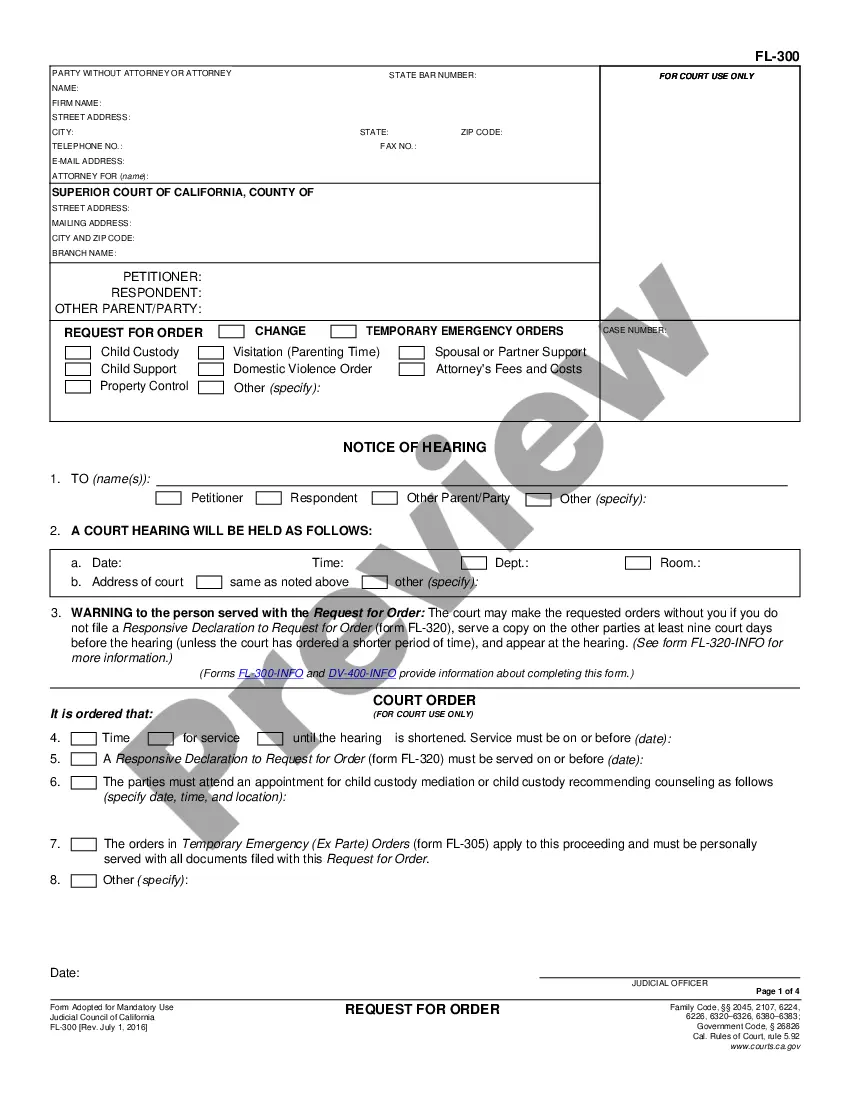

- Grantor and Grantee Information: Details about the parties involved in the transaction.

- Property Description: Specific information about the property being transferred.

- Official Capacity Declaration: Certification that the grantor is legally authorized to execute the deed.

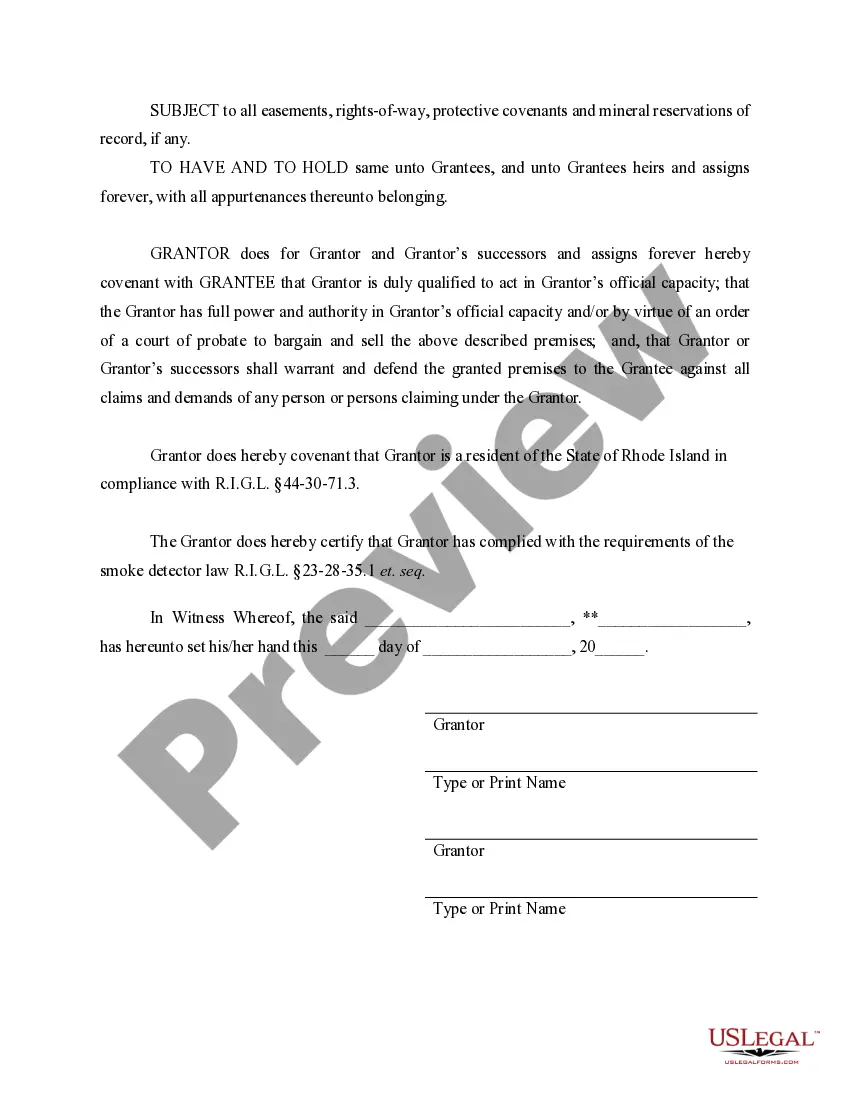

- Covenants and Warranties: Assurances made by the grantor regarding the ownership and transfer of property.

- Signature and Date: Required to validate the deed according to legal standards.

When to use this document

This Fiduciary Deed should be used when a fiduciary needs to transfer property as part of managing an estate. Scenarios may include the execution of a will where the executor must convey real estate to beneficiaries, transfers made by a trustee overseeing a trust, or actions by a guardian or conservator on behalf of an incapacitated individual. This form ensures that such transactions are legally binding and recognized by the state.

Intended users of this form

- Executors of wills handling estate property transfers.

- Trustees managing trust assets for beneficiaries.

- Guardians acting on behalf of minors or incapacitated persons.

- Administrators responsible for settling an estate without a will.

- Any fiduciary appointed by a court to manage property transactions.

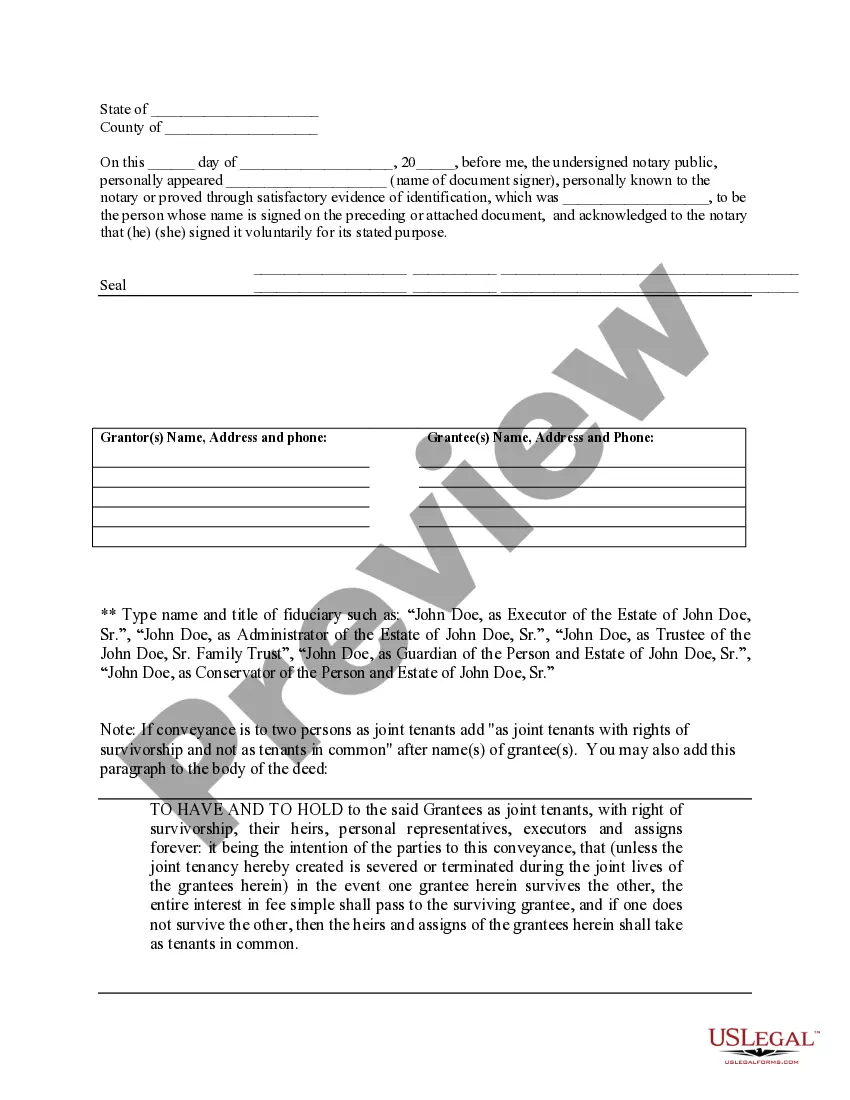

Instructions for completing this form

- Identify the parties: Fill in the names and addresses of the grantor and grantee.

- Specify the property: Provide a clear and concise description of the property being conveyed.

- Enter the official capacity: Confirm the fiduciary's role and authority in conducting the transfer.

- Include necessary declarations: Certify compliance with state laws and smoke detector regulations.

- Sign and date the deed: Ensure that the grantor signs the document and includes the date of signing to finalize the transaction.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes to avoid

- Failing to include complete descriptions of the property being transferred.

- Neglecting to specify the grantor's official capacity, leading to questions about authority.

- Not obtaining required signatures, resulting in an invalid deed.

- Omitting compliance declarations related to local laws.

- Filling out the form without reviewing for accuracy and completeness.

Benefits of completing this form online

- Convenient access to the form anytime and anywhere with an internet connection.

- Editability allows you to complete the form at your own pace.

- Immediate download after completion ensures you can act quickly when needed.

- Reliability of attorney-drafted forms that adhere to state laws.

Form popularity

FAQ

The purpose of a deed is to transfer a title, a legal document proving ownership of a property or asset, to another person. For the document to be binding in a court of law, it must be filed in the public record by a local government official tasked with maintaining documents.

When committing to a general warranty deed, the seller is promising there are no liens against the property, and if there were, the seller would compensate the buyer for those claims. Mainly for this reason, general warranty deeds are the most commonly used type of deed in real estate sales.

What is worst type of deed for a new homeowner to obtain and why?One of the riskiest and worst types of deeds is the quitclaim deed. Quitclaim deeds are those in which the grantor claims no interest in the property or transfers whatever interest they have to another (Liuzzo 2015).

Fiduciary deeds are just one of several types of deeds used in property transfers. This type is used to transfer property such as real estate when the owner can't sign a deed for legal or other reasons.The fiduciary is required to act only in the best interests of the owner.

California mainly uses two types of deeds: the grant deed and the quitclaim deed. Most other deeds you will see, such as the common interspousal transfer deed, are versions of grant or quitclaim deeds customized for specific circumstances.

Three basic types of deeds commonly used are the grant deed, the quitclaim deed, and the warranty deed. A sample grant deed. the property he or she is transferring is implied from such language.

The words with fiduciary covenants means the seller promises to the buyer that he or she is duly appointed, qualified and acting in his or her fiduciary capacity, is duly authorized to make the sale and convey the property to buyer.

A fiduciary deed is for use by a fiduciary such as an executor or administrator of an estate or a trustee of a trust. In this type of deed there is a warranty, but only as a fiduciary. A fiduciary does not own the property, rather they essentially manage it for another.

The General Warranty Deed. A general warranty deed provides the highest level of protection for the buyer because it includes significant covenants or warranties conveyed by the grantor to the grantee. The Special Warranty Deed. The Bargain and Sale Deed. The Quitclaim Deed.